Can markets be efficient before they even exist?

Trading tokens before they even hit liquidity has transformed markets. But how do these platforms differ? Is there an undisputed champion? What are the preferences of the users? Dive to discover the standout.

Key Takeaways

How successful have the protocols that allow for pre-token trading been? What else can we learn from the user behaviour? We observed the pre-token markets on several protocols over the last months to answer.

We arrived at a few major learnings:

- Two types of platforms: cash settlement and asset settlement. Asset settlement platforms are the choice for on-chain transactions.

- Most orders come from users eager to buy tokens or points.

- A strong preference for token markets, which made up 80% of the market

- Despite relatively low liquidity compared to post-TGE markets, an impressive $50 million has already been traded

- Average transaction size of $870 on Whales Markets.

- $JUP has emerged as the most traded market, primarily in Whales Markets.

The Rise of Pre-token

A newly formed narrative has emerged: traders can’t wait for tokens to launch—they want to trade now.

Until recently, trading tokens before the official Token Generation Event (TGE) involved navigating Over-The-Counter (OTC) transactions. This was the only way for investors and networking to secure a seat at the table by buying and selling token allocations. Some even resorted to more obscure routes through prediction markets, such as Polymarket, to bet on the timing of the TGE. Quite inconvenient if you ask us.

But those days are over

Platforms like AEVO and Hyperliquid now allow anyone to speculate or hedge against the future price of a token before its launch. Meanwhile, other platforms like Whales Market enable users to OTC trade their tokens and the future airdrops they will receive from the project.

This shift happened because protocols approach their token launches differently. They have realised they don’t need to launch and run a liquidity mining program that might impose selling pressure on the token to attract users. Instead, they could use points.

The point of points

But what exactly is a point? A point serves as “proof of participation” in the early stages of a protocol. It hints that there will be a conversion between points and tokens. This conversion rate could be any number the protocol deems appropriate.

More significantly, this sends a signal of how attractive a market where we can trade tokens before they’re officially launched is. Imagine being able to trade shares of Reddit months before its IPO. It’s revolutionary. It makes it possible for price discovery to happen before tokens go live. In this article, we’ll review the different pre-token platforms and give you a comprehensive comparison between them.

What are pre-token and point markets?

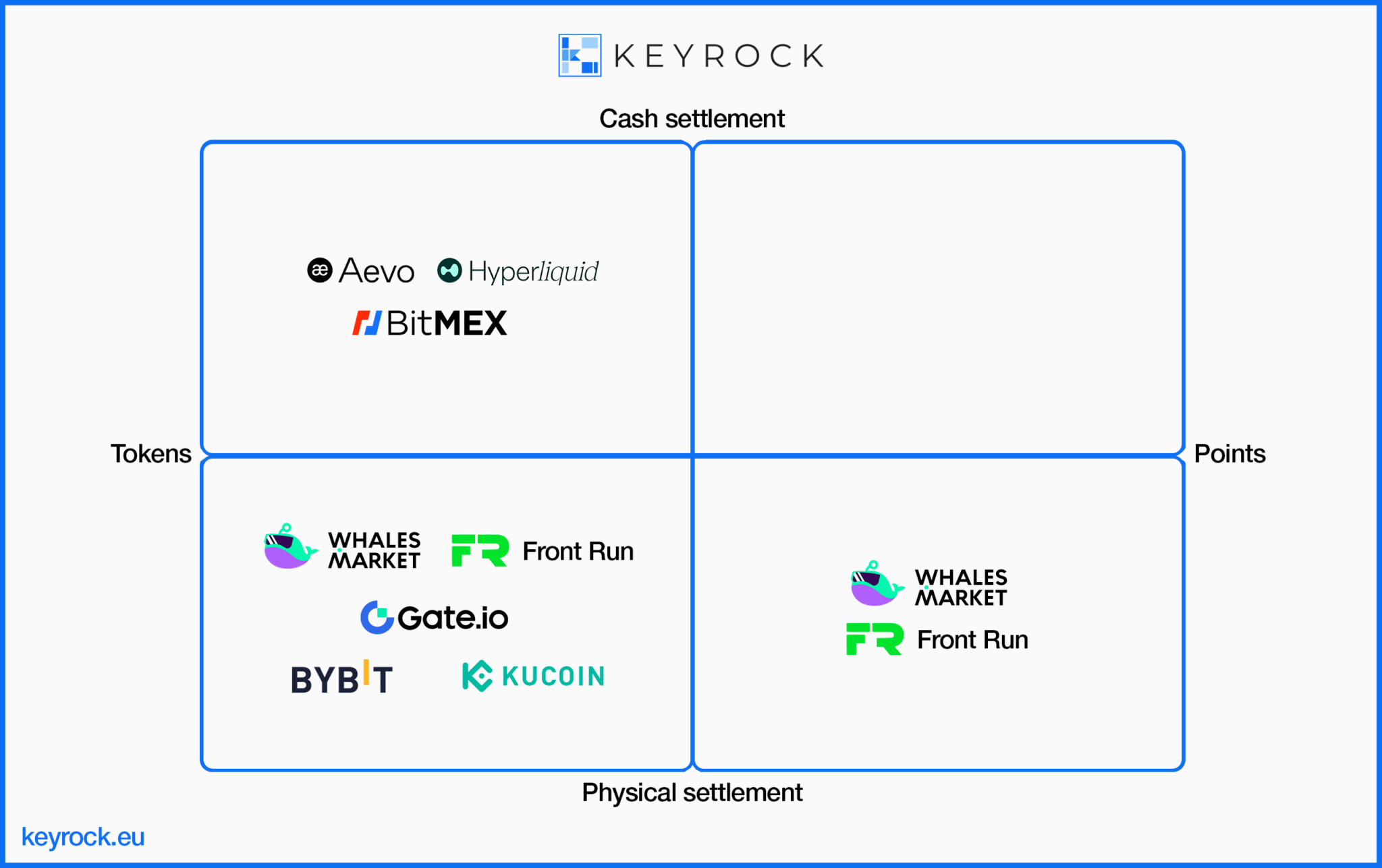

Pre-token and point markets typically fall into two categories.

The first is a perpetual futures derivatives market. The settlement is cash settled. That is, traders settle transactions in a different currency, such as USDC.

The second is a peer-to-peer OTC market. This platform enables users to trade a future of the token before its TGE. At settlement, traders exchange the tokens at the previously agreed price.

Both markets operate under distinct mechanisms, and we’ll get deeper into the topic. Yet they serve a similar purpose: to provide early access to token or points futures.

Decentralised

Hyperliquid

Hyperliquid is a decentralised perpetual trading platform. They call their product to trade pre-tokens Hyperps. Hyperliquid settles the trades on-chain and keeps the order book off-chain.

Whales Market

Whales Markets is a decentralized trading platform. Unlike AEVO and Hyperliquid, Whales Market allows traders to either trade points or trade futures on the token. Note that it is not a perpetual future, as there is a settlement date and a physical delivery. That date is the Token Generation Event (TGE).

AEVO

AEVO is a decentralised options and perpetuals trading platform. pre-token trading allows users to trade perpetuals at the token’s future price. AEVO settles the trades on-chain and keeps the order book off-chain.

Front Run

Front Run is an on-chain OTC order book DEX. It allows trading futures of points, airdrop allocations, pre-token and whitelists.

Centralised

CEXs have also hopped into this trend. Kucoin, Bybit, Bitmex, and Gate.io have added some form of pre-token trading.

Bybit, Gate.io, and Kucoin allow people to trade futures of the token with physical delivery of the tokens shortly after token TGE. Delivery risk is mitigated via collateralisation.

Bitmex allows perpetuals trading collateralised with USDT. This means that there is no physical delivery of the token, and the trade is settled in USDT.

How do pre-token and point markets work

What sets apart the various on-chain platforms? Let’s dive into a rapid rundown of their mechanism designs.

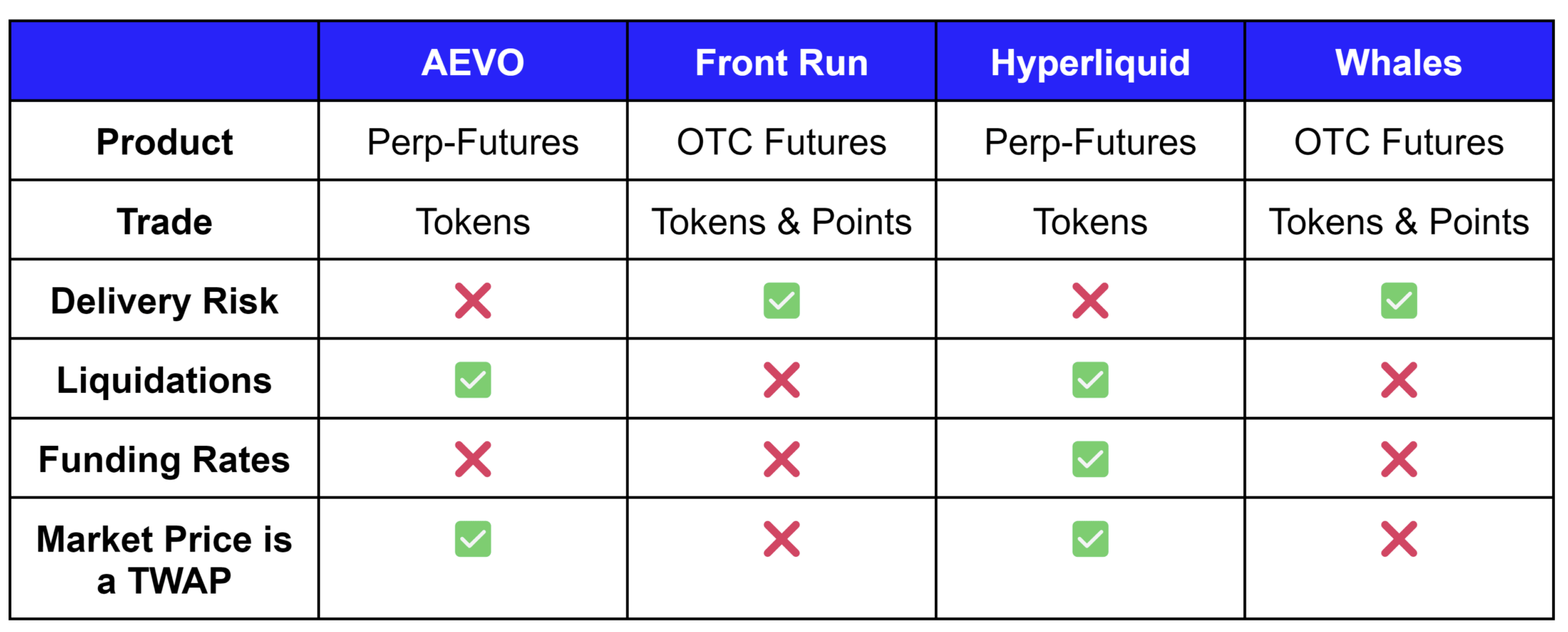

AEVO

AEVO lets people trade pre-tokens as perpetual futures. Traders can go both long and short directly against the token for both speculative and risk management purposes

The market price at AEVO is defined as the time-weighted average price (TWAP), with no index price involved. By using a TWAP, AEVO aims to protect traders from potential manipulations by whales. The specifics of this TWAP mechanism, however, remain undisclosed.

All trades, whether long or short, are collateralised using USDC. AEVO allows maximum leverage of 2x, and traders must maintain a minimum collateralisation of 48% to avoid liquidation. There are no funding rates.

Once the TGE occurs, pre-token markets transition to standard markets. The maximum position one can hold is capped at USD 50,000. Additionally, AEVO imposes no restrictions on the amount of total open interest for any particular market.

Front Run

A market will be settled after its TGE. During the settlement period, sellers must close active trades to trigger the smart contract and the token settlement.

Buyers lock a specified amount of collateral when entering the trade until the TGE, which is then used to purchase the tokens or points from the seller.

Sellers have a 24-hour grace period post-TGE to deliver the points or tokens. If they don’t, the collateral they used when entering the trade is seized.

If the conversion from points to tokens does not occur at the pre-agreed ratio, the agreement is voided and the collateral is refunded to both parties.

Hyperliquid

Hyperliquid enables traders to engage with pre-tokens, known as Hyperperps, as perpetual futures. At TGE, these markets evolve from pre-token to real-market status.

Similar to AEVO, Hyperliquid operates independently of an oracle or index price. It relies on an 8-hour exponentially weighted moving average, derived from the previous day’s minutely mark prices.

The platform distinguishes itself from AEVO by integrating funding rates based on momentum. It allows traders to use up to 3x leverage on Hyperperps. The required maintenance margin is 16.67%, which is half the initial margin at maximum leverage.

While there is no maximum open interest per individual, the markets have a maximum open interest cap of $1,000,000. This is done as a risk management tool given the volatile and illiquid nature of the pre-token markets.

Whales Market

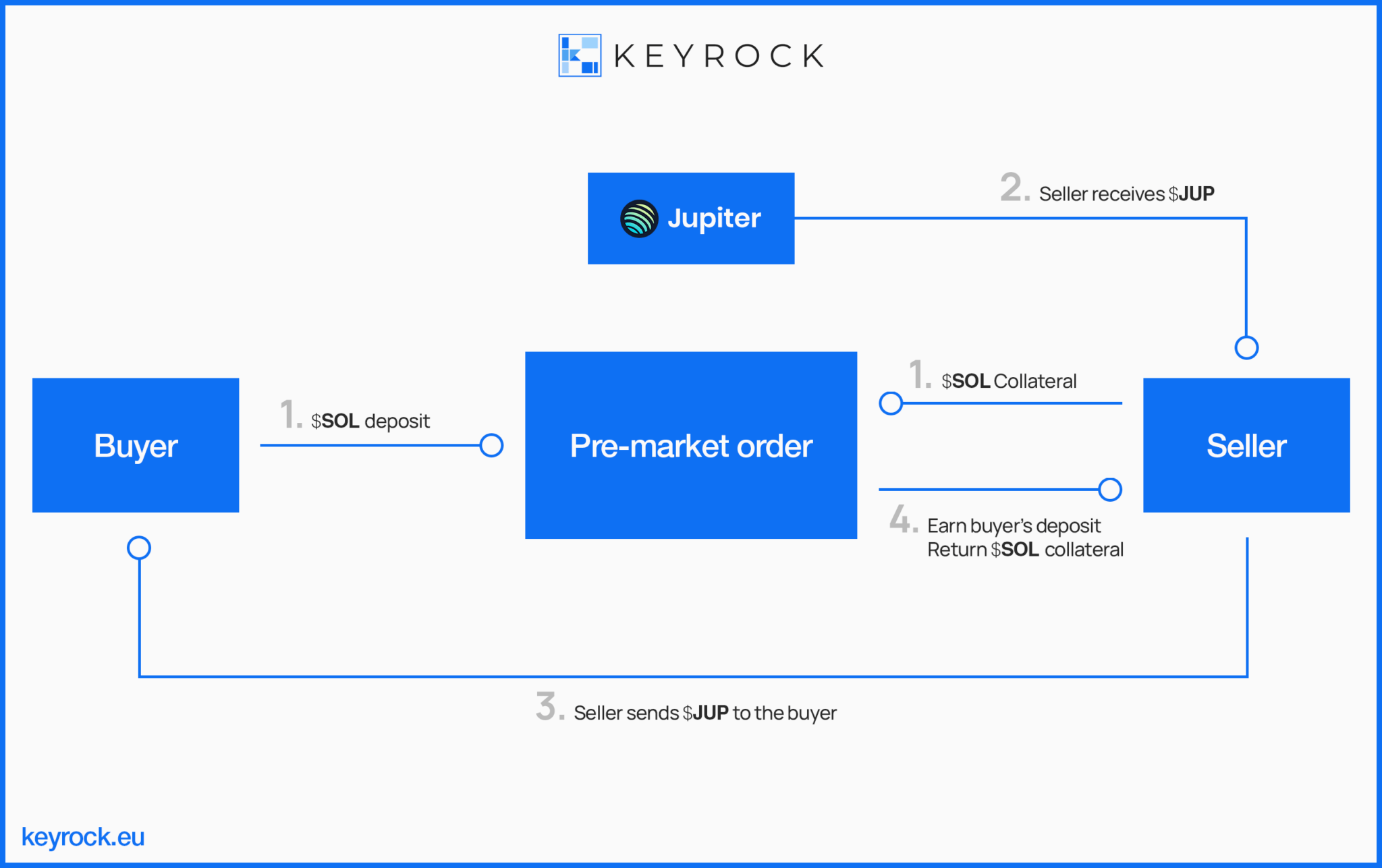

Both for tokens and points, the seller’s collateral ensures they will provide tokens once they’re released. If the seller wants to sell 100 points for $1 per point, they need to provide $100 worth of collateral.

At TGE the seller is to provide the tokens/points sold to get their collateral back. If the sellers do not settle before the deadline, their collateral goes to the buyer as compensation. Through this mechanism, Whales Market (fully or partially) collateralises the trade and mitigates the delivery risk.

However, this risk is only mitigated up to a certain point. Let’s consider a couple of non-exclusive scenarios. The seller sells 100 points at $1 per point.

- A–At TGE, if one point is worth approximately $2, the seller could take a $100 loss from the collateral and still profit $100. The buyer would receive $100, which would at best, partially (50%) cover their buying order.

- B–The buyer/seller is collateralising at current prices. Let’s say they add 0.25 ETH at $4,000 per ETH to settle the trade. If the value of the collateral drops at TGE, this could leave the counterparty with a depreciated asset.

Comparison

The table below provides a quick summary of the key mechanisms that pre-token projects have.

How popular are pre-token and point markets?

What’s the real deal with pre-tokens? To know if they’re here to stay, a pulse check on Whales Markets and Hyperliquid pre-token dynamics is needed. We’re talking about selling vs buying volumes, trade sizes, types of markets, and more. Let’s get into it.

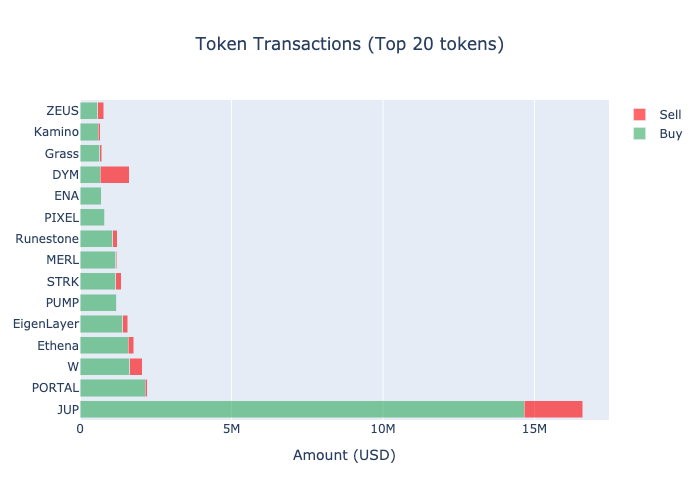

Here’s the total volume of the top 15 tokens traded on the platform. $JUP overwhelmingly win the category of the most traded token by far.

Most tokens exhibit a buying volume significantly higher than the sell volume. Only 5 out of 57 tokens that have been traded on Whales Market show a selling volume that exceeds the buy volume. Participants in Whale Markets demonstrate a strong preference for buying tokens, points, and runes.

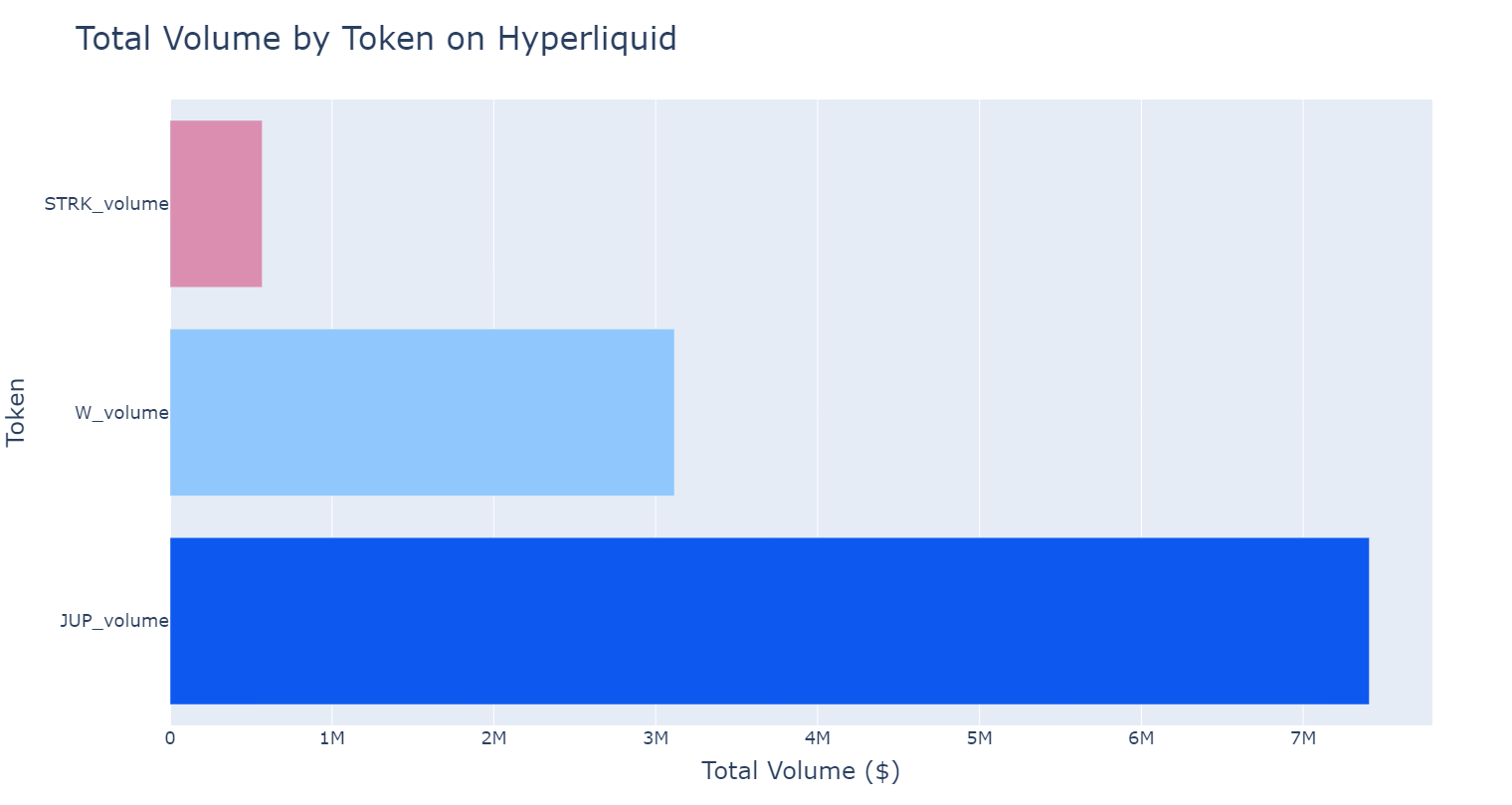

On Hyperliquid, $JUP dominates too, closely followed by $W and far from $STRK.

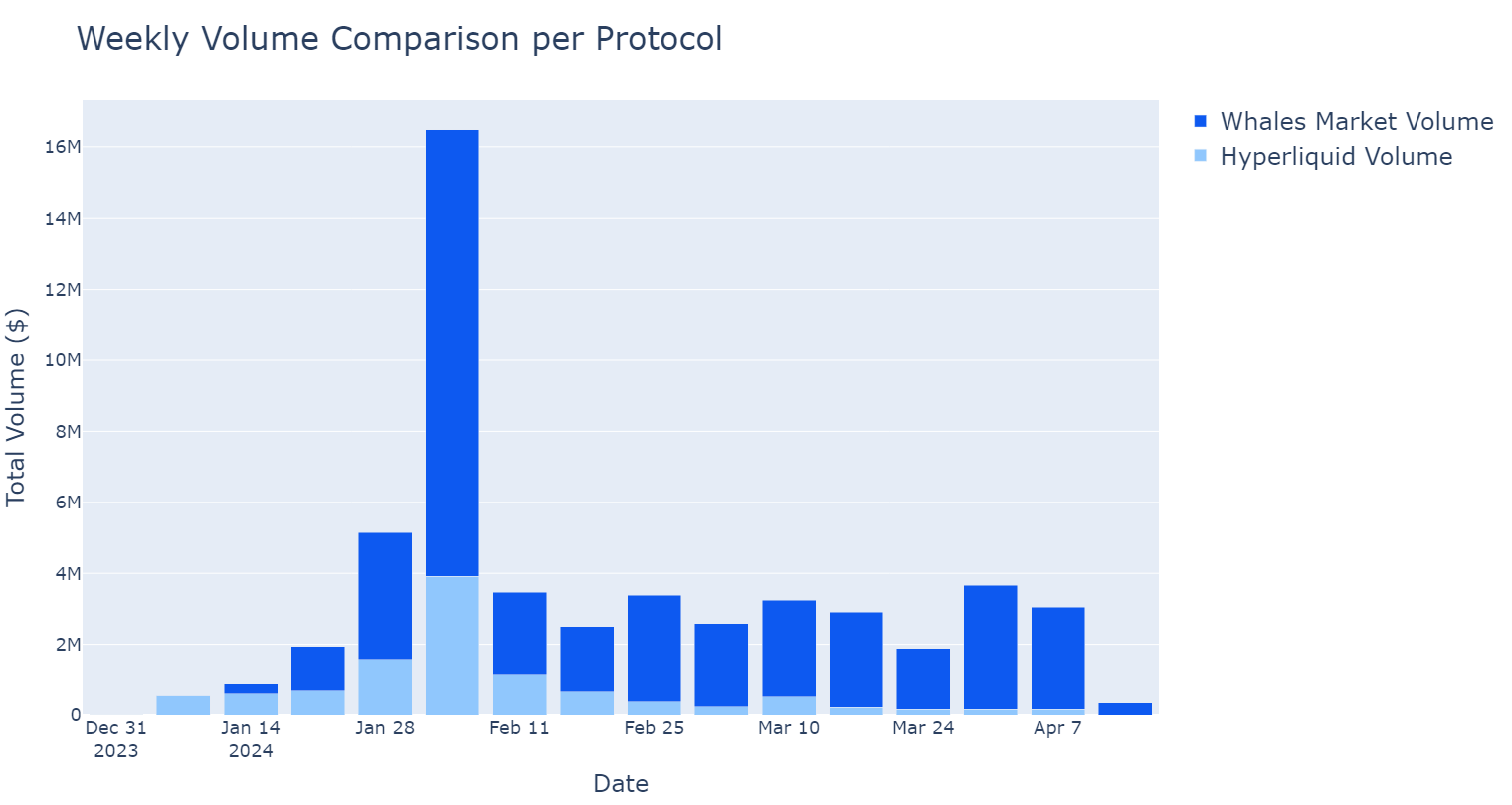

When comparing Hyperliquid to Whales Market, we observe a huge spike in volume on both platforms right before the $JUP TGE. It’s quite evident that Whales Market has been the preferred trading platform, with $41 million in volume compared to $11 million on Hyperliquid.

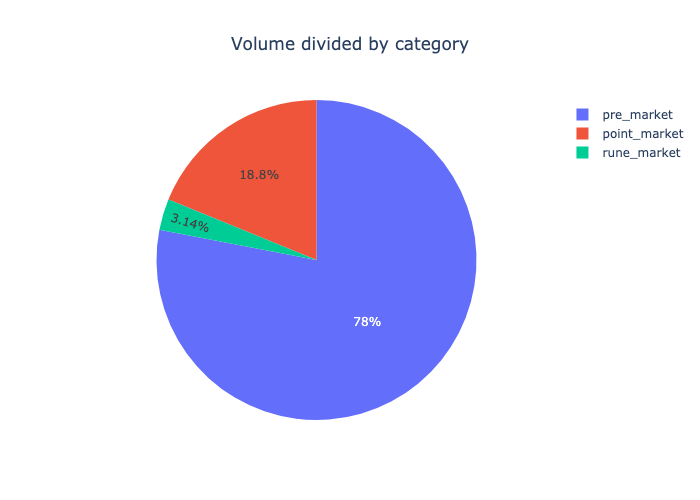

Interestingly, there is a marked preference for directly trading tokens (premarket) rather than points. This is not observable on Hyperliquid, where only perp-futures of the token are available for trading.

Are the markets dominated by whales or by smaller players?

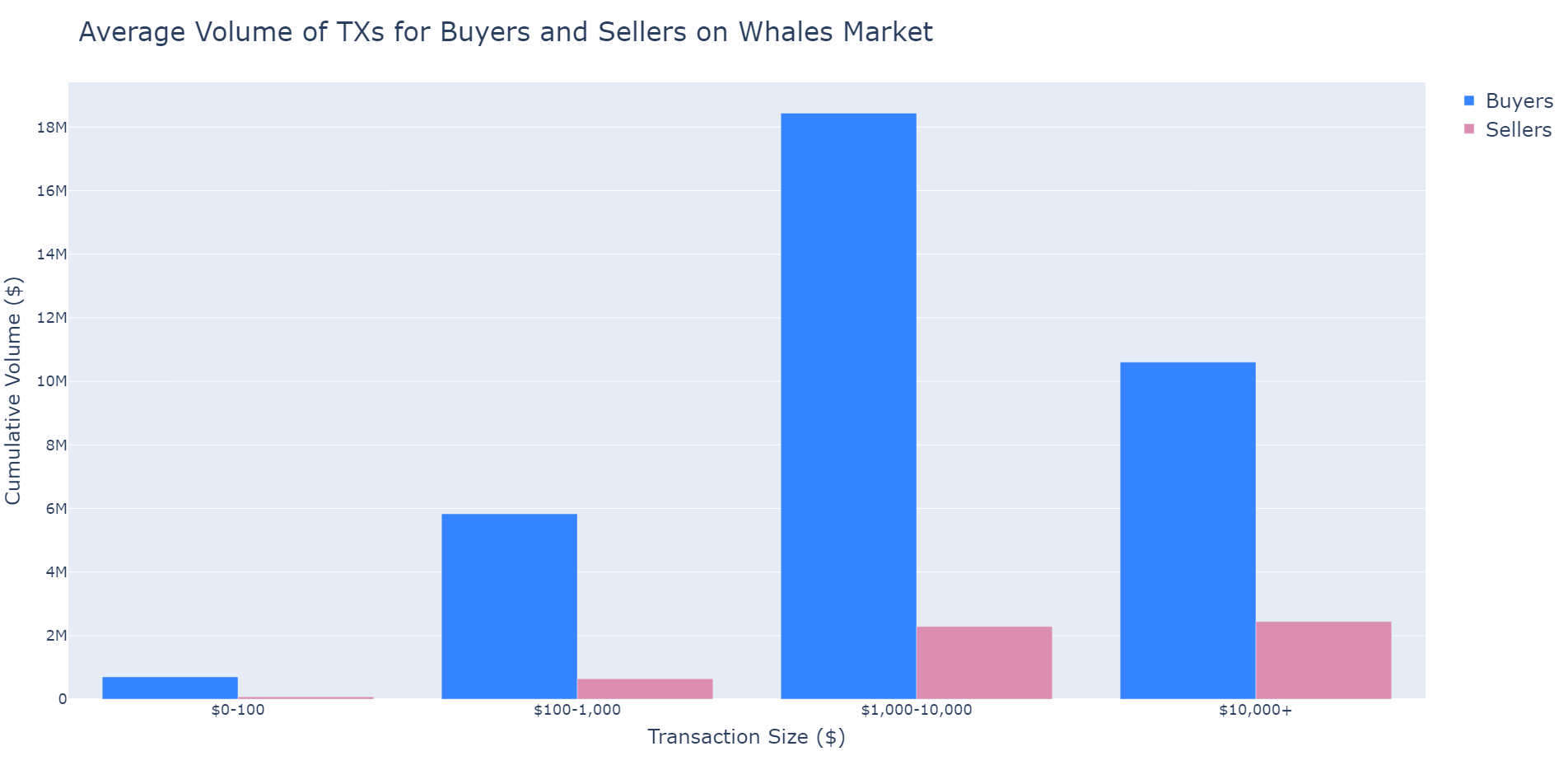

Out of 47,000 transactions on Whales Markets, 35,000—or 73.5%—involve amounts smaller than $1,000. Since the order book is kept off-chain, we can’t know the average trade size on AEVO or Hyperliquid for pre-tokens.

Analysing the cumulative volume by transaction size reveals that the majority of the volume stems from transactions between $1,000 and $10,000. With the average transaction size being just $870.

As a last note, but certainly not least: price discovery becomes very inefficient without sufficient volume.

This is often the case with pre-tokens, whether for tokens or points. Examining these markets made it clear that pre-tokens are only a tiny fraction of their post-launch counterparts.

For example, post-TGE, Wormhole’s volume was consistently around $1b to $10b, whereas the aggregated pre-token volume was around $100k—a disparity of 1,000 times. This is not something unique to Wormhole’s market. We’re seeing it with $JUP–1,000x less volume–or $STRK–32,000x less volume.

Conclusion

Even with “proof-of-participation” through points trading, most platforms rather focus on futures and perpetuals trading. This can largely be attributed to a significant gap in information, as there is no direct or guaranteed relationship between point and token conversion.

We identify two major mechanisms for trading pre-token. One is platforms offering cash settlement, where traders can trade virtually without needing to hold the underlying assets. The other is physical settlement, where sellers and buyers exchange assets at the TGE.

On users’ preferences, we have two main takeaways. They prefer to trade tokens over points, perhaps due to the aforementioned information asymmetry regarding point-to-token conversion rates. The vast majority of the order flow is from buyers and filled by sellers.

By a large margin, $JUP was the most popular market traded, with Whales Markets being the on-chain venue of choice for traders.

Secondly, most traders are “shrimps,” with an average transaction size on Whales Market of $870. This can potentially be attributed–though we have no clear evidence of that–to small airdrop farmers who split their capital across many wallets.

Whales Markets and Hyperliquid reached volumes of $41 million and $11 million respectively. But pre-tokens are still a tiny drop in the ocean compared to post-TGE markets.

In the case of $JUP, the most popular asset, pre-tokens were 1,000 times smaller than post-TGE markets. This stark contrast highlights how even with the continuous growth of pre-token trading, the potential inefficiencies of an illiquid market shouldn’t go unnoticed.

Read more: Are pre-token and points markets enough reliable to predict the future?

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube