Let's make NFTs more liquid

If NFTs are mostly known as quirky digital art pieces used as PFP (profile pictures), their use cases are expanding, offering more financial applications. And with this diversification of NFTs’ utility comes new market opportunities. Let us introduce NFTFi.

The NFT Boom

To this day, many seem to think of NFTs as this long-gone hype that contaminated every corner of the internet with pictures of animals and valueless drawings. Yet, non-fungible tokens offer so much more than what meets the eye. Yes, in case you were wondering, we did also drop our own NFT collection. Read about it here.

At their core, NFTs allow digital representation of any asset from the physical and virtual world (tokenisation) while guaranteeing sole or fractional ownership. They’re one-of-a-kind and can’t be reproduced or copied. That’s also what makes them often rare and valuable.

Non-fungible tokens (NFTs) have been around for a while, with the first NFT, Quantum by Kevin McCoy, released in 2014. But it was in 2017 that the NFT craze truly started. CryptoPunks, EtherRock, and CryptoKitties, to name a few, were all sought-after collections. All reaching astronomic value.

People have been avid collectors since dawn, so NFTs’ popularity shouldn’t come as a surprise. Nor the fact that NFT collections are as coveted, prized assets just as many physically collectible artifacts. Many whales (i.e., JP Morgan, Visa, and HSBC) have made sure to have a foot in the door as we speak. We’re simply past pondering on the potential of NFTs.

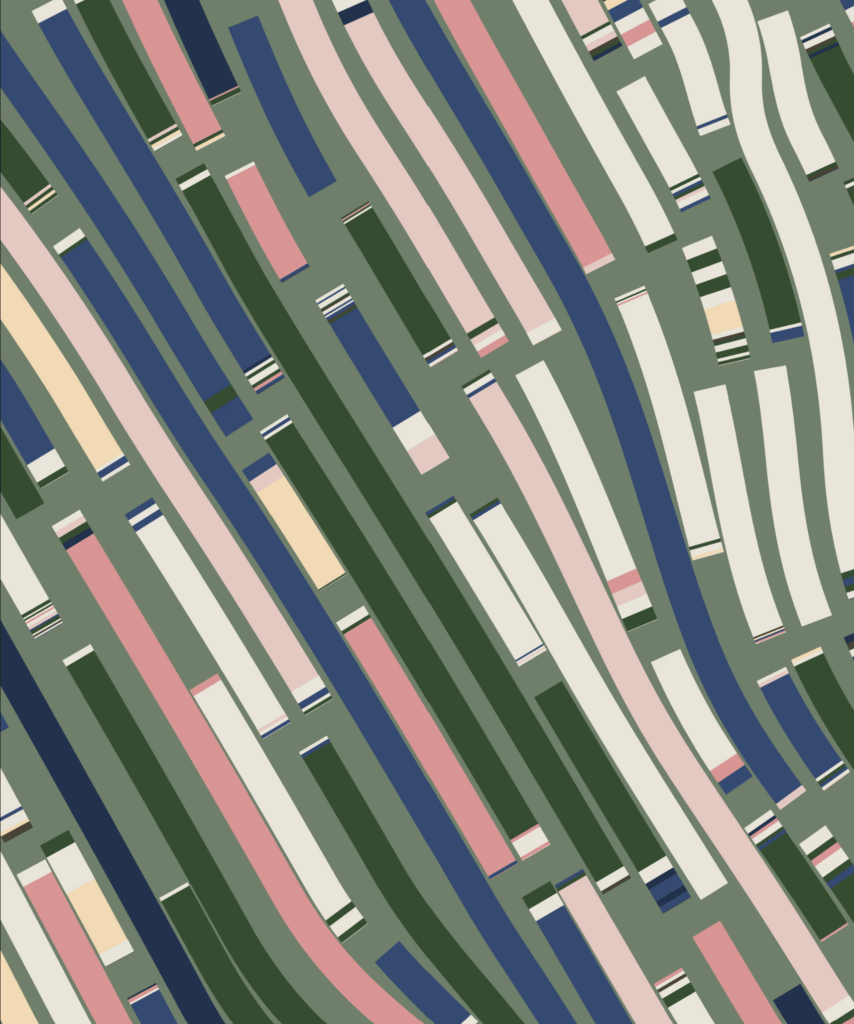

In addition to creating our own collection, we’ve acquired artworks from various collections and are proud owners of Terraforms. We view this generational art as a true innovation in on-chain art in its purest form. It’s only a matter of time before we introduce credit markets based on these text-based animated NFTs.

Terraforms #6774 and #7681, part of Keyrock’s portfolio.

But let’s be honest here. Spending millions on these collectibles cannot be solely rooted in a profound admiration for NFT art (and, accessorily, their ROI). There is so much more behind this sort of “NFThood.” NFTs are also a versatile asset class, and we’ve barely scratched the surface.

This is where we are

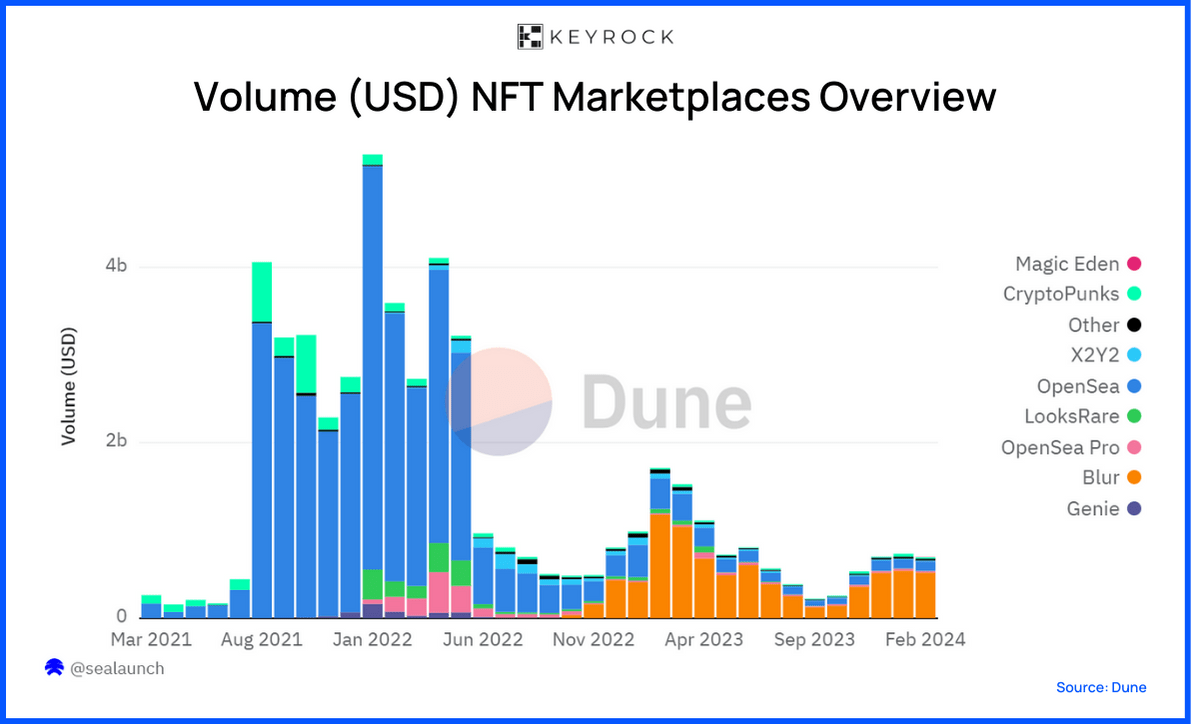

On-chain data reveals stark contrasts between bull and bear markets. Over $5 billion was traded in January 2022, plummeting to $214 million in January 2024—a 95% decrease in volume. That makes us wonder: Is the NFT mania gone? Our answer: it’s just starting.

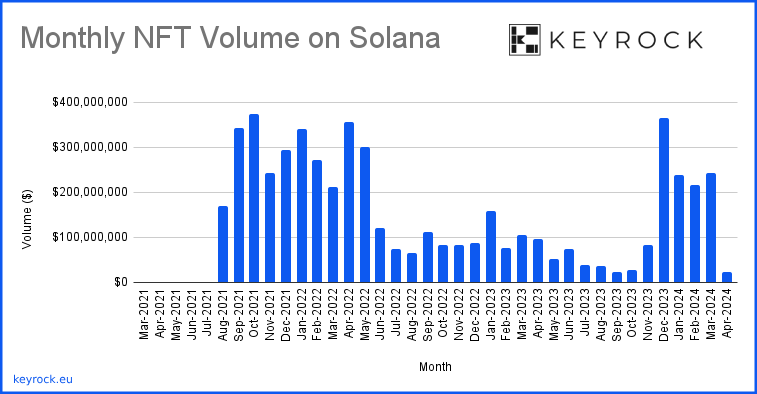

Solana on-chain data from the past three years reveals a trend similar to EVM data. During 2023, market volumes were low, and as market conditions improved, the NFT market also picked up. This is especially true for Solana, as the monthly volume increased 16-fold from September to October.

Source: Cryptoslam

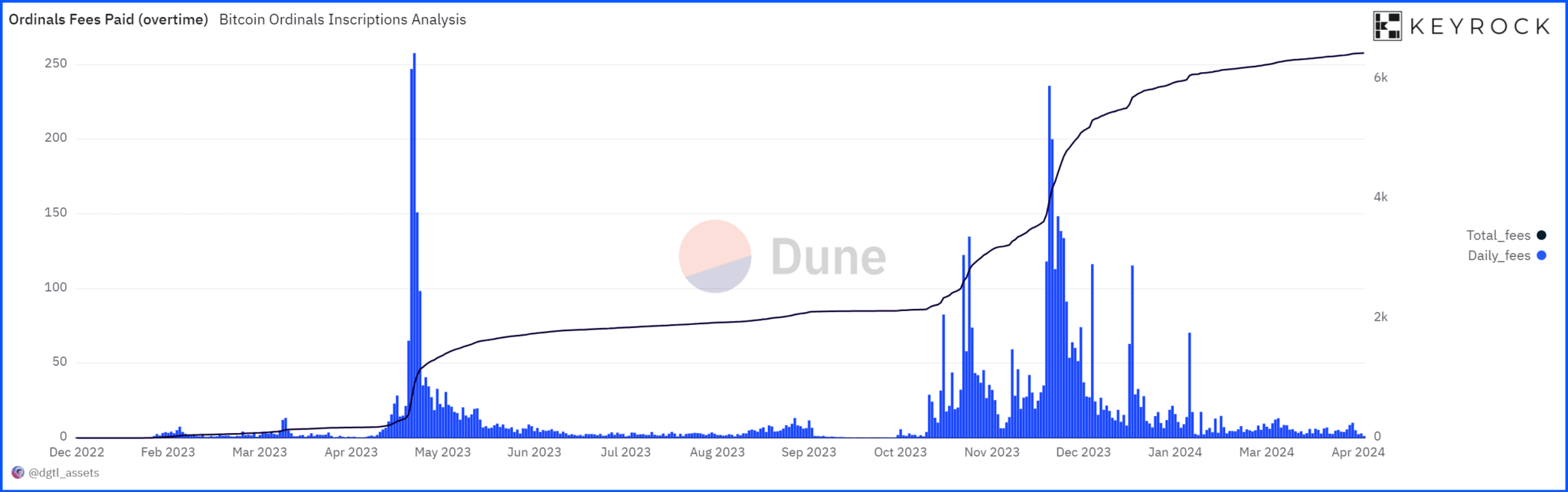

The launching of Bitcoin ordinals, otherwise known as Bitcoin NFTs started in April 2023 and took off later that year. As a rough estimate of the BTC NFT market size, the total market caps of the top 20 collections amounted to 23,919 BTC or 1.553 billion USD (@65k USD per BTC). A significant value that is certainly not to be underestimated.

In comparison, the top 20 collections on Ethereum are valued at 1,407,400 ETH or 4.785 billion USD (@3.4k USD per ETH). Given that Ethereum’s market cap is a third of Bitcoin’s, yet its NFT market size is 3 times larger, saying that BTC Ordinals/NFTs have growth potential would be an understatement.

Source: Dune. Note: Ordinals Protocol allows users to embed data into the Bitcoin Blockchain. This chart depicts the fees paid to the Ordinals Protocol.

The reality is that NFT ownership offers limited options. The gold rush has now hit a ceiling, and investors want more than just holding NFTs in a wallet. And where there is a want, there is a need. A need for secondary markets. A need for liquidity in these secondary markets.

But the facts remain: the surrounding financial infrastructure and ecosystem for NFTs are still nascent. A scenario that, as a market maker, is both intriguing and challenging.

This gap in financial infrastructure highlights how early we are, drawing lines of the transition from the ICO to the DeFi cycle. It hints at the potential for a Non-Fungible Token finance phase to transform the understanding and use of NFTs.

Financialisation of NFTs

One of the most expensive NFT collections (and controversial), “The Merge” by the digital artist Pak, was sold for $91.8 million. This sale was notable not only for its high price but also because of the large number of buyers who collectively purchased 312,000 shares, each paired with an NFT.

Now, imagine you’re one of the proud shareowners of a “The Merge” NFT piece. Would you sell it? You could, and you’d probably earn a good yield on it. But that’ll also mean you’ll no longer own it.

This is where Non-Fungible Token finance (NFTFi) comes into play. With NFTFi protocols, such as lending and borrowing (money markets), art becomes a financial tool that can be leveraged permissionlessly. It’s like taking a loan against a Monet painting—unfathomable in traditional finance.

The NFTFi landscape

Hedging and gaining NFT exposure added another fascinating layer to NFT finance. And investors are betting big bucks on these derivative protocols. Their rise deep into the 2021 bull market, right after the NFT frenzy, is a case in point.

Even when general market sentiment was low in 2022, NFTFi protocols still emerged and gained some traction. And then came Blur. The lending market launched, and loan volumes went through the roof quickly, taking 80% of the market share and originating $5+ billion in loans.

Blur, initially a marketplace rival to OpenSea, quickly became a standout in the NFTFi space thanks to an aggressive growth campaign. This strategy relied on token incentives and airdrops designed to reward platform activity while discouraging users from trading on other platforms.

Following this, Blur launched Blend, its lending platform, which swiftly rose to become the largest NFTFi platform. Leveraging its user base, Blend offered both a money market and leveraged trading through a “buy-now-pay-later” feature, highlighting the market’s emerging nature and demand for leverage.

Market making in the NFT landscape

If secondary markets facilitate NFTs’ selling and buying, NFTFi enhances them by integrating DeFi primitives. Besides money markets (lending and borrowing), NFTFi protocols also span spot-DEXs, Perpetual DEXs (Perp-DEXs), options, and many more. And each serves one of these premises: improving NFT trading and expanding NFTs’ productivity.

Money markets

Probably one of NFTFi’s most important and disruptive value propositions. A money market allows you to use your NFT as collateral to borrow another asset, such as ETH. This means that NFT owners can access liquidity without selling their NFTs.

But it doesn’t stop there. Investors can lend assets such as ETH against an NFT, thereby generating a yield on their holdings. In essence, the money market presents a robust use case for both lenders and borrowers.

NFT collateralisation is just one solution that has emerged to broaden NFT utility and unlock holding’s liquidity. But just as in any market, price volatility is a risk factor to tame to guarantee liquidity flow. And having big actors with ample capital entering these markets could bring lending-borrowing to the next level.

Market makers play a pivotal role in enhancing the liquidity of money markets, notably by underwriting loans against NFTs. Our efforts in the Solana lending markets have significantly contributed to this, with over 80 collections and $7 million in underwriting, on protocols such as Sharky.fi. Making markets more efficient on these platforms. And we’re fully committed to doing so.

This commitment extends to Bitcoin ordinals on Liquidium, featuring collections like Runestones and Nodemonkes. In the EVM space, our focus lies on generative art NFTs. We have provided loans for artwork such as Fidenza and Squiggle working with platforms like Gondi, Cyan, NFTFi, and Zharta.

Fidenza #159. One of Keyrock’s lending markets on Gondi.

These platforms offer interesting loan features, which, as market makers, allow us more room to adjust loan structures. Gondi’s refinancing feature is one good example. They enable active loan refinancing for lenders and offer negotiation via smart contracts without borrower intervention required.

Spot-DEXs

Traditionally, NFTs have been traded on dedicated marketplaces such as OpenSea, Blur, and LooksRare. These platforms function similarly to eBay, serving as P2P marketplaces where sellers list assets at prices they consider fair, leaving buyers to determine their value.

This model, however, complicates the price agreement process between buyers and sellers. Spot-AMMs, exemplified by SudoSwap, employ a pricing algorithm–a bonding curve–to simplify this. Liquidity Providers deposit assets, enabling the buying and selling of NFTs based on the bonding curve. This mechanism is just an example of how different AMMs enhance the trading experience by facilitating trading against the liquidity pool.

As market makers, we are very familiar with spot markets. By tweaking our algorithms from traditional spot-DEX order books to these NFT platforms, it was a logical decision for us to begin experimenting in these markets. We discovered that market making on platforms like Blur and Mintify is quite similar to how we conduct spot trading.

Derivatives

Derivative protocols like Perp-DEXs or Options-DEXs allow investors to speculate on NFT values without direct ownership and hedge downside risk.

NFTPerp is a notable example of utilising a virtual AMM (vAMM). The vAMM processes trades through a smart contract vault, which holds all traders’ collateral for a given asset. In this setup, profits and losses are directly transferred between traders, enabling positions to be taken on NFT values without actual ownership.

Market makers use derivatives markets to trade, hedge their exposure, or actively engage in market making. Our interest particularly lies with NFT options. This is a relatively new market, and we’re actively engaging with multiple platforms, such as Wasabi on Blast and Tensor Trading, Magic Eden, and Sharky.fi on Solana.

We’re just getting started

The days of the well-worn 10k NFT PFP collections are ending. NFTs represent a new asset class full of potential. They’re carving out new possibilities, making investing in art, music, games, real estate, experiences and any intellectual properties more accessible.

So far, NFTs have been volatile and largely illiquid, trading as extreme long-tail assets. The “floor prices” have been too easily manipulated. The introduction of secondary markets is set to address these issues. More importantly, they’ve emerged because there is a demand.

We’re still at the premises of a new wave, foreshadowing another market cycle. But NFTs can be so much more if we make these markets liquid. It’s now up to us, the big liquidity providers with the expertise, to step in and bring these possibilities to life.

Our focus is to boost liquidity. No matter the asset. No matter the market. We add value to markets by making them more inclusive and efficient, thanks to our airtight in-house tech that drives seamless price discovery.

And we’re just getting started.

Read more: Airdrops in the Barren Desert: Surveying the traits behind 2024’s 11% success rate

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube