The future of RWA Tokenisation: bridging TradFi and DeFi

Key Takeaways

- Spearheaded by stablecoins, the tokenization of real-world assets is a fast-growing sector of the crypto economy.

- The tokenization of real-world assets consists in representing them digitally to enable new features and properties that are unique to crypto markets.

- Some areas where tokenized real-world assets are becoming popular investment strategies include treasuries and private credit.

The Rising Tide of RWA Tokenisation

In the evolving finance sector, real-world asset (RWA) tokenization is a significant shift, merging traditional finance with decentralized finance’s innovative edge. At Keyrock, we see RWAs as key drivers for a new wave of DeFi innovation. This era is marked by a considerable influx of the global money supply — about 2% — into Web3 by 2028, led by stablecoins.

Stablecoins, however, are only a primitive version of what real-world asset tokenization could mean in 2024 and beyond. We’ll see more and more kinds of real-world assets going on-chain as the market warms up to other forms of tokenization. This will also spark a new wave of innovation in DeFi and open up new markets for TradFi.

What are RWAs and Tokenization?

Tokenization, in the context of cryptocurrencies and Web3, is the representation of an asset in the form of a token that is stored in a blockchain network. They’re typically smart contract implementations that are modeled after the asset they reference.

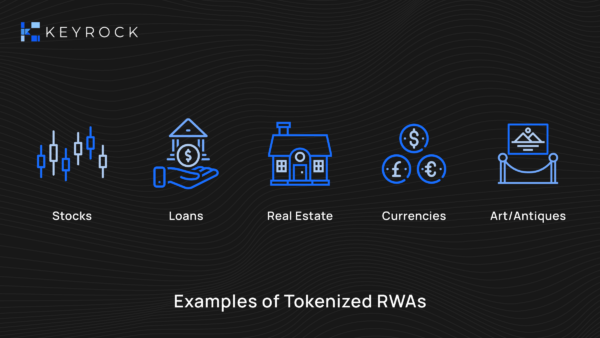

Real-world assets such as stocks, loans, and even real estate can be represented as digital assets just like fiat currencies have been in the past. Their implementation on a blockchain network is designed to follow the asset’s price in the real world, and ownership over it is taken as proof of ownership.

The Need for RWAs in Today's Market

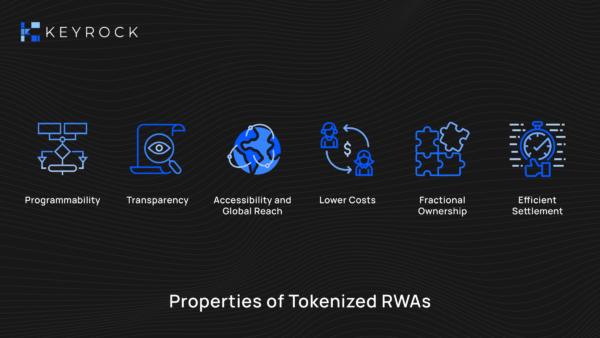

The advantage of having tokenized representations of real-world assets is very appealing to all market participants, including crypto market makers. The digital nature of tokens allows these assets to transcend many limitations that exist in traditional finance and acquire new properties. Some of these include:

Programmability

Tokenized assets can be programmed with specific rules, such as dividend distributions, voting rights, or governance mechanisms. This provides an added layer of flexibility when structuring investments and creates opportunities for new markets and financial products.

Transparency

Transactions on blockchain networks are transparent and immutable. This reduces the risk of fraud or disputes.

Accessibility and Global Reach

Tokenization simplifies cross-border transactions and allows investors to access a global market of assets around the clock. This lack of geographic constraints, coupled with a reduction in intermediaries, allows assets to attract a wider investor base.

Lower Costs

A lack of intermediation also results in lower transaction costs. Traditional financial markets involve high fees for intermediaries like brokers and clearinghouses that are completely bypassed in peer-to-peer transactions.

Fractional Ownership

Tokenization enables the division of real-world assets into smaller, more affordable fractions. This lowers the barrier to entry for retail inventors and allows them to participate more actively in markets for traditionally illiquid assets such as real estate or art.

Efficient Settlement

Transactions for tokenized assets also enjoy significantly reduced settlement times that are sometimes near-instantaneous. This is an improvement over traditional settlement systems that can take days.

Benefits of Tokenizing More Assets

We believe in the broader potential of RWAs, indicating a larger trend of various real-world assets being brought on-chain through tokenization.

The advantages of tokenization, including improved distribution and composability, are what will revolutionize asset distribution, making RWAs accessible to more investors.

Distribution

Being fully digital means that tokenized assets are accessible to a greater number of investors through more channels, including all the ones we have started to get used to in crypto. It also means that they can benefit from fractionalization, which makes the underlying assets more liquid and more accessible to retail investors.

Composability

More importantly, these assets start to benefit from the infinite composability of DeFi. They become one of the financial building blocks that can be combined with all the others as part of an open and programmable financial system. While in the past, this kind of creativity could only be applied to “crypto” assets (i.e., utility tokens, stablecoins, and NFTs), now it can also impact real-world assets.

New On-Chain Financial Instruments

The tokenization of other real-world assets and their resulting improvements in distribution and composability will enable the creation of new on-chain financial instruments. It also points to the development of fresh alternatives for DeFi protocol designs that are backed by these assets and perhaps provide a way to overcome their current need for over-collateralization.

The only limit to the potential of real-world assets is now the developer’s imagination. The possibilities here are endless, and this is tremendously exciting.

Future of RWAs in 2024 and Beyond

As we look towards 2024, the landscape for RWAs is set to be transformed by the increasing adoption and innovation in tokenization. Crypto market makers are benefiting from a current growth in tokenization use cases that is bridging the gap between TradFi and DeFi.

Two key areas demonstrating this trend are tokenized treasuries and private credit.

Tokenized Treasuries

The tokenization of U.S. Treasuries is emerging as a highly popular use case for bringing real-world assets onto the blockchain. This trend aligns with a shift in investor interest towards more traditional financial instruments like bonds, especially in times when DeFi yields are declining.

The market for tokenized treasuries has expanded rapidly, now valued at around $600 million. Projects like Ondo Finance (or Centrifuge) are at the forefront, introducing a short-term US government bond fund specifically tailored for crypto market makers. The diversity in this market is growing, with numerous funds offering various participation methods in this rapidly developing sector.

Private Credit

In parallel, the tokenization of private credit represents another significant stride. This approach involves bringing real-world debt assets owned by credit solution providers onto the blockchain. These are then made accessible to accredited investors through Web3 platforms. Here, tokenization can bring benefits that are available in crypto market making such as lowering the barrier to entry through fractionalization.

A prime example of theis is the tokenization of private credit through receivables pools. Platforms like Credix are enabling crypto market makers to acquire tokenized private notes backed by receivables from private loans. The yield generated from these investments is distributed to investors in stablecoins like USDC. Highlighting the potential in this space, Credix recently announced that its partners have already filed for a $100M USD-denominated private note, indicating significant growth prospects for this application of tokenization.

Reshaping Traditional Assets

As we move into 2024 and beyond, these developments in tokenized treasuries and private credit illustrate just the beginning of what’s possible with the tokenization of RWAs. This evolving landscape promises to offer innovative financial instruments and opportunities, reshaping how traditional assets interact with and are valued in the digital era.

What RWAs Could Unlock in 2024

In 2024, we will see new kinds of Web3 applications that make use of real-world assets in creative ways and expand their financial possibilities for both TradFi and DeFi market participants. We can imagine protocols that create financial possibilities for stocks, bonds, real estate, or carbon credits in ways that were unheard of for brick-and-mortar institutions.

These on-chain representations of a growing number of real-world assets will have a strong impact on financial markets in general. For TradFi, this will mean more liquid, accessible, and programmable assets. For DeFi, this will lead to the availability of new and more reliable assets as well as great improvements in the utility of decentralized applications.

Read more: All the basics on Liquidity Pool management

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube