Onboarding the masses: Crypto Prediction Markets

In the latest chapter of Onboarding the masses: Are Memecoins the way to Adoption?, we explored a key trend for the mainstream audience, uncovering its capacity for community building.

Now, in this article, we’ll shift focus to Prediction Markets, diving deep into their core features and examining their growth potential.

Key Takeaways

- With over $300M traded in July alone, Polymarket is the new playground for speculators and seasoned traders.

- A sharp 50% spike in trading volume proves Polymarket is leading its sector.

- During the incentivisation surge from November to January, Polymarket offered $1 in rewards per $73 of liquidity provided.

- The platform has paid out a total of $433,075 in liquidity rewards in July, highlighting its commitment to incentivising liquidity providers.

- Polymarket’s fee structure allows users to trade without charges on their transactions, relying instead on a few dollars for deposits.

- With deposit options ranging from MoonPay to PayPal and Robinhood, Polymarket is accessible to users worldwide.

- Adoption is partially driven by its easy setup, which allows users to trade quickly without extensive blockchain expertise.

- Polymarket represents a novel financial primitive, opening up investment strategies beyond traditional crypto trading and betting.

Opinions tokenised

Predicting is in our nature, be it to avoid a predator, navigate a tricky social situation or avoid rush hour traffic. Perhaps this is why Polymarket has captured the collective imagination of so many on and offchain.

It’s a simple premise: what if you can pool money together on your convictions, with and against others? Let’s explore this success story.

Speculating on events

The unpredictability of the current U.S. political landscape has everyone on edge, especially with the turbulence of the 2024 presidential election. Keeping up with the news is a challenge, with events unfolding at a relentless pace, leaving many questioning what’s true. But in the fast-moving world of crypto, nothing seems too quick to act on. Enter Polymarket, a decentralised prediction market that thrives on such volatility.

During a turbulent four-week period from late June to July, speculation about Joe Biden’s ability to secure a second term reached a fever pitch. So when he withdrew from the race, bets on the Democratic nomination process rose on Polymarket. Meanwhile, Donald Trump’s chances remained nearly unchanged, highlighting the market’s sharp efficiency. As these political events unfolded, Polymarket processed a staggering $216 million in trades across 36,000 traders, more than doubling its lifetime cumulative volume.

What sets Polymarket apart is its accessibility—anyone with a crypto wallet can jump in, placing trades that influence the odds in real-time. When we overlay the timeline of these events against the value and odds of each token market, it becomes clear just how reactive Polymarket is – both in reacting and determining real-time sentiment with precision.

This highly reactive activity highlights not only the power of prediction to reflect real-time sentiment but also align financial incentives with belief in an outcome.

In this article, we’ll explore what prediction markets are, how they function, and why Polymarket is leading the charge in this emerging sector.

What’s a Prediction Market?

A prediction market is a marketplace where individuals trade contracts based on the outcomes of events. These contracts settle on a fixed outcome (e.g., A or B), either reaching full value or no value, with the opposing side effectively funding the winner. As the event approaches, the collective trades establish real-time odds, making the market dynamic and eliminating the need for pundits, bookmakers, or oddsmakers.

Markets can revolve around anything with two or more sides, such as political elections, sporting events, or even the weather forecast for next Tuesday in Berlin. These contracts resemble futures contracts, where traders bid and ask various prices in anticipation of a future outcome. This fluidity theoretically creates more efficient and rapidly evolving markets.

Prediction markets have existed as long as there has been currency to wager. The modern, digitised form dates back to 1988 when the University of Iowa launched the Iowa Electronic Markets (IEM) to test their accuracy against opinion polls. Since then, similar markets have proliferated globally, especially for events with uncertain outcomes, enabling continuous trading.

How do Prediction Markets work?

The operation is straightforward: traders sell shares at specific prices, representing a fraction of a unit (e.g., a dollar). Both parties receive tokens representing their stakes, with the money held in escrow. Once the outcome is certain, the winning side is paid from the funds of the losing side.

Consider a scenario where you and a friend debate whether an apartment building across the street will be completed by the end of the month. Your friend is confident it will be done on time, while you believe it will take longer. You agree to odds of 70/30. For every 70 cents your friend bets, they stand to win 30 cents if they are correct, and vice versa.

Now, imagine another neighbour joining the discussion. He is even more sceptical about the timely completion of the project and is willing to buy shares at 40 cents. You decide to sell your shares to this neighbour, pocketing the difference, therefore adjusting the odds to 60/40.

Even if nothing fundamental about the building’s construction has changed, the introduction of a new market participant with a different conviction alters the contract’s value.

As the month progresses, more neighbours might join, each bringing their own perspectives and bets. One might think the construction will be delayed further, offering to buy shares at 30 cents, shifting the odds once again. This continuous adjustment reflects the market’s dynamic nature, driven by the ever-changing beliefs and bets of its participants.

When the month ends, the side that predicted correctly takes the pooled money from the opposing side, profiting based on the price at which they entered the market. As long as you’re on the winning side, you can’t lose money, as the payout is always one full unit, and you can only buy one side for a maximum fraction of that whole.

Prediction Markets in Crypto

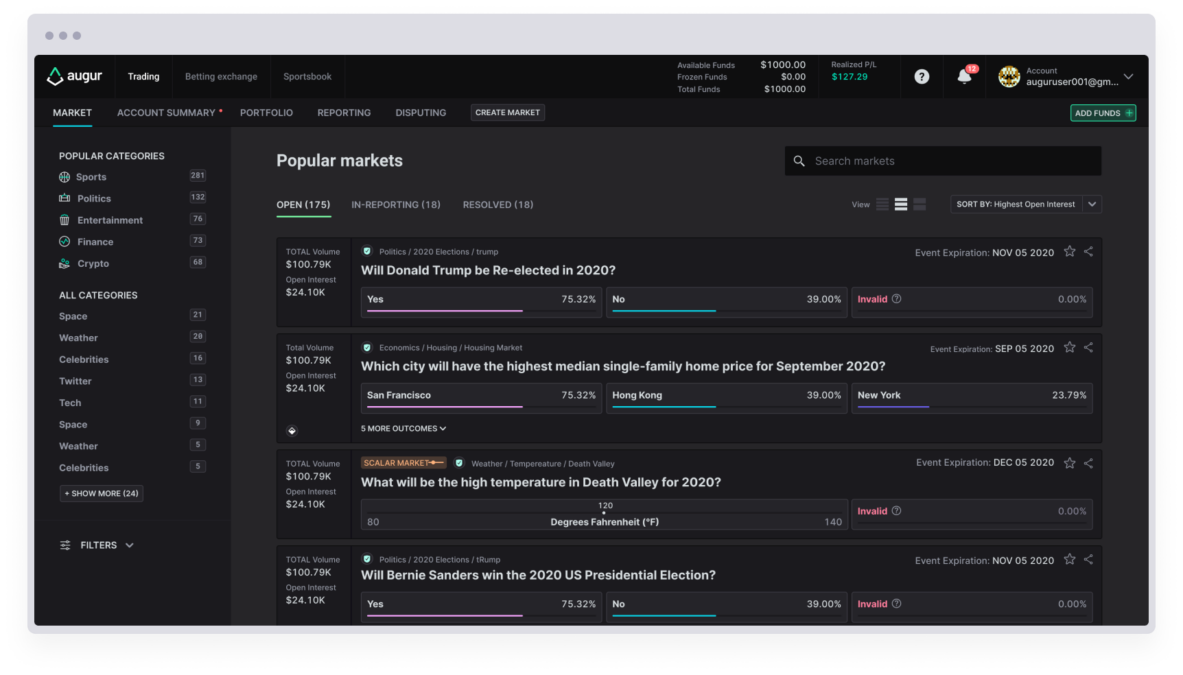

The first prediction market protocol in crypto was Augur, founded in 2014 and launched in 2018. At the time, it was an incredibly innovative application of smart contracts, utilising novel methods for settlement secured by the REP token. Augur v1 settled around $20 million in bets—an impressive figure for 2018-19.

Around the same time, Gnosis also entered the scene, launching in 2015 and pioneering the Conditional Token Framework for betting. However, Augur eventually fractured and turned over to the community, while Gnosis diversified its technology suite, becoming better known for its multisig wallets, decentralised exchanges like CowSwap, and the Gnosis Chain for Ethereum scaling.

Screenshot of the now defunct Augur Trading platform.

Though these early prediction markets no longer exist, the technology they pioneered now permeates the DeFi sphere. Betting is part of human nature—much like how sports betting once drove the development of early high-speed computers and satellite systems, this technology has come full circle.

Today, with Augur dissolving its DAO and Gnosis focusing on broader initiatives, the prediction market mantle has been passed to Polymarket, a protocol launched in 2020 on Polygon. However, Polymarket still owes much of its existence to the Gnosis (CTF) Conditional Token Framework, which pioneered the backend management of such markets.

Additionally, while a few other markets exist, they generate only a fraction of the volume seen on Polymarket.

Polymarket takes the lead

Right now, it’s Polymarket and effectively no one else. Launched four years ago, the platform initially struggled with user acquisition, seeing a brief spike during the 2022 U.S. midterm elections before tapering off. However, the chaotic, action-packed 2024 U.S. elections have helped drive an unprecedented surge in users, with growth now appearing exponential.

Source: Dune

Polymarket currently counts over 37,000 unique active users, trading more than $300 million in volume in July alone. While this volume might seem modest compared to popular memecoins, it’s crucial to remember that most of Polymarket trades are longer-term bets. Traders typically hold their positions until outcomes are determined, unlike the high turnover seen with most tokens.

Source: Dune

And it’s not just users who believe in Polymarket. The platform has raised $74 million across three funding rounds, with the latest round in May securing $45 million from Peter Thiel’s prestigious Founders Fund. Other notable investors include Vitalik Buterin and Airbnb’s Joe Gebbia. Additionally, it has attracted high-profile advisors like esteemed American Election Statistician Nate Silver.

Currently, on-chain, Polymarket faces few real competitors, though it certainly contends with several off-chain rivals/ Web2 betting platforms like PredictIt, launched in 2014, which is often compared to Polymarket. PredictIt operates technically similarly but lacks the blockchain component.

PredictIt’s main advantage is its regulation by the U.S. Commodity Futures Trading Commission (CFTC) under the guise of “Academic Research,” allowing U.S. users to participate legally—a privilege Polymarket doesn’t have. However, this regulation also limits market participation to 5,000 participants per market and caps bets at $850.

So why compare Polymarket to an off-chain platform? Aside from the fact that no on-chain competitor comes close to its scale, Polymarket stands out by competing directly with traditional betting sites. Major news outlets frequently quote Polymarket’s odds to gauge market sentiment, whether speculating on Trump’s VP pick or Biden’s withdrawal.

Thanks to its monetary incentives, Polymarket often reacts faster than any other platform, with users rushing to act on new information as quickly as possible.

For instance, when Biden tweeted his decision to drop out, Polymarket traders began reacting within 65 seconds. In just four minutes, the Biden “Yes” token plummeted by 78.2%, while Kamala Harris’s equivalent token surged by 70.4%, with $30,000 in combined volume. This rapid response was mirrored across related markets, such as Kamala as VP and the Democratic nominee market.

In a hyper-fast trading environment, five minutes may seem like an eternity, but compared to traditional news agencies, Polymarket traders consistently lead the charge in drawing conclusions. We’ve compiled the tweet times of major U.S. news outlets confirming Biden’s decision, showcasing just how swift Polymarket’s market can be.

And it’s not just Americans using Polymarket to gauge the value of truth. During the elections, many Venezuelans also turned to Polymarket, as reflected in the platform’s web traffic.

Behind the adoption

Polymarket’s quick user adoption stems from a simple but powerful principle: access is success. This platform has mastered the art of making prediction markets accessible to everyone, regardless of their crypto experience or depth of pocket.

Frictionless experience

From the moment you log on, even if you’ve never touched crypto before, Polymarket’s interface is intuitive and welcoming. The homepage greets you with a clean display of active markets—each one featuring clear, bold gauges showing percentages or options, along with the total money wagered.

Categories and subcategories are neatly organised across the top bar, making navigation simple. Unlike the intimidating dashboards of traditional exchanges like Binance or dYdX, there are no complex charts or order books with flashing numbers. Polymarket instead opts for easy-to-read line graphs paired with simple buy and sell options for “Yes or “No”.

The traditional location of the “Connect Wallet” button instead gives way to a more familiar “Login” option, which then allows connection via a Crypto wallet or a Google Account. Funding accounts is just as easy. You can deposit crypto directly, or if you don’t have any, simply click “No Crypto” to access MoonPay, where you can convert your local currency to USDC.

Other funding options include PayPal and Robinhood, emphasising Polymarket’s ambition to be more than just a crypto prediction platform—it’s positioning itself as a globally accessible service. Crypto isn’t the focus; accessibility and inclusivity are.

This is just one front where Polymarket shines; by straddling the UI between simplicity and more familiar Web2 elements, it puts the primary user experience first, targeting broad appeal. This focus on ease of use is what sets Polymarket apart and will likely continue to drive its success as it grows.

Liquidity as a priority

While Polymarket has large amounts of money in its accounts as a result of deep investment, the platform itself does not actually generate any money (yet). Rather, despite its deep success, it is losing money. This isn’t for some flaw but rather because Polymarket has opted not to charge Fees on trades made by users, only a few dollars on the deposit. This is relatively unique as most Web2 betting platforms take 5-10% of winnings or 200-500 bps on trades. Yet this is critical to their long-term success strategy.

Polymarket understood early on that without deep liquidity on the other side; you could not sustain a meaningful audience. If betting more traditionally at a Casino where the odds are determined by the house, you still know that they have the ability to take a large bet and pay you out. But in Polymarket’s case, they are not setting the odds. The market is.

To ensure generous liquidity provision from third parties, they give out generous rewards. While the exact formula can get quite complex, one can most simply understand that rewards are given to those who post liquidity on the book. This is scaled as a function of the amount of liquidity posted and the distance to the mid price. In July alone, Polymarket paid out $433,075 of rewards on $342,693,000 of volume, a ratio of $846 of volume to $1$ of rewards.

However, this is less rewarding than in June, where the volume was less than a third of July’s, and May, where it was only 1/6th. Polymarket is paying but seemingly less as they drive more volume. What might be leading this?

For any market to work, there needs to be liquidity. So, while purely trading peer-to-peer retail would be preferable, there is not always someone willing to be on the other side of your trade at any given price or moment. Hence, market makers exist to put up liquidity on both sides. Early on, the invention of LPs with AMMs helped mitigate the need for a dedicated Market Maker, but it still is not as efficient as limit orders moving in an order book.

Polymarket recognised that in order to bootstrap deep liquidity, they needed to pay rewards, which they aggressively ramped up from November 23 to January 24. At this time, reward ratios were as high as 1$ per 73$ of liquidity provided. This heavy incentivisation jump-started the high volumes we have seen and let major Market Makers become deeply integrated.

Even at the current ratio of 846:1, that represents almost 12bps (0.118%), which may not seem like very much but is huge for Market makers. At Keyrock, we consider making 2-3bps consistently on the volume we do to be very good.

If Polymarket themselves implemented just a 12bps fee on top of trades, they could easily cover the rewards they are paying out and break even. This is about 2x less than Uniswap and 8x less than Metamask. However, they have yet to do this.

One thing is certain: Their strategy is working. And as they grow ever larger, the market makers need less incentive to trade the spread, making it harder to compete.

So, Polymarket is losing money but gaining users and liquidity. But liquidity is deep, and users are having fun; some even top the leaderboards with millions in profit. Can Polymarket keep the burn up? Will they eventually turn on fees for themselves? What happens after the election is up in the air.

Dynamic Usage

Beyond the smooth user experience that Polymarket has curated, another significant driver of adoption is the unique financial primitive that prediction markets represent. When paired with other financial instruments, these markets offer innovative strategies for capital preservation. For example, predicting outcomes in the political arena can serve as a hedge against regulatory changes that might impact the crypto market.

Recent discussions in the financial and crypto communities have highlighted an intriguing hedging strategy that involves combining cryptocurrency investments with bets on the political fortunes of key figures like Kamala Harris. The strategy is based on the premise that if Harris, known for her cautious stance on crypto regulation, ascends to greater political power, it could have negative implications for the crypto market.

By holding crypto assets while simultaneously placing bets on Harris through prediction markets, investors can balance potential risks and rewards, effectively diversifying their hedge against regulatory outcomes.

This approach highlights the broader relevance of prediction markets for crypto users. While they may not be the primary driver of new user adoption, they offer seasoned crypto investors sophisticated tools for managing risk. This goes beyond a simplistic gambling outlook, positioning prediction markets as a critical bridge between the volatile world of cryptocurrencies and more traditional financial strategies.

The ability to hedge against outsized events, such as shifts in regulatory policy, demonstrates the deep potential of prediction markets to serve as an integral part of a diversified investment portfolio in the crypto space.

The community angle

But there is one final element that contributes to why Polymarket is the people’s favourite. The proposed and created by the users. Much like how Pump.fun allowed anyone to launch a memecoin, Polymarket lets users propose their own Markets Via their discord. This has allowed people to bet on all manner of things. If there is demand, it will get created, be it Movies, Sports, Geopolitics or Pop Culture.

As the community of Polymarket users expands, it allows more people to dip their toes into crypto. Polymarket allows people to deposit through Robinhood, PayPal, or directly from a coin-based account; there are no bridges or wallets; their backend handles everything.

What’s next?

Currently, Polymarket is a one-person show onchain. There is almost nothing notable that is able to challenge it, let alone do a fraction of the volume. One would expect that if there were multiple markets, there would be lots of arbitrage, but it is likely most Polymarket arbitrage is being conducted across real-world Web2 betting sites. The truth is that Polymarket is competing with the likes of BetFair, Draftkings and Ladsbrokers and offering speculators and traders alike the fairest game.

But others are trying to boot up and get in on the fun. On August 21st, a new prediction market was launched. According to D8X, they will soon have a testnet for a prediction market frontend, and Azuro is following behind with a new all-time high of TVL at 6mm. No doubt anyone who wants to enter must do so soon as much of the volume done on Polymarket is based around the US Election in three months.

After November 8th, will Polymarket volume fall off a cliff and go dormant again, or will their winning strategy of User Proposed Markets, incentivising liquidity, and Easy first-time user onboarding win them over?

Polymarket’s winning formula

Polymarket’s success isn’t just due to its user-friendly design or its generous incentives; it also taps into a fundamental human drive—the desire to predict, understand, and make sense of the unknown. The satisfaction of being right, of saying “I told you so,” reflects a deeper sense of self-fulfilment.

A significant part of Polymarket’s success also comes from its clever approach to attracting liquidity providers through reward programs and its ease of onboarding, which helps bring in non-crypto-native users. This approach not only facilitates participation but also enhances the natural human inclination to predict.

Moreover, Polymarket offers a unique way to hedge against outsized outcomes, functioning as an exotic financial tool. This provides users with an innovative method to manage risk in uncertain scenarios, adding another layer to its appeal.

The monetary aspect deepens our commitment to the outcomes we foresee, much like how even ordinary events become more exciting when money is at stake. Polymarket amplifies this engagement, with cryptocurrency as its enabler.

Polymarket’s success lies not only in its design but in how it connects with a fundamental human drive for prediction while also offering strategic ways to hedge risk and effectively onboarding new users through attractive incentives.

Read more: Airdrops in the Barren Desert

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.