Swiss Approval Paves the Way for Keyrock's OTC Trading Expansion

Keyrock receives Swiss regulatory clearance, proving that Keyrock fulfills one of Switzerland’s most respected self-regulatory organizations’ standards. Keyrock’s OTC desk extends its fiat on/off-ramp services, now offering GBP, AUD, and 10+ other currencies next to USD and EURO pairs. Same tight spreads and fast settlements around the clock. Operating as a global market maker, these expanded OTC services facilitate the needs of our global partners.

Keyrock is proud to announce that we have received highly coveted Swiss regulatory approval, clearing the path for further expansion around the globe. With operations in over 85 exchanges across more than 400 markets, this strategic advancement sets us even further ahead of the competition.

In keeping with our growth efforts, our OTC desk has expanded its fiat on-ramp/off-ramp services to support GBP, AUD, and 10+ other currencies alongside the standard USD and EURO. These exciting additions reinforce our dedication to fully servicing and innovating within the Web3 landscape as we maintain the same high-quality service with tight spreads and lighting fast 24/7 settlements on an even broader scale.

Expanding our OTC desk’s currency coverage was a logical next step as we extended our services across different geographical regions. Kevin de Patoul, CEO of Keyrock, shares:

“As the complexity and diversity of digital financial products increase, we recognize the necessity to adapt and innovate. Hence, we are steadfast in our commitment to offering a specialized OTC solution enriched with a variety of currency options, reflecting our essential belief in flow diversity. This strategic approach propels us towards our goal of global excellence.”

Kevin de Patoul, Co-Founder and CEO of Keyrock

Keyrock’s Swiss Regulatory Approval

Within the scope of our OTC trading desk expansion, Keyrock has reached another major milestone with its successful registration with the Financial Services Standard Association (“VQF”) in Switzerland. This achievement is a testament to our dedication to adhering to stringent Anti-Money Laundering Act (“AMLA”) regulations in Swiss financial markets.

The registration process involved a comprehensive review of Keyrock’s internal controls, processes, and procedures to ensure compliance with the AMLA guidelines. Following the VQF’s extensive evaluation, this positive outcome confirms that Keyrock meets the rigorous standards set by one of Switzerland’s most respected self-regulatory organizations.

Keyrock’s VQF membership further enhances our reputation as a trusted partner, operating with the highest levels of integrity, transparency, and accountability. Furthermore, our engagement with the VQF signifies Keyrock’s dedication to regulatory matters and our continued aim to advance the industry responsibly. Kevin de Patoul comments: “Securing the VQF membership reinforces Keyrock’s stance on upholding rigorous regulatory standards within the crypto space. As the landscape evolves, our focus remains steadfast on ensuring both compliance and trust in our services.”

Reza Ghadiri-Zare, Keyrock’s General Counsel, added: “As Keyrock continues to expand its activities into new jurisdictions, this milestone confirms our commitment to engage with regulatory authorities globally to align our operations with the highest level of compliance requirements.”

Why Choose Keyrock For Your OTC Deals?

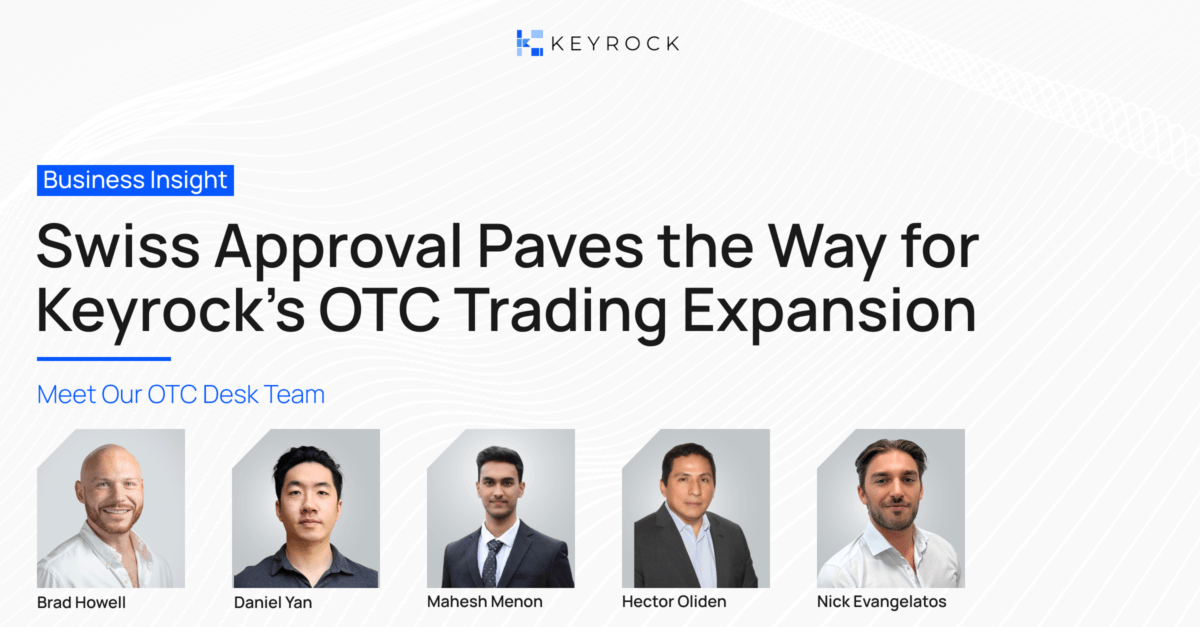

Being both a global liquidity provider and active in the OTC market requires the agility to evolve and innovate constantly. Keyrock’s international scope is as much a demonstration of our dedication to innovation and dynamic growth abilities as it is a direct response to the more diverse and complex demand of our partners and the competitive landscape, “Operating as a market maker ensures a position that is in perfect harmony with our clients’ OTC needs, as our primary focus at Keyrock is to provide liquidity at the most favorable prices,” explains Brad Howell, Managing Director UK at Keyrock.

He continues: “For this reason, the expansion of our OTC services is not just a tactic but a logical strategy in our growth. Working with a market maker like Keyrock for OTC trades allows us access to liquidity both internally and externally. As a result, we find ourselves in a robust position to offer incredibly tight spreads and fast settlements, ensuring quality service around the clock.”

Explore Our OTC Desk and Get Started

Interested in learning more? Get acquainted with Keyrock’s bespoke OTC deals, or for more personal insights, get in touch through our contact form. We look forward to working with you.