Are pre-token and point markets reliable enough to predict the future?

By offering early access to tokens pre-TGE, these too-good-to-be-true-sounding protocols seem to serve as a crucial barometer for initial market reactions and investor mood. But is that really simple? We turned to the data to get full clarity.

Key Takeaways

How well have the protocols facilitating pre-token trading performed? What additional insights can we gain from user behaviour in terms of their financial outcomes? Given the rising popularity of pre-market trading, it makes sense to have a close look at these platforms. That’s what we’ve done. We’ve analysed, compiled and compared various protocols over several months.

Here are the key insights we’ve gathered:

Profits for the Few: Constant profits are not guaranteed. It’s a pretty unpredictable market, so both buyers and sellers can score wins but also suffer losses. Most markets are unprofitable for buyers.

- Reliable Indicators: Both AEVO and Hyperliquid serve as potential predictors of post-TGE prices. Especially in the 10 days leading up to the TGE.

- FOMO-meter: The Whales Market emerges as a clear indicator of FOMO, reflecting heightened buyer activity and speculative interest. Traders are interested in buying at high prices as they don’t want to miss out on potential future gains.

- Decoupled Dynamics: No clear ties bind the price movements of points and pre-tokens in these markets. Blast and Parcl? They dance to their own beats. Each showcases wildly distinct trading patterns in token prices against their points markets.

- Volatility: Liquidity is missing. Price discovery is off the map. It’s kind of an “expect the unexpected” environment. Volatilities skyrocket to 10-20 times the norm in pre-token madness compared to after the TGE hype.

Introduction

In the first act of our points exploration, we navigated the market dynamics and mechanics of pre-token and points trading platforms. Because, let’s face it, the pulse of the market keeps us ticking.

It’s time to be real about numbers and price.

Our observations highlighted a buyer-dominated arena. But does dominance translate to profit? How precisely do these pre-token markets reflect the volatile dances of price just after tokens go live?

Let’s peel back the layers of speculation. Are these pre-token arenas merely speculative playgrounds, or do they hold predictive powers, offering a glimpse into the market’s future movements?

This introduction sets the stage for a rigorous analysis aimed at correlating the chaos of pre-market activities with the structured realities following TGEs.

We will explore standout cases like Jupiter and Wormhole, where pre-launch trading volumes—mere whispers in the grand scheme—explode into a post-launch roar.

As we venture forth, remember: what we uncover here could redefine not just perceptions but also the strategies that shape the future of digital asset trading.

Unmasking the Market: Post-TGE Price Behaviours

We’ll dissect price discovery pre-token release, scrutinise its accuracy against post-TGE conditions, and determine profitability for market participants. We’ll also explore how points and tokens interact and the role of volatility in shaping these dynamics.

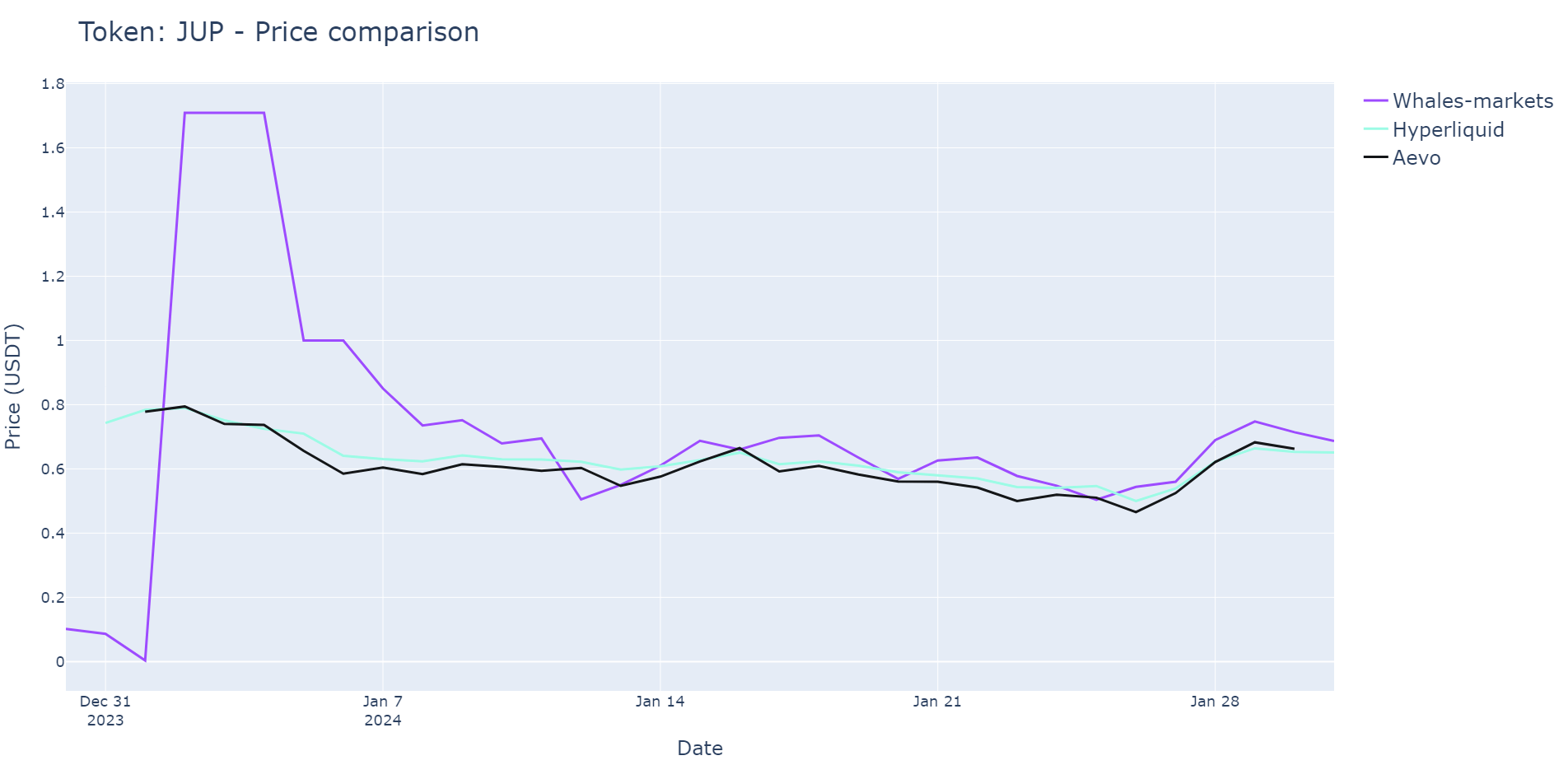

For pricing, the spotlight shines on two of the tokens that traded for the longest on the pre-token markets. Both had a significant amount of volume on the platforms: JUP (#1 volume on Whales Markets) and STRK (#6 volume on Whales Markets).

Source. Keyrock Data Intelligence

Source. Keyrock Data Intelligence

We’ve observed intriguing patterns. For instance, prices for JUP exhibit remarkable convergence, a trend echoed across other tokens like W. This suggests a certain level of price alignment post-TGE across these platforms.

But not all tokens follow this pattern. Some display significant price variances, highlighting the unique market dynamics each token experiences. Notably, Whales Market often commands a premium over AEVO or Hyperliquid.

Do Pre-Token Prices Hold Up

We’ve observed that participant behaviours differ under similar market conditions. Markets like JUP and W maintain tight trading, while others, such as STRK and ALT, show significant price differences across venues.

Trading a token before its official launch is the whole purpose of pre-markets. Yet, if pre-token markets occasionally struggle to agree on the correct price, can they truly forecast post-TGE prices accurately? This raises critical questions: Can these markets be trusted, and are they genuinely efficient?

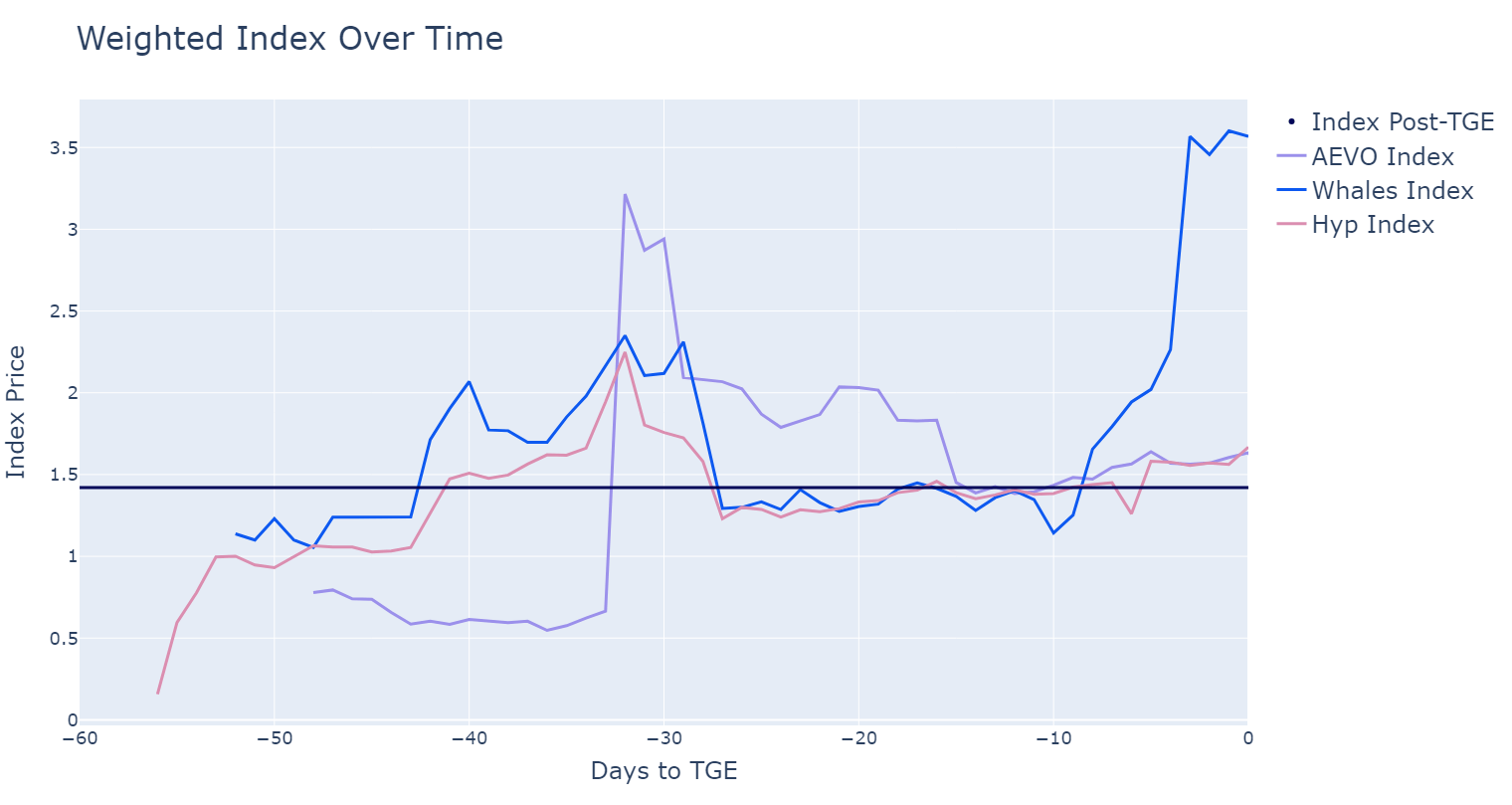

Because many factors can influence the price action of a token. We are restricting ourselves to only looking at the price 24 hours post-TGE. Mimicking the S&P 500, we created an index price that uses market caps as weights to determine an average.

In essence, the pre-TGE index price should converge post-TGE.

Key tokens under our lens include ALT, DYM, ENA, JUP, Pixels, Portal, STRK, TNSR, and W. All these tokens are traded on AEVO, Hyperliquid, and Whales.

Source. Keyrock Data Intelligence.

Source. Keyrock Data Intelligence.

What are we really seeing here? The navy blue line charts the index price post-TGE, serving as our benchmark. If we’re right about the mechanics of an efficient market, the pre-token market index price should, theoretically, align with this post-TGE index over time.

Both AEVO and Hyperliquid markets begin to converge on this benchmark, as we edge closer to TGE. This isn’t just incidental; it signals their potential as reliable predictors of immediate post-TGE prices.

On the flip side, the Whales Market tells a different story. The platform experienced a dramatic spike just days before TGE. Talking about a surge. This has likely been fuelled by a palpable wave of FOMO, with buyers making up a whopping 80% of the market action.

Numbers are essential to drawing conclusions. But these same numbers also tell us a story—an insightful narrative in which emotions and psychology are characters profoundly intertwined in fuelling market behaviour pre-TGE. Understanding these is crucial for anyone looking to navigate the volatile waters of pre-token launches.

Who is Cashing in on this Market?

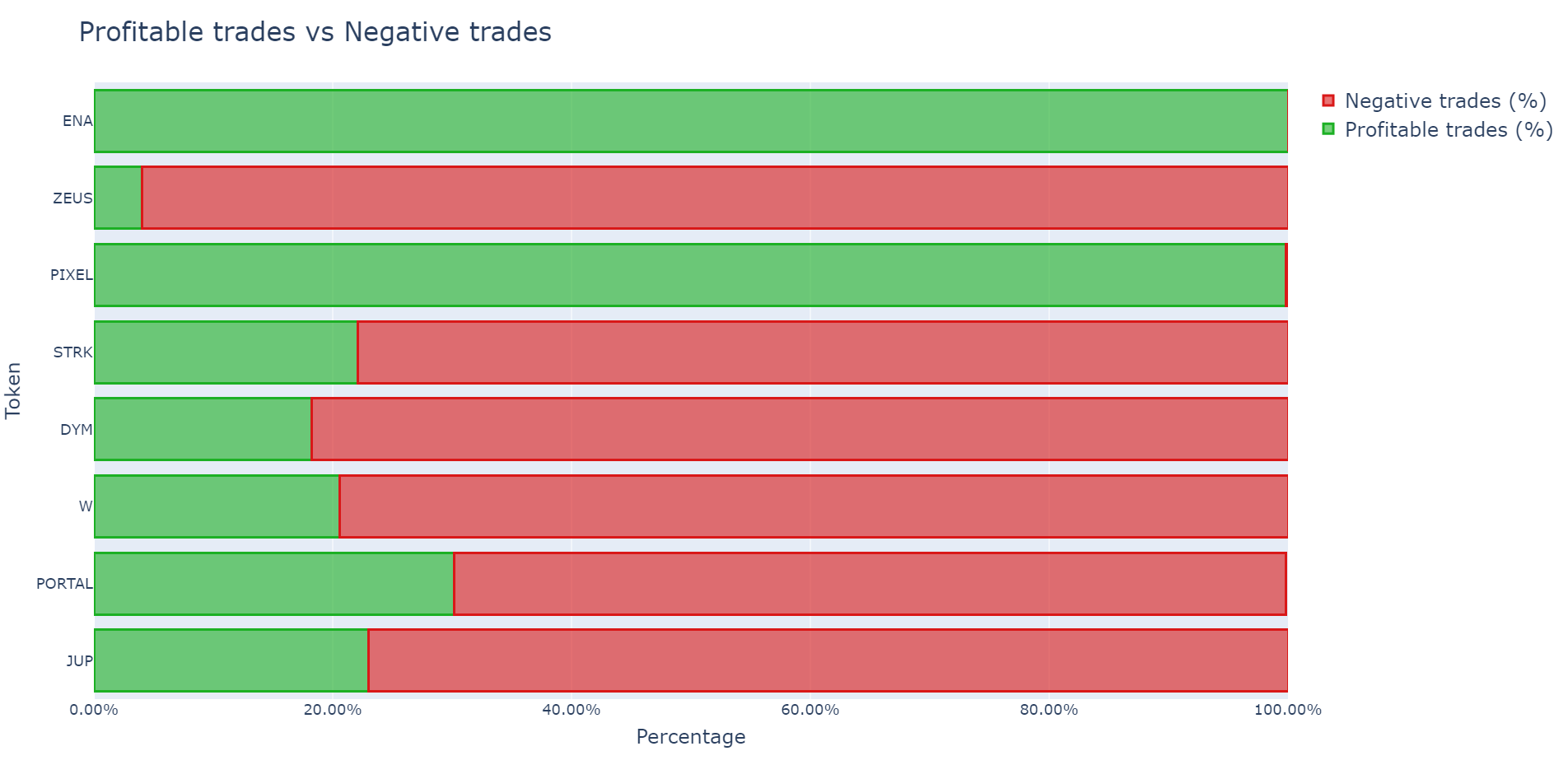

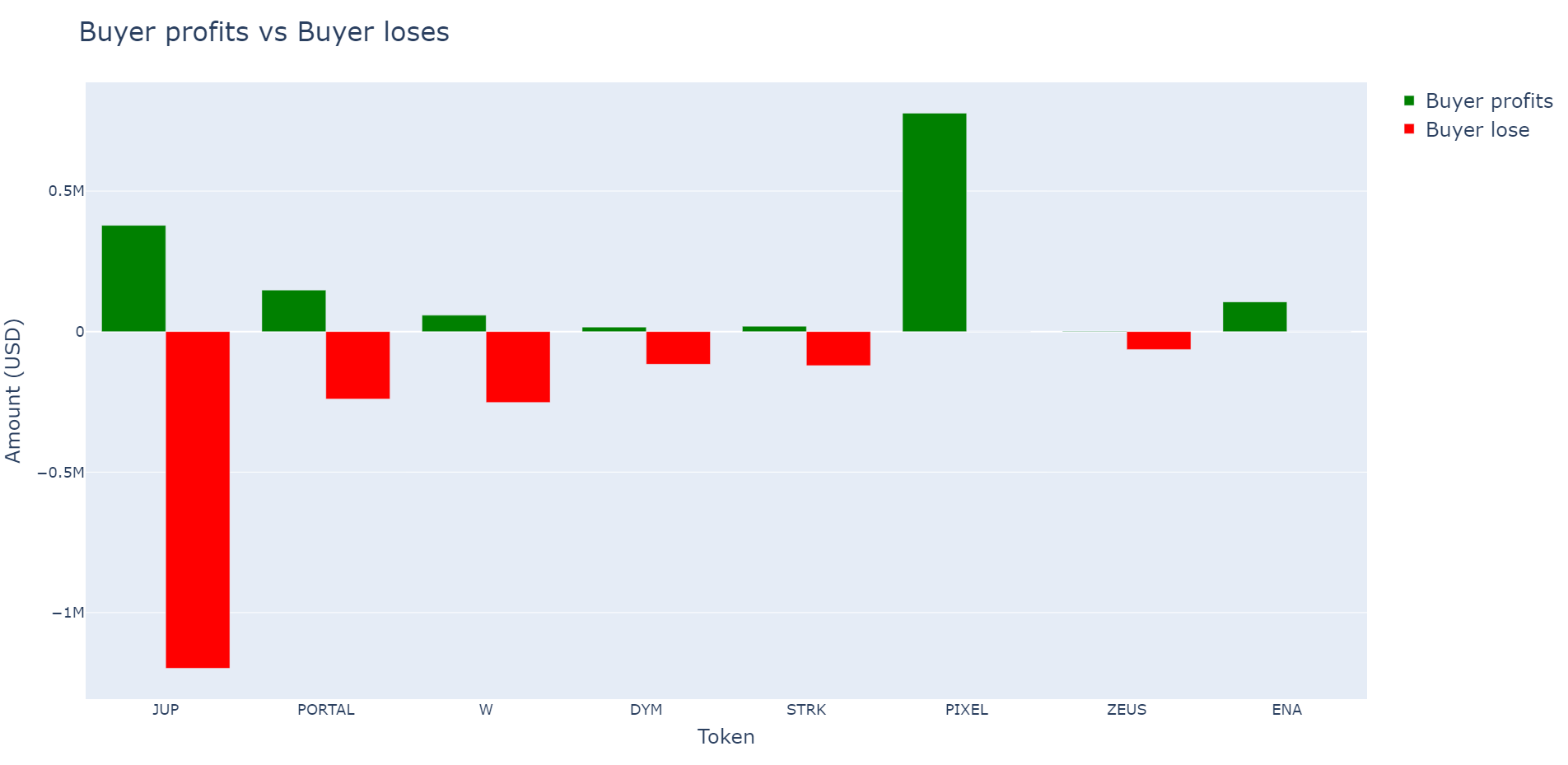

Buyers flock to Whales Market with high hopes, even FOMO’ing the markets, as shown by the index-price spike a couple of days before TGE. But who truly reap the rewards? On-chain transparency allows us to get deeper into Whale Market’s details. So we did. We could precisely track order sizes and strategise accordingly.

Rather than dissecting individual profit and loss, our analysis pivots towards a broader perspective. We want to know if it’s more advantageous to engage in pre-market trading or to enter at the median post-Token Generation Event (TGE) price within a 24-hour window. Having clear answers and being able to come up with conclusive findings reshape investment strategies.

The evidence is telling.

Source. Keyrock Data Intelligence.

Source. Keyrock Data Intelligence.

In the landscape of pre-token trading, ENA and PIXEL markets emerge as clear victors, proving to be undervalued and rewarding buyers with profits over 95% of the time. PORTAL, while showing an overall positive outcome, reveals a nuanced picture—significant gains are concentrated in just a few large transactions, with the majority (60%) of participants actually incurring losses.

Not only this spotlights the variances across different pre-token environments. But also challenges the view of market participants, balancing the allure of potential high returns by being early against the palpable risk of losses.

Market Dynamics between Points and Tokens

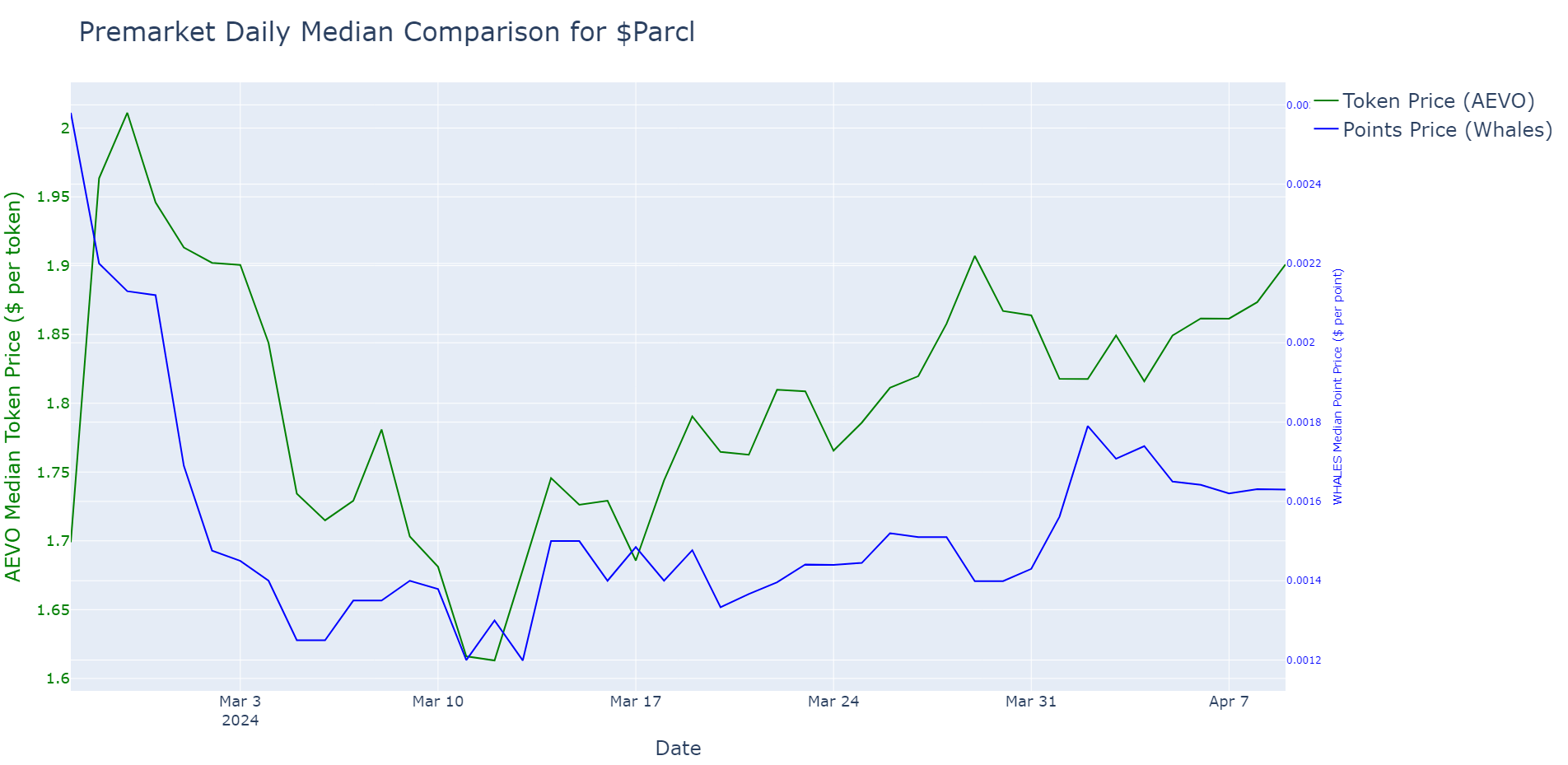

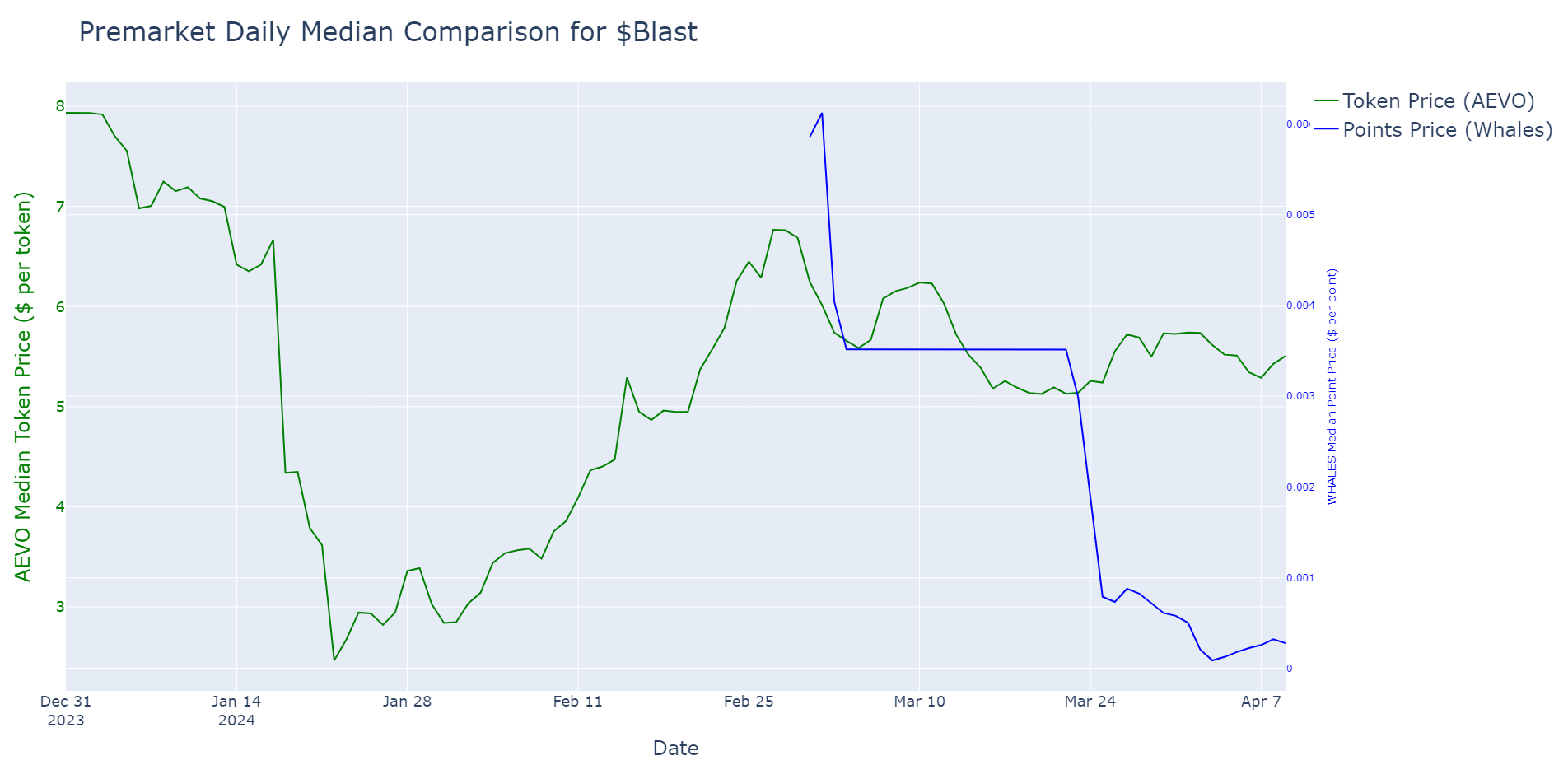

So far we have seen that markets don’t consistently align on pre-TGE prices across venues or with pre vs post-TGE prices. But what happens when a pre-token market has both a point and a token market? Let’s have a look at Blast and Parcl—the only two pre-markets where both points and tokens coexist.

Source. Keyrock Data Intelligence.

Note. Assets were not available on Hyperliquid.

Common sense would suggest a rather straightforward picture: a rise in pre-token market prices typically signals a corresponding uptick in points market prices. But correlation does not imply causation. The conversion dynamics between points and tokens are cloaked in layers of uncertainty, making any straightforward correlation unreliable.

Parcl defies expected trends. Here, a decrease in point prices often precipitates a fall in the token price on AEVO—a bewildering reversal where typical market roles are unexpectedly exchanged.

Meanwhile, for Blast, predictability dissipates into the ether. The relationship between tokens and points refuses to adhere to any discernible pattern, transforming each market movement into a question rather than an answer.

The trading volumes in Whales Market, while significant, further emphasise the place of unpredictability. With weekly fluctuations and a total movement ranging in the hundreds of thousands, these numbers illustrate how market dynamics are, more often than not, governed by volume-driven volatility.

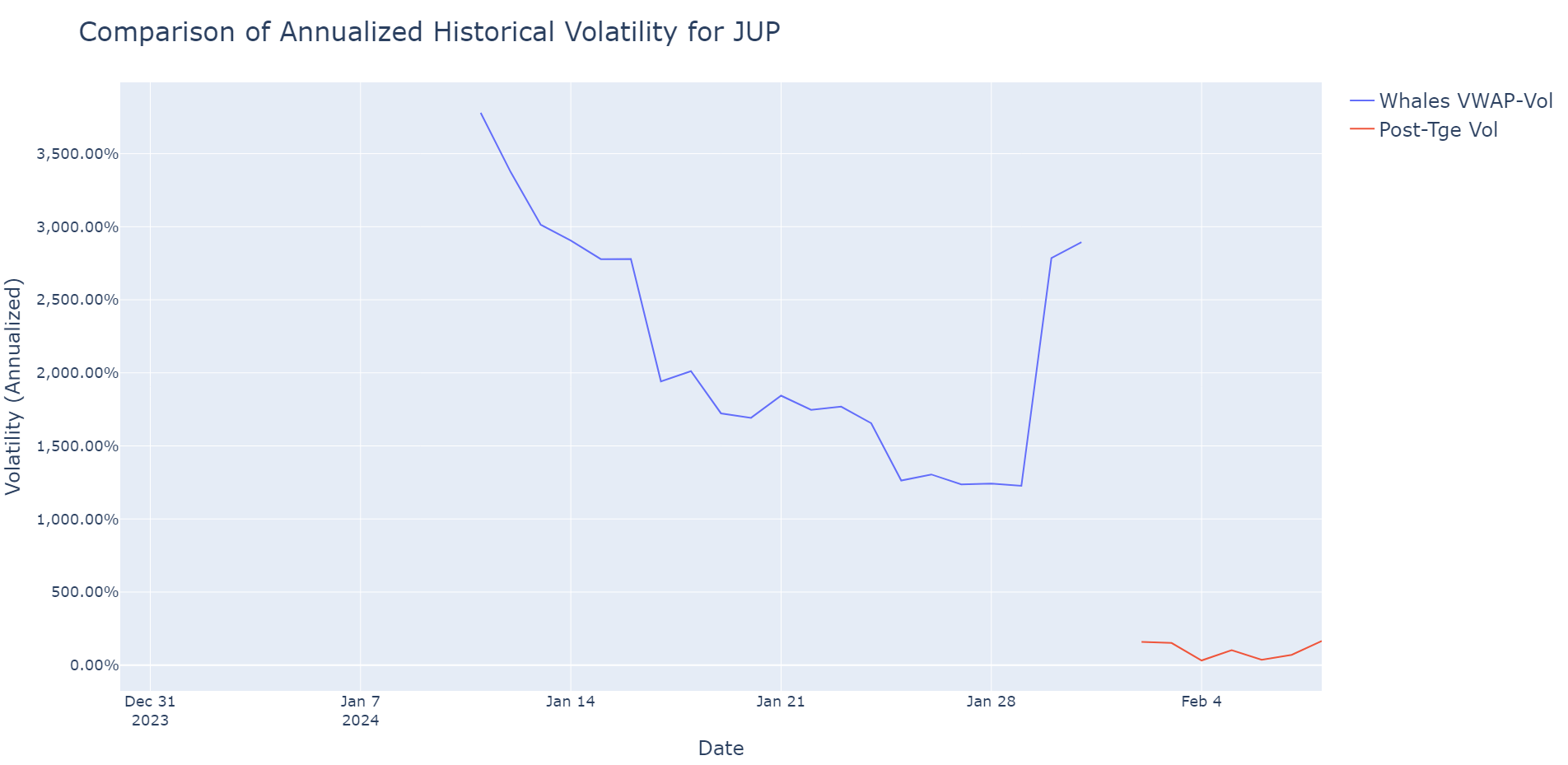

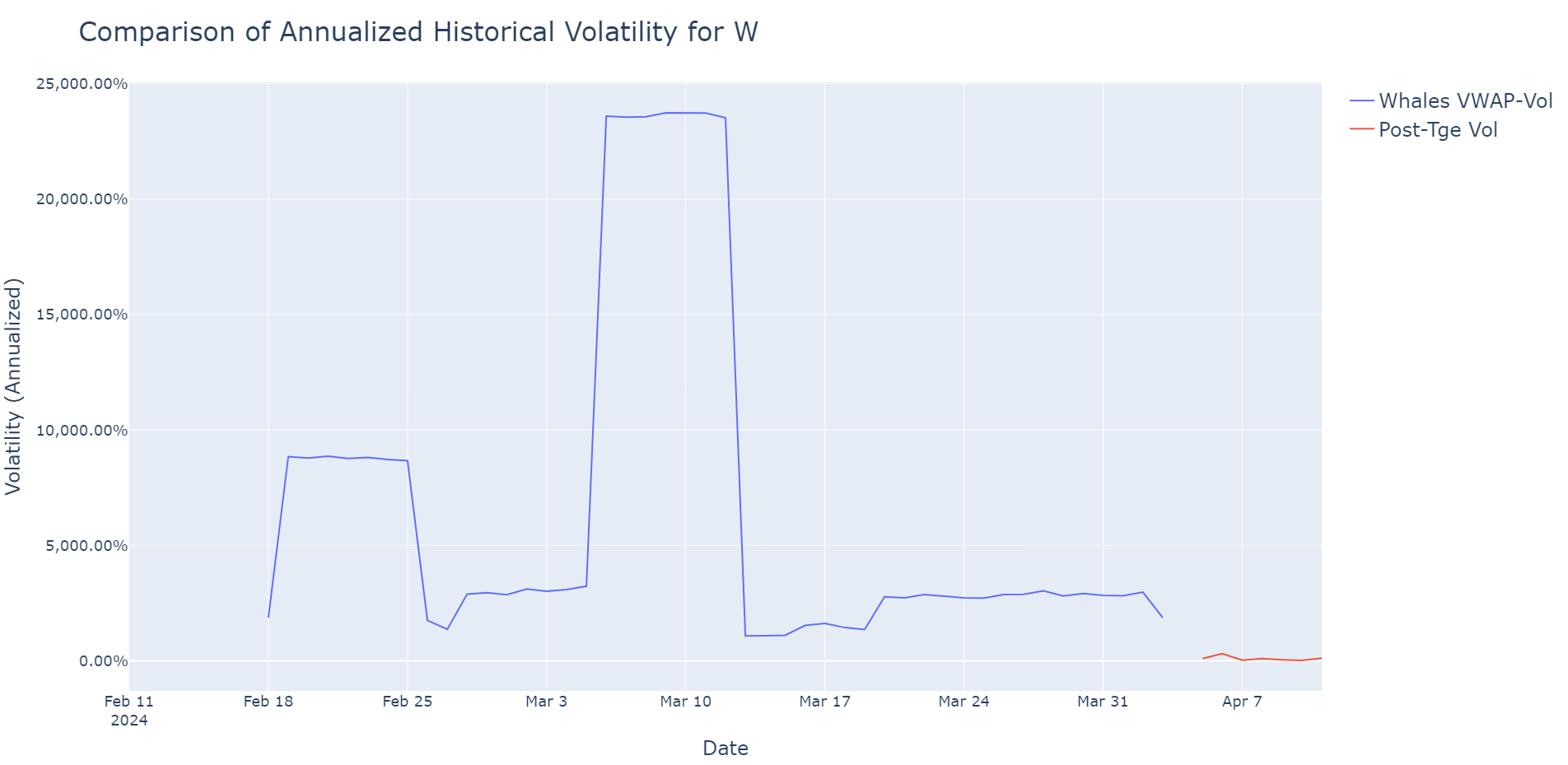

Breaking Down Pre and Post-Launch Volatility

Without liquidity, there is no price discovery. And it’s pretty simple to demonstrate that.

We’ve plotted the historical volatility based on the 7-day rolling standard deviation of returns based on a VWAP (volume-weighted-average-price).

We observe that volatility is magnitudes apart from volatility observed one week post-TGE. In W’s case, volatility went from mid-3,000 % to around 100%. The same can be seen in the JUP market. Here, there’s a sharp rise in volatility right before the TGE to ~2,800%, then fall to ~150% after the TGE.

The disparity in volatility before and after the TGE proves how critical the role of liquidity is in stabilising markets. This phenomenon highlights not only the importance of sufficient market depth for effective price discovery but also serves as a crucial indicator for buyers and sellers alike.

Source. Keyrock Data Intelligence.

As markets evolve, understanding the dynamics of liquidity and its impact on volatility can guide better decision-making and create more resilient financial ecosystems.

Conclusion

So, what does this all mean? We’ve looked at price, volatility and dynamics between pre-token and post-TGE markets.

In markets such as W and JUP, prices at different venues tend to converge, showcasing stability and consistent valuation. However, for less traded tokens like STRK, prices can vary widely, demonstrating the impact of volume on market consistency.

As we edge closer to a Token Generation Event (TGE), AEVO and Hyperliquid consistently prove their worth as reliable indicators of market trends, especially effective from 10 to 30 days before the event. In contrast, the Whales Market acts as a robust FOMO barometer, vividly reflecting spikes in speculative interest and buyer activity.

The market landscape does not favour a consistent set of winners; both buyers and sellers can realise significant gains depending on their timing.

Moreover, an intriguing lack of correlation exists between price movements and points in pre-markets. Blast and Parcl, for instance, exhibit unique trading patterns in their token prices that do not mirror their points markets. This disconnection points towards a broader issue: the glaring lack of liquidity that obstructs genuine price discovery, resulting in volatilities that are 10-20 times higher in pre-token markets than those seen post-TGE.

As markets evolve, we’re on the brink of embracing new primitives. Pre-markets, though still nascent with their modest volumes and heightened volatility, capture our undivided attention. This development promises to reshape the wider financial landscape. Trading markets before they truly materialise is set to revolutionise the way we perceive and interact with financial instruments. We’re watching meticulously as these markets unfold and evolve.