What is Crypto market making? A guide

In this comprehensive guide, we will delve deep into the world of market making, exploring its various aspects, strategies, and its applications in the rapidly evolving crypto space.

Market making is a vital element in ensuring the health of financial markets. By supporting liquidity, reducing spreads, and ensuring fair markets, market making helps to facilitate global tokenized economies.

Given the complexities typically associated with market making, this cheat sheet aims to provide a clear understanding of the role of market makers, delving deep into the intricacies and their function within the rapidly evolving digital asset industry.

Through greater transparency, all market participants, particularly token issuers, are able to make a more informed assessment of the services market makers provide.

What is Market Making

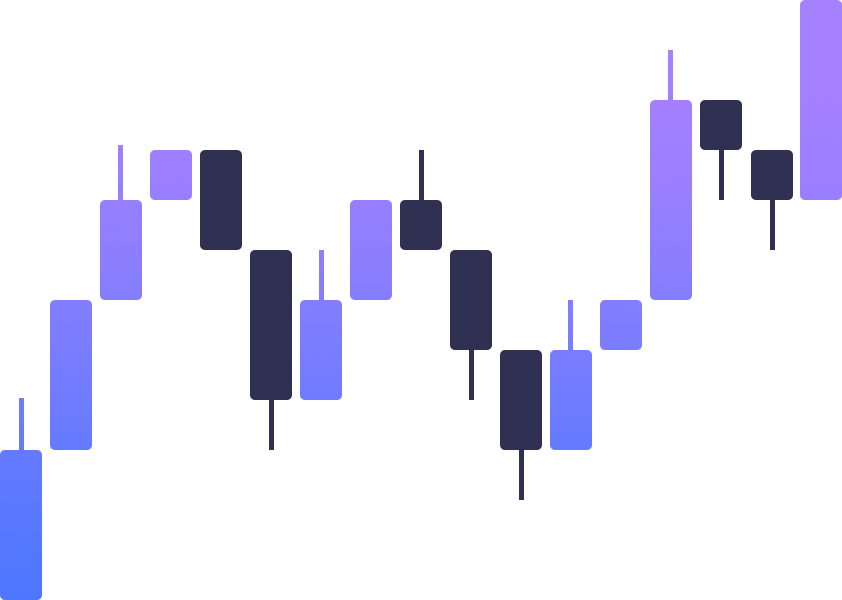

Let’s begin with a fundamental definition of a market maker. A market maker is essentially an entity playing a critical role in pricing assets by discovering their fair value. Behind these ‘fair’ prices, a market maker is always present and prepared to both buy and sell the asset. This concept is universal across asset types.

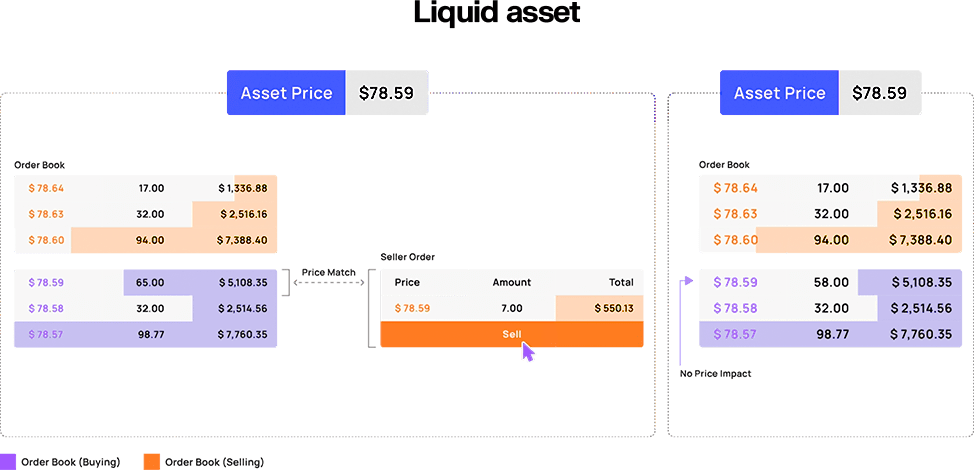

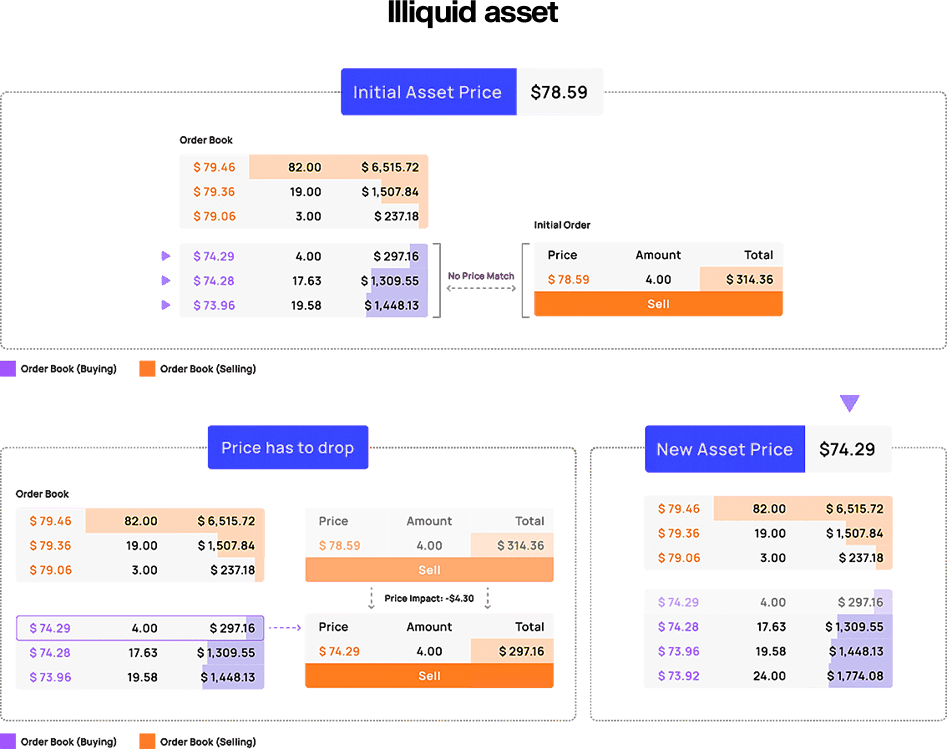

In traditional finance, consider a scenario involving a publicy traded company’s stock. Market makers actively contribute to ensure smooth trading for all participants, bringing value to both the investors and the the company itself. To do so, market makers aim to increase the overall liquidity, which is the ease with which an asset can be bought or sold in the market without significantly impacting the asset’s price.

Suppose Company XYZ has its shares listed on a stock exchange. Market makers continuously allocate capital inside the order book to buy shares from sellers or sell shares to buyers at what they believe is the asset’s fair value. The presence of market makers helps maintain liquidity in the stock, which decreases assets’ volatility and price impact.

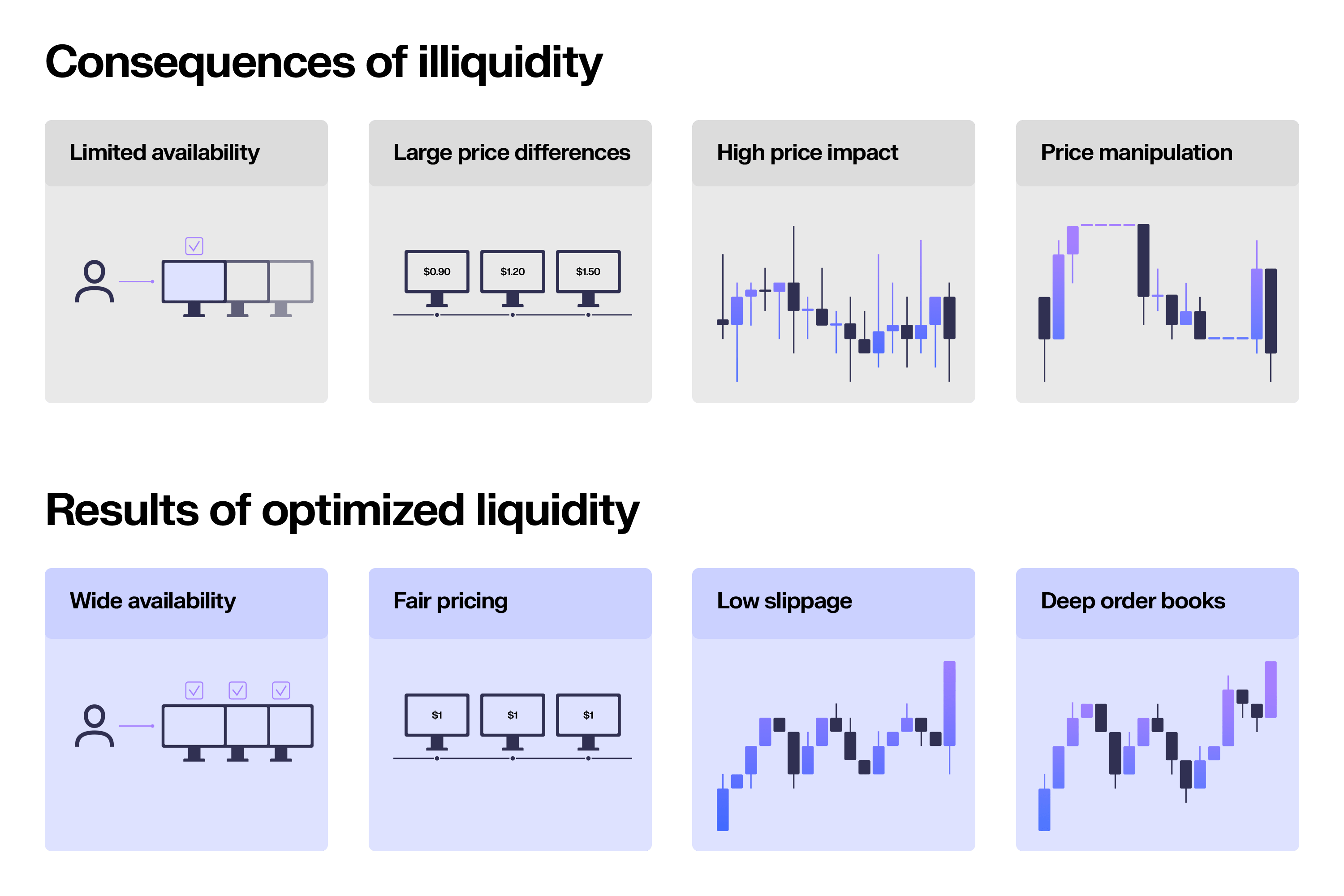

Highly liquid assets, like Company XYZ’s stock, can be readily bought or sold without causing significant price impact. The easier it is to buy or sell a stock, the more liquid it is. This is because market makers facilitate trades even when there are no direct buyers or sellers at a specific moment. In turn, investors can enter or exit their positions in Company XYZ’s stock efficiently without experiencing major price disruptions.

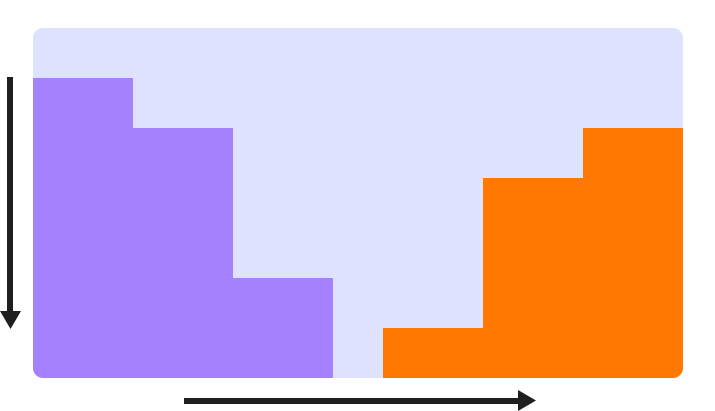

In contrast, less liquid assets, such as newly launched or less traded stocks, can experience substantial price swings when relatively small trades are executed. Market makers play a key role in transforming low-liquid assets into higher-liquid assets.

They bridge the gap between buyers and sellers, providing continuous buy and sell orders, which not only makes trading smoother but also contributes to the overall liquidity of the asset. This liquidity is essential because it ensures that participants can enter or exit their positions without causing significant price movements, facilitating growth for the market.

What are Crypto Market Makers

At its core, what market makers do in the crypto space is akin to traditional finance, with the added complexity of staying innovative with their service offerings, as one would expect from an actor in the dynamic digital asset space. Keeping the concept above of liquidity in mind, let’s look at how that translates within the crypto arena by taking the launch of a new token, $NEW, as an example.

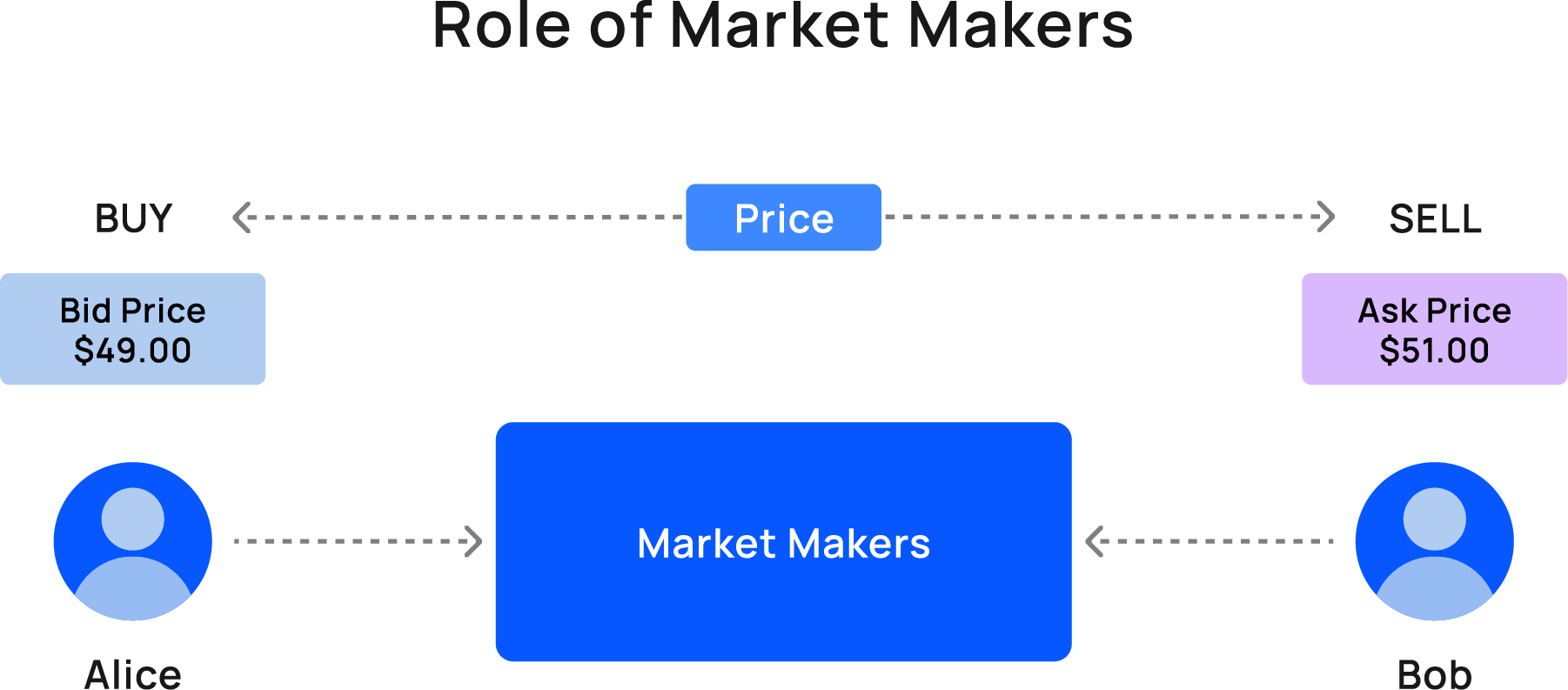

Right after its introduction (initial listing) to the market, there may not be many buyers and sellers, making it challenging for participants — let’s call them Alice and Bob — to find each other and agree on a price for $NEW tokens. This is where market makers come into play.

Here, market makers ensure a level of liquidity by providing continuous buy and sell orders for various cryptocurrencies. In this scenario, we could have Charlie act as a market maker who steps in to bridge the gap between Alice and Bob. Charlie offers to buy $NEW tokens from Alice at a price she finds acceptable and sell them to Bob for a price he deems fair, closing the difference between the prices of Alice and Bob, which is also called tightening the spread.

By doing so, Charlie facilitates the trade and contributes to the overall liquidity of $NEW in the market. This means that participants like Alice and Bob can enter or exit the market at any time with relative ease, thanks to the presence of market makers like Charlie.

The role of market makers in pricing assets is closely tied to their responsibility to provide liquidity in the market. Not only are they prepared, but they are equipped to buy and sell assets, making it possible for all participants, including buyers, sellers, and the issuing company, to trade efficiently and effectively in both traditional finance and the crypto asset space.

Why use a Crypto Market Maker

A market maker could be considered as a smart shopper who buys an asset when its price is low and then sells it when the price goes up. Doing so ensures there’s always activity in the market, making it easy for people to buy and sell tokens at stable prices. This is exactly how they provide liquidity for assets.

Providing liquidity

The flow of constantly selling and buying assets creates a healthy market, incentivizing traders to be active participants. Attracting the asset’s organic volume, as opposed to engaging in unethical practices like wash trading, which creates fake volume, is crucial. This distinction is significant in maintaining ethical financial practices and building investors’ trust. Market makers play a vital role in this, as their ability to optimize liquidity directly impacts the organic volume and investors’ confidence.

For token issuers, understanding why having an active or ‘liquid’ market matters can make a difference in their quest for token adoption. Emphasizing organic volume growth over deceptive tactics ensures long-term stability and credibility. From this perspective, having market makers as partners facilitates scalable growth for the token and its ecosystem, underlining the importance of ethical practices in financial markets.

Mitigating arbitrage

Arbitrage is the practice of traders buying an asset in one market where it’s cheaper and selling it in another market where it’s more expensive in order to profit from the price difference. A token subjected to constant arbitrage might be perceived as unstable or not well-integrated across markets. As previously discussed, price instability can affect investor confidence, potentially leading issuers to face challenges in maintaining their token’s value and reputation.

Crypto market makers can play a role in mitigating price discrepancies caused by arbitrage through various operational action points (see section “How to choose a Crypto Market Maker”). They continuously quote buy and sell prices for assets across different venues, which reduces price discrepancies that could be exploited with arbitrage and ensures constant liquidity. Additionally, their ability to handle large volumes of trades is vital in absorbing substantial orders, preventing significant price disparities and market inefficiencies between markets.

Market Making for Token Adoption

After illustrating the concept of liquidity and its importance for a market’s overall health and performance, it is clear to see the correlation with the adoption of a given token. As third-party facilitators, market makers play a pivotal role in enhancing an asset’s liquidity and maintaining and optimizing overall liquidity.

Let’s clarify three by-products from market making activities that facilitate token adoption:

![]()

Stability: Stability in the crypto market is crucial due to its inherent volatility. Stable assets are preferred, and achieving this requires deep liquidity. Market makers play a significant role in ensuring fair pricing and reducing the bid-ask spread, which, in turn, stabilizes the price of an asset over time.

Trust: Improving liquidity helps grow organic volume in the asset’s market. This deep liquidity elevates developing projects and their tokens, cementing their market position and affirming competitiveness and legitimacy. Through liquidity growth, we, in turn, see positive correlations to market position and the trust of its investor base with increased faith in the project’s long-term prospects.

Market Performance: Token issuers are usually development teams who should not worry about the ins and outs of the marketplace. Market makers can give token issuers a pulse check on how their product and tokenomics designs behave in the market. This feedback can be very valuable to projects still in the early stages.

Working with Exchanges

Some exchanges partner with market makers to maintain liquidity and reduce price opportunities for arbitrage on their venue. In return, market makers can earn fee rebates — incentives given for engaging in certain types of transactions — or other incentives. This can benefit both parties: the exchange boosts its trading volume, becoming an increasingly efficient market, while the market maker is able to trade at great capital efficiency.

From the perspective of a token issuer, this kind of relationship helps exchanges have confidence in listing the asset. The market maker plays a fundamental role in ensuring that the exchange’s users are able to make trades with the token issuer’s asset and thus increase organic volume.

Additional Liquidity Solutions

Market makers can also help large investors bypass exchanges altogether if necessary. They offer OTC (over-the-counter) trading services that directly match large orders outside of an exchange, avoiding slippage and other trading inefficiencies that would otherwise occur if these large trades were placed directly in the order book. This can help reduce the price impact of large trades. Having this option can be meaningful to token issuers with large investors.

Let’s say an institutional investor is looking to participate in a crypto market. They might face slippage costs if they trade on a decentralized exchange or on an illiquid centralized exchange. They might endure an increased indirect cost to fill the large size of their order, creating immediate price movements by removing significant liquidity from the market. A market maker could offer OTC services to facilitate more favorable conditions for the investor.

When to Use a Crypto Market Maker

Successful market making can help introduce an asset, increase trading liquidity when necessary, and, in turn, attract investors. Besides a need for price stability, these are other situations where you might consider a market makers’ services:

Launching a New Token

Market makers are especially necessary in building investor confidence in a new asset. Whenever a new token is launched, investors want to be sure that there is enough liquidity across exchanges to meet potential demand for the asset. As investors, they are betting on a project’s success, and sufficient liquidity to respond to high demand can be essential to the asset’s success.

This goes hand in hand with ensuring low volatility. If a new asset is adopted but has low liquidity, it will have more dramatic price movements and be more susceptible to overall market conditions. This can be off-putting to both large and retail investors.

Likewise, investors also want to be sure that their funds are liquid enough to exit their positions if necessary. Investing in new assets is usually a risky activity. Despite working through due diligence processes, investors also need to have assurances that they can easily exit and safeguard funds in the event of negative outcomes.

Attracting Institutional Participants

Not all markets can handle large trades as those executed by institutional traders. These operations often require a certain level of liquidity to prevent slippage and drastic price movements that would affect the market negatively — events that would ultimately make it costly for investors to enter or exit the market for a particular asset.

Working with a reputable market maker indicates a certain level of liquidity that helps attract institutional players because it increases the market’s tolerance for these large operations. This is similar to market makers’ effect on reducing the bid-ask spread. In many cases, they can also engage in OTC trades with the market maker for a particular asset, which, as we’ve seen, can be very favorable for large operations.

Investors also understand that when a token issuer works with market makers, there are reduced chances of price manipulation by bad actors. A higher level of liquidity means the market is more resilient to fraudulent activities because they require more capital to be effective.

How to choose a Crypto Market Maker

Once we’ve determined when to use a market maker, we must look into how to choose a market maker. Choosing the right market maker can be a make-or-break decision for token issuers, financial institutions, exchanges, and individual traders. Conducting thorough research to understand their practices, terms, and potential implications for your market is as decisive as an investment or token launch.

When choosing a market maker, consider the following parameters:

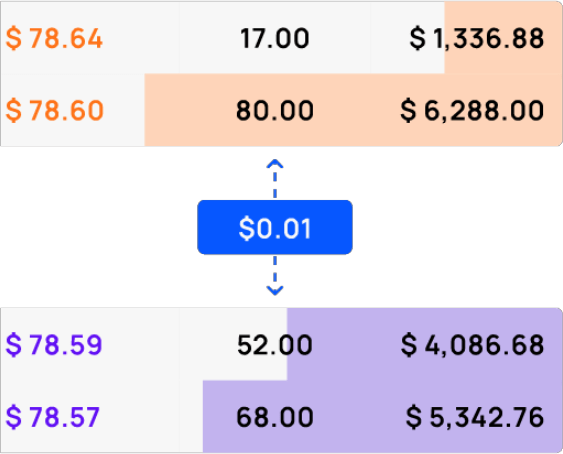

Tight Spreads

A good market maker should analyze average spread and daily volume to assess an asset’s market effectiveness. The ideal scenario is to observe a steady relationship, where tighter spreads indicate larger average volumes. Therefore, markets with wide spreads are precisely where market makers can intervene to help close the gap between the highest bid and lowest ask orders to ensure more trades are executed and an overall better experience for investors.

To have a deep understanding of markets, a market maker’s Data Intelligence team compiles valuable insights into liquidity across various exchanges. They first look at the spread across different markets, where they assist partners in tightening it to attract more volumes, thus making the asset more appealing to trade.

Market Depth

Insufficient liquidity harms the attractiveness of a given market, deterring traders from participating in it. A skilled market maker enhances asset market depth by strategically managing buy and sell orders.

Token issuers partner with market makers to improve their asset depth, creating a more active and liquid market for their tokens for greater adoption. Market makers analyze the variance in expected liquidity within a 2% range to identify markets that require support. Increasing market depth is crucial to reduce slippage, boost trading activity, and enhance market appeal.

Optimised Liquidity

As mentioned above, improving market depth adds to a token’s appeal. Successfully assessing where depth is lacking is a key factor in enhancing a token’s outstanding liquidity, leading to a smoother trading experience for investors, who can buy and sell assets without causing substantial price fluctuations. Greater market depth instills trust in traders and investors, thus facilitating demand.

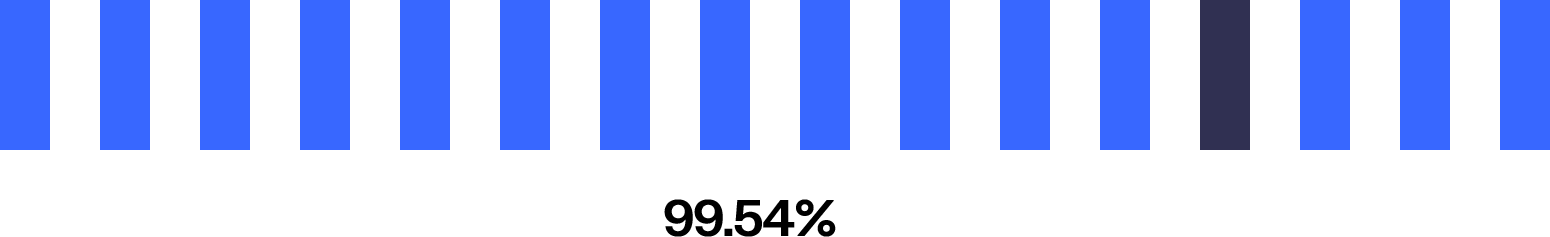

Guaranteed Uptime

Uptime signifies a trading system’s continuous and reliable operation, measured as a percentage of time it’s being active. For example, “90% uptime” means the system is active 90% of the time, indicating strong dependability in servicing the market.

Market makers should typically commit to maintaining 95%+ uptime, reflecting a presence across multiple markets without compromising operational abilities. Generally, high uptime is crucial for market makers, ensuring their trading algorithms can consistently adapt to market conditions and optimise asset pricing.

Broad Listings

The crypto industry keeps growing and changing. New exchanges are launched often, and many become market leaders in their own categories. Working with a market maker that offers broad coverage and can provide liquidity to different markets, not just the most popular ones, might be beneficial depending on the unique needs of the project and its community.

Capital Strength

The amount of capital that is available to a market maker goes hand in hand with how much potential market depth they’re able to provide. A well-capitalized market maker is more likely to weather financial storms and continue to provide liquidity. Determining how much capital is available to a market maker is important to determining how helpful they can ultimately be in the event of unfavorable market conditions.

Risk Management

Another way to assess how a crypto market maker could respond to challenges in the market is to ask about their risk management strategy. Although some of this information will be proprietary, it’s essential to have at least a general idea of how well-prepared they may be and how they’ve thought about avoiding risks.

Regulatory Compliance

Ensuring that the market maker complies with all relevant regulatory requirements in the jurisdictions in which they operate is crucial to avoiding legal risks. It’s also helpful to see if they are members of any industry associations that might impose additional standards of conduct.

Service Quality

Catering this service in a way that is transparent, insightful, and relevant is what token issuers should pay attention to. Is the market maker attentive to the token issuer’s needs? Are they provided with transparent and fair pricing for their assets? Can they reach the market maker at any moment?

Naturally, partnerships and the nature of the relationship are as important as they are indicators of professionalism and strong work ethics. So, when benchmarking market makers, it’s good practice to pay attention to their performance and onboarding process, ensuring all their terms and promised outcomes are explicitly presented.

Reputation

A way to assess a market maker’s history in the industry is to look for any regulatory fines, sanctions, or other negative actions taken against the firm. In some cases where crypto market makers might have less of a track record, speaking with other industry participants can be helpful, especially since the crypto industry is still a relatively “small world.”

Business Ethics

We should take note of a market maker’s adherence to fair business practices. A market maker should share clear information with all parties and disclose any potential conflicts of interest. It should avoid practices such as insider trading, wash trading, or any form of market manipulation. Overall, fair treatment of all market participants is an indicator of that market maker’s disposition and long-term business outlook.

Cost Effectiveness

Finally, consider your budget with all these criteria in mind. Understanding all the costs associated with the market maker, including hidden fees, is important. The next step is to compare the costs with other market makers to ensure you get a competitive rate for these services.

A well-informed decision based on a comprehensive evaluation of these parameters will empower financial institutions, exchanges, and traders to choose a market maker that aligns with their specific needs and goals in order to foster a successful and sustainable trading environment.

Why use Keyrock as your Crypto Market Maker

We stand out from the competition with our holistic approach that emphasizes scalability. Over the previous 6 years, we’ve improved our infrastructure to provide long-term liquidity for various digital assets. Rather than immediate growth, we prioritize a robust foundation for long-term market expansion while ensuring resilience.

Aligning with our philosophy of longevity, we consider ourselves a companion to our partner’s success, with transparency at the center of our business relationships. We take great pride in being a service provider first and bringing our partners the best experience possible by offering an array of guiding materials. From comprehensive reports to weekly insights on their assets, we ensure our partners are hands-on with their liquidity and market goals, sealed by tailored agreements fitting their budget requirements.

Because we’ve been future-focused from the start, we’ve consistently maintained our partners’ high level of satisfaction, which echoes in their long-term commitment to working with us.

Tight Spreads and Deep Liquidity

We are experts in filling the gaps preventing digital assets from thriving across markets. Therefore, we’re committed to tightening spreads and optimizing depth on any of the 85+ exchanges and 400+ markets we’re connected to. Our Data Intelligence team is hands-on in analyzing our partners’ liquidity performances and spotting the defining market opportunities.

Personal Support and Tailored Monitoring Tools

Crypto markets never sleep, and we keep our focus steady, regardless of the day or the hour. Hence, we have a global team to assist our partners 24/7 with the queries they need help finding the answers to on their personal and up-to-date dashboards. Working towards excellence means providing tangible numbers at all times, guaranteeing our commitment to reaching whatever milestones we’ve agreed on, and being held accountable for it.

Trusted Partner Since 2017

We’ve established Keyrock on the core value of helping develop tokenized economies. Being a crypto market maker since 2017 and effectively driving trading technology development across 400+ markets and 85+ exchanges despite many bear markets are all testaments to our tenacity and ability to expand tactfully. Along the way, we’ve gathered strong expertise in pricing assets and optimizing liquidity, which we proudly offer our partners through our tailored services.

Proactive Approach to Risk Management and Regulation

At Keyrock, our commitment to risk management and regulatory compliance intertwines seamlessly, reflecting our holistic approach to maintaining our integrity as a market maker and promoting good practices within the crypto space.

We value stability above all to ensure token longevity, which is why we commit to maintaining delta-neutral strategies. We rather take calculated risks by effectively balancing exposure to price movements than taking price incentives. This risk management approach fosters trust among token issuers and participants, reinforcing our position as dependable partners.

Simultaneously, we champion regulatory clarity as the catalyst for promoting sound practices and fostering the expansion of tokenized economies. To this end, we’ve strategically established a robust compliance division capable of meeting the most rigorous regulatory demands. As a result, all stakeholders can rest assured of our trustworthiness in an increasingly regulated crypto ecosystem.

Expanded Bespoke Solutions

Keyrock thrives at the intersection of innovation and precision in the ever-evolving digital assets landscape. Our hallmark lies in our commitment to tailor-made solutions, from offering crypto OTC trading services to investing in new protocols, entering governance initiatives, and pioneering innovations.

OTC services

As a market maker, our close interactions with our partners and their needs allow us to offer bespoke OTC trading solutions for specific assets, investment, and liquidity strategies. As a result, working with an OTC desk that is a market maker is a next-level trading strategy as we tap into our liquidity from our internal market making systems, offering the finest price inputs.

Keyrock Labs

Our approach to innovation is being a power-user before venturing deeper into new tech and DeFi protocols. This method entails our Innovation team, the Keyrock Labs, being completely immersed in new projects and looking for potential synergies.

Strategic Investments

Testing new protocols through the Keyrock Labs is also a way for us to become acquainted with new technologies. Exploring what other innovators are doing opens the doors to shaping new strategies, improving our algorithms, and connecting with industry leaders.

We constantly engage with new blockchain projects and invest in them when there are strong grounds for future collaborations, notably by providing expert advice on everything from regulation to tokenomics.

Conclusion

Market making is the backbone of modern financial markets, ensuring liquidity and efficient price discovery. In recent years, it has extended its influence into the world of cryptocurrencies, bringing new opportunities and challenges. As market makers continue to adapt and innovate, their role remains essential for the stability and growth of both traditional and digital asset markets.

Navigating the complex landscape of crypto market making can be daunting. Still, this guide aims to equip readers with essential insights for adequately evaluating and engaging with crypto market makers, highlighting key questions and factors to consider. Bridging the gap between understanding the general market and identifying a trusted partner, Keyrock emerges as a leading actor in this arena.

As a global service provider, we are dedicated to transparency, tailored offerings, and ethical practices. Our constant focus on liquidity management, combined with our innovative approach, positions us uniquely to support and enhance tokenized economies.

With us, token issuers and traders are not just engaging with a market maker; they are partnering with a visionary ally dedicated to cultivating sustainable and efficient market environments.

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Download our Crypto market making guide

Cracking the code of crypto market making. Submit you email to receive our straightforward guide that covers all the essentials. By submitting your email you agree to receive marketing communication.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.