The slow birth of Bitcoin's Layered Ecosystem: the Roots behind today's L2 Surge

Bitcoin is massive—over $1 trillion in value, rooted in security, decentralisation, and its hard-to-produce nature. Yet, for years, this value was underutilised, stifled by a lack of infrastructure.

Introduction

Bitcoin started out simple—it had to be. For most of its life, it was mined or exchanged, and that was the limit of its utility. But in the last two years, that simplicity has begun to evolve. While the main chain remains straightforward, what’s being built on top—layer by layer—is turning Bitcoin into something far more versatile.

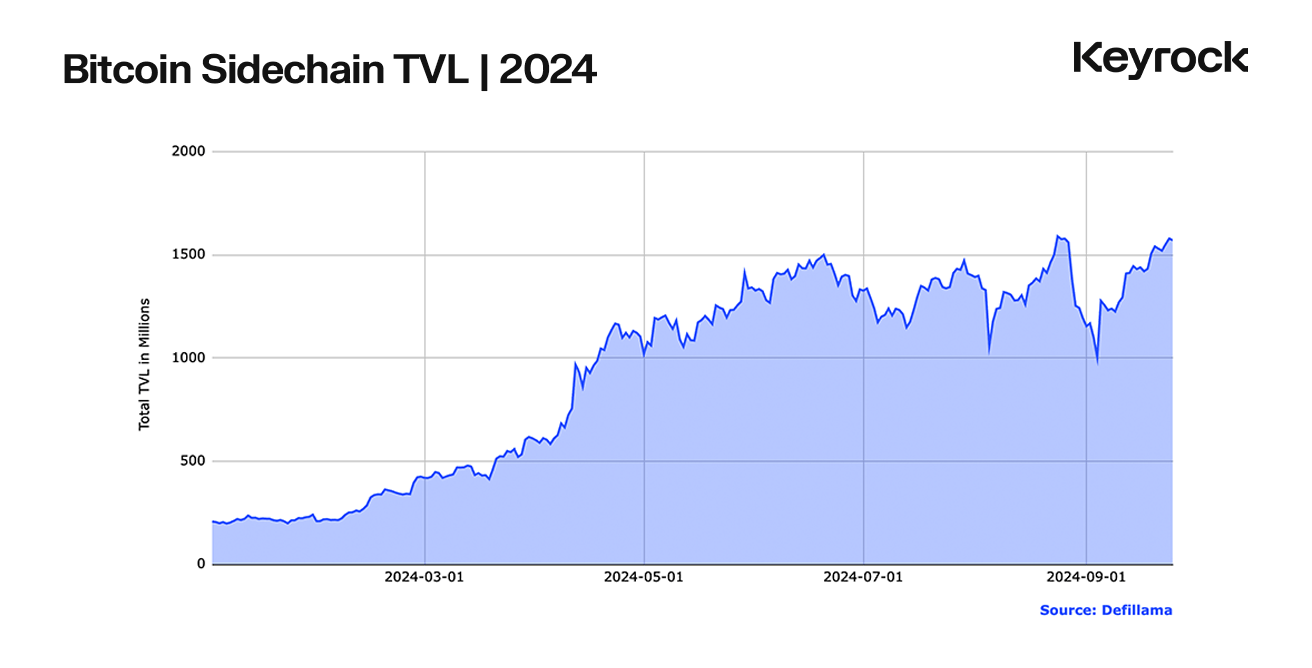

In the past year alone, Total Value Locked (TVL) on Bitcoin Layer 2 solutions has surged sevenfold. From zero to $1.25 billion in just three years. So how did Bitcoin, a chain lacking DeFi or smart contracts, spark this wave of growth? Why did it take so long? And is Bitcoin now ready to do it all?

Humble beginnings 2008-2010

On August 18th, 2008, Bitcoin.org was registered anonymously. Just 74 days later, Satoshi Nakamoto published the Bitcoin whitepaper, outlining a peer-to-peer system for electronic transfers without trust. By January 3rd, 2009, the first block—the Genesis Block—was mined.

Bitcoin’s launch was simple: mine coins, send, receive, and validate transactions. Its true revolution lay in its decentralised, trustless design, a radical shift in how money could work.

A year later in 2010, Bitcoin made its first real-world impact when 10,000 BTC were exchanged for two pizzas—proving its value extended beyond the digital realm. But Bitcoin’s potential was just starting to be tapped.

Light Tinkering 2011-2012

After its launch, Bitcoin entered a period of relative stasis. In 2011 & 2012, Bitcoin grew in users, hashrate, and cultural relevance, but saw no major functional changes. Updates 0.3 and 0.4, released in 2011, were modest, focused on bug fixes and security.

Yet innovation happened around Bitcoin. Enthusiasts soon discovered GPUs were far more efficient than CPUs for mining, individuals built trustless markets on Bitcoin changing goods and services, and realised the network’s code could be forked. The most notable example was Litecoin (2011), a coin built from Bitcoin’s codebase but with faster block times and a different hashing algorithm—positioned as silver to Bitcoin’s gold, though not a true Layer 2.

It wasn’t until 2012, that the first significant feature was added: P2SH (Pay to Script Hash), enabling more complex addresses and laying the groundwork for multisig wallets. It wasn’t DeFi, but it marked the first step toward a broader, programmable future for Bitcoin.

The first Meta-Layer 2013-2014

As Bitcoin grew rapidly, it became clear that a more formal system for proposing changes was needed. No longer a hobbyist project, Bitcoin was evolving into a serious economic entity. By August 2013, the BIP system (Bitcoin Improvement Proposal) was introduced, allowing anyone to suggest improvements, setting the stage for Bitcoin’s collaborative evolution.

That same year, Bitcoin saw its first ‘Meta-Layer’ solution—what we now call Layer 2 (though the term ‘L2’ wasn’t in use at the time)—with the launch of Mastercoin. Mastercoin aimed to expand Bitcoin’s functionality, with plans to enable custom tokens, enable a basic DEX, and conditional smart contracts. It even introduced pegged assets, an early precursor to stablecoins. However, adoption was slow due to its complex implementation, which involved embedding data into rarely-used fields like OP_Return.

Though Mastercoin itself didn’t succeed, it evolved into the Omni Layer, which became a bridge across chains. Most notably, Tether (USDT)—the first and most successful stablecoin—was initially issued on Omni, a pivotal moment in crypto history.

In 2014, Ethereum launched via an ICO, built with smart contracts and programmability in mind. As platforms like Ethereum, Lisk, and Waves began expanding DeFi, interest in modifying Bitcoin or building on top of it waned. Bitcoin’s chain was too rigid and hard to work with; attention shifted to more flexible platforms that could natively support decentralised applications.

Planting Roots 2015-2016

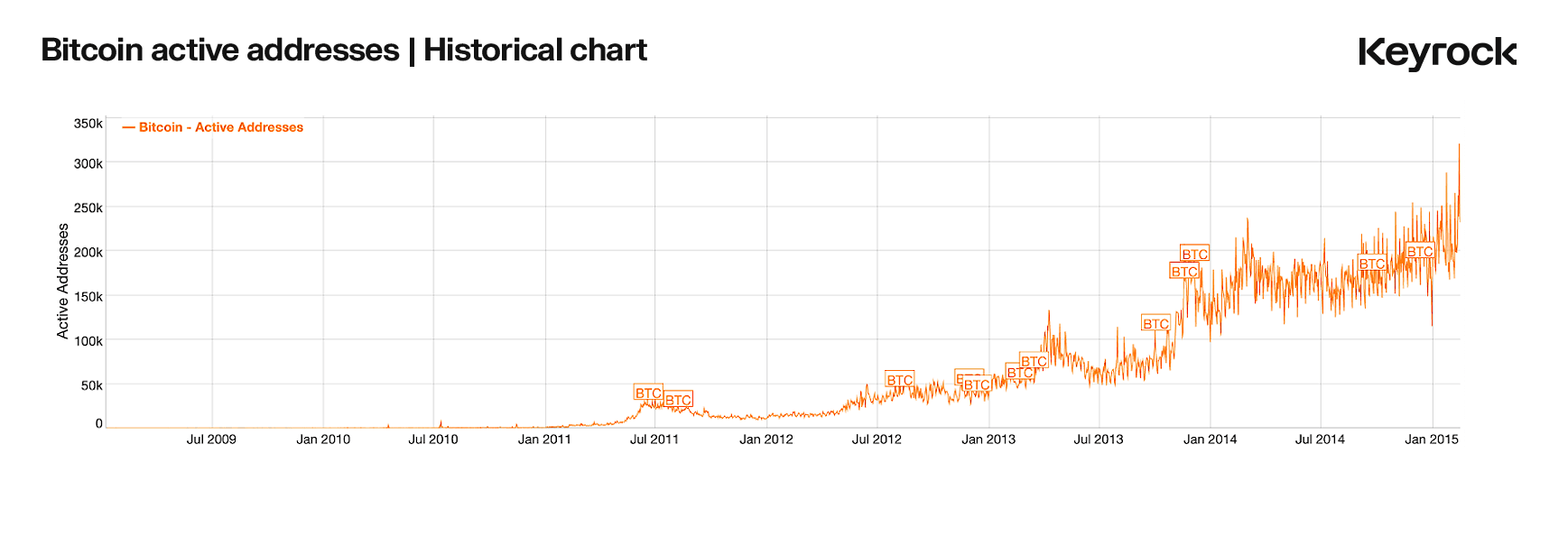

By 2015, Bitcoin had around 200,000 active addresses, but performance was slowing. Despite scaling efforts, its core design limited improvements. Real scalability required either deep structural changes or a “meta-layer”.

In 2016, the Lightning Network whitepaper proposed a Layer 2 solution for faster, off-chain transactions. Lightning allowed users to open payment channels and bundle multiple transactions off-chain, settling only the final result on-chain. This reduced fees and block space usage while keeping Bitcoin’s structure intact. Though not a true Layer 2 like modern rollups, Lightning promised to enable near-instant and cheaper transactions than directly on the main chain.

Around the same time, Rootstock (RSK) was proposed to bring smart contract functionality to Bitcoin via RBTC (Smart Bitcoin), allowing BTC to be used in a smart contract environment. However, as smart contract chains like Ethereum, Lisk, and Waves gained momentum, RSK didn’t directly address Bitcoin’s congestion issues, leading to less interest in its early stages.

Lightning strikes a little late 2017-2018

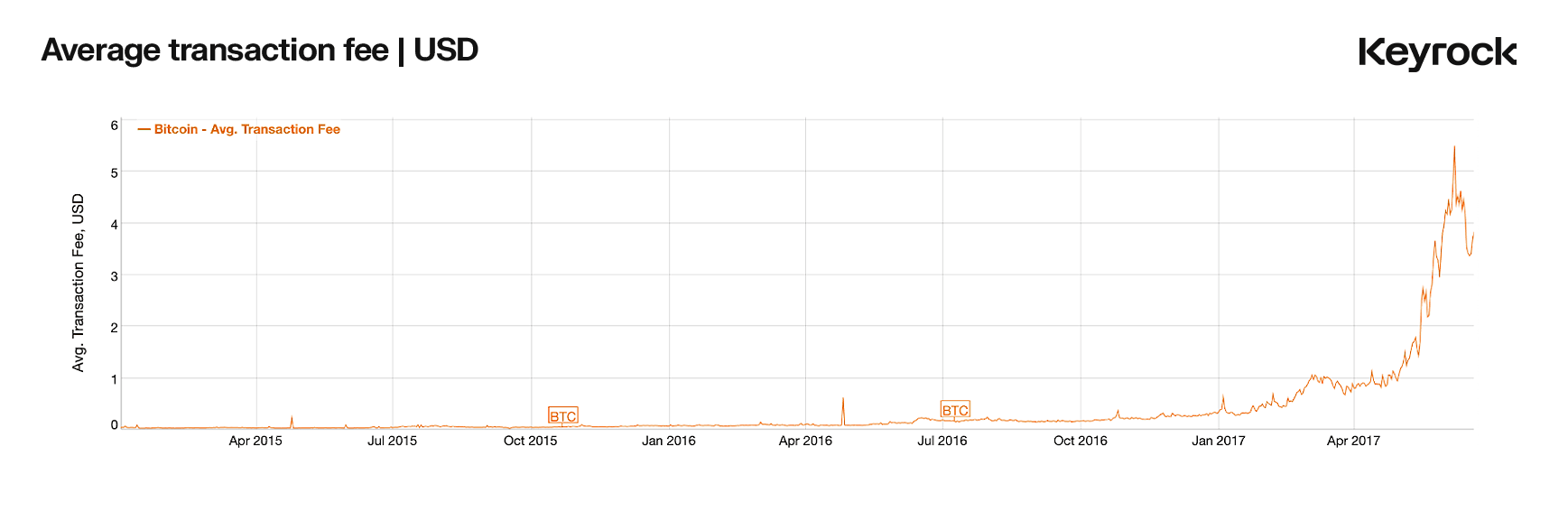

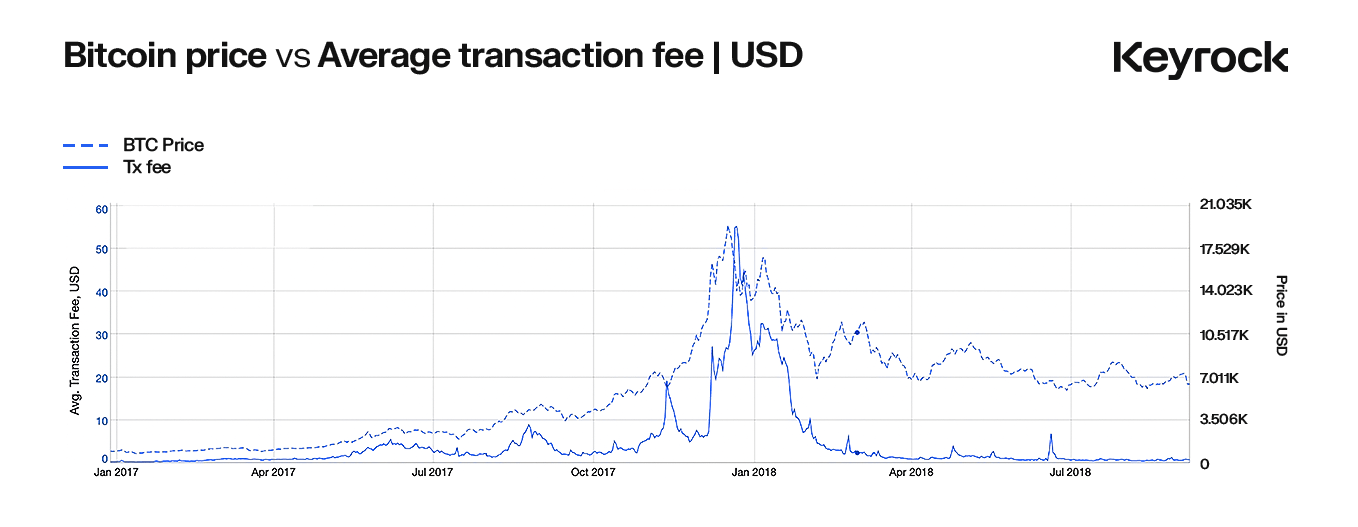

By 2017, active Bitcoin addresses had surged 250%, and average transaction fees had skyrocketed by 700% over two years—then soared another 1400% from January to June alone. At that moment, few were concerned with adding new features like smart contracts; projects like Rootstock were relegated to the sidelines. The focus was singular—users just wanted their transactions to succeed without exorbitant costs.

With the Lightning Network not yet operational, Bitcoin’s mounting congestion culminated in its first major hard forks: Bitcoin Cash (BCH) and Bitcoin SV (BSV). These forks made minimal changes beyond increasing block sizes to relieve network strain. BCH expanded block capacity from 1 MB to 8 MB, easing on-chain congestion at the cost of reduced decentralisation. BSV took this further, increasing the block size to 256 MB. These forks were born out of the bull run’s urgency, fix it no matter the cost, reflecting the dominant view that scaling should happen on the base chain, not through secondary “meta-layers”.

By December 2017, Bitcoin hit an all-time high of $19,000, but by Lightning’s launch in March 2018, it had dropped by 40% and transaction volume had fallen. Still, Lightning was a technical success. Its gradual development and smooth rollout paid off, with few bugs or security issues enthusiasts quickly embraced it. Yet with lower transaction volume due to Bitcoin’s price decline, it’s difficult to pinpoint Lightning’s exact impact on alleviating network congestion.

Although Lightning effectively worked as a Layer 2 solution, it was more of a sophisticated transaction bundler than a full L2 with its own chain. Around this time, the Taproot upgrade was proposed, offering enhancements to privacy, flexibility, and paving the way for more complex Layer 2 solutions. However, unlike Lightning, Taproot’s impact wasn’t immediately felt—while it laid the foundation for future innovations, it didn’t directly address the pressing issues of fees and congestion.

Crypto winter 2018-2019

From 2018 to 2019, Bitcoin experienced another phase of relative calm, reminiscent of 2011-2012. The Lightning Network gained traction, boosting Bitcoin’s scalability, hash rate, and node network, though broader development was subdued. Across the crypto space, prices and activity dipped sharply, living in the shadow of the 2017 highs. Yet, development in Turing-complete smart contract chains, particularly Ethereum, laid the groundwork for decentralised finance’s coming surge.

By then, a new consensus emerged: Bitcoin was digital gold, a store of value, while Ethereum was a global, programmable computer. Bitcoin’s cultural role solidified as a foundation, best leveraged as a value bridge rather than a flexible platform.

The Big DeFi Bang and NFT nebula 2020-2021

Emerging from the quiet of 2019, 2020 quickly ignited into a wave of innovation. Years of groundwork in smart contract platforms set the stage for an explosion of novel DeFi protocols like Curve, Compound, Balancer, Yearn and Sushiswap. Together they redefined what Defi could be, turning finance into a compostable, interconnected system.

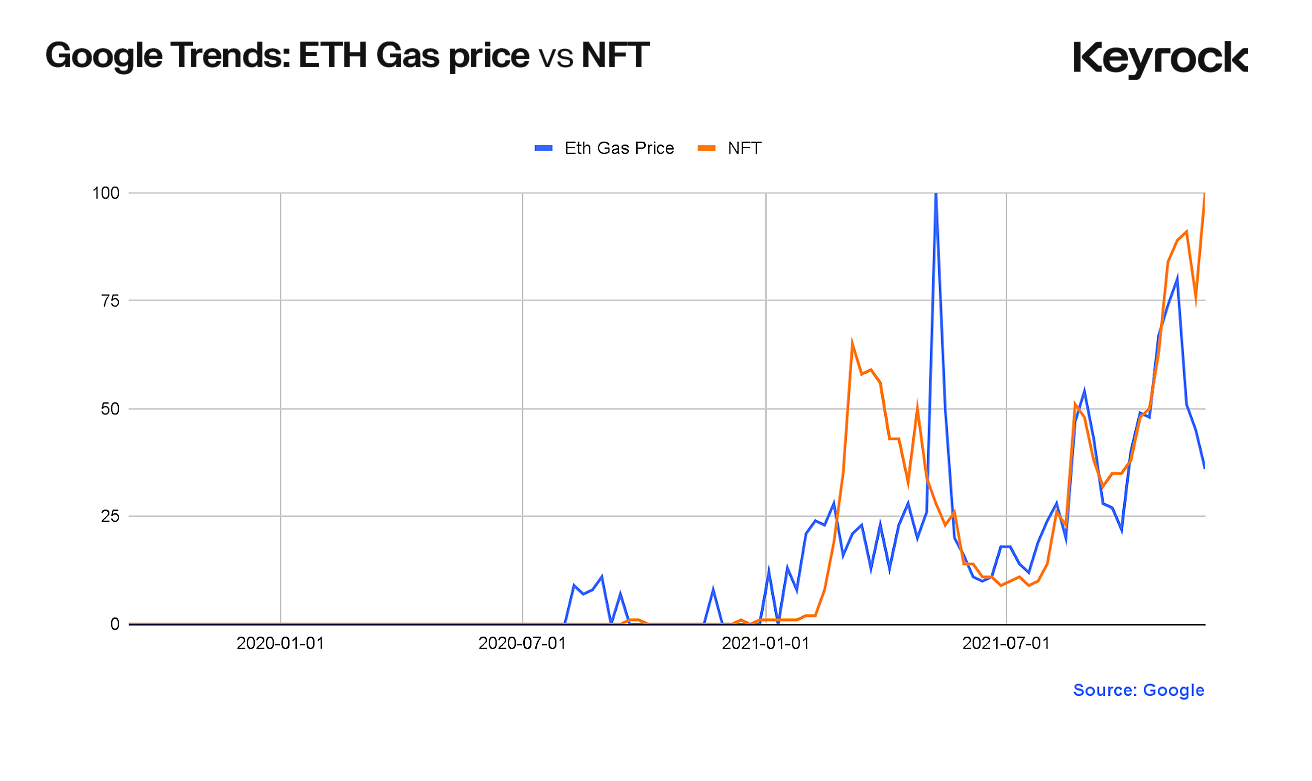

By 2021, NFTs had erupted into the mainstream, with OpenSea recorded a staggering $2 billion in volume in March alone. But with this fervent growth came with familiar challenges—Ethereum, like Bitcoin in 2017, struggled under skyrocketing demand, and fees surged over $1,000 per transaction. This congestion pushed users toward Layer 2 solutions, much as Bitcoin’s limitations had spurred hard forks.

The parallel is hard to miss—history repeating itself, but with a key difference. These new L2s were more sophisticated than the reactive Bitcoin forks of 2017. The release of Optimism and Arbitrum in late 2021 offered effective scalable solutions—expanding Ethereum’s capacity without sacrificing security, rapidly becoming essential parts of the Ethereum ecosystem.

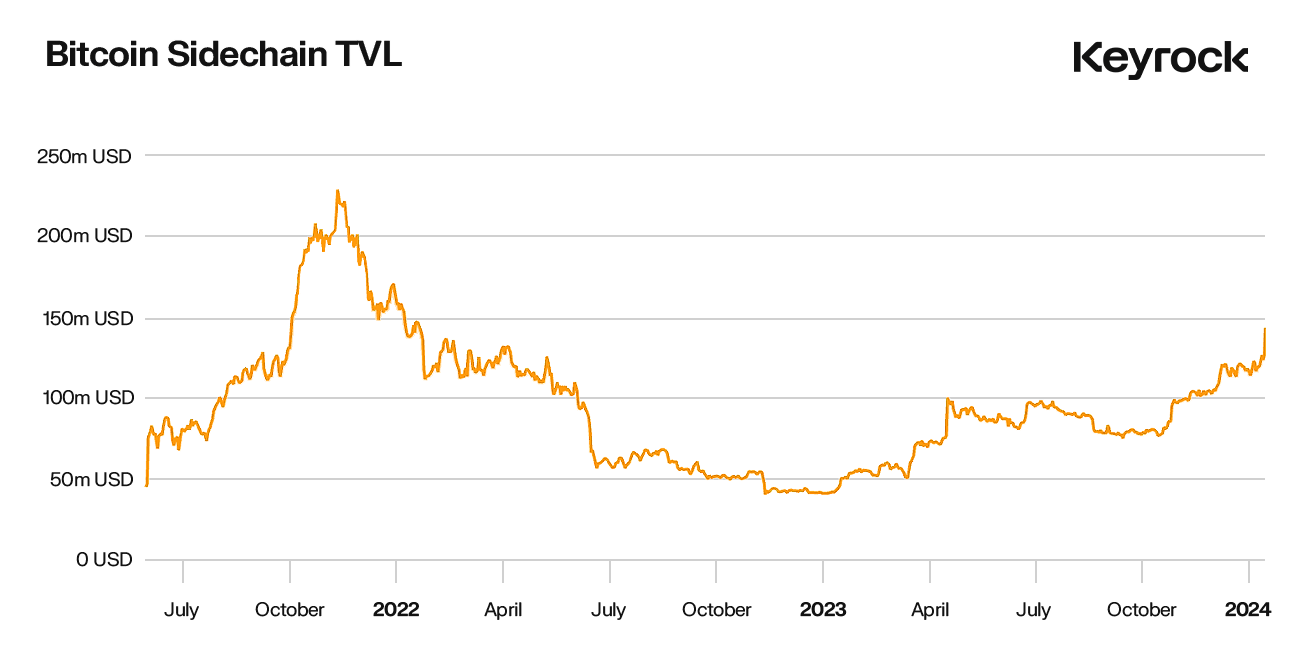

The EVM Catalyst 2022

As capital began flowing off Ethereum mainnet to Layer 2 solutions, the same trend began to take shape with Bitcoin, as users turned to its legacy L2—Rootstock (RSK). Though Rootstock had been around since late 2018, it wasn’t until the broader crypto community truly grasped the power of L2s that RSK found its stride. With vast value locked in BTC and DeFi exploding on other platforms, it was only a matter of time before the idea of Bitcoin being just “digital gold” began to shift. Rootstock offered a way to bring DeFi to Bitcoin, and from July 2021 to December 2021, Total Value Locked (TVL) on Rootstock grew by 400% as users rushed to lend and swap.

While the graph shows a return to lower TVL levels, it’s crucial to note that Bitcoin’s price also fell by 70% during this time. Since nearly all TVL in Rootstock was BTC-denominated, the drop largely mirrored Bitcoin’s price decline, rather than a loss in user activity or interest.

2022 also saw the release of Stacks, another Bitcoin Layer 2 that introduced a novel consensus mechanism—Proof of Transfer (PoX). Similar to Polygon, Stacks uses its own native token (STX) for gas fees. However, Stacks took a different approach, focusing more on transparency and security rather than on maximising features or trying to replicate Ethereum’s full programmability.

Where we are today 2023-2024

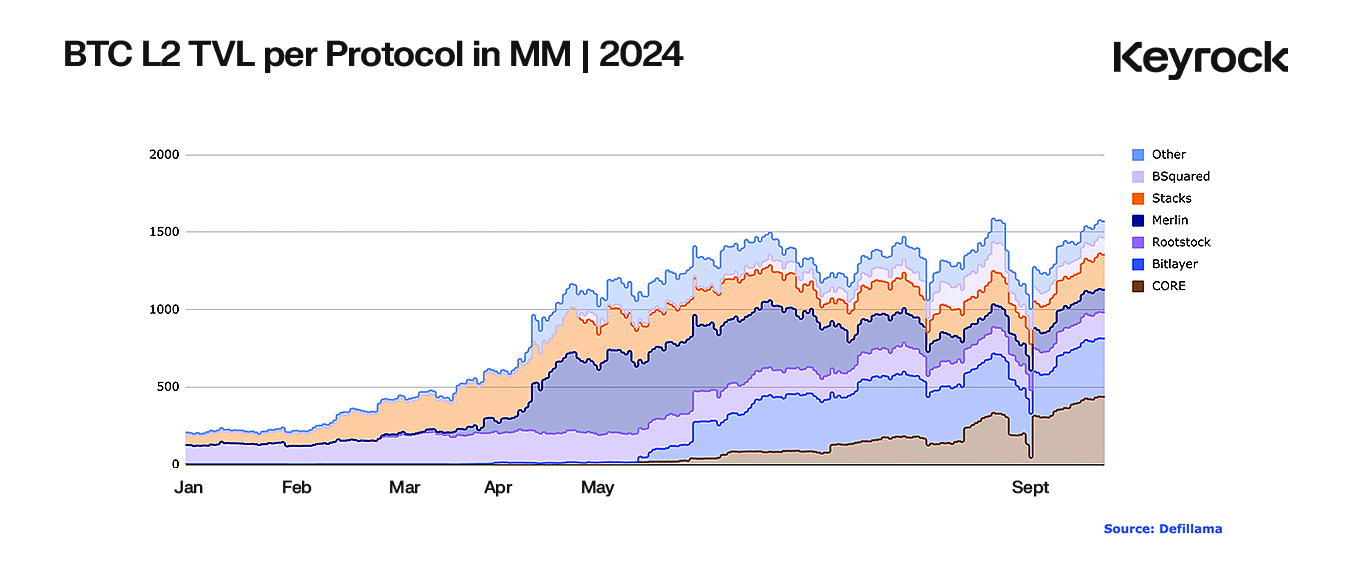

During 2023 and 2024, Bitcoin witnessed the launch of several new Layer 2 solutions including: CORE, Merlin, Stacks, BSquared, and Bitlayer. No single Layer 2 has taken a dominant share of activity yet, with total TVL distributed relatively evenly across the set. Each Layer offers something different to the Bitcoin Ecosystem. So let’s close out by taking a look at the Top 6 contenders and what sets them apart.

Rootstock

Rootstock is the oldest L2 on Bitcoin and currently ranks third in TVL. With that seniority comes time-tested security, anchored to Bitcoin through merge mining—a feature that lets miners validate both BTC and Rootstock blocks simultaneously, earning rewards on each. Its long existence also means more developers are familiar with its setup.

But age has its downsides. Rootstock was designed to enable Turing-complete smart contracts, but it lacks the flexibility and composability of newer L2s. It’s also missing the latest innovations like Optimistic or zk-rollups, which boost scalability. Plus, merge mining keeps Rootstock tethered to Bitcoin’s block times, limiting its high-speed capabilities.

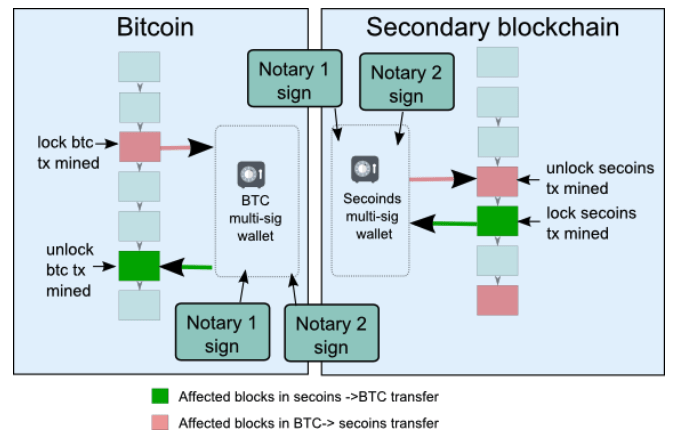

The last legacy component that it possesses is a Federated Bridge. Which means the bridge onto Rootstock is not trustless and is controlled by a small party of trusted individuals known as “The Federation”, they have special hardware devices that store their private keys. Ultimately any corruption of the majority of these members would risk the entire network’s BTC.

Rootstock has been around and will likely continue to stick around, but whether it can keep drawing in new TVL and projects when faced with shinier, newer chains remains to be seen.

Stacks

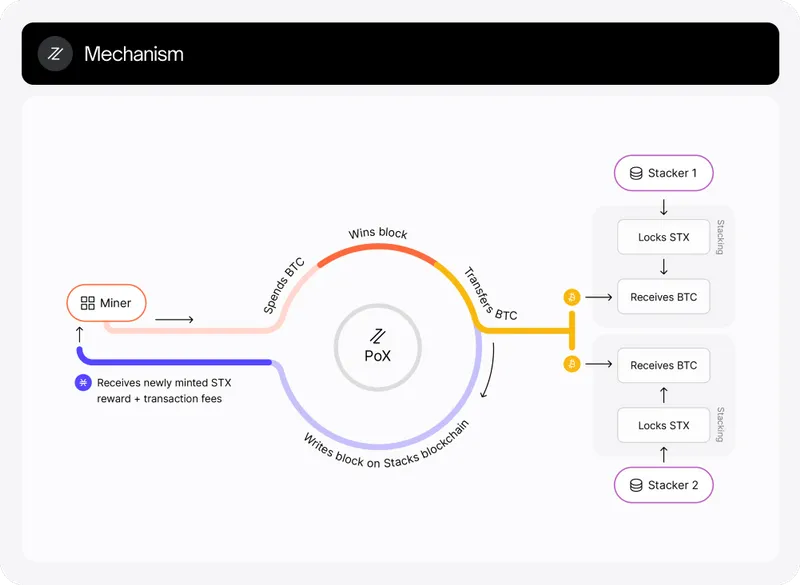

Stacks is the second oldest Bitcoin L2 after Rootstock. Though it was conceptualised as early as 2013, its mainnet didn’t launch until 2018. What makes Stacks unique is its consensus mechanism, Proof of Transfer (PoX). Unlike Rootstock, Stacks isn’t a sidechain in the traditional sense—it doesn’t use merge mining. Instead, it relies on Bitcoin’s block finality for security. Stacks miners must spend BTC to mint new Stacks blocks, effectively linking it directly to Bitcoin’s economy.

Participants in the Stacks system are divided into two groups:

- Stackers: These individuals Operate the competitive Bidding system, by locking up their or delegated STX tokens for 2 weeks, they receive BTC proportional to the STX locked up. The BTC-STX Ratio is recorded on-chain during this process, which allows it to also serve as the global oracle for the Price.

- Miners: The Miners engage in this competitive bidding system to earn STX block rewards and Tx Fees. They are chosen randomly based on BTC transfers. This miner then generates the newest block and provides pre-confirmed microblocks.

This novel approach where it is two sides locking up opposing rewards help encourage user participation and balance security and scalability.

Unlike many other L2s, Stacks doesn’t use an EVM. Instead, it relies on its own Rust Based language, Clarity instead of Solidity—focused on predictability and security. Clarity avoids runtime errors, making contract behaviour more transparent and easier to verify.

Stacks stands out from the other top chains with its different consensus model and unique smart contract approach. Whether going against the grain will boost adoption or hold it back is still up in the air—but it definitely brings something fresh to the Bitcoin L2 space.

Core (COREDAO)

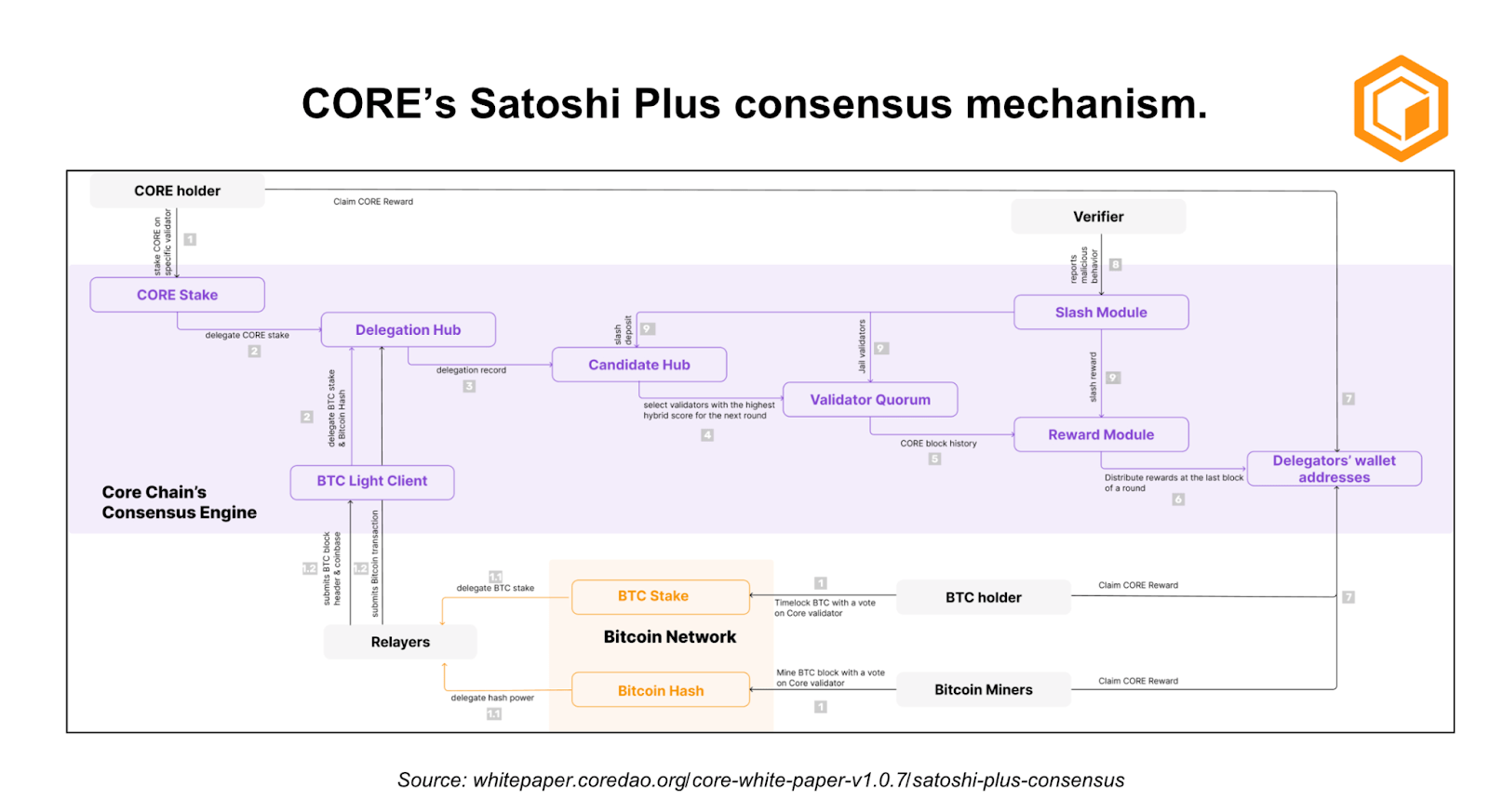

Core is the second-largest L2 by TVL, almost neck and neck with Bitlayer. Launched earlier in 2023, it only truly gained traction with the surge in other L2s in 2024. COREDAO takes a unique stab at the blockchain trilemma, aiming to balance scalability, security, and decentralisation. To tackle this, they built on the Satoshi Plus Mechanism—an innovative blend of Proof of Work (for decentralisation) and Proof of Stake (for scalability and consensus).

It works through a sophisticated process involving dynamic delegation of hash power to rotating validators, alongside the delegation of CORE tokens. An algorithm intelligently selects among validators, aiming for an optimal mix of decentralisation and scalability, resulting in a relatively high TPS (transactions per second) and solid decentralisation.

Like Bitlayer, Core also uses an EVM for its smart contracts, making it approachable for seasoned developers. Its reliance on the internal CORE token helps incentivise users to stay, though for some it may feel disconnected from Bitcoin’s core values. Either way, Core and Bitlayer look poised to keep battling for the top spot as things evolve.

Merlin

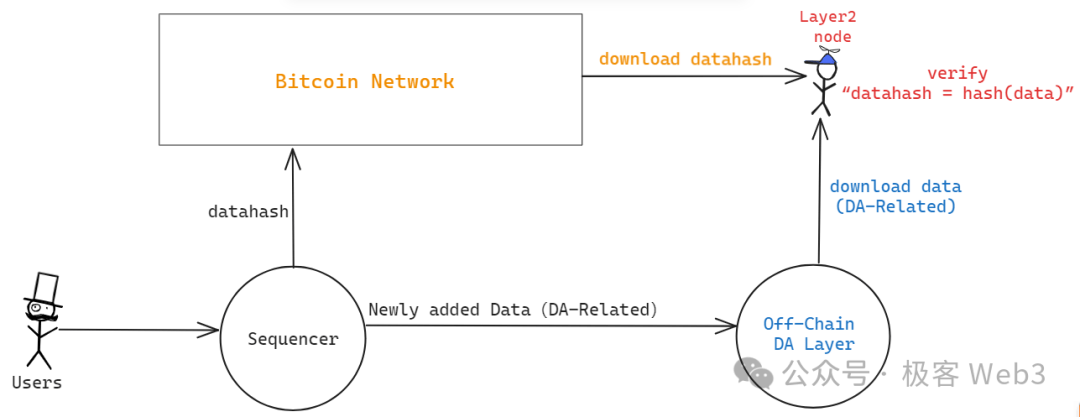

Merlin L2 currently ranks fourth, just behind Rootstock. Merlin takes a simpler, more streamlined approach compared to the other top L2s. Merlin is driven by Zk Rollups, effectively identical to the Polygon CDK-based rollups, with the difference being these ZK proofs are submitted directly to the BTC chain.

Merlin focuses on enhancing and empowering the use of existing Bitcoin-native assets rather than hosting its own. This allows BRC-20 tokens and Ordinals to move onto Merlin and be utilised in DeFi applications. Additionally, Bitcoin-native tokens can be launched on Merlin and then inscribed back onto the Bitcoin blockchain—a unique take that sets it apart.

Merlin’s commitment to expanding the utility of Bitcoin-native assets beyond just exchange has earned it a dedicated user base. Whether its “Native L2” focus will gain broader traction or complement other L2s in the long term remains to be seen.

Bitlayer

Bitlayer is one of the newest L2s on the scene but has already risen to the top, sitting in second. This is largely thanks to its mix of new and legacy tech. It uses a Layered Virtual Machine (LVM) based on BitVM to batch transactions, combining Optimistic Rollups with zk-proof elements through a system of “Challengers,” aiming to take advantage of the best of both worlds.

The LVM is built to be EMV-compatible, so most Solidity code can be easily ported to Bitlayer with minimal changes. This makes it simple for existing protocols to move over, and developers to work with both new and existing ideas. Alongside a fast trustless bridge and parallel execution, Bitlayer’s rise to the top has been swift and understandable.

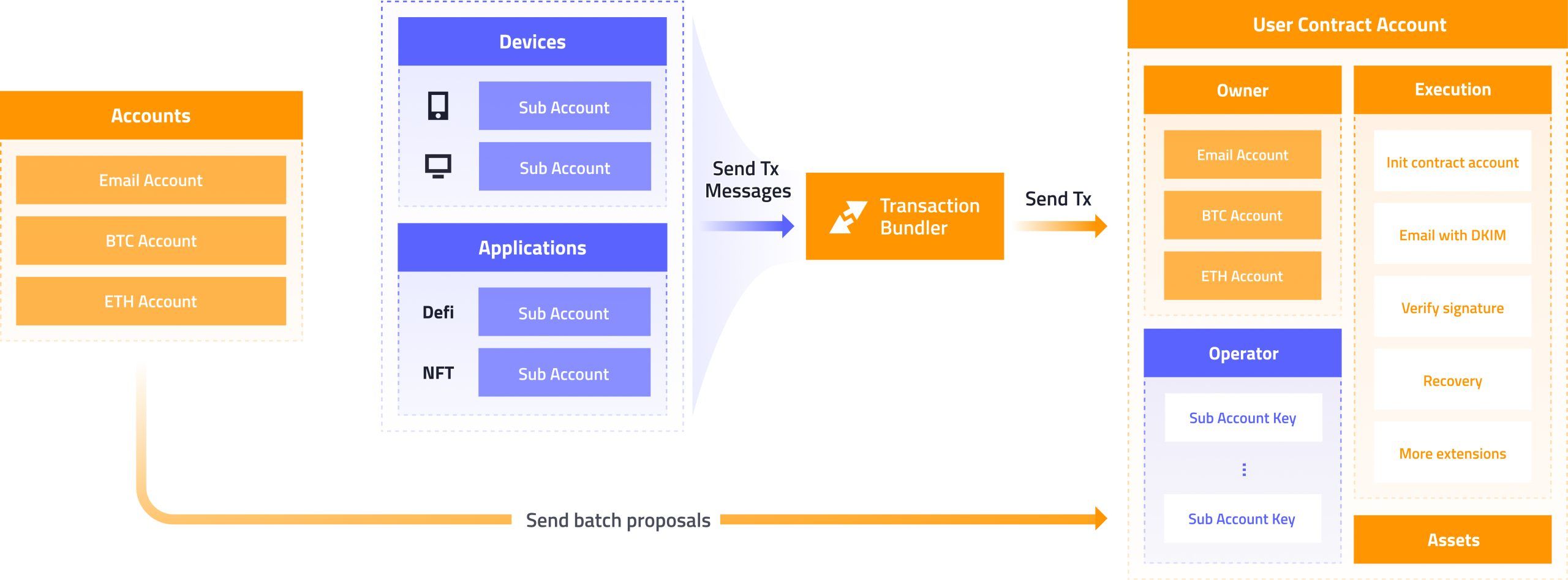

BSquared

Next up is BSquared, a Bitcoin L2 that stands out by focusing heavily on Account Abstraction (AA). AA reimagines how users interact with wallets and accounts on the blockchain. Typically, there are two types of accounts:

- EOA (Externally Owned Accounts): Used by individuals and controlled by private keys.

- Contract Accounts: Controlled by smart contract code, capable of executing functions autonomously.

Account Abstraction unifies these two types, transforming EOAs into programmable entities. This means that user accounts can have embedded logic allowing them to:

- Automate transactions and payments across different tokens.

- Batch tasks together for efficiency.

- Self-implement multisignature rules for improved security.

Traditional EOAs require careful management of private keys, but with AA, customisable logic enhances the user experience without compromising security. Imagine a wallet that automatically selects the cheapest gas option or transfers funds to a recovery address if keys are lost—AA makes this possible.

For BSquared, Account Abstraction is the central feature. Every user account functions like a smart contract, offering extensive functionality that makes it truly user-centric. Accounts can be linked to social accounts or use MFA (multi-factor authentication) through physical devices, adding layers of recovery options. With AA, dApps can also interact in more complex ways with user accounts. This ground-up rethink of L2 design is what sets BSquared apart, making it one to watch in the evolving Bitcoin ecosystem.

Wrap-Up

As we close, it’s essential to reflect on the journey that has brought Bitcoin to where it is today.

Bitcoin started as a peer-to-peer, decentralised currency, its strength lying in its security and resilience. For its first few years, innovation was minimal. The launch of Mastercoin in 2013—Bitcoin’s first “meta-layer”—paved the way for L2 ideas, though its adoption was limited by the inflexibility of Bitcoin’s network at the time. Shortly after, Ethereum launched in 2014, bringing smart contracts and programmability to the forefront, shifting attention away from Bitcoin’s more rigid design.

For years, Bitcoin remained focused on being a store of value, while Ethereum developed its reputation as a decentralised global computer. It wasn’t until the 2017 bull run and the resulting scalability issues that Bitcoin saw its first major forks—Bitcoin Cash (BCH) and Bitcoin SV (BSV). These forks increased block sizes but added no real functionality, underscoring the need for more advanced scaling solutions.

The concept of Layer 2 solutions wasn’t yet fully understood by the public until the arrival of the Lightning Network in 2018. Though it came after the market frenzy, Lightning proved that Bitcoin could scale off-chain, preserving its core principles.

In the following years, Ethereum faced its own scalability challenges during the DeFi boom of 2020, leaning heavily on L2s like Polygon, Optimism, and Arbitrum. Their success reignited interest in Bitcoin’s scaling and DeFi capabilities, pushing developers to explore similar solutions for Bitcoin.

The real turning point for Bitcoin came in 2023, starting with the rise of Ordinals and Rune, which introduced NFT-like functionality to the Bitcoin network. This paved the way for a new wave of L2s, including CORE, Merlin, Stacks, BSquared, and Bitlayer. Each brought something fresh to the ecosystem—CoreDAO with its Satoshi Plus Mechanism, Merlin with a native focus on Bitcoin assets, and Stacks leveraging Proof of Transfer (PoX) to bring programmability to Bitcoin without being a sidechain.

These new L2s not only enhanced scalability but also expanded Bitcoin’s utility into DeFi and NFTs, making Bitcoin more than just digital gold. As the ecosystem evolves, these L2s are transforming how users interact with Bitcoin, pushing it into new realms that once seemed exclusive to Ethereum.

Conclusion

This history illustrates the symbiotic nature of innovation in crypto—particularly between Bitcoin and Ethereum. Each has its strengths and weaknesses, and both have borrowed lessons from one another. Bitcoin’s congestion spurred Ethereum’s focus on scalability, while Ethereum’s success with DeFi and Layer 2s reignited interest in expanding Bitcoin’s capabilities. Both networks have evolved through iterative improvements, often shaped by challenges and solutions seen in each other.

The once-clear distinction between Bitcoin as “digital gold” and Ethereum as the “decentralised global computer” is blurring. As both ecosystems mature, they increasingly overlap, with new Layer 2 solutions pushing Bitcoin beyond its original use case. At the same time, Ethereum is embracing the principles of security and stability that Bitcoin has long championed.

In our upcoming article, we’ll take a deeper dive into this new wave of Bitcoin L2s—exploring on-chain activity, liquidity flows, and the distinct advantages of solutions like CORE, Bitlayer, Merlin, and others. We’ll also look at the explosive growth these L2s have seen throughout 2024, and how they’re reshaping the future of Bitcoin.

Read more: Airdrops in the Barren Desert: Surveying the traits behind 2024’s 11% success rate

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.