Stablecoins: Concept, Utility, and Categorisation

Key Takeaways

- Stablecoins are digital assets that are designed to remain tied to the price of another asset that is relatively more stable, usually a fiat currency.

- Stablecoins are important for providing liquidity, hedging against market volatility, and in new markets for cross-border transactions.

- There are three main types of stablecoin with different approaches to maintaining price stability: fiat-collateralized, crypto-collateralized, and yield-bearing stablecoins.

Introduction

Stablecoins are the most successful financial use case for cryptocurrencies to date. They make up a USD $136 billion market cap (for reference, Bitcoin’s dominance is based on a $566 billion market cap). They’re also a key component in crypto market making.

Let’s look at what they are, why they’re so useful, and how they’re classified. We’ll also compare different approaches to stablecoins.

Defining Stablecoins

The idea for stablecoins was introduced during the early days of Bitcoin. Their first issuer, Tether (USDT), saw the need for a price-stable digital asset that could be implemented in a similar way to Bitcoin. The solution was to design a cryptocurrency that would maintain a 1:1 relationship with the US dollar.

Since then, stablecoins have come to be defined simply as digital assets that are designed to maintain a value that makes reference to another asset, which is typically a fiat currency. We can think of them as the starting point for tokenizing real world assets. They’re an appealing midpoint between all the advantages of cryptocurrencies and the properties of traditional assets like fiat currencies.

Use Cases for Stablecoins

This makes stablecoins useful in many ways. They can serve as a vehicle for:

Liquidity

Stablecoins are an essential form of liquidity for both centralized and decentralized exchanges (CEXes and DEXes) because they’re usually the trading pairs with the most volume. They also provide liquidity to DeFi lending protocols where the relative price stability can act as an anchor for collateralized loans. As a result, stablecoins’ role in providing liquidity for a diverse range of markets is especially relevant to crypto market makers.

Hedging

Another useful role that stablecoins play for crypto market makers is their ability to hedge against market volatility. In moments of extreme volatility, they become a safe haven for traders and investors, and in some market conditions they act as a store of value. For crypto market makers, stablecoins are an important component in any risk management strategy.

Borderless transactions

Outside of trading activityies, stablecoins are also becoming the digital asset of choice for borderless transactions. This is due to the stability they inherit from fiat as well as the low transfer fees and censorship resistance that come from being a cryptocurrency. These features are especially important for emerging markets where remittances are a large component of the economy and present opportunities for market making.

Stablecoin Classification

However, not all stablecoins are created equal, and the different approaches that exist for their implementation are the subject of debate. Understanding the difference between stablecoins is key to understanding their utility as well as their underlying risks.

Stablecoins can be broadly classified into three distinct categories depending on their mechanism for achieving price stability:

Fiat-collateralized stablecoins

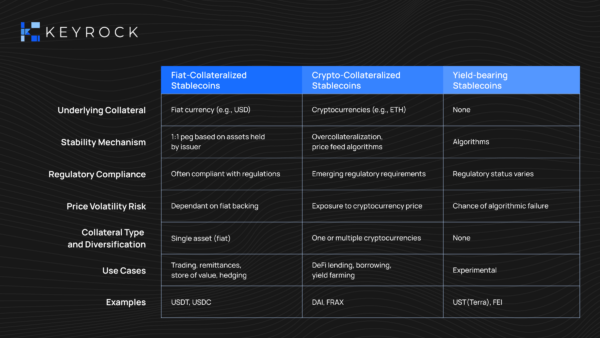

This mechanism for maintaining price stability in stablecoins works as a simple IOU and has been the most widely adopted approach. It works by maintaining a 1:1 ratio between the digital asset’s supply and the amount of fiat held by the issuer.

Fiat-collateralized stablecoins like UDST and USDC are usually dominant in the market, especially in CEXes. They are referred by the market for their high liquidity and performance relative to other approaches.

Crypto-collateralized stablecoins

Similar to fiat-collateralized stablecoins, crypto-collateralized stablecoins also derive their value from being “backed” by a different asset — in this case, another cryptocurrency. Stablecoins like DAI and FRAX can be bought by staking another cryptocurrency like Bitcoin or Ether at a ratio higher than 1:1 to compensate for market volatility.

This mechanism makes them less popular than fiat-backed alternatives due to a need for over-collateralization and the risk of liquidation. However, since they can be issued programmatically by a protocol, they’ve become a popular source of liquidity for DeFi applications.

Yield-bearing stablecoins

There’s another approach to stablecoins that involves no collateral at all. This approach relies on algorithms that continuously adjust the supply of a stablecoin in order to maintain price stability and follow the price of an external asset.

Yield-bearing stablecoins have been seen as a promising development for crypto markets. This has been especially true for market participants who prefer an alternative to the reliance on third parties of fiat-backed stablecoins and the over-collateralization of crypto-backed stablecoins. However, failed attempts like Terra’s have left a bad impression on the market.

Comparison

Let’s compare these different types of stablecoins in terms of what they could mean for market makers:

Conclusion

Stablecoins enjoy market demand and a wide array of important use cases. This makes them an essential component in market making strategies while considering the nuances of their different implementations.

Fiat-collateralized stablecoins are especially relevant for crypto market makers since they’re still dominant in most crypto trading activity. There can also be unique opportunities for crypto-collateralized assets in DeFi markets.

Read more: The scale of stability: the Stablecoin landscape dissected

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube