What is a Liquidity Pool? A guide

One of the hottest activities in crypto, especially in DeFi markets, is providing liquidity to pools. This trend took off during the 2020 DeFi Boom, drawing in both retail investors and larger players. They engaged with DEXes and other platforms through strategies like yield farming and liquidity mining.

Since then, liquidity pools have become one of the main forms of making the market efficient, or “market making,” in DeFi. But many other onchain liquidity provisioning solutions exist, and choosing where to deploy liquidity depends on several factors that we’ll explore.

This guide covers liquidity pools, liquidity provisioning, and key considerations for deploying liquidity. Let’s get into it.

Why is Liquidity Important in Crypto?

Liquidity is the lifeblood of crypto. It’s the measure of how easily you can buy or sell a cryptocurrency without throwing its market price into chaos. High liquidity means you can trade swiftly with minimal price impact, while low liquidity means your trades are like moving a mountain with a teaspoon.

High liquidity equals market stability. Quick, efficient transactions without wild price swings attract traders and investors, building market confidence. It also helps in price discovery. In a liquid market, the gap between buy and sell prices is narrow, giving you a fair reflection of an asset’s value.

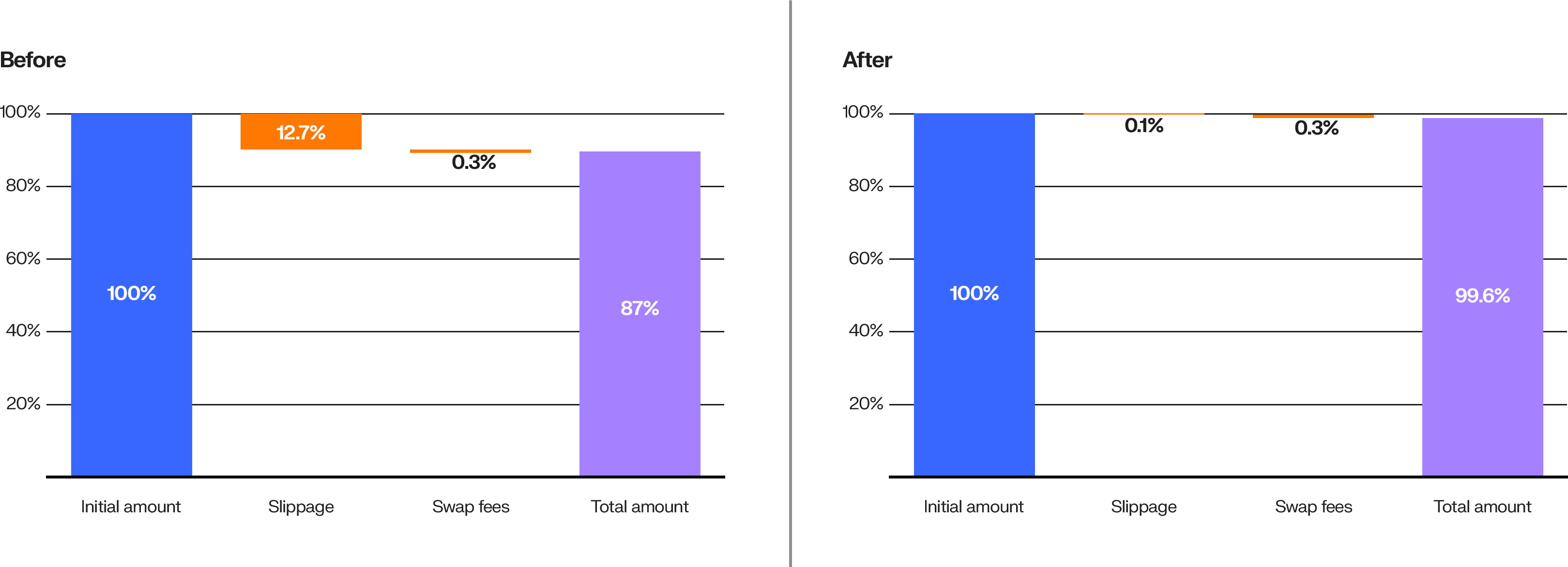

But high liquidity also minimises slippage—that gap between the price you expect and the price you get. This is especially important for large trades. In short, liquidity makes the crypto world go round, promoting a stable, efficient, and fair trading environment. It is essential for growth and innovation within ecosystems.

The impact of liquidity

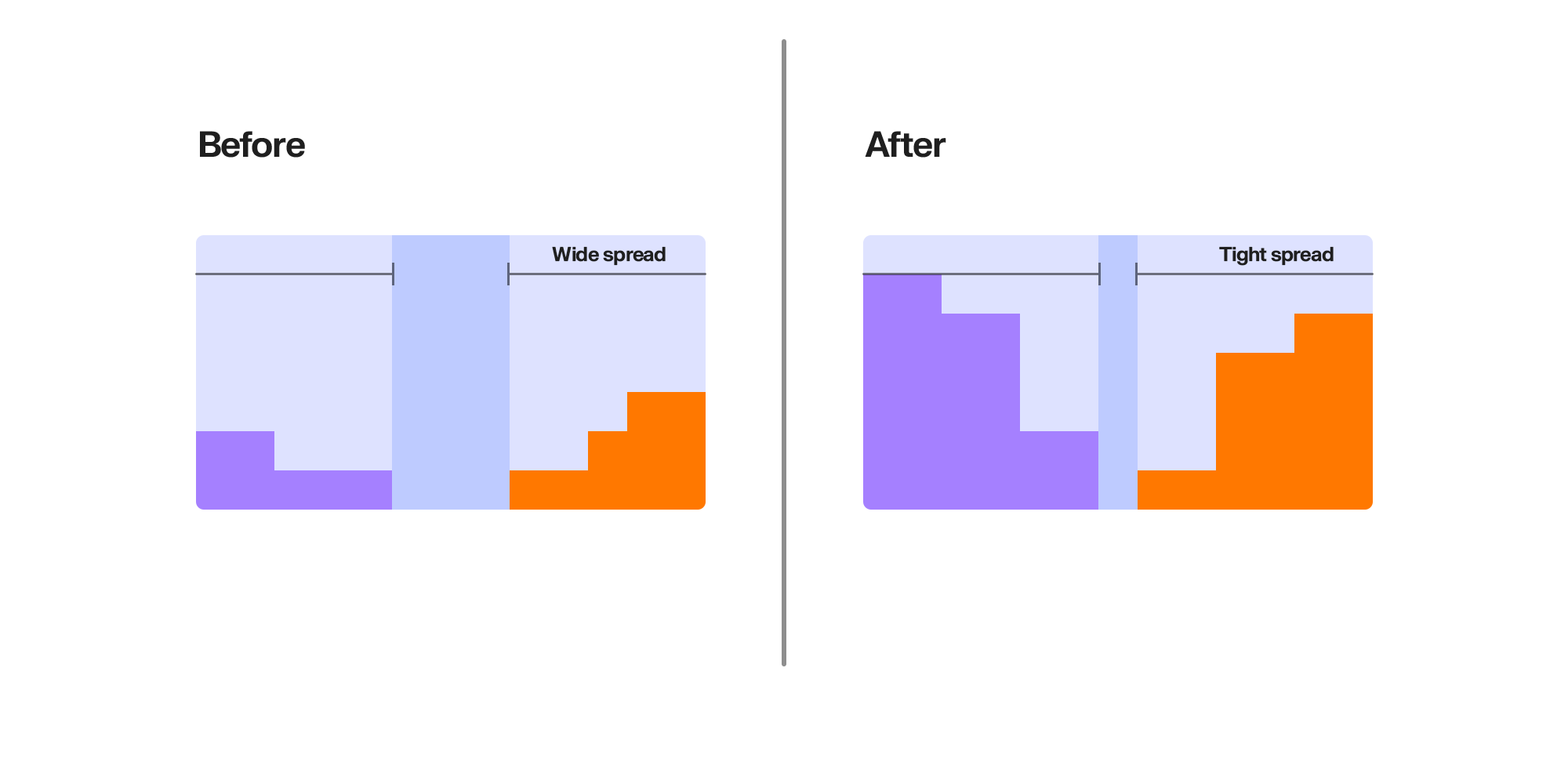

Liquidity and, by extension, those who provide liquidity (liquidity providers) are central to maintaining a good market flow. They keep the markets ticking by fulfilling buy and sell orders. This process, known as market making, allows everyone else to trade easily at consistent prices.

Market makers use sophisticated algorithms and hefty capital reserves to offer buy (bid) and sell (ask) prices, earning a tidy profit through spreads while boosting market liquidity. This results in narrow bid-ask spreads and less price volatility.

In DeFi, liquidity pools take this a step further, using smart contracts to handle liquidity automatically. No need for complex algorithms, but it still requires deep knowledge of how to move liquidity. You still need to manage it well to avoid losses.

Price Slippage

Price slippage is the bane of every trader’s existence. It happens when there’s a mismatch between the expected trade price and the actual execution price. This is common in high-volatility or low-liquidity markets. The larger the trade imbalance, the greater the slippage.

Price Stability

Deeply liquid markets are your best friend. They handle large volumes within a narrow bid-ask spread, keeping prices stable. This is crucial for efficient, predictable trading and lessens the risk of market manipulation.

Large Volume Trades

Large trades are the ultimate test of a market’s liquidity. Conducted by big players like institutional investors or large whales, these trades can shake up market behaviour. In thin markets or in markets with not-so-well-distributed liquidity, such trades can cause sudden price movements and increased slippage.

Who are liquidity providers in crypto?

If we were to use TradFi terms to qualify them, liquidity providers are the market makers of DeFi, using their tools to make markets more efficient. They fulfil buy and sell orders, exactly how market making works. Armed with sophisticated algorithms and substantial capital, they offer bid and ask prices, making a profit through spreads while adding liquidity to the market.

In DeFi, liquidity pools automate this process via smart contracts. This innovation means no more complex algorithms, but it requires careful management to avoid losses.

The role of liquidity in the crypto market

Liquidity is a game-changer for exchanges, token issuers, and investors:

- Exchanges: High liquidity means more organic trading volumes, signalling to traders that they can enter and exit the market easily with less risk. This activity generates transaction fees and boosts the exchange’s competitiveness.

- Token Issuers: Listing on a liquid exchange ensures an immediate market for their asset, allowing holders to trade freely and helping attract capital from investors. Reduced volatility aids in the price discovery process for new assets.

- Investors: Deep liquidity provides a smoother trading experience, creating trust in the asset. It enables faster execution times and lowers slippage, enhancing the overall trading experience.

Liquidity providers on DEXs vs CEXs

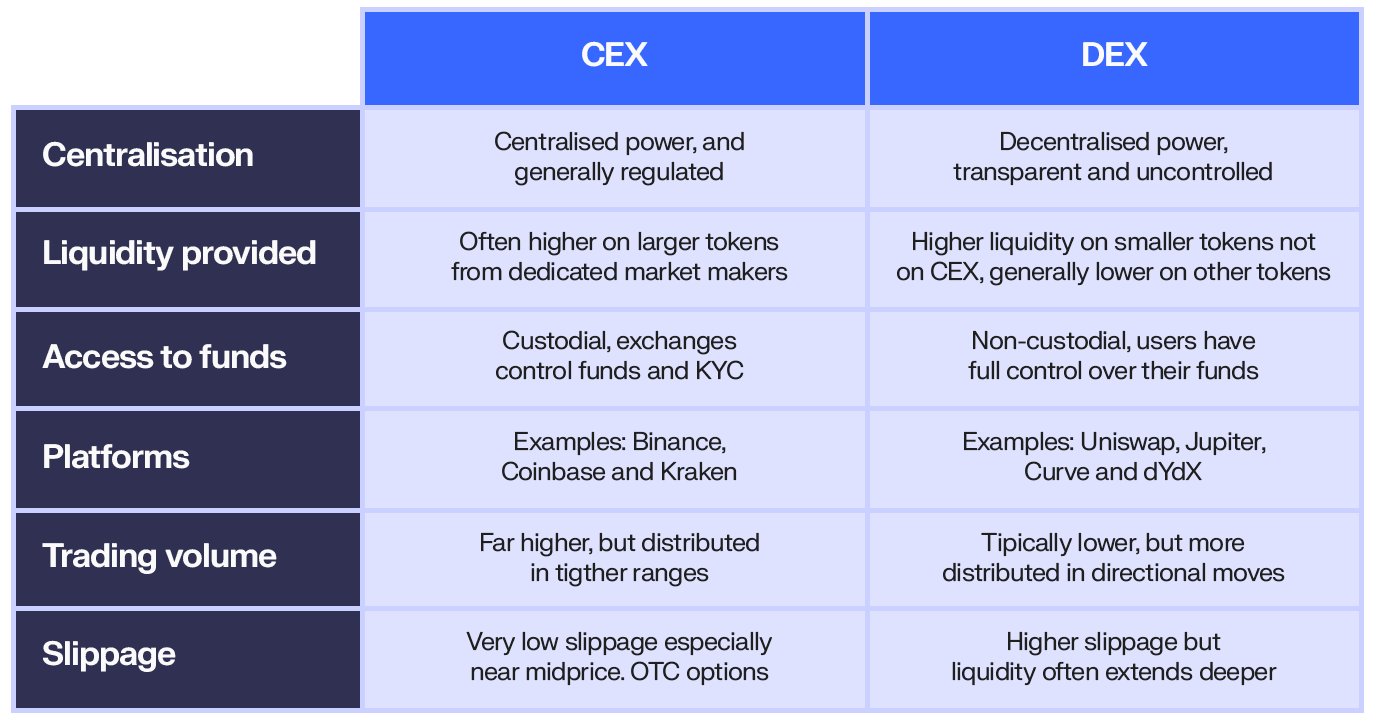

Moving, optimising, and creating liquidity differ between decentralised exchanges (DEX) and centralised exchanges (CEX).

In CEX, liquidity is usually managed by financial institutions with the capital and tools to handle many buy and sell orders, similar to traditional finance. Here, market makers and brokers are the main actors who have the ability to provide deep liquidity.

In DEX, liquidity comes from the community. No central third party. Liquidity providers deposit into a smart contract. This contract manages liquidity and sets prices based on asset ratios and pool activity (how many users buy and sell the asset).

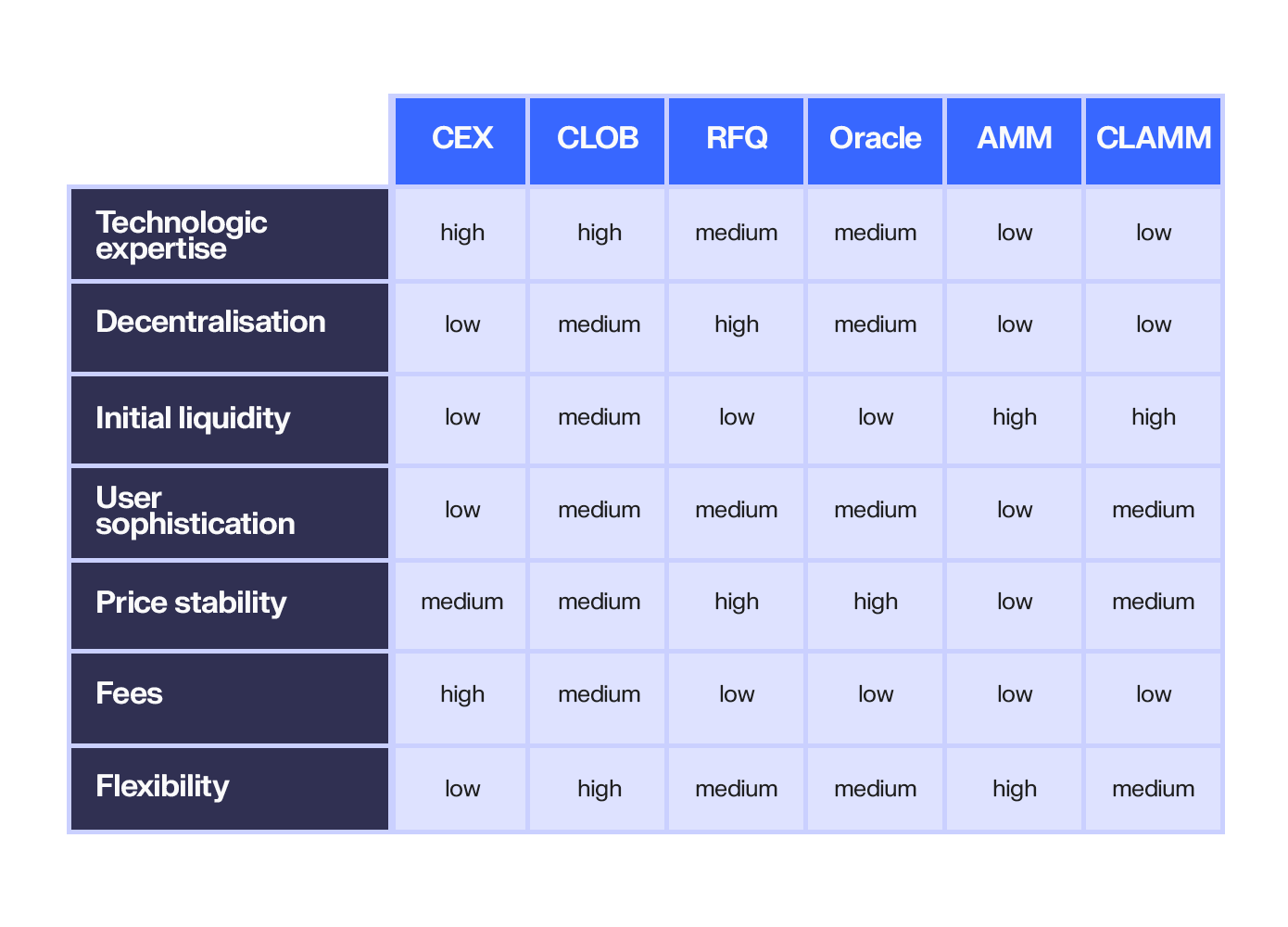

Let’s compare the two:

What is a liquidity pool?

The Liquidity Pool is a recent innovation that seeks to solve a core issue in most trading markets. How can you make a market and determine a fair price without a direct counterparty? This is needed in decentralised finance as not all actors can be aligned on the same platform and coordinated over time. That is what the liquidity pool solves.

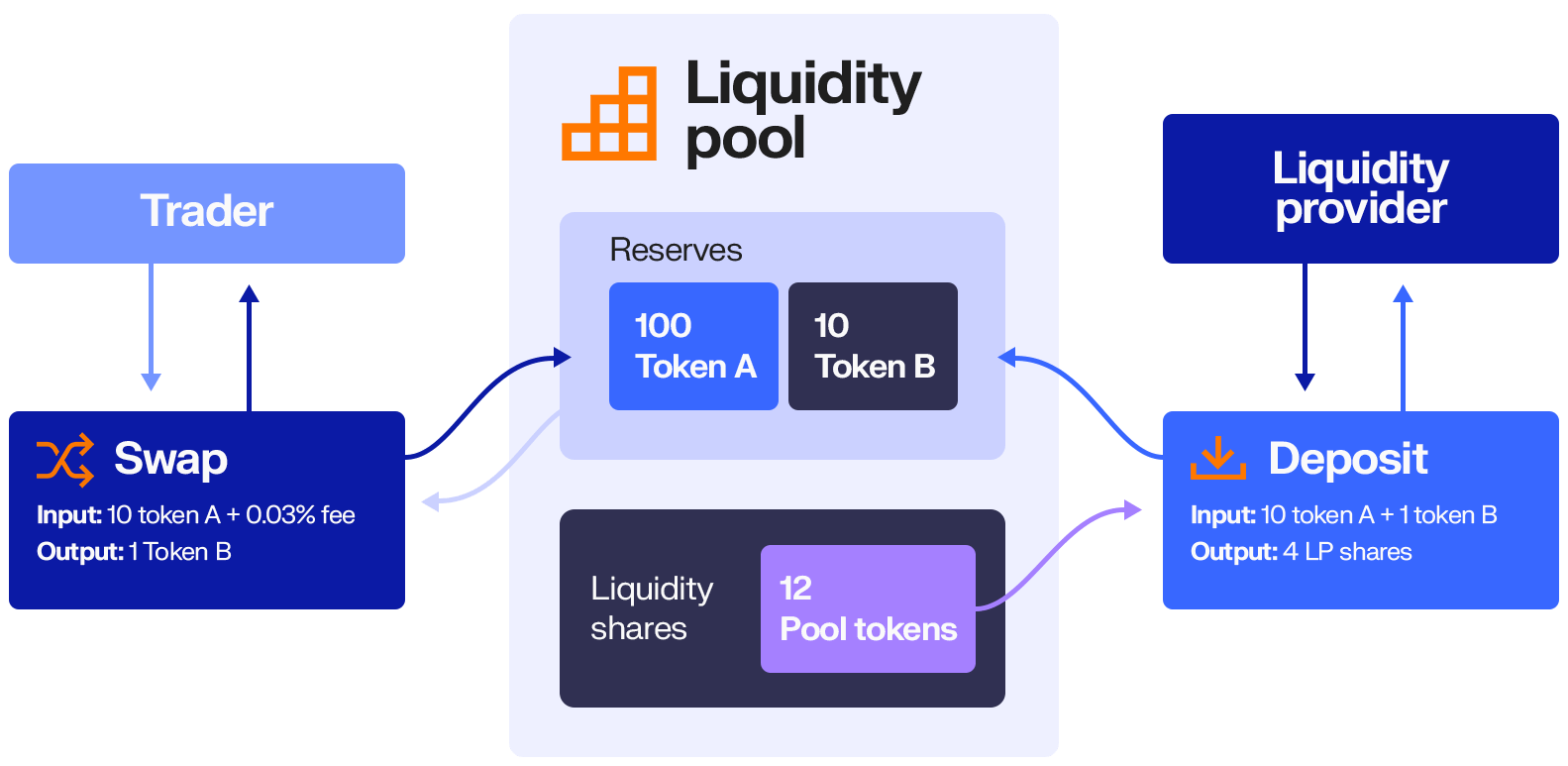

Essentially, liquidity pools are collections of crowdsourced funds locked in smart contracts to provide essential liquidity for decentralised exchanges and various DeFi applications like lending and borrowing protocols. These pools always consist of two different tokens, maintaining a balance between them to allow continuous trading.

The price of each token in the pool is determined by a mathematical formula based on the relative quantities of the two tokens. Trading in the pool changes the token balance, which in turn alters the price. Due to this imbalance, larger trades have a more significant impact.

To become a liquidity provider (LP), an investor deposits equal values of the two designated tokens into the pool. Given the central role of liquidity and liquidity pools in DeFi, protocols incentivise liquidity provision by distributing a percentage of the trading fees to LPs based on the trading volume.

Why are liquidity pools important?

Given their ability to help facilitate trades without the need for a centralised intermediary, liquidity pools form the cornerstone of a fluid and efficient DeFi ecosystem for these primary reasons:

Democratisation

Anyone can add liquidity and earn fees. Token issuers get market access without needing CEX listings. Opening a pool is often cheaper and community-driven, widening reach without third-party costs.

Market efficiency

Liquidity pools cut transactional friction. With enough assets, users can swap and aggregate volume, ensuring accurate price discovery and reducing arbitrage. For Defi to work, trades need to get the fairest price with the best accuracy.

Decentralisation

These pools enable peer-to-peer exchanges, eliminating traditional financial intermediaries. This not only ensures a more equitable financial system but also empowers users with greater control and autonomy over their financial transactions.

In essence, liquidity pools are more than just a technical feature of the DeFi ecosystem. They are a cornerstone of the decentralised, inclusive, and efficient financial system that DeFi aims to create. Their role extends beyond providing liquidity; they are instrumental in shaping the landscape of decentralised finance, making it accessible, efficient, and user-centric.

The different kinds of liquidity solutions

Liquidity provisioning in decentralised exchanges depends on the type of exchange and its underlying infrastructure. To understand how liquidity provisioning works in DeFi markets, we need to consider the key differences and features across two distinct DEX types: AMMs and order book-based exchanges.

Automated Market Maker (AMM)

Liquidity provisioning is straightforward in an AMM DEX. It involves depositing funds into a liquidity pool—smart contracts that hold specific pairs of assets. This process creates liquidity for trades and contributes to price stability.

Liquidity providers in AMM DEXes ensure transaction flow and are incentivised with a share of the trading fees, LP tokens, and participation in protocol governance. The smart contracts use algorithms to automate price quoting for these assets, employing formulas such as constant product and constant mean. Some of the most popular AMMs using these methods include:

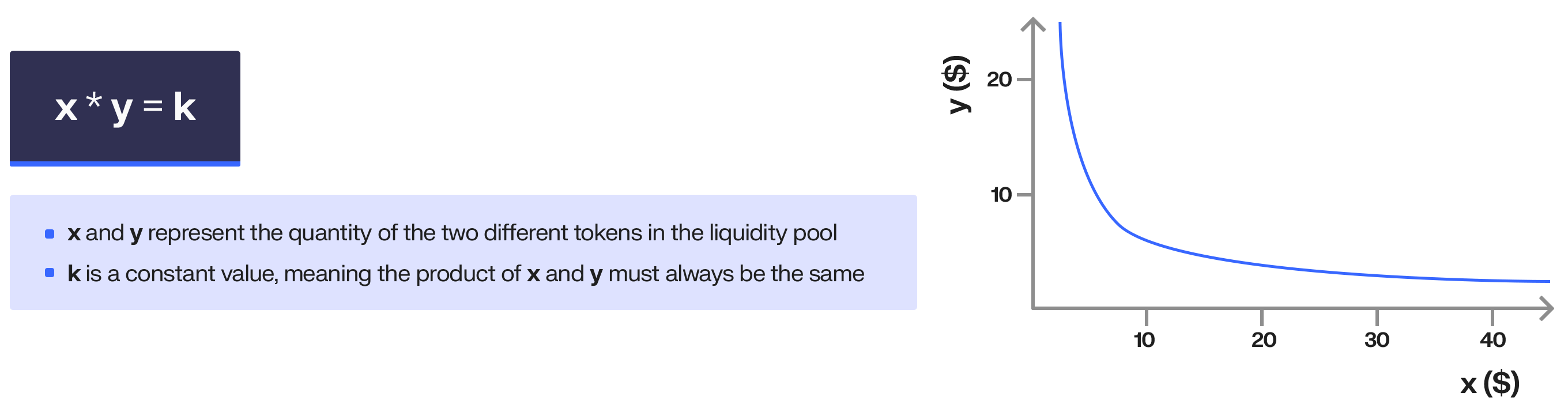

Constant product AMM

This is one of the most common types of AMMs, and it is used by exchanges such as Uniswap. Under this model, the funds in the liquidity pool are priced according to a formula that keeps the product of the quantities of the two assets constant. This causes the impact that trades have on price movements to be non-linear.

x × y = k

Where:

- x and y represent the quantities of the two different tokens in the liquidity pool.

- k is a constant value, meaning the product of x and y must always be the same.

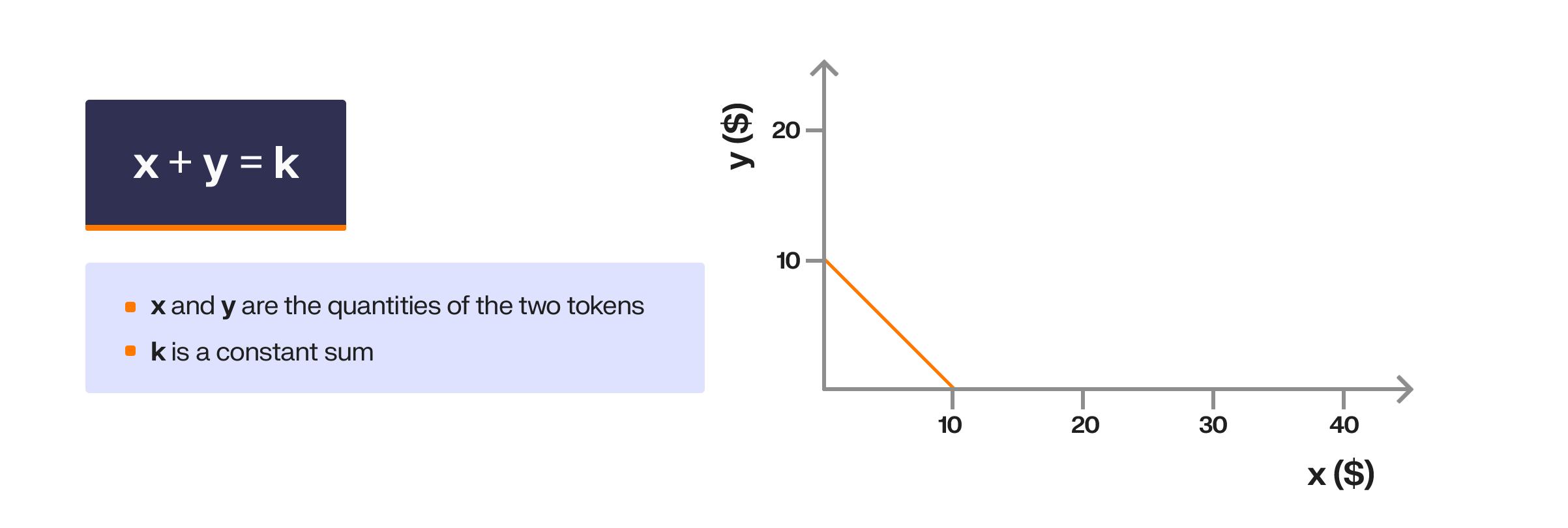

Constant sum AMM

Similar to constant product, constant sum AMMs such as Balancer also maintain the price constant by applying a simple arithmetic formula. The only difference is that it relies on the sum of the quantities to stay constant instead of the product. These are commonly used for liquidity pools that contain more than one asset.

x+y=k

Where:

- x and y are the quantities of the two tokens.

- k is a constant sum.

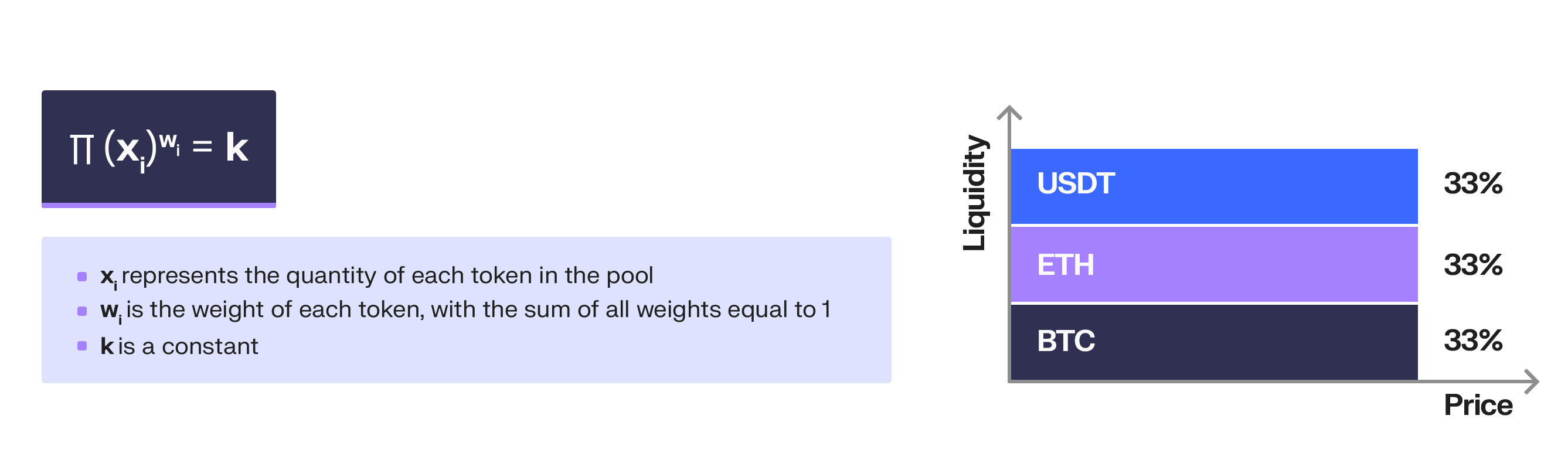

Constant mean AMM

There are also AMMs with slightly more complex variations on the constant product formula, such as the one used in some Balancer pools. Here, the average price of the assets remains constant. This helps reduce price slippage and reduces trades’ impact on asset prices more than the constant sum.

∏(xi)wi =k

Where

- xi represents the quantity of each token in the pool.

- wi is the weight of each token, with the sum of all weights equal to 1.

- k is a constant.

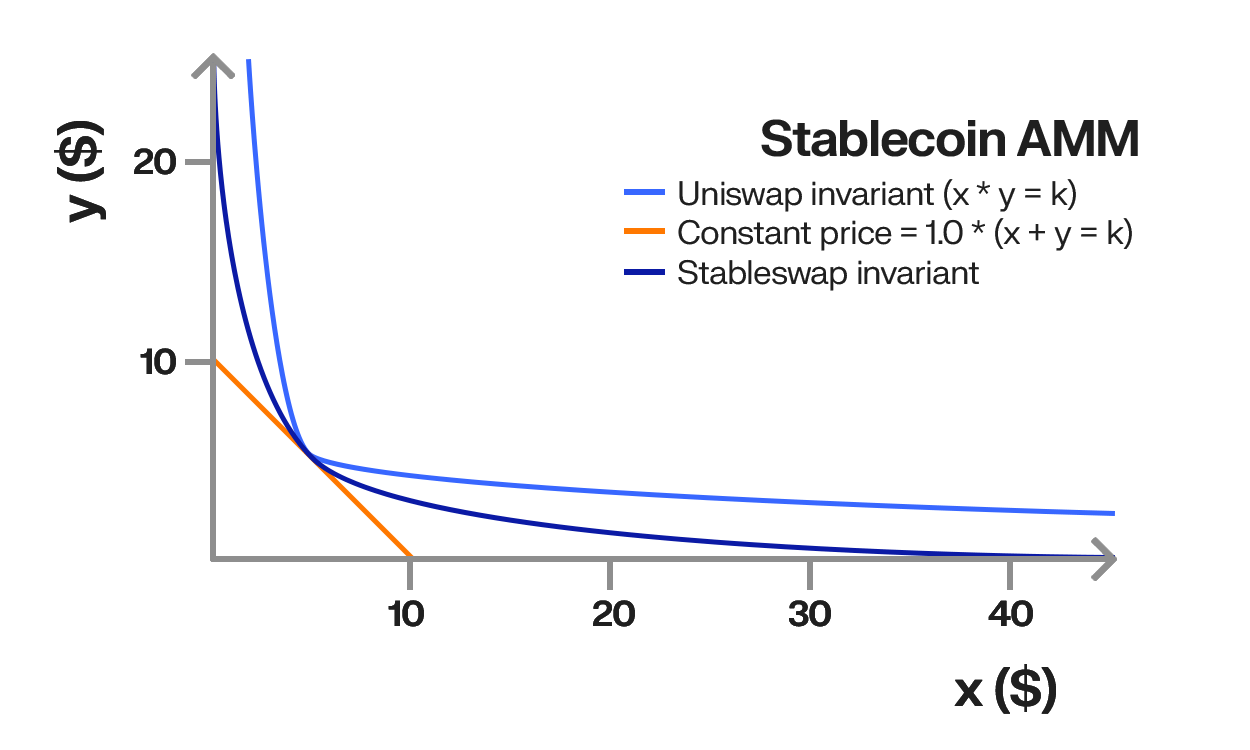

Stablecoin AMM

Another variation of the AMM is a stable AMM that effectively tunes the above formula. Because stablecoins are pegged to fiat currency, such as the dollar, they do not have volatility or real large price changes.

Therefore, they superconcentrate liquidity close to the 1:1 ratio. A great example of this is Curve. Ultimately, this helps hold the price very tight, and it would take tremendous volume to deviate away from this.

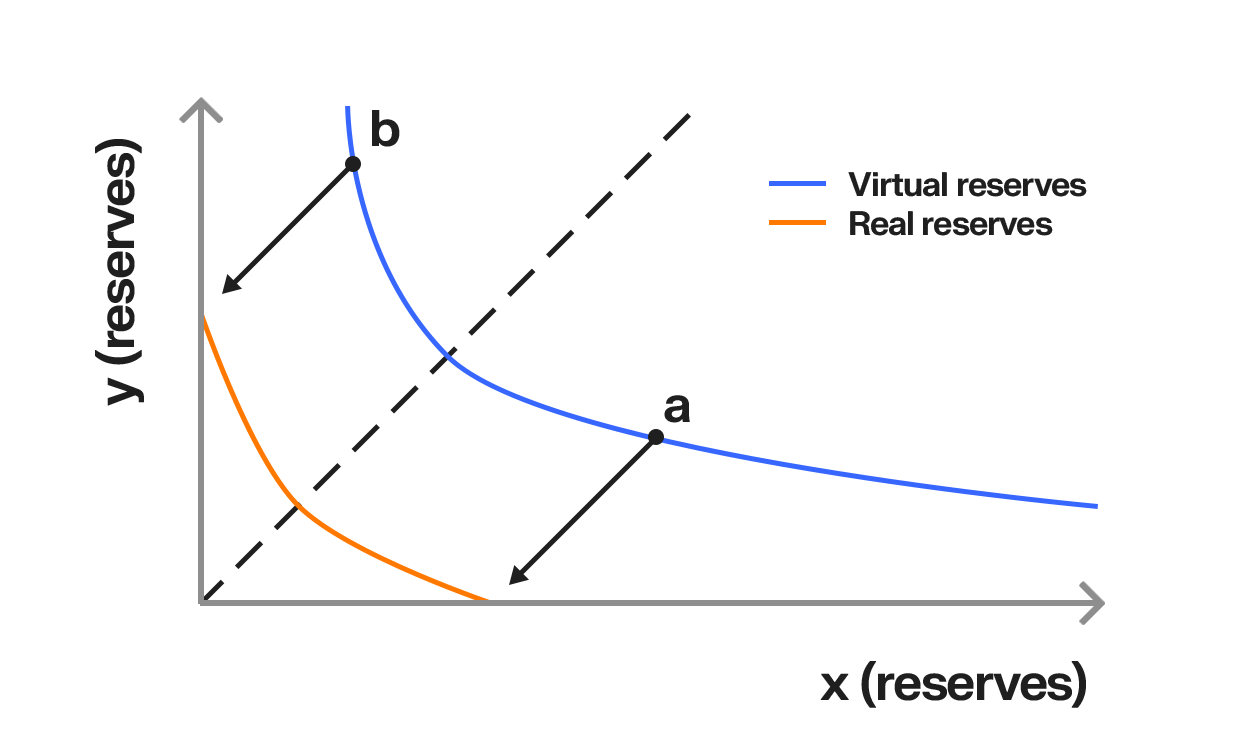

Concentrated liquidity DEX

There are also other approaches to AMMs altogether that go beyond changing the market making formula, such as concentrated liquidity DEX. This particular AMM introduced by Uniswap v3 allows liquidity to be more available within certain price ranges, which are expected to have greater demand.

Liquidity providers can choose their preferred range with varying fee distributions. This model is designed to lower slippage in more popular price ranges. Thus, different price ranges have different slippage depending on liquidity density.

Other onchain liquidity solutions

Liquidity pools are not the only way to provide liquidity onchain. DeFi is the host of several other liquidity solutions that are more or less popular and fit particular investor and token issuer profiles. Knowing how these other solutions work is the first step before deciding where and how to deploy liquidity.

Oracle-based DEX

Oracle-based DEXs integrate external Oracles to provide real-time market price data for their trading mechanisms.

This model presents a different risk profile for liquidity providers, focusing more on the reliability and accuracy of the oracles than on the typical impermanent loss associated with AMM models. But even if impermanent loss is avoided in the traditional sense, liquidity providers effectively take an opposing market position to the trader on the other end.

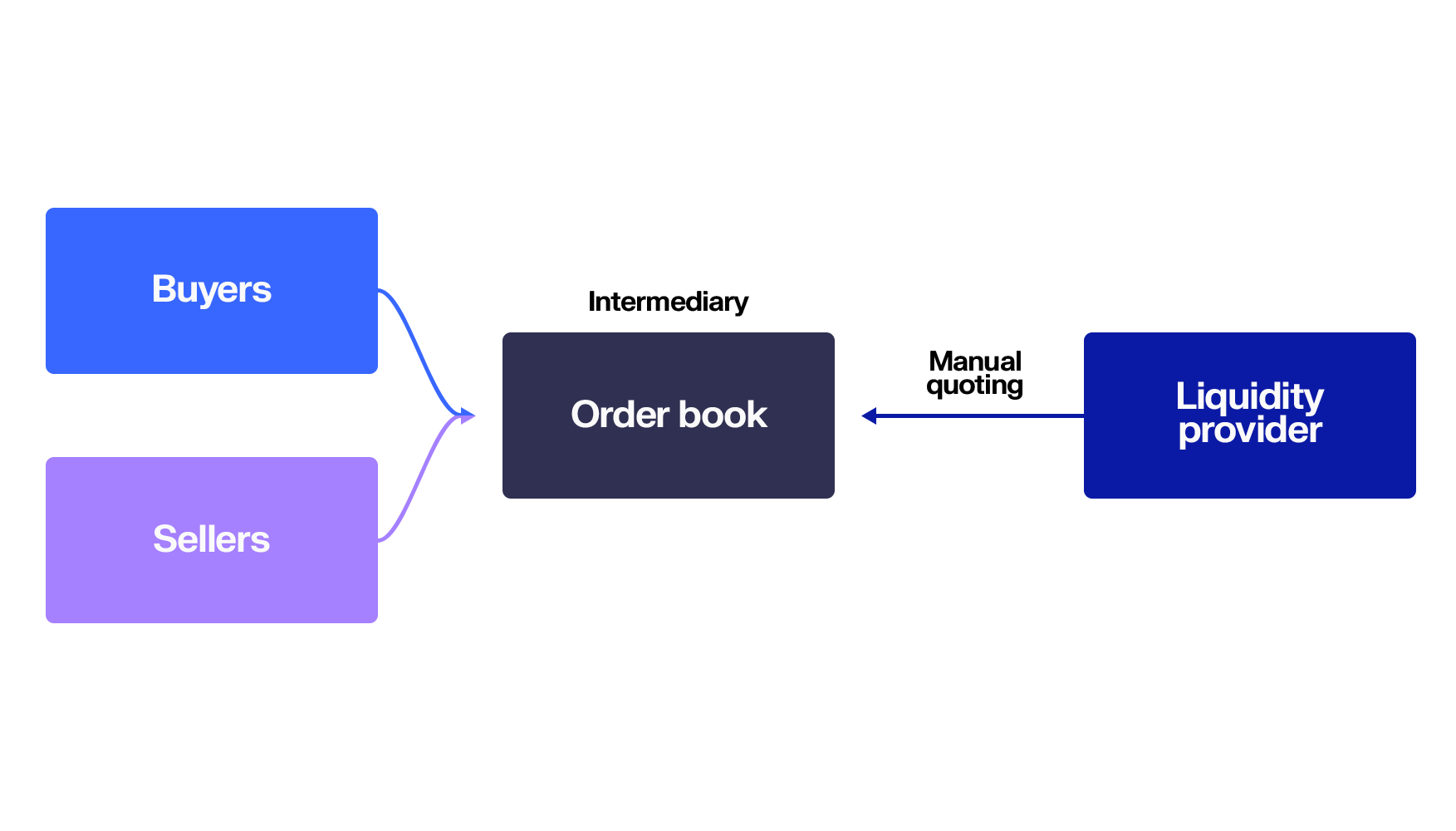

Central Limit Order Book (CLOB) DEX

Order books are a model for matching buyers and sellers. Market participants quote or offer prices in a public book, and other parties choose which quotes to place orders for.

Liquidity provisioning in an order book DEX is similar to market making in a centralised exchange (CEX). The order book model requires the liquidity provider to manually quote prices for different assets in order to narrow the bid-ask spread efficiently. This is why only sophisticated actors can serve as liquidity providers on these platforms.

Here, liquidity providers have to state their offers for specific asset prices, but network transaction times often delay this info to potential buyers or sellers. This lag turns off liquidity providers from order book DEXes. In contrast, AMM DEXes automate price quoting, making them more appealing to a wider range of liquidity providers.

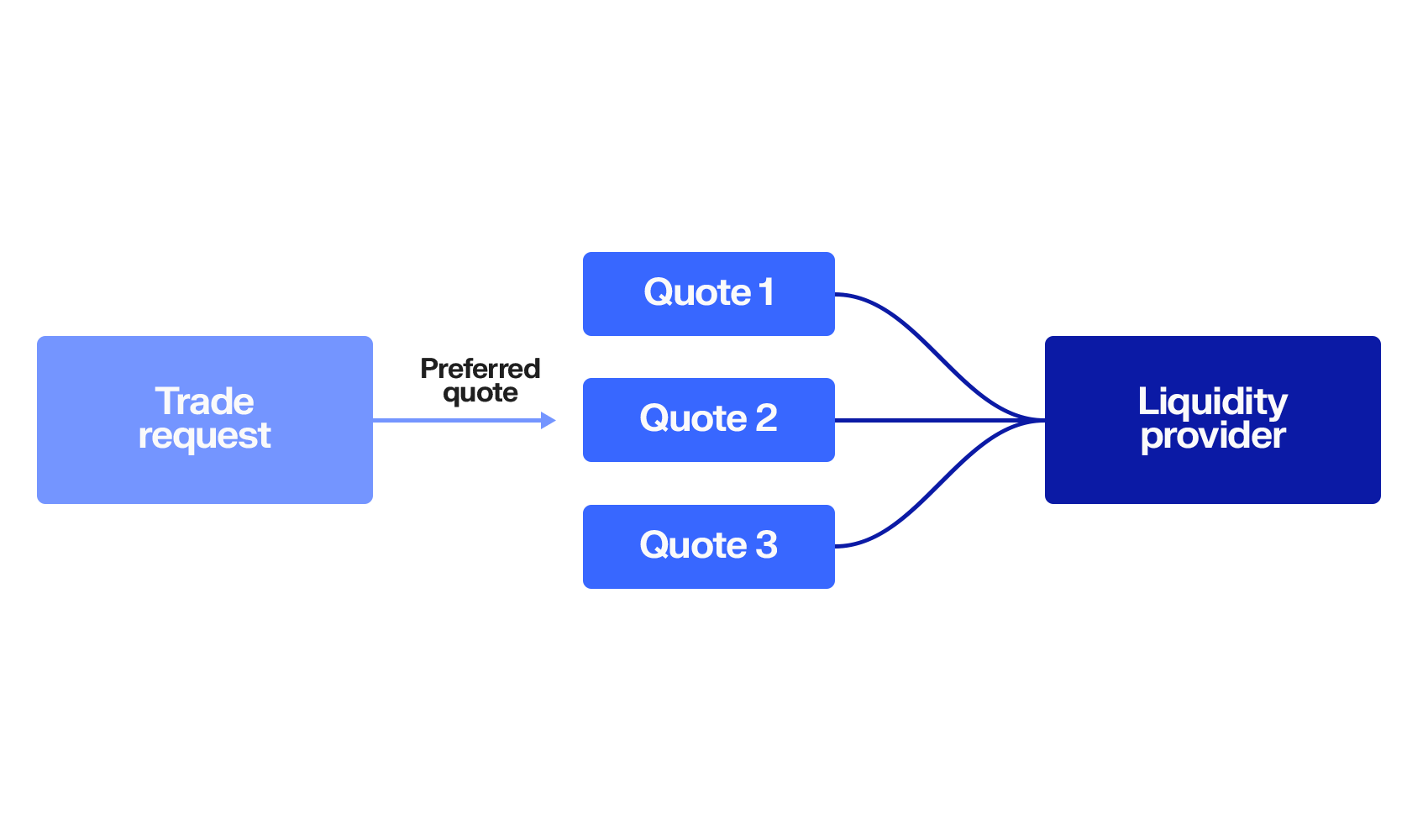

Request-for-quote (RFQ) DEX

Request-for-Quote DEXs operate by allowing users to request quotes for specific trades, which are then filled by market makers or liquidity providers.

Unlike traditional DEXs, where trades are executed against a pre-funded liquidity pool, RFQ DEXs involve more direct interactions between buyers and sellers. When a user submits a trade request, market makers provide quotes for the requested trade size at specific prices. The user can then choose the most favourable quote.

This model offers advantages in terms of reduced slippage for large orders and better price optimisation as market makers compete to provide the best quote. But it relies heavily on the availability and responsiveness of market makers, making it more suitable for larger or more sophisticated traders.

Because these liquidity provisioning solutions require significant tech means, AMMs stand as the preferred arena for liquidity providers, where most of the market activity actually concentrates. Note that this overview does not cover DEX aggregators, derivatives platforms or perpetual markets.

Which kind of liquidity pool to deploy?

Choosing between different onchain liquidity venues impacts both liquidity providers and token issuers. Deploying a token on a constant product algorithm has different effects on market behaviour and management than deploying on a concentrated liquidity algorithm.

Here are 7 parameters to consider:

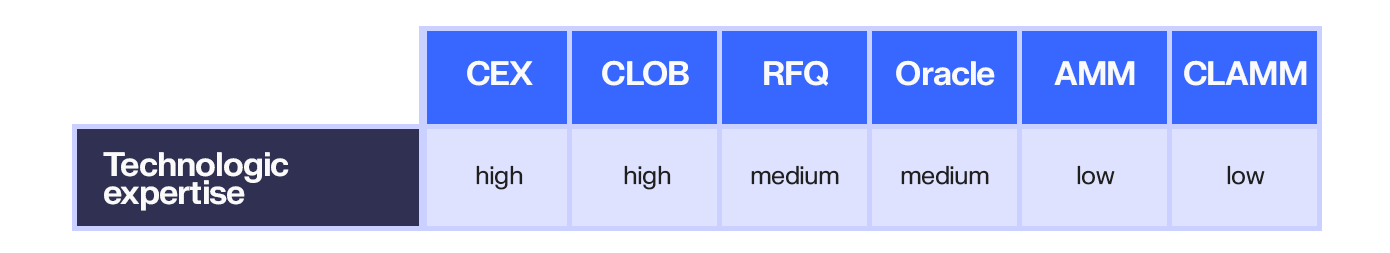

Technological expertise

Ensuring to have the technical and financial skills needed to manage onchain liquidity solutions effectively. Tech abilities should match the protocol complexity.

Uniswap V2 involves simpler smart contracts suitable for basic tasks like providing liquidity and swapping tokens. But, Uniswap V3 requires deeper tech knowledge due to its more complex contracts and features like concentrated liquidity.

And protocols using oracles introduce additional complexities. That’s because they rely on external data sources for accurate pricing, calling for a solid understanding of both smart contracts and oracle mechanics.

Decentralisation

Deciding how much centralisation suits the needs. Fully decentralised solutions do not rely on external oracles for price or an offchain matching engine to pair orders, ensuring around-the-clock reliability as long as the network is up. Partially centralised solutions require outsourcing elements to offchain capabilities to operate liquidity, introducing secondary points of failure and trust issues.

Order Books:

- Centralised: Centralised order books provide high liquidity and regulatory compliance, offering traders safety and control but with higher fees and complex approval processes.

- Decentralised: A decentralised order book could work but is often limited by the chain’s gas and transaction speed.

RFQ Systems:

- Centralised: Centralised RFQs offer better privacy and pricing but are less accessible.

- Decentralised: Decentralised RFQs are transparent and secure but complex to set up and dependent on smart contract reliability.

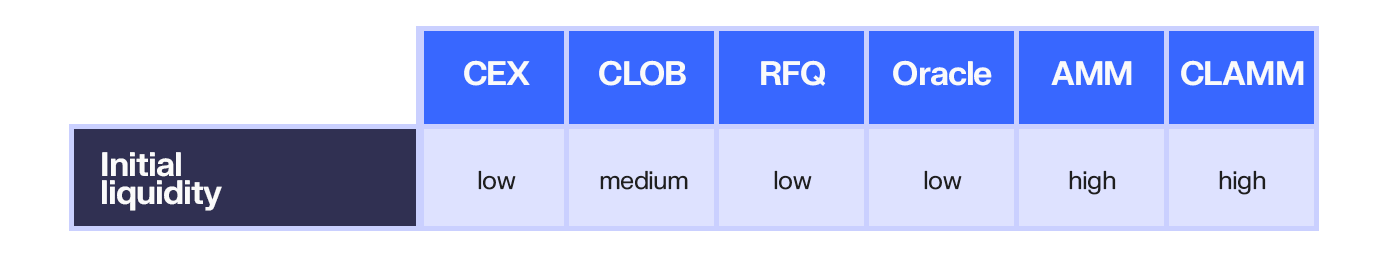

Initial liquidity

Having clear visibility on financial abilities is crucial. A thorough assessment of available funds for liquidity can dictate which liquidity provisioning solutions will suit.

A well-funded solution may involve a multiprong approach to providing liquidity across multiple types of Defi Apps, such as traditional orders in a book or in Pools. This may even extend to having multiple pools with different pairs to offer more optionality.

Issuers with limited resources might opt for a single AMM, which requires less capital for liquidity provisioning. To further maximise liquidity, they can strategically deploy capital in tighter ranges to improve slippage and ensure smoother trading, although this comes at the cost of requiring more active management and increasing the potential for impermanent loss.

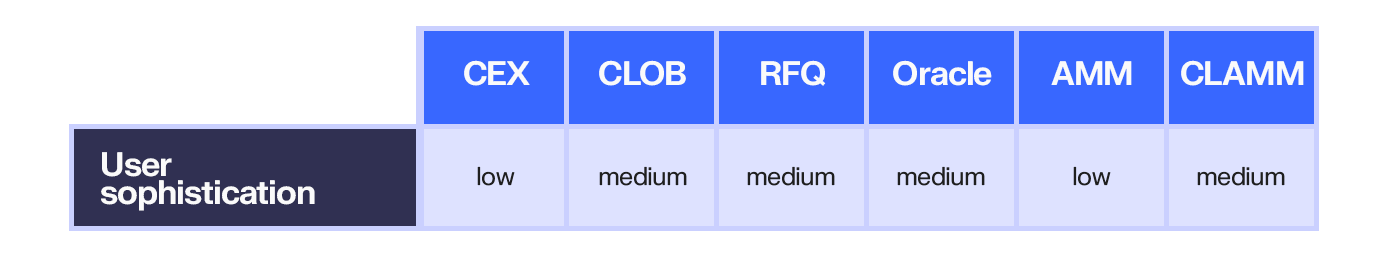

User sophistication

It’s about knowing the targeted user audience and their level of trading sophistication. That’s what allows to match the platform to user’s expertise.

Centralised exchanges attract less crypto-native retail and institutional participants. Decentralised platforms, including order books and AMMs, draw users looking for privacy, reduced slippage, and access to niche tokens.

Oracle-based DEXs and RFQ DEXs cater to seasoned traders involved in advanced strategies like hedging and speculating. These platforms offer specialised trading environments but require a higher level of expertise.

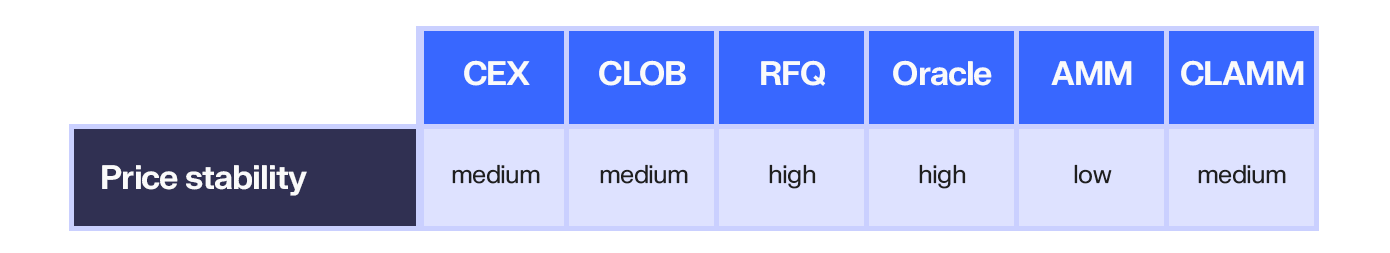

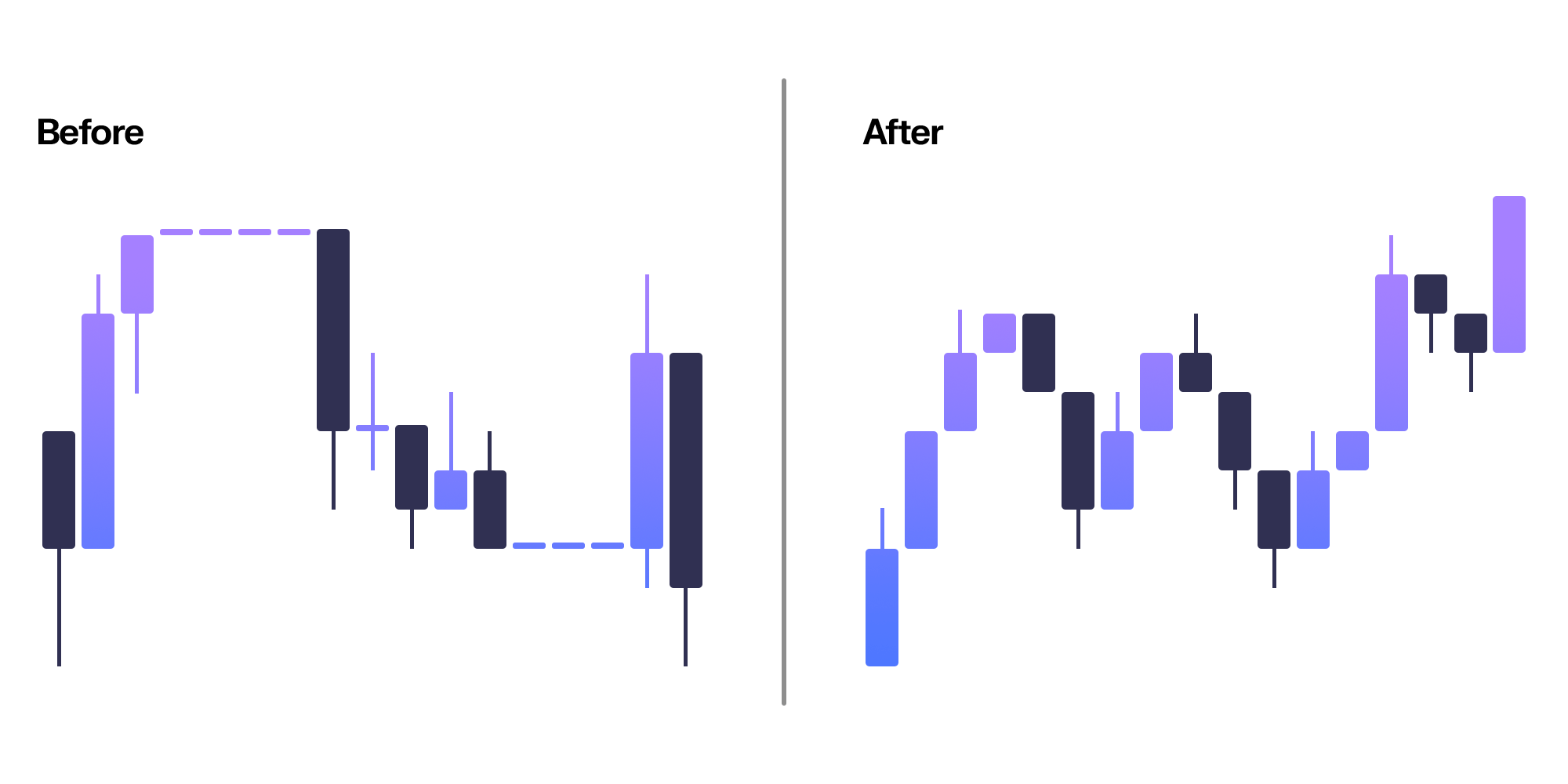

Price stability

For high-volatility tokens, constant product AMMs like Uniswap are suitable as they handle large trades effectively but carry the risk of impermanent loss. Stablecoins benefit from AMMs like Curve, designed to minimise impermanent loss. For tokens with predictable price ranges, concentrated liquidity AMMs like Uniswap V3 are ideal since they allow for efficient capital use within set price bands.

Oracle DEXs are fitted for tokens with limited on-chain liquidity or synthetic assets, Oracle DEXs provide accurate pricing using external feeds, reducing reliance on pool liquidity. And centralised exchanges are preferred for minimising risk and volatility, though they come with additional costs and higher trading activity requirements.

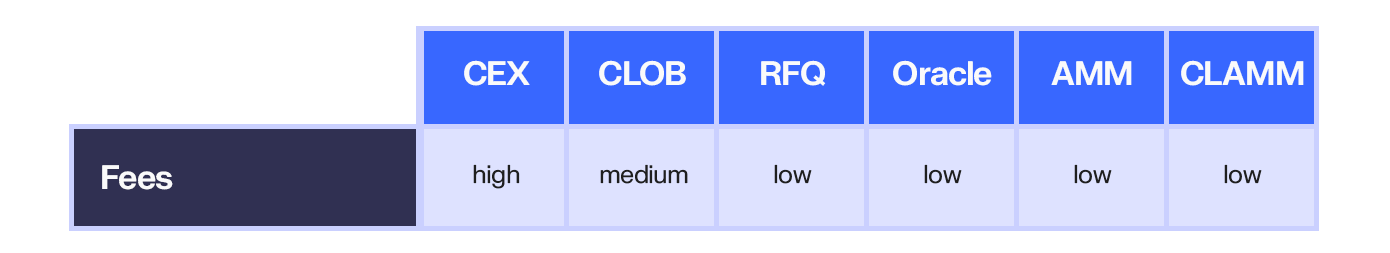

Fees

Listing a token incurs costs depending on whether it’s on centralised or decentralised venues. Centralised platforms come with high listing fees, including costs for compliance and promotional activities. However, they have minimal to no gas fees for transactions.

Decentralised Platforms such as AMMs, decentralised order books, and Oracle-based DEXs generally have lower listing fees but incur gas fees for blockchain transactions. The choice of blockchain can significantly influence these costs.

Flexibility

Various outside factors will influence token prices, and some platforms allow for some leeway in defining the price.

Centralised exchanges and order books offer limited direct price-setting freedom, with prices driven by trading dynamics. However, issuers can influence pricing through market making strategies. AMMs allow issuers to influence initial pricing by seeding the pool with a specific token ratio, leveraging algorithmic pricing mechanisms.

Oracle-based DEXs rely on external price feeds, offering limited direct control over pricing but flexibility through Oracle design and external data linkage. And RFQ systems provide greater pricing control for large trades, enabling issuers or market makers to offer specific quotes for substantial orders.

Liquidity pools: the risks & rewards

Liquidity providers can navigate various DEXes by fine-tuning strategies to match incentives. DeFi offers big gains, but liquidity pool risk management is essential. Here are key considerations:

Understanding impermanent loss

Impermanent loss happens when token prices in an AMM pool shift from their initial value. The more volatile the token, the higher the risk. In a constant product AMM, big price changes can leave liquidity providers with less return than simply holding the tokens. Stablecoin AMMs like Curve Finance reduce this risk by using tokens with stable values.

Fees and rewards

To compensate for impermanent loss, DEXes reward liquidity providers with a share of trading fees. Liquidity providers earn passive income from these fees, which are distributed based on their deposited funds and LP token holdings. Each trade on a DEX incurs a transaction fee, which is then shared with liquidity providers.

For example, if a liquidity provider deposits Assets A and B into a pool and Asset A’s price drops compared to Asset B, the strategy might underperform compared to holding the assets. To offset this, exchanges like Uniswap offer fee shares, such as their 0.3% fee. Other strategies include joining pools with pegged assets or those with a mix of volatile and stable assets.

Liquidity providers can also optimise returns by participating in yield farming and liquidity mining across various DeFi protocols, not limited to DEXes. These practices may involve staking, lending, and transferring assets between protocols to capitalise on the most lucrative yields and rewards.

In DEXes, liquidity mining focuses on finding the best incentives and adjusting funds accordingly. Liquidity miners look at a DEX’s fee distribution and LP token rewards, often staking them for extra gains.

Monitoring

Effective monitoring uses advanced analytics for real-time data on yield rates, asset ratios, and total value locked (TVL). Staying on top of market trends, asset news, and protocol updates is crucial for smart decisions.

Setting up alerts is essential. Platforms that notify you of significant market changes, pool dynamics, or asset prices act as early warning systems to keep you ahead.

Rebalancing

After careful monitoring, strategic rebalancing comes next. This involves adjusting asset allocation to address any disparities caused by market movements, essential for mitigating impermanent loss risks. Rebalancing isn’t just about correction; it’s about spotting opportunities. If a pool underperforms or risks rise, moving assets to a more profitable or stable pool is prudent.

Timing is key in rebalancing. Making adjustments during periods of market stability minimises potential losses. Tax implications should also be considered, as they can impact overall profitability. Automated tools and bots can help with rebalancing but require a thorough understanding of their mechanisms and associated risks.

Risk management

DEXes run on smart contracts, making them targets for security risks like hacks and exploits. Most DEXes counter this with audited smart contracts and security measures like Oracle service guarantees. On-chain risk analysis tools like Glassnode and Nansen help ward off potential attacks.

In short, managing DeFi liquidity pools is a tightrope walk of risk and reward. To succeed in this space, understanding impermanent loss, optimising fee distributions, staying vigilant through monitoring, strategic rebalancing, and robust risk management are the basics to watch out for.

Using Keyrock for liquidity pool management

When listing a token, liquidity is a cornerstone parameter to pay attention to at the risk of missing market opportunities and losing investors’ interest, which we extensively cover in our crypto market making guide.

Market makers help in various scenarios: providing liquidity, stabilising prices, and ensuring smooth trades. Understanding their role, like Keyrock’s, can greatly benefit token issuers, whether they’re well-funded or working with modest means.

Keyrock supports token launches with enough liquidity to attract investors. For long-term projects, our holistic approach ensures scalability. We cater to different budgets, optimising liquidity for each token project.

Targeted liquidity provision

Focus on where your audience is most active. Keyrock helps you deploy resources wisely, identifying the most relevant exchanges to maximise your impact and create a robust trading environment.

Deepening liquidity

With our presence across 85+ exchanges and 400+ markets, your token gets substantial liquidity. This deep liquidity ensures large orders don’t cause price swings, helping you establish your token effectively.

Price stabilisation

Price volatility can scare off investors. Keyrock stabilises your token’s price with continuous buy and sell orders, stabilising your token price. A stable price not only reduces uncertainty but also entices a more diverse range of investors, strengthening your token’s positioning in the market.

Advisory services

Liquidity management and market volatility are complex. We offer advisory services to guide you, crafting strategies aligned with your project’s goals for a smoother journey in the crypto world.

Data and market analysis

Knowledge is power in crypto. We provide market intelligence and analysis to help you make informed decisions on liquidity strategies and market positioning. Our data-driven insights give your project an edge.

Strategic expansion

Keyrock does not confine your token’s reach to a solitary exchange. We help your token reach multiple exchanges and AMMs, boosting visibility and accessibility. Diversifying your presence widens your audience and strengthens your market standing.

Facilitating partnerships

In this space, partnerships are a catalyst for growth. Our network helps you forge collaborations with other projects, exchanges, or AMMs, leading to shared liquidity pools or joint marketing initiatives.

Whether you’re starting a new venture or seeking to enhance your existing presence, our comprehensive approach, strategic insights, and solid support can empower you to unlock the full potential of your token.

Conclusion

Liquidity provisioning is crucial for market making in crypto and DeFi markets. Strong support from liquidity providers is vital for the success of exchanges and token issuers, as they help maintain stable prices and boost investor confidence.

Liquidity providers have plenty of opportunities, thanks to DEX incentives that enable strategies like liquidity mining while mitigating risks such as impermanent loss. Providers can also customise bid and ask prices in liquidity pools using specific formulas.

DeFi platforms like Uniswap and Balancer have been pioneers in this space. Uniswap’s AMM model allows users to swap tokens efficiently, while Balancer extends this concept by enabling multi-asset pools that act as self-balancing investment portfolios. Curve focuses on stablecoin trading with minimal slippage, and Compound facilitates lending and borrowing with algorithmically determined interest rates.

The future of liquidity provisioning in DeFi is promising, with innovations like segmented liquidity provisioning, variable fees, and custom pool hooks, such as those seen in Uniswap v4. These developments aim to make liquidity provision more efficient and adaptable, potentially transforming how market making is conducted in DeFi.

Read more: What is Crypto market making? A guide

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Download our Liquidity pool management guide

Get a head start on how to wisely choose your liquidity deployment method with our guide. Submit your email to get the downloadable version. By submitting your email you agree to receive marketing communication.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.