The scale of stability: the stablecoin landscape dissected

Key Takeaways

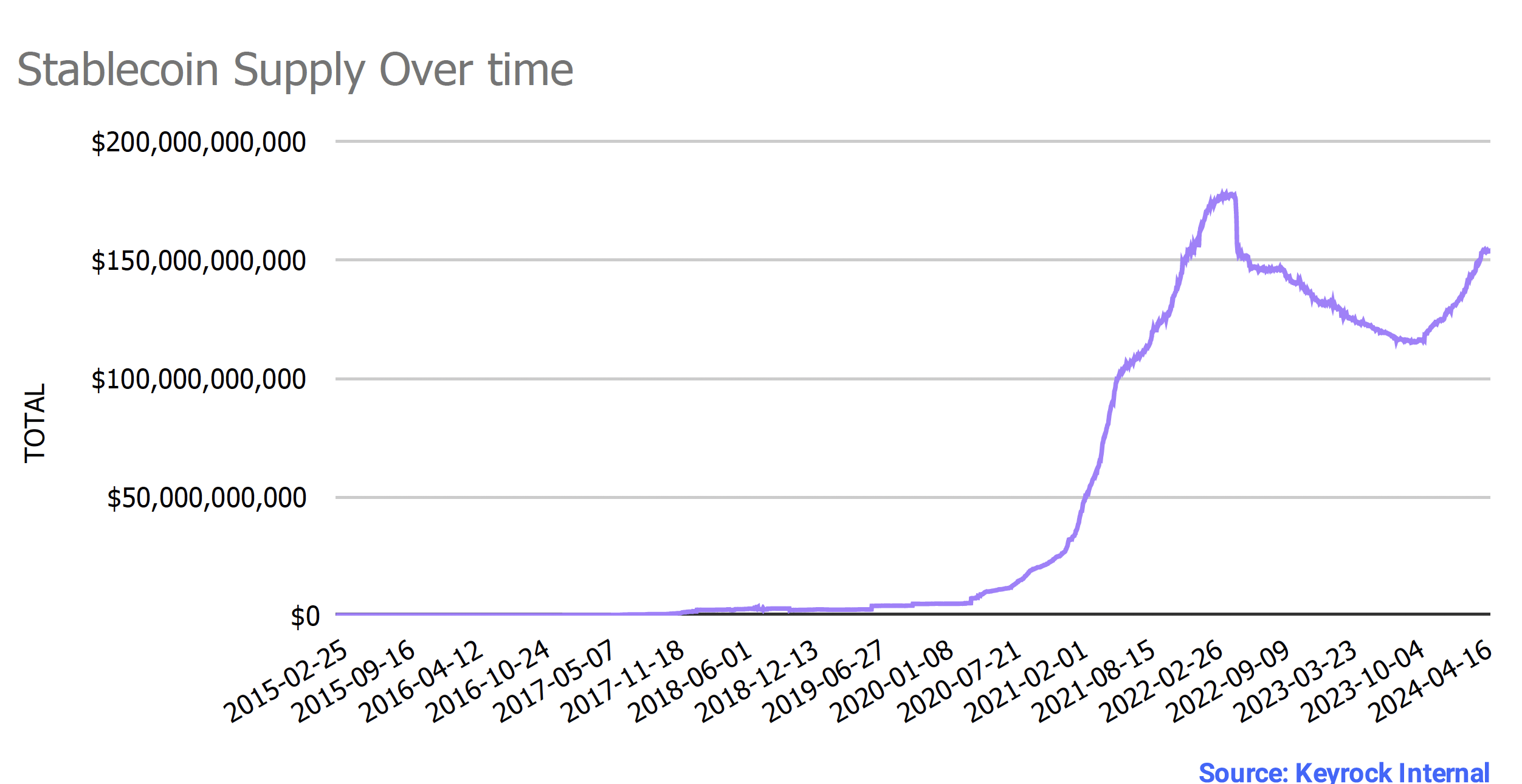

- Stablecoins have surged to a $150 billion supply since USDT’s 2014 debut.

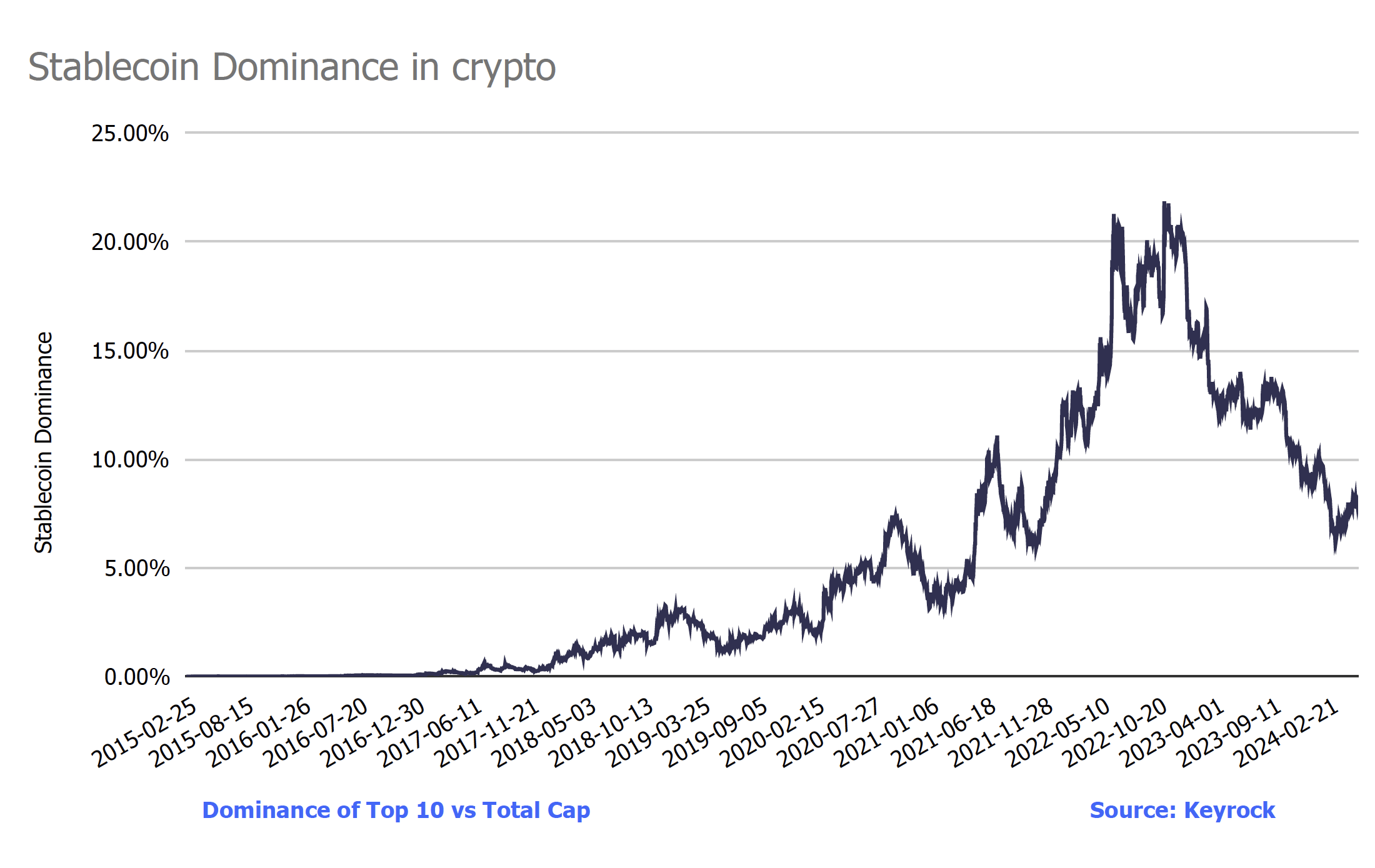

- During the crypto downturn, stablecoins hit a 20% peak market share in 2022.

- Tight competition has USDT leading in supply and USDC in transaction volume.

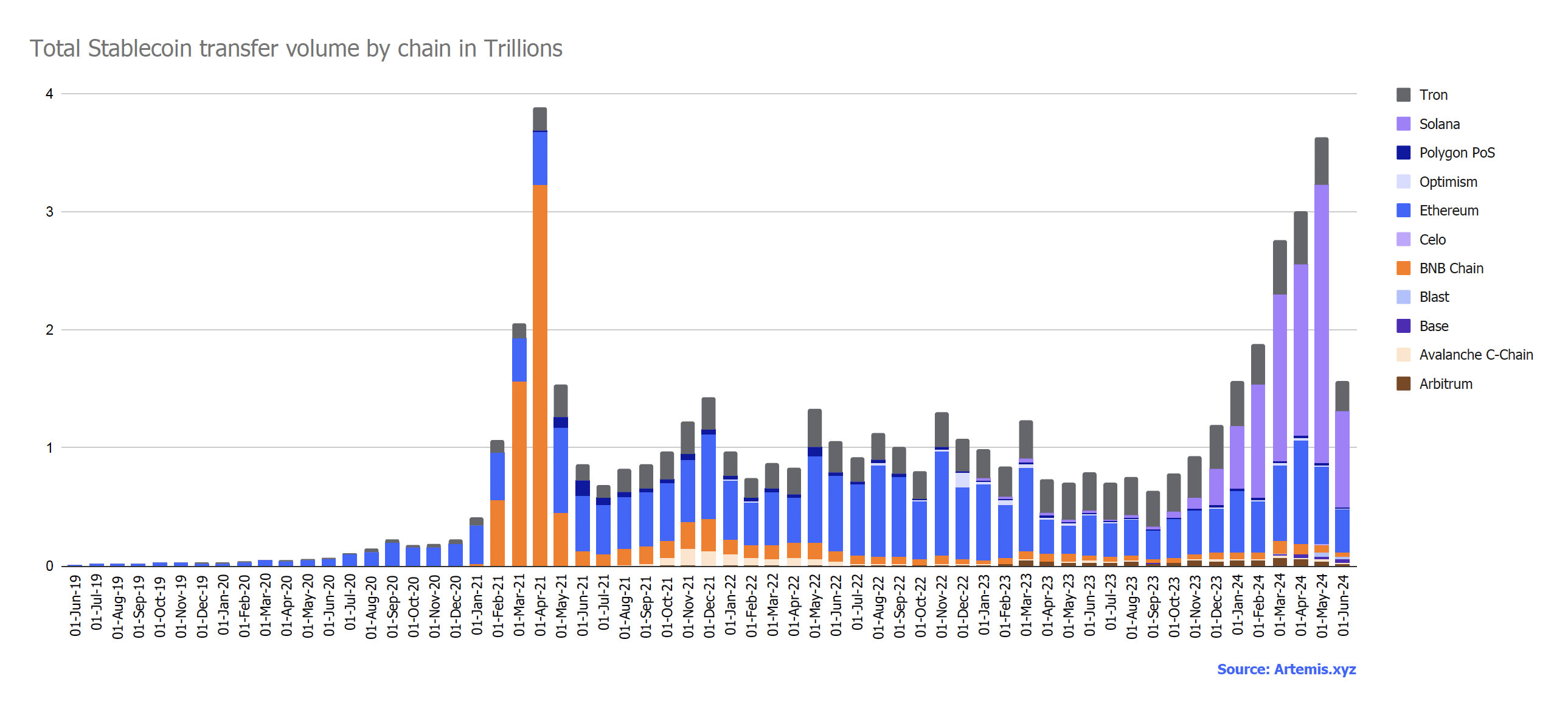

- Ethereum continues to lead in stablecoin supply, with Solana recently topping transaction volume.

The rise of stablecoins

Stablecoins: the silent disruptors of the crypto world. From USDT’s debut in 2014 to today’s multibillion-dollar market, these digital assets have skyrocketed in popularity, providing stability in a turbulent landscape. As the crypto market evolves, stablecoins have become indispensable—not just as safe havens but as essential tools for DeFi, cross-border payments, and everyday transactions.

Let’s dissect the meteoric rise of stablecoins, tracking their growth to a $150 billion market cap. We’ll analyse their expanding market share and role as reliable assets in uncertain times. Our focus will primarily be on the tight competition between USDT and USDC as the global leaders and their blockchain battleground, with Ethereum leading and Solana emerging as a potential new contender.

Steady popularity

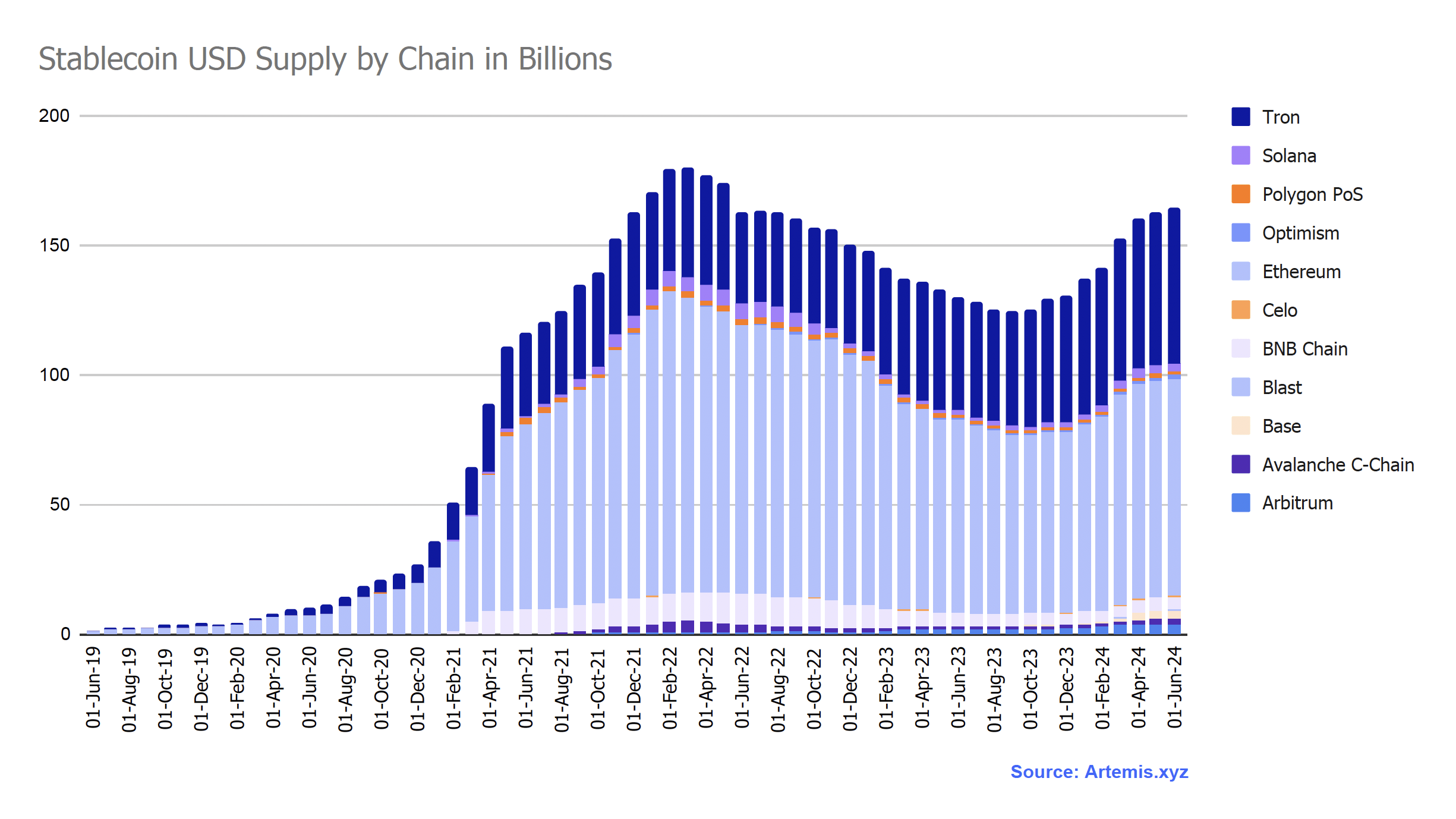

Since USDT’s launch in 2014, the supply of stablecoins has exploded. Currently, the total supply hovers around $150 billion, with roughly $80 billion on the Ethereum mainnet.

Their rising popularity is no surprise. Across all ecosystems, stablecoins have steadily grown, peaking at 20% market dominance in 2022. This surge aligned with market lows in 2022 when traders sought safer investments—a predictable move.

Just as investors flock to bonds or gold during traditional market downturns, stablecoins provide a safe haven within the crypto ecosystem. Their appeal lies in their price stability compared to other cryptocurrencies.

Investors convert volatile assets into stablecoins, pegged to stable assets like the US dollar, to shield their portfolios from crypto market volatility. This shift helps preserve the value of their holdings during market turbulence.

More often than not, due to various banking circumstances, it is far easier to simply go from Crypto to Crypto-stable than to off-ramp into Fiat and revamp back when ready to reenter. Fees, Transfer times, and banking uncertainty are all contributing factors.

Battle of the Titans

Stablecoins are not just part of the digital asset landscape—they’re shaping its future. And some are making a bigger impact than others. Let’s dive into the data.

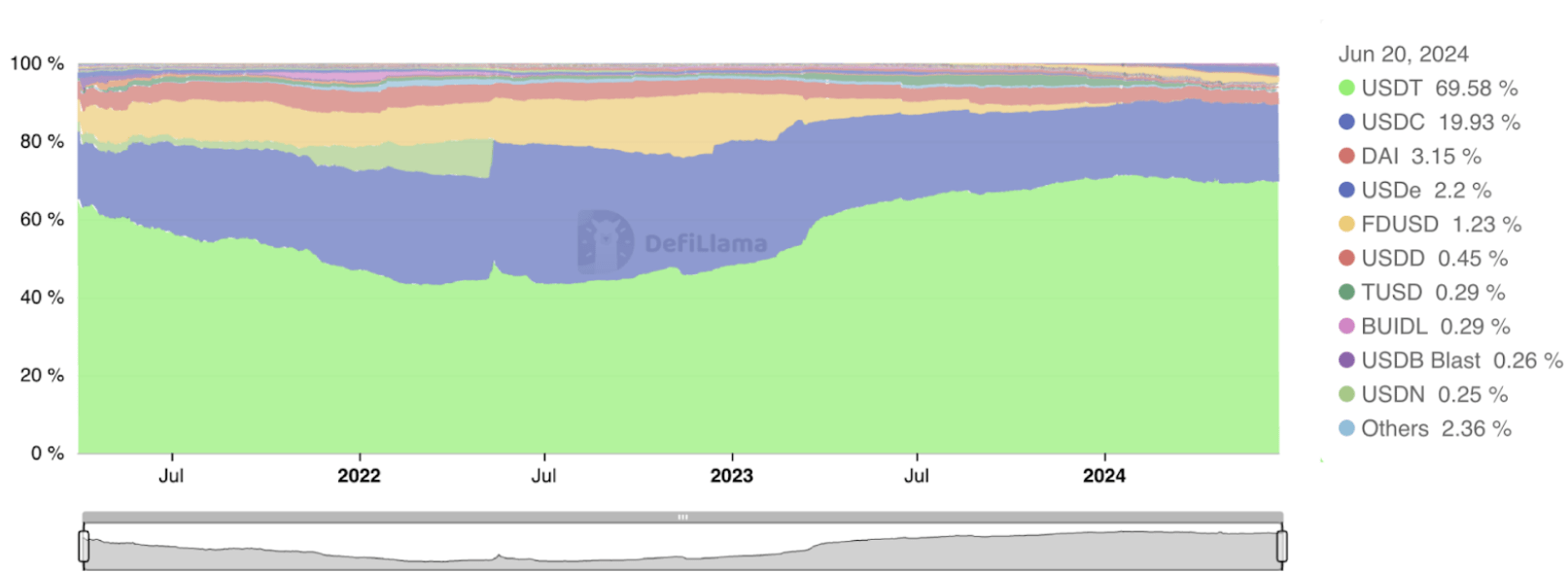

It’s an everlasting battle between USDC (USD Coin) and USDT (Tether). These centralised, dollar-backed stablecoins are vying for the top spot in DeFi. Historically, USDT has dominated, holding over 70% of the market compared to USDC’s 20%.

The remaining 10% concerns other coins backed by USDT or USDC, which are bridged tokens. And algorithmic coins like FRAX, unlike DAI, are not backed by fiat at all. In truth, it’s really a two-player game between USDC and USDT.

Throughout 2021, USDC steadily gained market share owing to its institutional connection and zero-cost redemption. This easy redemption process was a massive point for USDC, as USDT redemption and minting required both a 0.1% fee and a complicated process involving wires to the British Virgin Islands.

Yet on March 10th, 2023, the music stopped, and rumours ran about USDC reserves held at Silicon Valley Bank (SVB) being in jeopardy as the bank went under. USDC quickly lost supply—$10 b gone in a matter of a month.

Source: Stablecoins Dominance, DeFiLlama

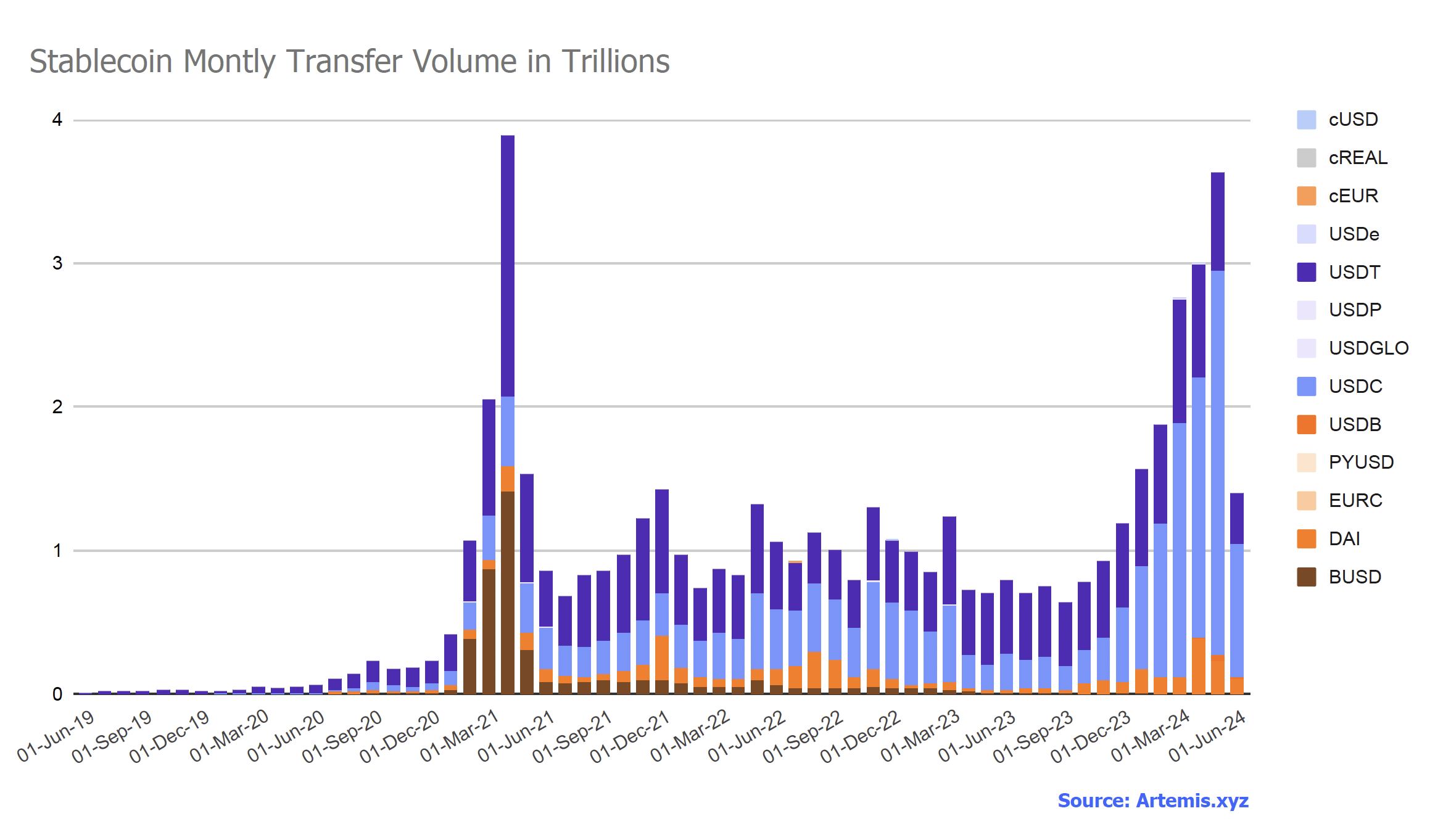

On the other hand, USDT’s dominance is largely due to its early entry and user adoption. It ruled its category for four years before USDC appeared, enjoying an undeniable first-mover advantage. Though one might think that USDT has a stronger hold given its nearly threefold market cap, the tables turn when examining transfer volume.

Despite USDC’s smaller supply—three times less than USDT—its on-chain transfer volume is 2.8 times greater. This indicates that investors primarily use USDC for transactions and payments in DeFi.

Several factors explain UDC’s use case: regulatory compliance, institutional adoption, and DeFi integration. USDC emphasises transparency and is fully backed by cash and short-term U.S. Treasury bonds, with regular audits by reputable third-party firms.

This transparency builds trust among users and institutions, making USDC a preferred choice, especially for institutional investors requiring high assurance and regulatory compliance. Its associations with major financial institutions like Circle and Coinbase add another layer of credibility.

In contrast, USDT has faced criticisms and doubts regarding its reserve assets. Based in the British Virgin Islands—a known tax haven—USDT’s location adds to the wariness of major American institutions.

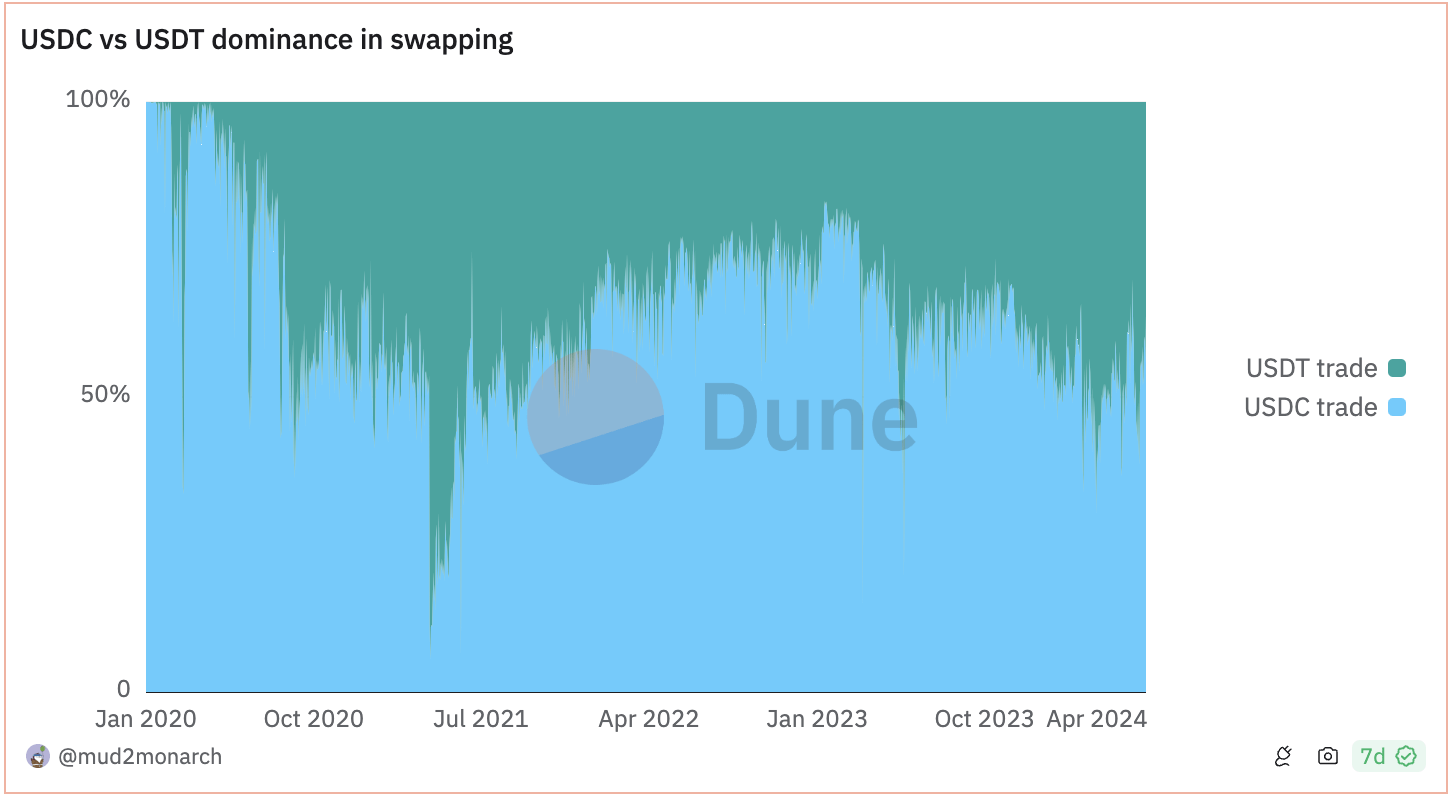

Source: Dune

Circle, the issuer of USDC, operates under U.S. jurisdiction from Boston. They’ve partnered with BlackRock, an SEC-registered market fund, to hold their reserves, highlighting their compliance with U.S. regulations. This attracts high-net-worth and institutional investors, and it works.

USDC has seen significant peaks in transactions. In November 2022, daily transfers exceeded $14 billion, compared to $5 billion for USDT. This suggests that USDC traders generally have higher capital than those trading in USDT.

That is not to say that USDT is not used at all. Being a first-mover has advantages, and the primary place where USDT is used continues to be as the quoted pair on Centralised exchanges.

Almost all volume on CEXs is driven through USDT pairs. And though attempts have been made to spur volume on USDC pairs, both users and market makers continue to vote with their trading, further reinforcing its use in spot, futures and options settlements.

The place to be

Ethereum currently holds almost 50% of all stablecoins. A dominance that can be explained by several factors. The most obvious one is that it’s the birthplace of decentralised finance, which has created a robust ecosystem for stablecoins. DeFi applications like lending, borrowing, and yield farming heavily rely on stablecoins for liquidity and stability. The blockchain still hosts most DeFi projects, attracting significant stablecoin usage.

But that doesn’t mean that dominance remains unchallenged. Tron is second in stablecoin supply, with 35.62%, leaving a huge gap with the third contender, BSC, with a humble 3.15%. It should be noted that Tron does not have a real DeFi ecosystem to do much with this USDT.

Most would argue that it exists as a cheap, reliable settlement layer for interexchange transfers. We at Keyrock frequently prefer to do inter-centralised exchange transfers for rebalancing on Tron due to its 1$ transaction fee, fast speed and network reliability.

Yet even though Tron and BSC can handle a greater number of transactions and active addresses, Ethereum has long remained the leader. Regarding the volume of stablecoin transactions, it indicates that it is used for larger, more significant transfers, such as settlements. This is particularly true if we look at the USDC transfer volume, where Solana has taken the lead since this year before experiencing its lowest dip of 2024 in June.

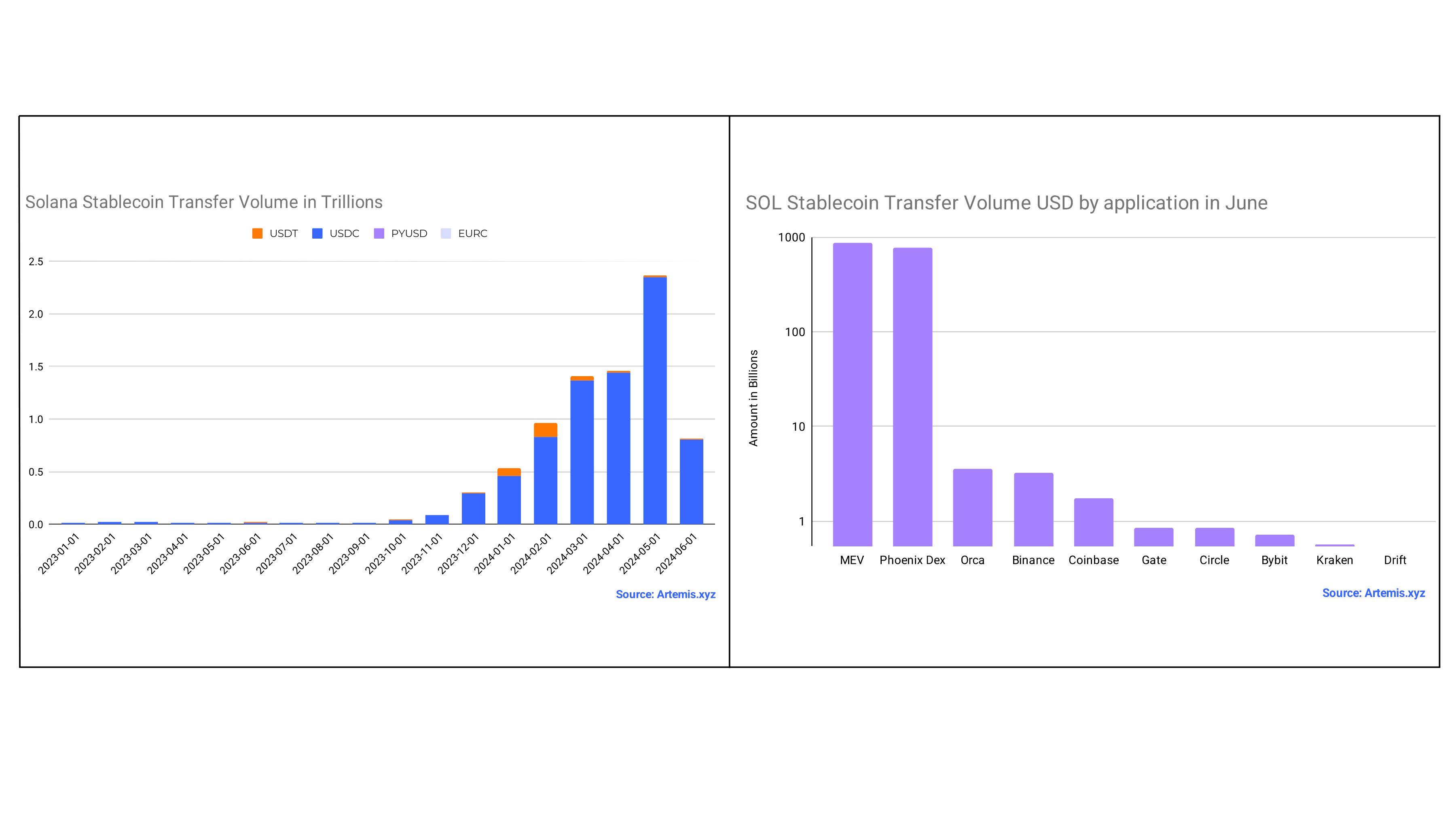

2024 marked the year Solana became the leading blockchain in terms of transfer volume. The network recorded a dramatic increase in USDC transactions, likely driven by market makers and high-frequency traders. This dominance of USDC on Solana has significantly boosted the blockchain’s overall stablecoin transaction volume.

It should be noted that this volume is also a reflection of the increased user base and interstate swaps, as many participants add liquidity to pools denominated against SOL but have to make an interswap SOL-Stable. This stopover often indirectly contributes to transaction volume.

Additionally, MEV and market makers seek arbitrage opportunities across volatile-volatile pairs (such as SOL/ETH or SOL/BTC). These activities, involving both stablecoins and volatile assets, collectively enhance Solana’s transaction volume and establish an apparent leading position.

Source: Artemis

However, this rate of high-frequency trading and market making wouldn’t be possible without adequate tech to support these activities. Solana’s technical advantages, such as its high throughput—processing a large number of transactions quickly—and low transaction costs, are the main factors that facilitate high-frequency arbitrage trades.

These trades leverage Solana’s efficient infrastructure to execute rapid transactions, significantly driving the increased transaction volume. And Solana seemed to be the preferred network for USDC’s high-frequency trading.

When investigating this USDC surge further, the data showed that most of these transactions are executed from MEV and Phoenix, an onchain order book. Both facilitate high-frequency arbitrage trading, as bots execute a non-humanly possible number of daily transactions.

The nature of the volume traded on Phoenix DEX does not solely come from transactions, though. At least for the most part. While there is a high transaction volume, much of it consists of placing and cancelling orders rather than completing trades. This is typical in high-frequency trading environments where strategies often involve continuously adjusting orders to maintain favourable market positions.

Again, such activity is only possible because Solana’s infrastructure allows it. But without these types of transactions and considering USDT dominance, we ought to ask if Solana would still overthrow Ethereum and Tron. Looking at the data, the answer is “not yet”.

In reality, Ethereum and Tron remain the leaders in the supply value, with a large dominance of Ethereum. This makes it clear that so despite the surge happening on other chains, Ethereum remains #1 in the stablecoin arena.

Solana’s infrastructure proves the network’s capabilities to handle mass adoption. High-frequency trading or not, arbitrage or not, stablecoins are starting to look like they are on the road to being as easily and quickly tradeable as any fiat currency.

Who’s creating this activity, and how?

So, who exactly is driving all this activity, and where? For this examination, we will focus purely on USDC and USDT, given that they effectively control the entirety of the market as of now.

Individuals vs smart contracts

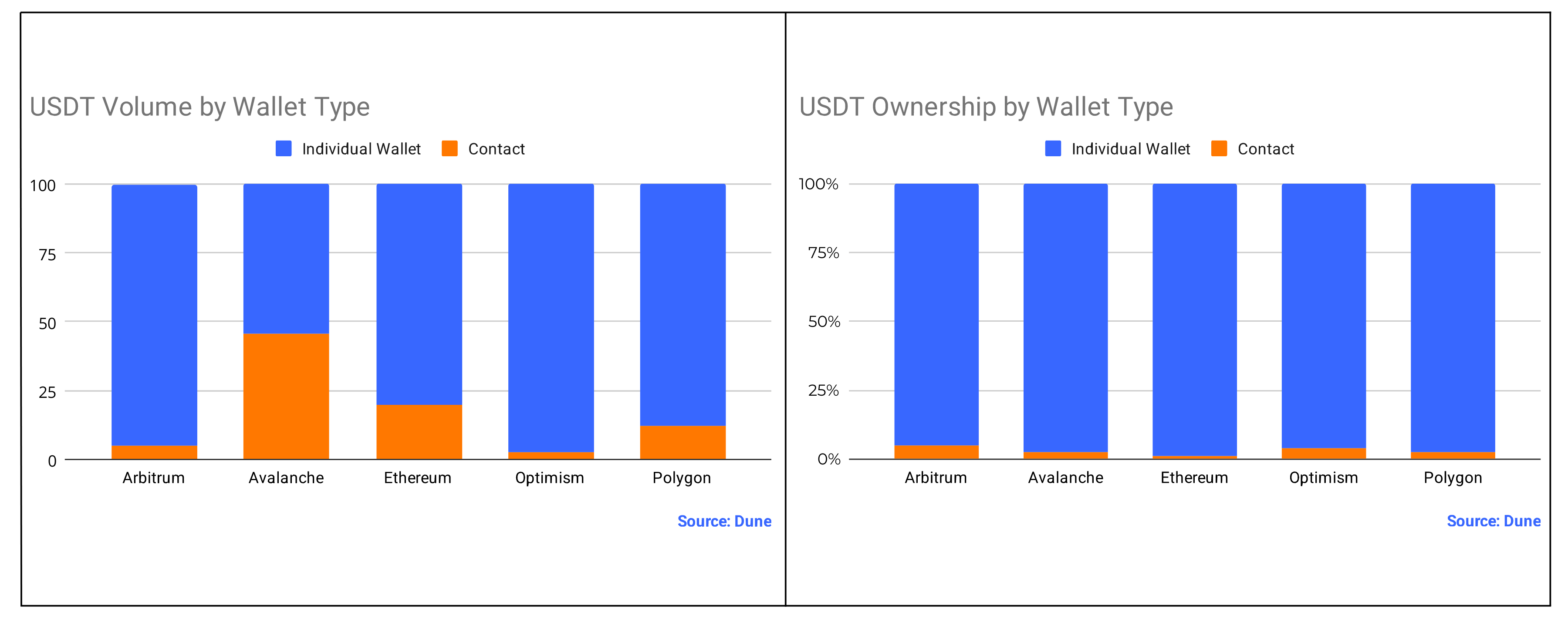

When looking at the main activity on Ethereum, USDC’s 70% of the volume is done wallet to wallet, with the remaining 30% pushed through smart contracts. Yet of that, 96.2% are held in personal wallets.

The same, though, carries through for USDT, with 98.8% also being in wallets and not contracts. This means that a small percentage of the supply drives a significant portion of the transactions, and smart contracts disproportionately drive the onchain activity.

In raw numbers, this amounts to 1.2% of the USDT supply, accounting for 20% of transactions. With USDC, 3.8% of the supply is responsible for 30% of transactions.

Source USDT: Dune

Source USDT: Dune

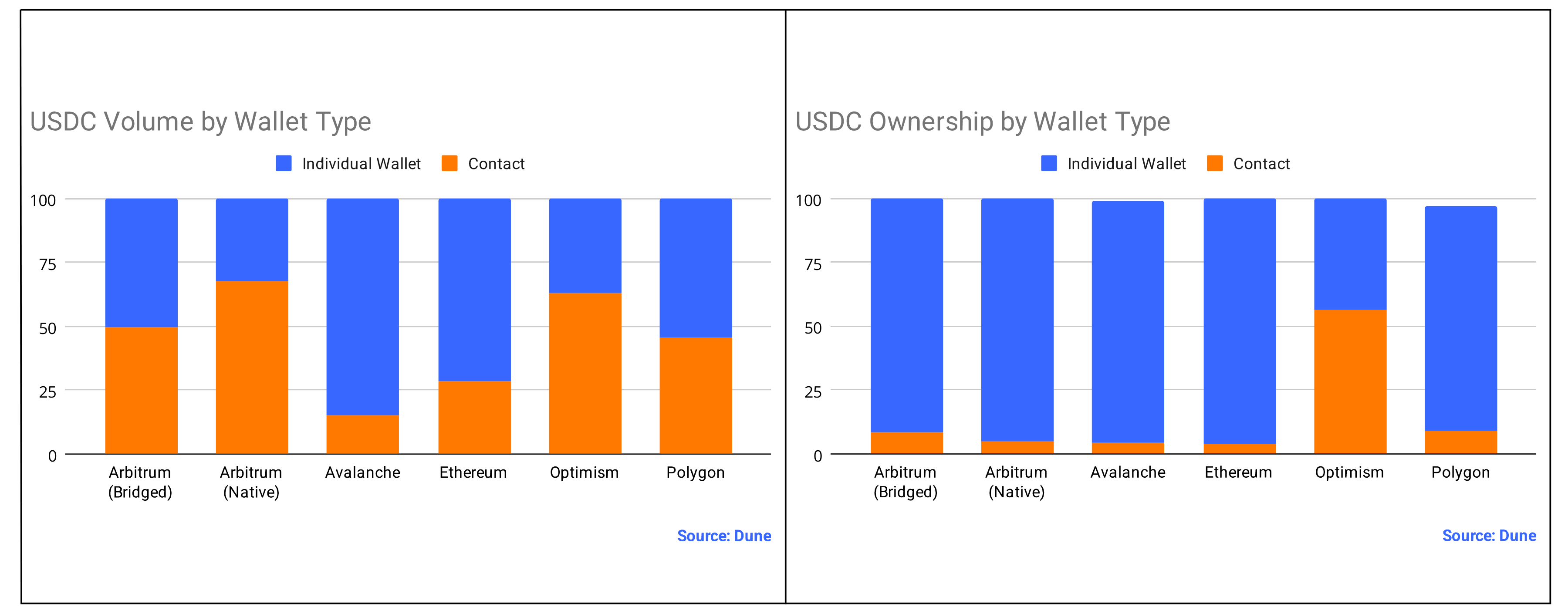

Source USDC: Dune

Generally, these observations do not vary much by chain or activity and do not exhibit divergent behaviours.

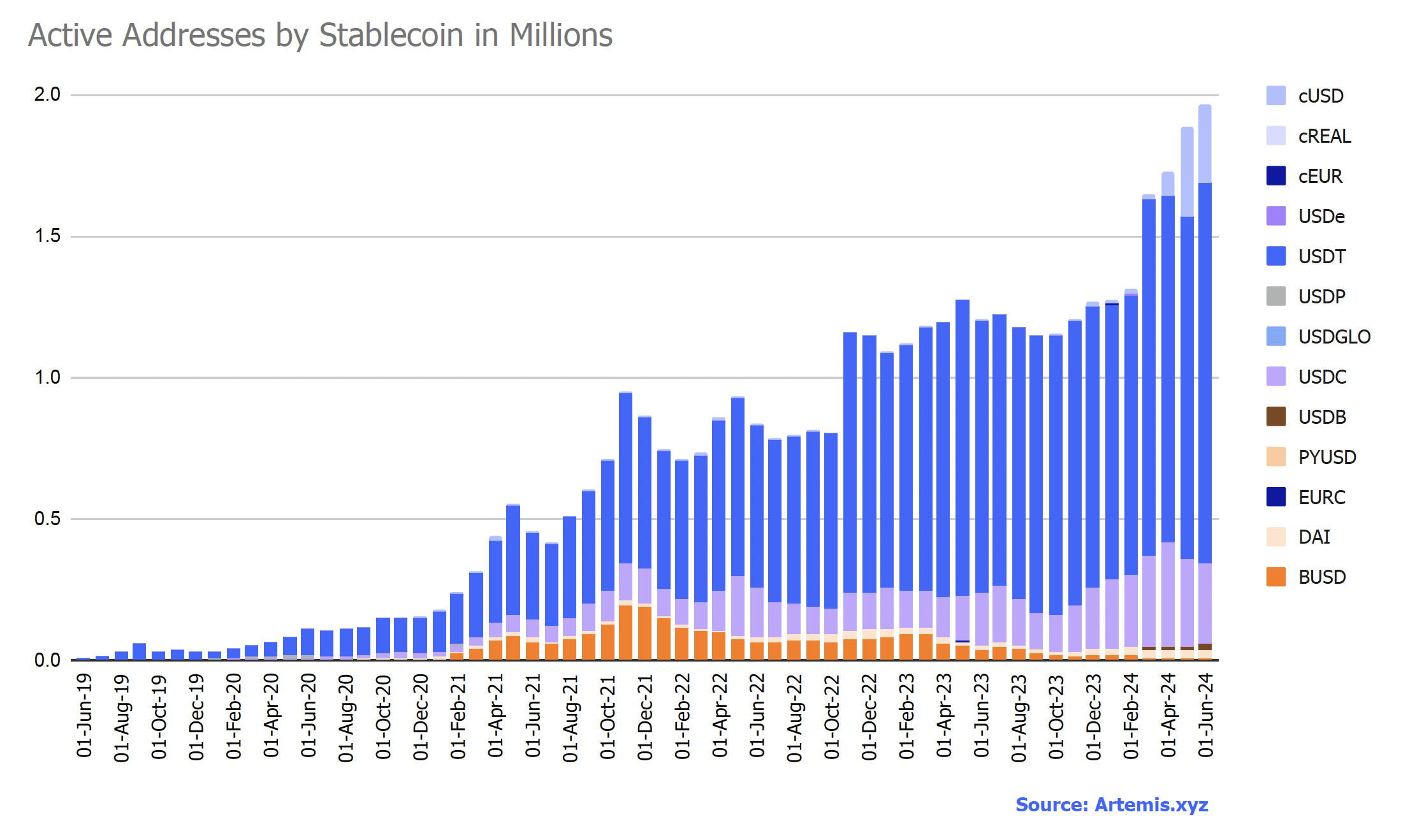

Source: Artemis

Once again, looking at Active addresses (Addresses used in the past 30 days), the data remains similar, with USDT dominating others. Yet, as a relative proxy for volume, USDC makes more — more high-volume and complex transactions. Ultimately, this tends to suggest that USDT retains higher usage amongst retail versus USDC, which institutions prioritise.

Contract holders

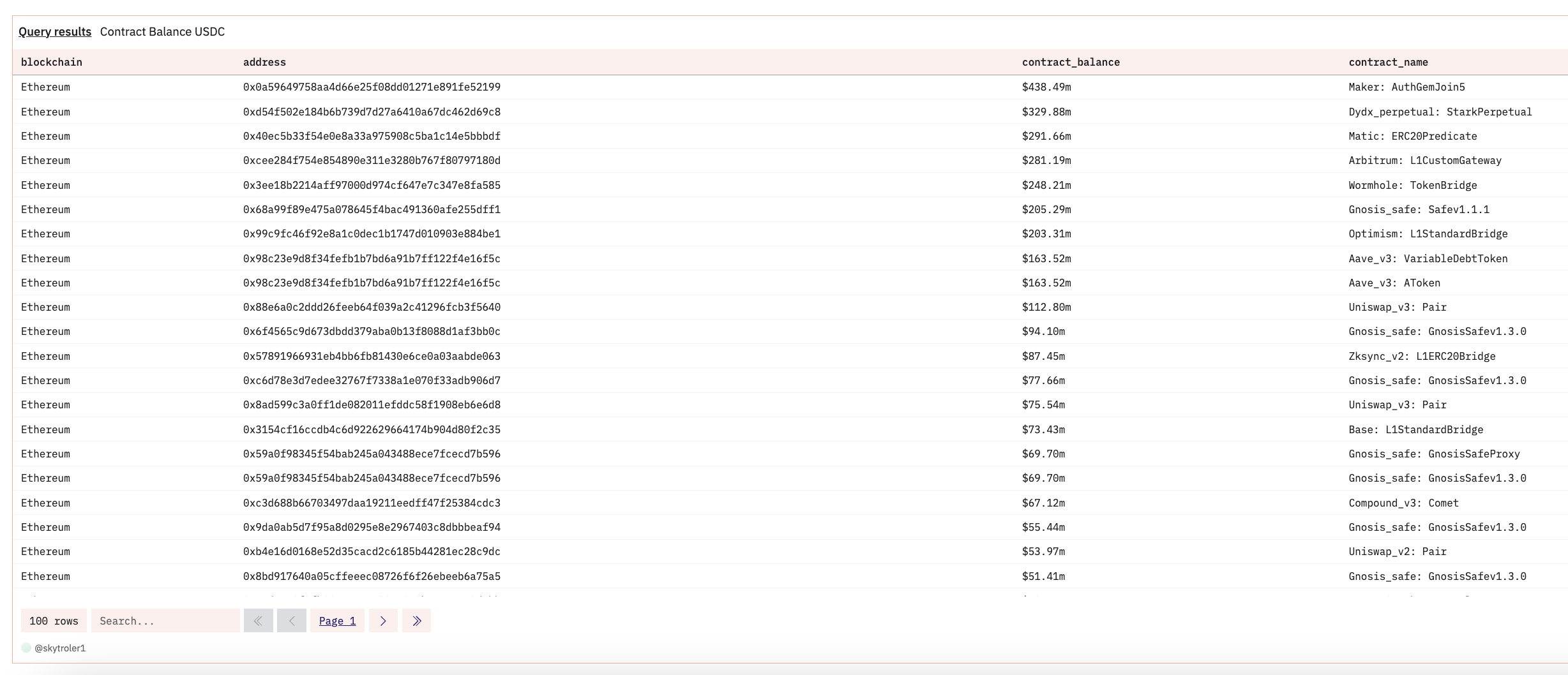

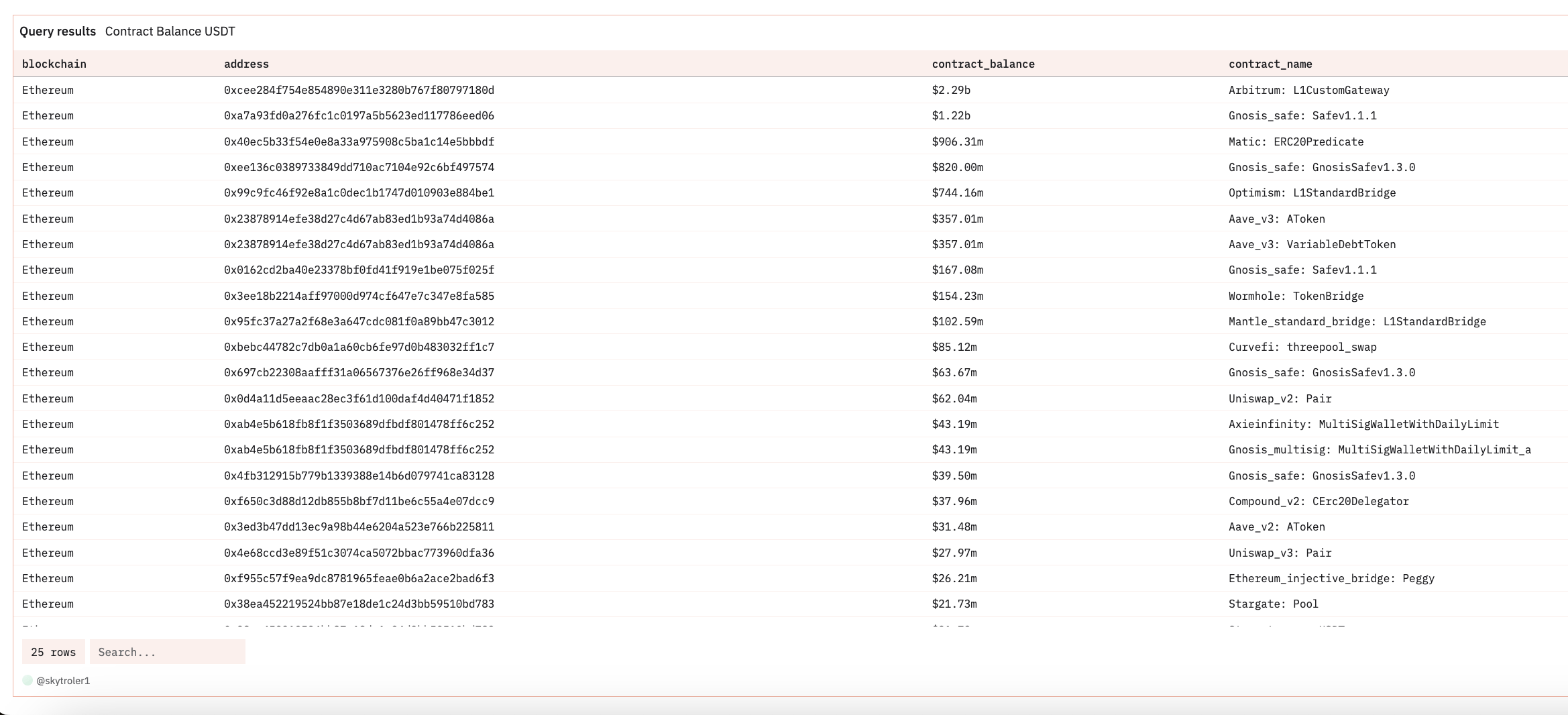

A significant portion of transaction volume in the cryptocurrency space is driven by bridges, which are major holders of USDC and USDT. Users often mint these stablecoins on Ethereum and then bridge them to Layer 2 (L2) solutions, as direct minting on L2s isn’t always feasible. Key bridges facilitating these transfers include Arbitrum, Matic, Optimism, and Wormhole, with dYdX exclusively settling in USDC.

Bridging stablecoins to L2s is a practical strategy to circumvent the high transaction costs on the Ethereum network. L2 solutions provide cheaper and faster transactions, making them an appealing option for users. By bridging stablecoins from Ethereum to L2s, users can significantly reduce fees, thus enhancing the overall efficiency of stablecoin transactions.

Source: Dune

Source: Dune

MakerDAO is a major holder of USDC, utilising its Price Stability Module (PSM) to maintain the DAI peg at $1.00. Currently, 8.5% of DAI is backed by USDC ($460 million), down from 50% ($2.4 billion) in January 2023 as DAI diversifies its collateral. Other significant smart contracts holding USDC and USDT include Curve 3pool, Compound, and AAVE.

Automated Market Makers (AMMs) also hold substantial amounts of USDC and USDT, though these holdings are distributed across many contracts. After aggregating the amounts across various pools, we find that Uniswap V3 custodies are valued at $310 million in USDC and $160 million in USDT.

For context, Uniswap V3 has $814 million worth of wETH locked in it, indicating that while stablecoins are significant, they still represent a fraction of the Total Value Locked (TVL) in Uniswap.

In short, bridges are transforming the crypto space, cutting down transaction costs and speeding up processes by moving stablecoins to Layer 2 solutions. MakerDAO’s clever deployment of USDC for DAI stability and Uniswap V3’s significant stablecoin reserves their crucial role in DeFi.

More to come

In conclusion, we have only begun to scratch the surface of stablecoins’ deep integration into the current crypto landscape. While individual users still hold the majority of assets, a small number of top holders drive most of the price discovery and transaction settlement. Despite ongoing crypto innovations, stablecoins’ stability remains crucial amidst the volatility of other digital assets.

USDT’s dominance in centralised exchanges contrasts with USDC’s leadership in DeFi, thanks to its regulatory backing and transparency. Bridges have significantly improved transaction efficiency, making Layer 2 solutions popular for their cost-effectiveness and speed.

Ethereum remains the leading stablecoin hub, with Solana emerging in high-frequency trading. This indicates that stablecoins are set to become as fluid as fiat currencies, solidifying their role as the backbone of decentralised finance. They will continue to draw regulatory attention, both from entities working collaboratively with them, like the Circle Group with USDC, and those famously being under scrutiny, like Tether’s USDT.

In our upcoming analysis, we’ll dissect how stablecoins are the lifeblood of Automated Market Makers (AMMs), balancing price dynamics for numerous cryptocurrencies. As a liquidity provider, we see the crucial role of stablecoins in advancing digital finance and advocate their use beyond the US dollar.

The recent slowdown in stablecoin issuance didn’t stop the onchain adoption of the Euro and Swiss francs. We’ve seen how having more regulatory clarity has played in favour of USDC, so witnessing a similar rise for Euro-pegged currencies—thanks to MiCA—is a strong possibility. In all scenarios, we stand ready to facilitate these markets.

Read more: DeFi dynamics: the Critical Role of the top 6 Stablecoins

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Read more about stablecoins

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.