Understanding Front Running

Front running happens when a market participant is able to use information on pending transactions to place their own ahead of another’s buy or sell order. In crypto markets, it can happen in the context of miners or bots that are able to pay higher gas fees and intercept a buyer or seller. Using privacy tools and seeking pairs with high liquidity are some ways crypto market makers can protect themselves from front running.

Now that we understand wash trading and how it can come into play within crypto markets, let’s take a look at front running. This is another activity that has unfortunately been ported over from traditional finance and into Web3.

What is Front Running?

Front running is a practice in financial markets where a market participant takes advantage of advanced knowledge of pending orders to execute their own orders ahead of those.

In traditional finance, front running is considered unethical and can be illegal because it gives the front runner an unfair advantage over other market participants. Such practices are similarly frowned upon by crypto market operators, who employ a variety of countermeasures to prevent them.

How Front Running Works

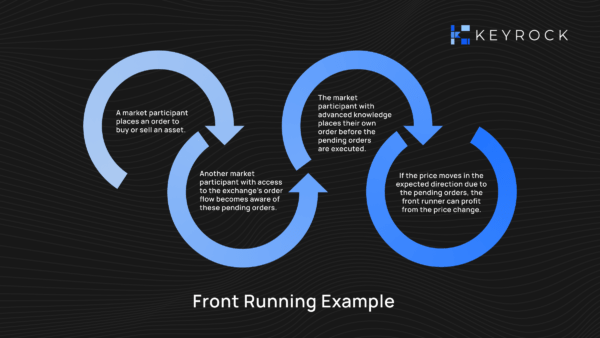

The general pattern behind a front running operation would look as follows:

Pending Orders

A market participant places an order to buy or sell an asset at a specific price. These orders are often routed through an exchange.

Advance Knowledge

Another market participant with access to the exchange’s order flow becomes aware of these pending orders before they are executed.

Front Running

The market participant with advanced knowledge uses this information to their advantage. They quickly place their own order to buy or sell the same asset before the pending orders are executed. By doing so, they can benefit from the anticipated price movement caused by the pending orders.

Profit

If the price moves in the expected direction due to the pending orders, the front runner can profit from the price change. They can then either close their position for a gain or sell the asset to the traders who placed the pending orders, taking advantage of the price movement they anticipated.

Front Running in Crypto Markets

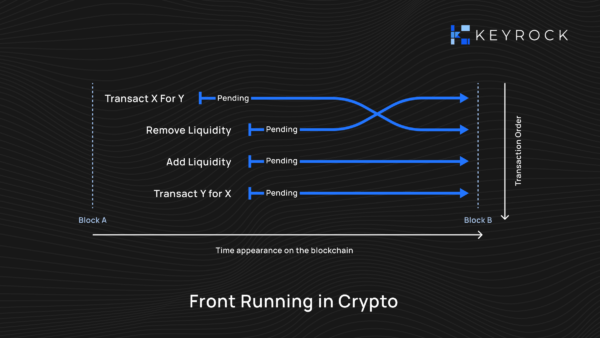

Front running also exists in the context of cryptocurrency markets. It can happen when a miner is able to use its knowledge of pending transactions to place its own transactions in front. More commonly, it happens when a third party is able to intercept a buy or sell order by offering a higher gas price than the original market participant. This is usually done via bots.

Some ways in which crypto market makers can protect themselves from front running include:

- Using privacy-enhancing tools to prevent bots from reading their transactions.

- Having a low tolerance for slippage to limit how much front-runners can gain.

- Seeking out asset pairs with high liquidity in both CEXes and DEXes.

Read more: Scaling up our onchain operations

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube