Onboarding the masses: are Memecoins the way to adoption?

The community is a driving force in the crypto space, and Memecoins are a prime example of this. Despite their high risk, they continue to draw in users, even outpacing the market size of many of the largest stablecoins we’ve previously analysed.

Key Takeaways

- Memecoins, once jokes, are now major players. Risky? Yes. But they’re also wildly popular.

- The top 300 memecoins have a combined market size of about $64 bn. That’s double the current amount of USDC in circulation.

- Dogecoin and Shiba Inu are often crypto newbies’ first buys.

- Solana’s Pump.fun allows easy token creation, driving significant blockchain usage.

- Since Pump.fun release, it’s not less than 1 million memecoins that attempted launching, highlighting the platform’s impact on user engagement and innovation.

- Even if Pump.fun drives significant blockchain usage, its overall volume remains lower than DOGE and SHIBA. $2.66 billion for Pump.fun over 90 days against $1.2 billion in 24 hours for DOGE. But in transactions, it dwarfs the Doge group.

Memecoins: jokes on us?

Whether we love them or hate them, memecoins are no longer just a joke. They’re risky and speculative, yet they’re continuously growing, attracting users who are eager to be part of a community or hope to be the next millionaire. In any case, you just can’t ignore them.

However, the critics aren’t silent. Many raise caution against the speculative frenzy. They argue that memecoins lack intrinsic value and utility, making them highly volatile and risky. And they’re right, to an extent. But that’s not the whole story. Memecoins, with their vibrant communities and viral appeal, are bringing in users who might never have touched crypto otherwise.

Their wild popularity is driving attention, and that means we need to dig deeper. Take Polymarket, for example—a platform that thrives on community engagement and speculative fervour. The platform’s success demonstrates that speculation can, too, drive adoption.

Other platforms, like Pump.fun (Solana), are taking a step further by making it easy for anyone to launch a token and jump into the crypto game. This ease of entry is a double-edged sword—it brings in fresh blood but also invites scams and volatility.

So, let’s cut through the noise. Are memecoins just a speculative bubble? Maybe. But they’re also a gateway—an entry point for millions into the digital asset world. Polygon was initially seen as just another scaling solution for Ethereum. Now, it’s a household name. The crypto industry thrives on innovation, and the new kids often prove their worth in unexpected ways.

We believe in having a practical and nuanced approach before dismissing these altcoins. Our commitment to empowering the tokenised economy means we must grasp what makes memecoins thrive, how they shape market trends, and their broader significance in the digital asset space. Overlooking memecoins could mean missing a key driver of mass adoption.

What are memecoins?

First, memecoins are rooted in cultural references rather than solving practical problems. They often feature external people, places, or things, with many referencing crypto culture itself. Second, Second, they typically lack significant utility beyond their own proliferation. For example, Shibarium and Doge Network have limited benefits for the broader ecosystem.

This definition, while not exhaustive, covers 99% of cases, which finds consensus among many of our partners and leader platforms such as CoinGecko or CoinMarketCap.

The role of memes in crypto

It is difficult to navigate the crypto space without seeing threads of memes and cryptic lexicons. They are impossible to ignore, as they’re image responses to every thread, cryptic lexicons, Discord custom emojis, and animated Wojaks. It’s the language of the culture.

So, it is no surprise that memes play a crucial role in the crypto space. They blend culture with finance. They bring the fun, attracting newbies with their jokes and relatable vibes. Coins like Dogecoin and Shiba Inu, born as pranks, now have loyal, buzzing communities.

Hype and FOMO drive their wild price swings, making headlines and catching influencers’ eyes. Memecoins simplify crypto for beginners, turning complex concepts into something anyone can get. In short, memes aren’t just laughs—they’re driving adoption, taking more and more space.

Memecoin market size

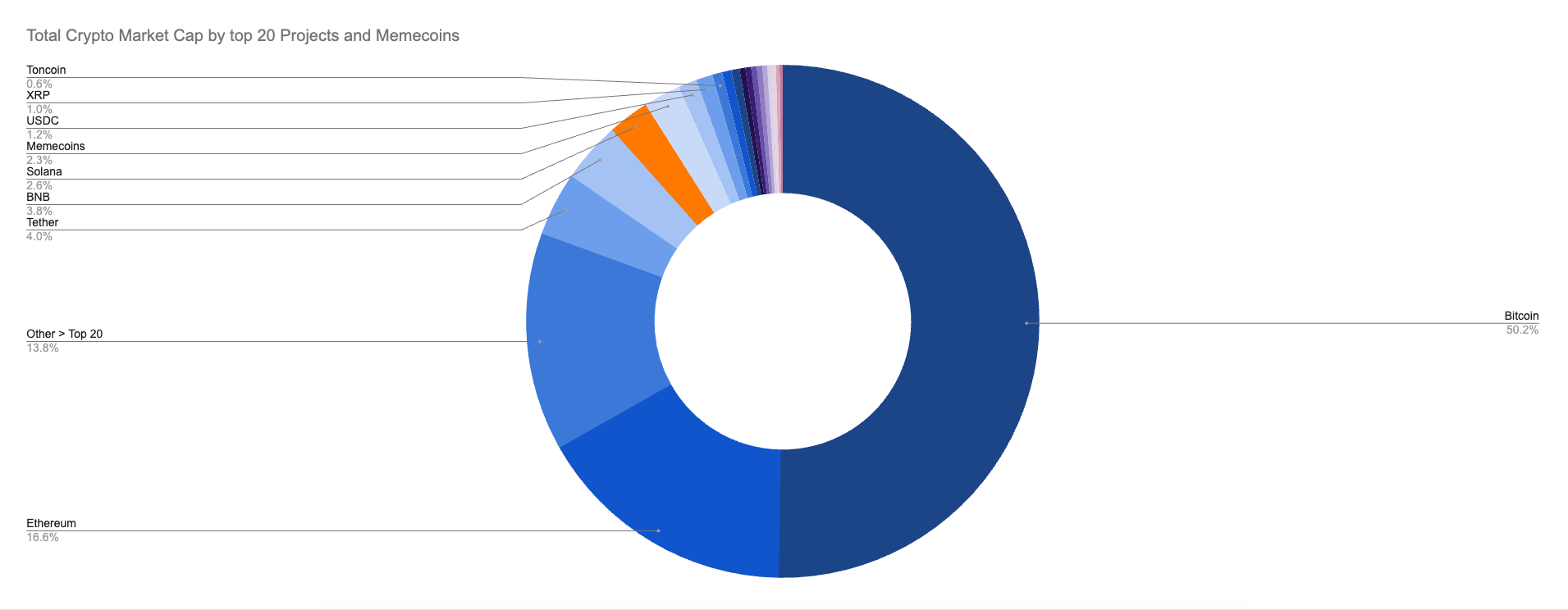

Let’s break down the memecoin scene. As of this writing, the top 300 memecoins claim a market size of about $64 billion. That’s about the same as Volkswagen, Marriott, or PayPal and double the amount of all the USDC in circulation.

Zooming in, the top 20 memecoins cover 95% of this market—$61 billion. These are the heavy hitters. The coins outside the top 20 tend to be far more volatile, with values often fluctuating by tens of millions within a week or less.

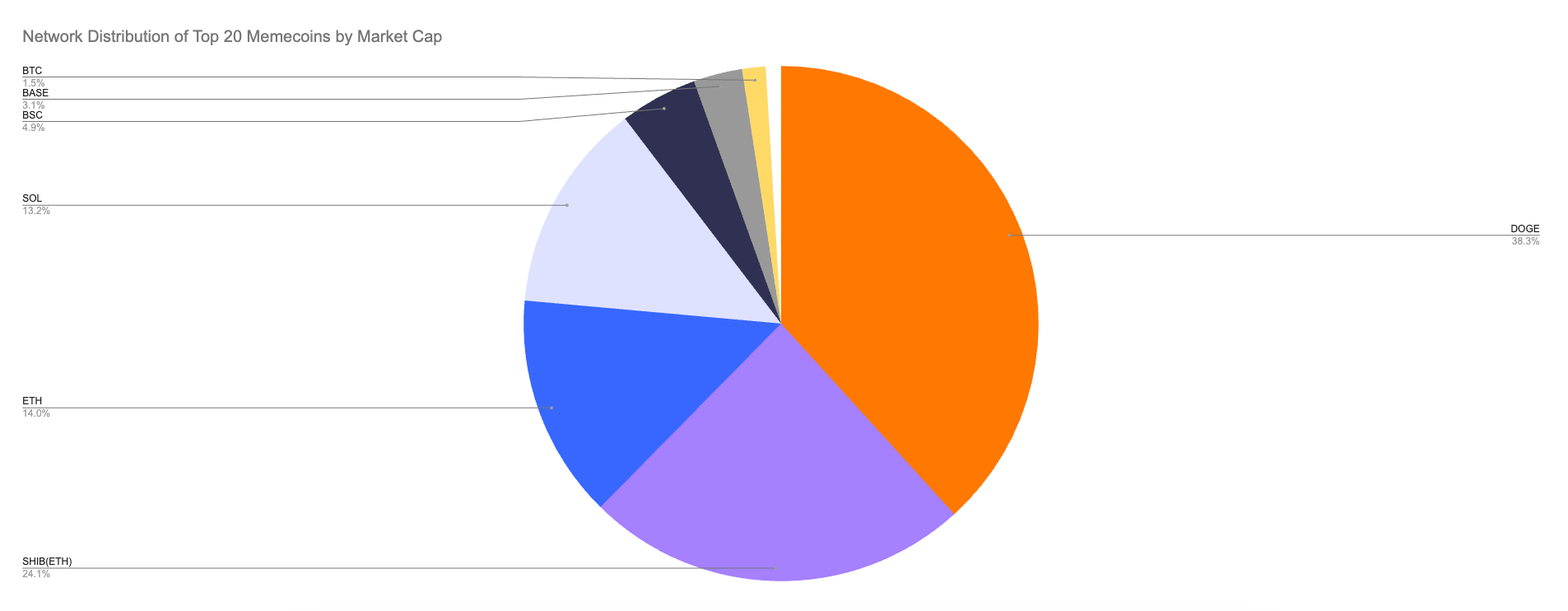

Dogecoin still holds most of the value. SHIB, originally on ETH, is trying to push its own chain, Shibarium, but it’s not quite there yet. Over the last year, Solana memecoins have taken a strong share, with most coins on BSC falling by the wayside.

More recently, BTC, with the adoption of Runes, has carved out a place among memecoin communities. But the chart above points to a far more interesting distinction in the memecoin space.

Onboarding new users: DOGE & SHIB

When discussing crypto with the average person, Bitcoin and Dogecoin are often the first names mentioned. The Doge meme predates almost all crypto, emerging in 2010, just a year after Bitcoin mined its first block. This longevity has cultivated a diverse audience, continually fueled by social media and influencers. A popularity that has translated into mass adoption.

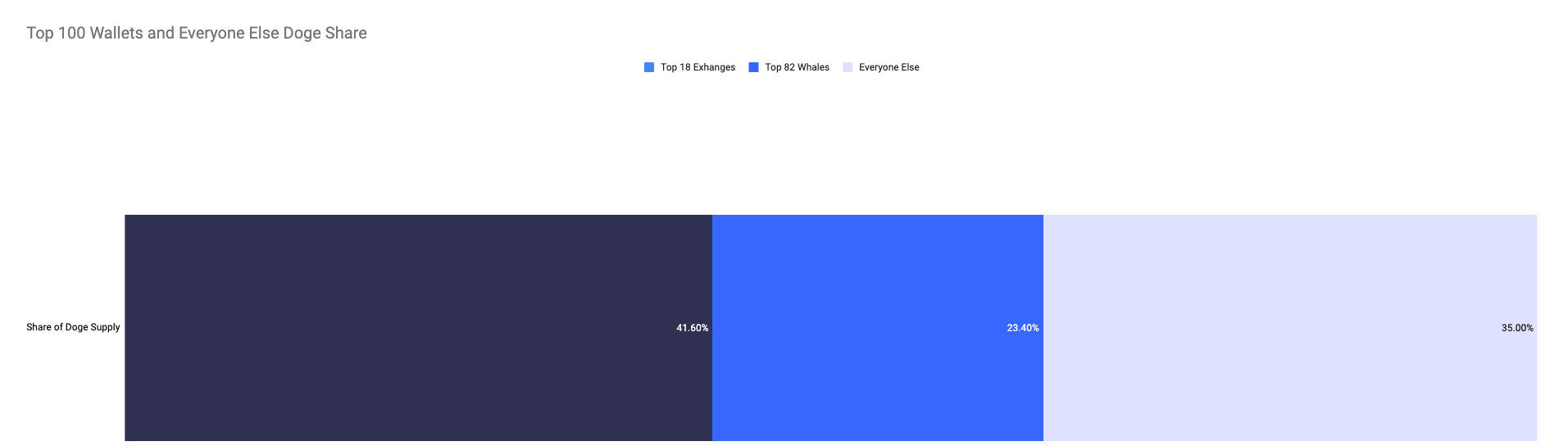

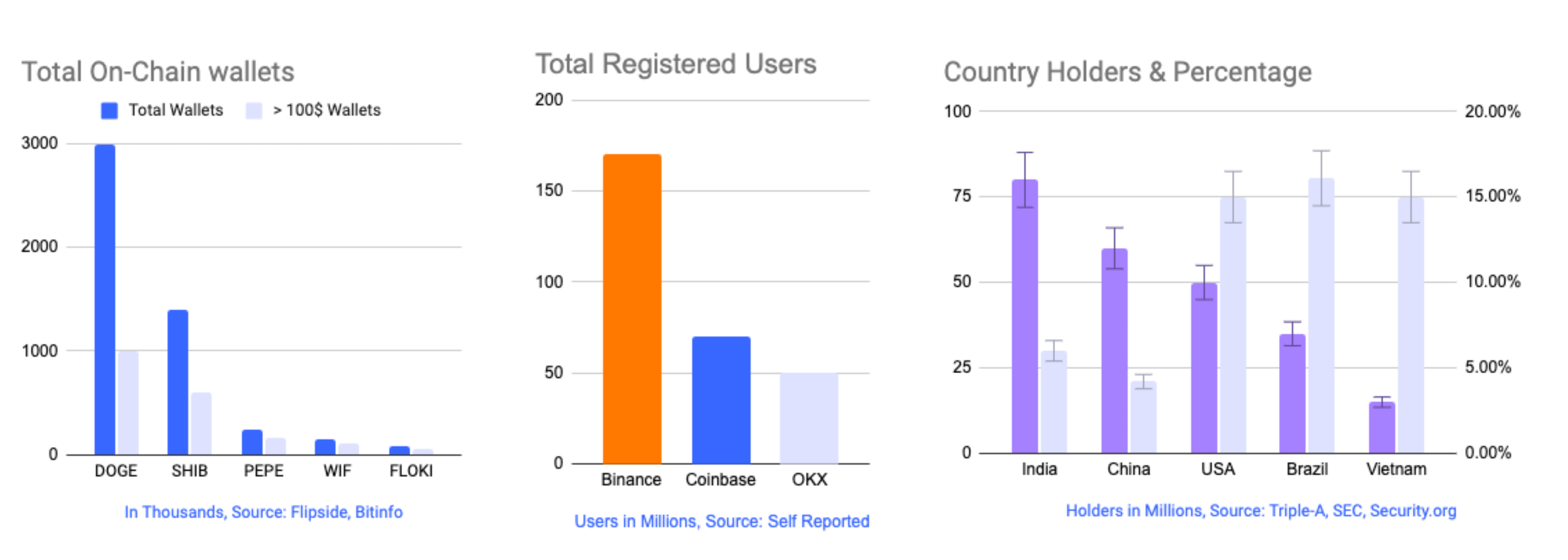

Among the top 20 coins, four—Doge, Shiba Inu, Floki, and BabyDoge—are either Doge or Doge derivatives, making up a staggering 67% of the total market cap. But here’s the thing, most of this activity is not driven onchain. Most holders use centralised exchanges, making it tough to measure actual user numbers.

This means that onchain metrics alone—like the number of wallets and active wallets—fail to paint a complete picture of the user base. But here’s what we do know: top wallets own significant portions, about 65% of Dogecoin and similar for Shiba Inu, with 18 of these being exchange wallets holding 41.6%, depending on the day. Despite 3 million Dogecoin wallets, estimates suggest there could be 15 million or more Dogecoin holders globally.

Memecoin: a tool for adoption?

So why does this matter? Because memecoins play different roles in the crypto world. The Dogecoin family (Doge, Shiba Inu, etc.) attracts newbies who buy through exchanges and don’t use wallets. They’re dipping their toes in crypto, mixing as investors and speculators.

Pop culture, word of mouth, and Doge’s absurdity act as their gateway into digital assets. But their offchain ownership doesn’t boost blockchain use. This becomes clear when we look at the new breed of memecoins. Yet, users don’t stop to indulge in them, still finding value in the “fun” they have. And with the promising launch of Pump.fun, Solana takes that unbridled desire for absurdity and lets it run wild onchain, unchained.

Solana: the meme-friendly chain

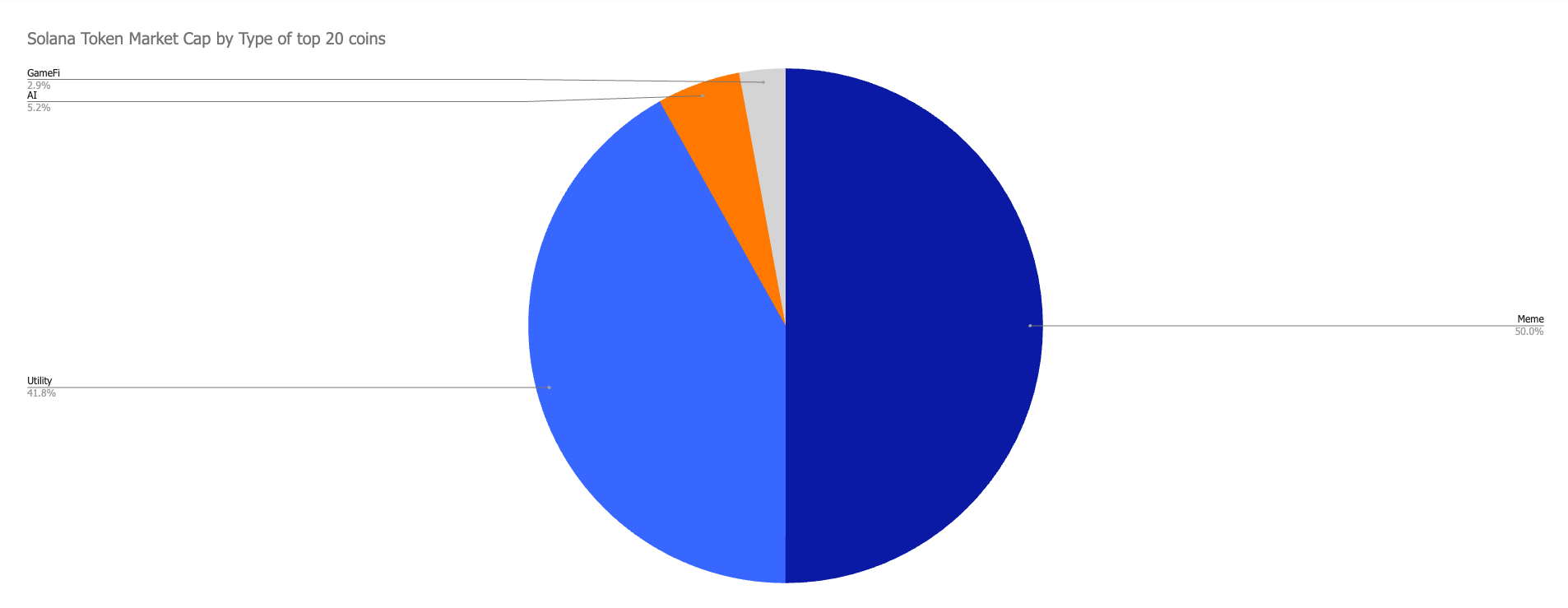

Thanks to a loyal user base, innovative dApps, a sleek design, and low fees, Solana has drawn a critical mass of users. These users, especially lately, have embraced memes. A look at the top 20 Solana coins by market cap shows this clearly. Solana was built by memes or at least largely driven by them.

In May 2024, Solana saw a burst of new memecoin launches, each soaring to tens of millions in market cap. This new wave pumped fresh life into memes and pushed the network to its limits with Pump.fun.

Pump.fun: memes for blockchain usage

Pump.fun launched on January 14 with a straightforward idea: for just 0.02 SOL, anyone can upload an image, assign a ticker, name it, and add Telegram and Twitter links to launch a virtual liquidity pool seeded with a synthetic $5,000 of liquidity. Hundreds of thousands of tokens have launched this way- most failing, but some crossing a threshold of $75k market cap to be properly deployed onchain.

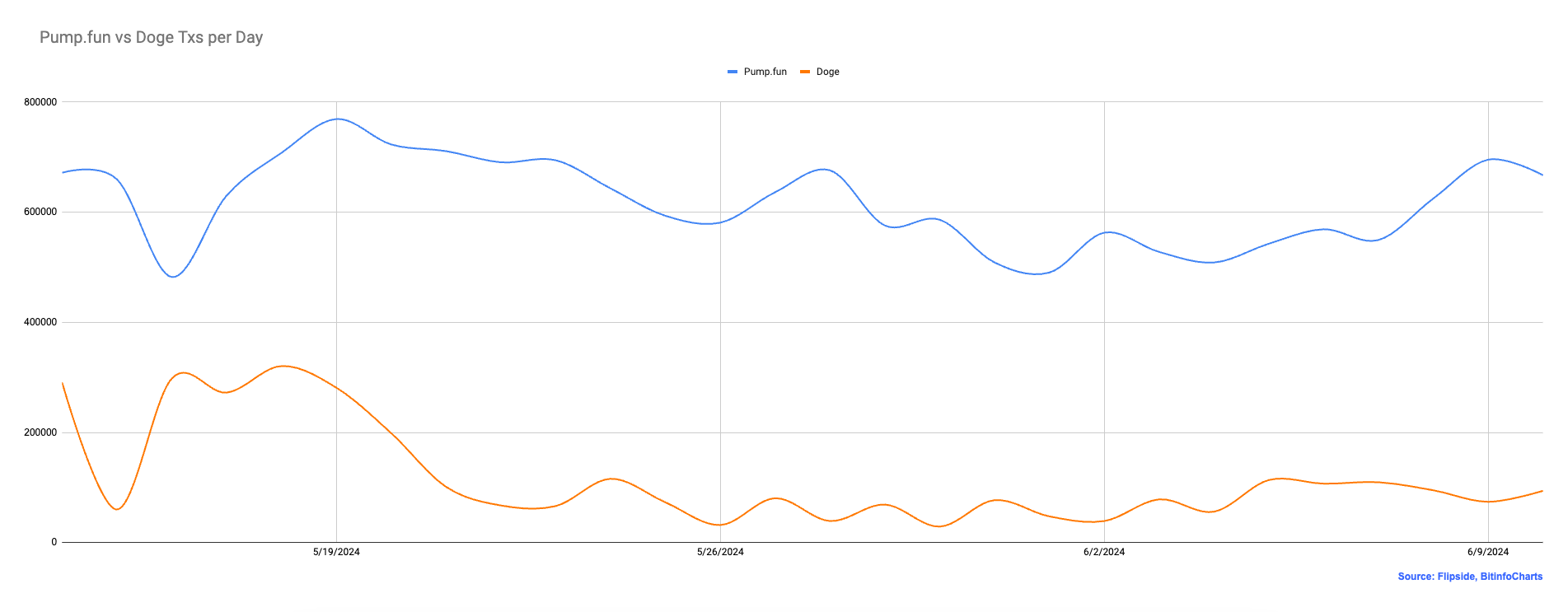

In contrast, self-deploying a token costs 3-4 SOL to reserve space onchain for the smart contract and another 5 SOL to seed locked liquidity. This high barrier has pushed 434k unique addresses to create coins on Pump.fun. Keeping that number in mind, here’s how Pump.fun stacks up against Doge in terms of transactions:

Pump.fun alone dwarfs Doge in daily transactions. While a counterargument might be that these transactions span hundreds of different coins and are actually DeFi activities as opposed to simple transfers, it highlights a clear divide in how memecoins drive blockchain usage.

Consistently, Pump.fun has driven 5-6% of all Solana transactions daily, without even considering transactions and trading on other memecoins on Raydium or Orca. In fact, Pump.fun has occasionally surpassed the number of daily transactions on the entire Bitcoin network.

Memecoin democratised, adoption boosted

What ultimately makes Pump.fun incredibly unique, is that it solved 3 major obstacles to launching meme tokens—and it’s almost painfully easy.

Easy Token Creation: Most DeFi users have never launched a token, but Pump.fun makes it idiot-proof. Simply name it, pick a ticker, add socials, a pic, and a bio. You don’t even need to decide on the token amount. And the cherry on top of the cake: Pump.fun hosts the meme picture for free. Tokens and liquidity pools go live together—no jumping through hoops with Raydium or Orca.

Acquisition of Buyers and Marketing: Without a following, starting from scratch is tough. Pump.fun’s real-time leaderboard keeps users engaged, with the best memes rising to the top. Users engage through messages, fostering a sense of community and urgency. The platform’s transparency, including visible dev holdings, discourages scams.

Seeding of Liquidity and Chain Deployment: Launching a coin requires seeding liquidity and making it discoverable by DEX engines. To prevent bots from buying all the supply cheaply, a fair amount of SOL or stables is needed. Locked liquidity reassures buyers against rugpulls, with LP tokens burned to ensure permanence.

Pump.fun allocates virtual liquidity to new pools, reducing volatility and initial costs. Once a coin hits a market cap threshold, it moves to Raydium with automatically locked and burned liquidity.

The memecoin-generator just nails it by turning complex processes into simple steps. That’s why the platform has spawned billions in volume and over a billion in market cap.

Pumponomic Scale

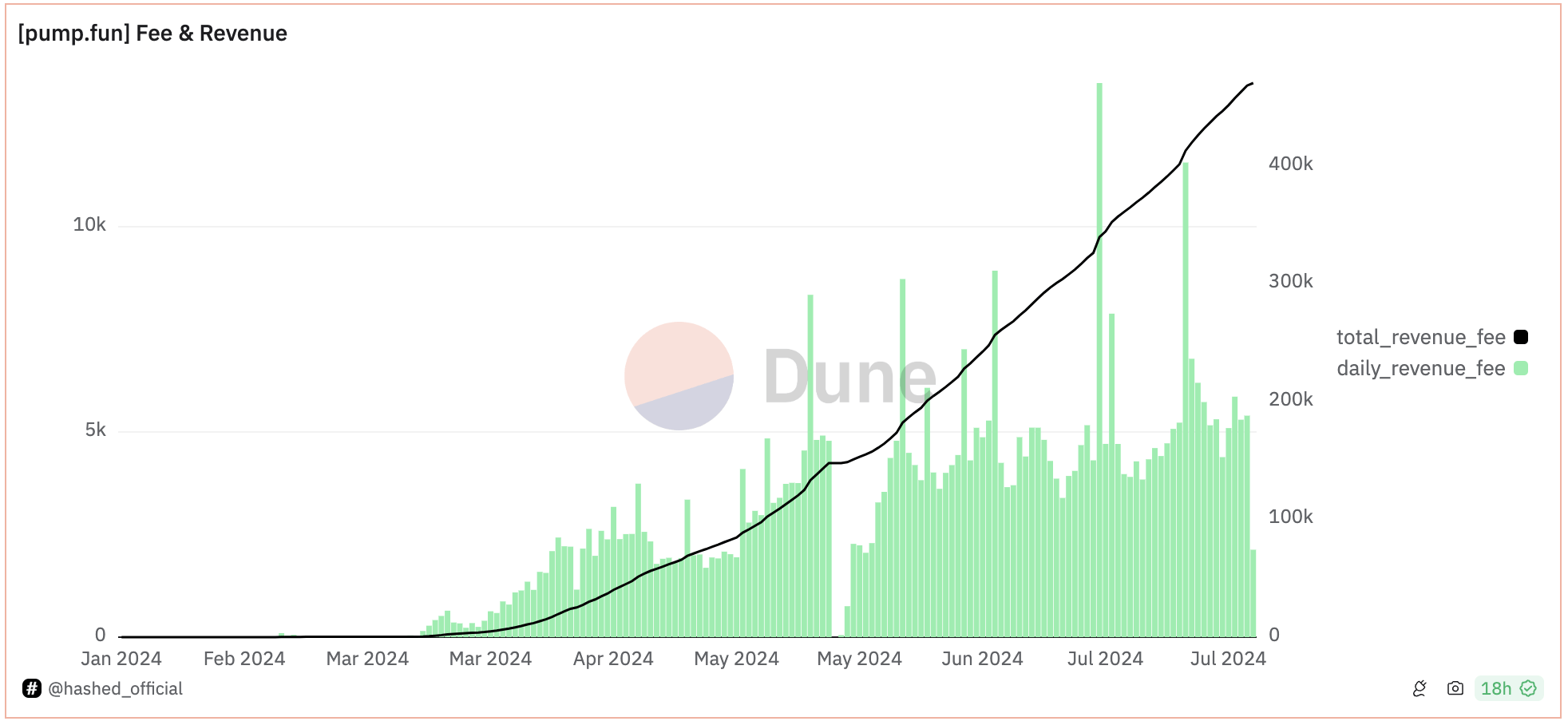

The developers have generated significant revenue from the protocol. While a 1% fee for swapping may seem high elsewhere, the quality and service provided by the platform justify the earnings of 422k SOL (approximately $6.5 billion with SOL at $155).

Source: Dune

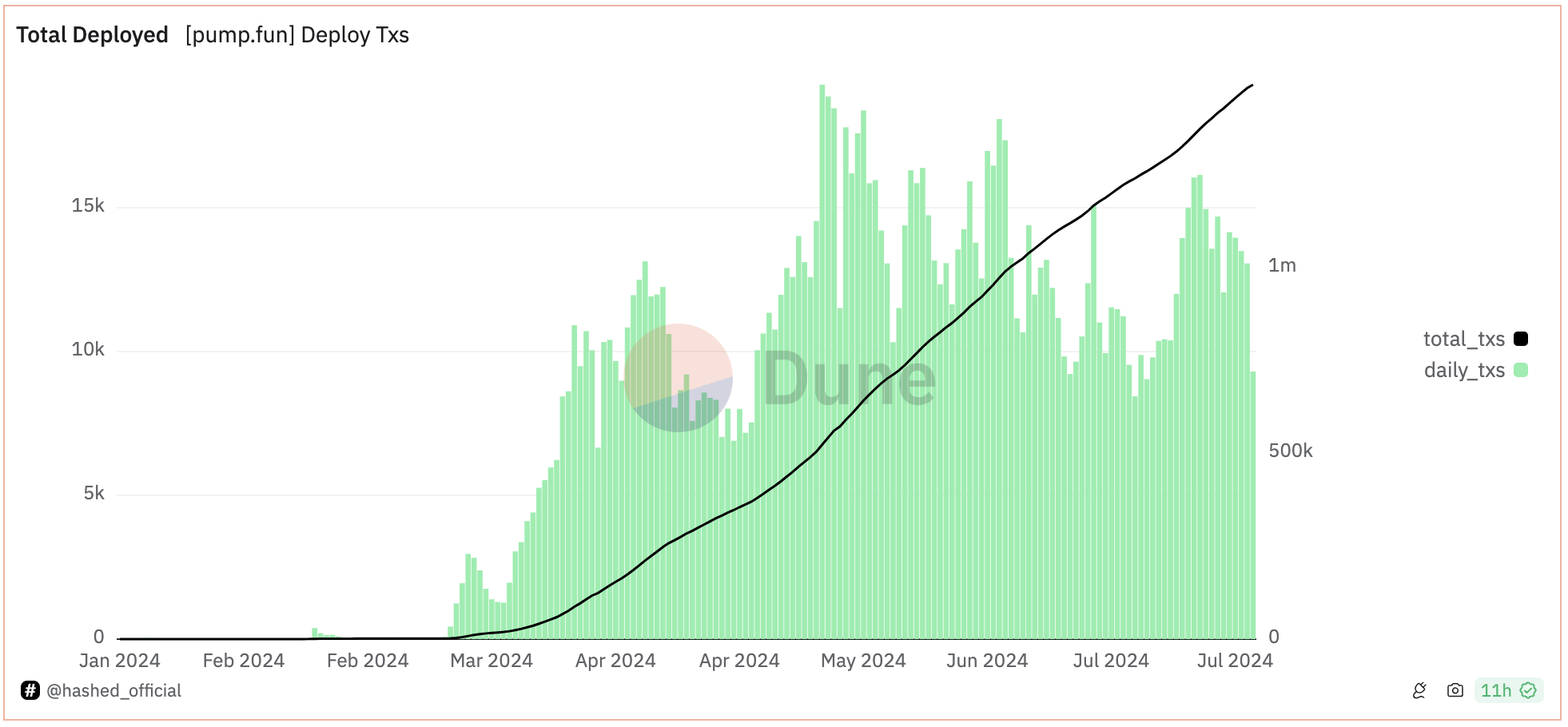

The platform has facilitated over 1 million attempts at launching new memecoins. While many of these attempts did not succeed, several memecoins have generated substantial returns for users and increased interactions that pushed innovation on the chain.

Source: Dune

From cat coins like like $MICHI to self-referential ones like $BOME and celebrity memecoins, Pump.fun has seen it all. Despite challenges such as hacks and competition, the developers’ innovation and community engagement have still led to significant user adoption. A success difficult not to recognise, regardless of the token’s posterity (or lack thereof).

It’s about accessibility

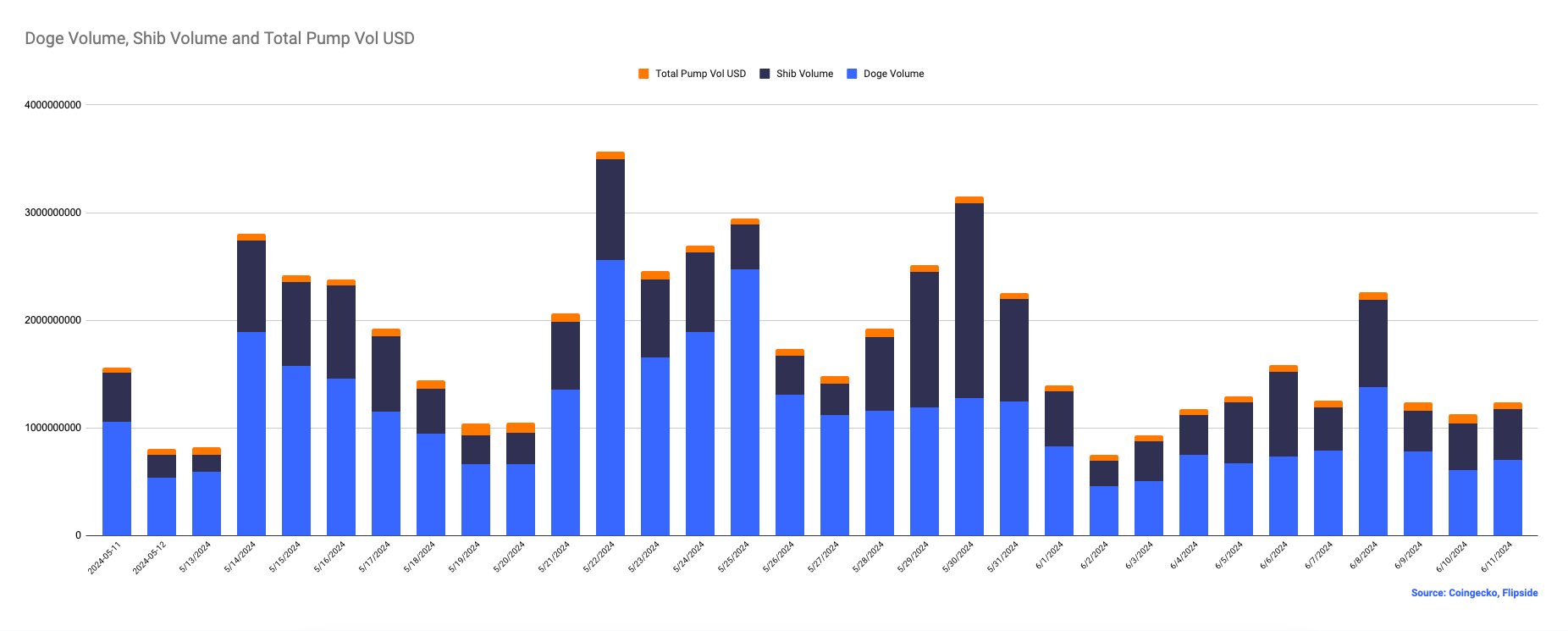

Looking at Pump.fun’s volume against DOGE and SHIB sheds light on how memecoins are bringing the masses into digital assets. Although Pump.fun drives significant blockchain usage, its overall volume remains lower compared to the more established Dogecoin and Shiba Inu.

Over its lifetime, Pump.fun has seen about 17.2 million SOL in volume (roughly $2.66 billion with SOL at $155) over a period of 90 days. In contrast, on June 11th alone, Doge did $1.2 billion and Shib $750 million in volume within 24 hours.

Most legacy memecoin activity happens on centralised exchanges, likely involving unique users. While SOL newcomers aren’t yet matching the old guard in raw numbers, their noise and transaction volume show they’re bringing unique users into the onchain world.

In short, Pump.fun is driving active on-chain engagement and is in the early stages of mass adoption. Meanwhile, the Doge group shows strong mass adoption with high trading volumes on centralised platforms, indicating widespread acceptance and usage. Memecoins, in both cases, are widely accepted and used.

Proceeding with caution

The new lowered bar for entry and easier access to creating and speculating on memecoins has brought new problems. While platforms like Pump.fun have increased transparency by limiting devs’ control and showing all holders, scams are still very much a thing.

Some developers, known as serial ruggers, hoard a lot of supply and dump it as prices rise. Others manipulate activity using multiple automated wallets to artificially push their coins to the top of rankings. These are sophisticated scams by experienced operators, making them tough even for seasoned users to spot.

Most platforms haven’t yet tackled these issues comprehensively. But where there’s money, there are bad actors, and memecoins are no exception.

Wrapping up

Memecoins have evolved from internet jokes to influential drivers of mass crypto adoption. Platforms like Pump.fun have democratised token creation, making it so simple and affordable that anyone can launch a coin. This accessibility has led to increased blockchain activity, attracting users who might not have otherwise engaged with crypto.

While SOL newcomers like Pump.fun are not yet matching the raw numbers of legacy memecoins, their role in driving onchain engagement and attracting new users is undeniable.

Memecoins, whether through the innovative chaos of Pump.fun or the established dominance of Doge and Shiba, are definitely shaking up the digital asset landscape. For many new users, they’ve become a gateway, sparking curiosity and participation in the crypto space.

At Keyrock, we recognise that, for many, they’re an introduction to exploring onchain environments— whether for trading, staking, investing, or voting. Platforms like Pump.fun and the spread of memecoins on Solana and other low-cost chains may not always create new utility, but they play a crucial role in driving adoption and stress-testing networks.

The future of memecoins is wide open. New challengers will rise, and existing platforms will continue to evolve and innovate. One thing is clear: memecoins are here to stay, driving mass adoption and transforming how we interact with digital assets.

Read more: Onboarding the masses: Crypto Prediction Markets

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.