DeFi dynamics: The Critical Role of the top 6 Stablecoins

We’ve previously explored how stablecoins support the crypto market. In this article, we’ll take a closer look at the top 6 stablecoins by onchain activity and their impact on the ecosystem.

$USDT $USDC $DAI $USDE $FRAX $PYUSD

Key Takeaways

- Even if a large amount of stablecoin is circulating, only 6 out of +100 make up most of the onchain activity.

- USDC and USDT are clearly in a market share battle, but one has more potential to lead in DeFI.

- Smaller coins have a niche use case, demonstrating no point in having a one-size-fits-all stablecoin.

- Stablecoins specific use case attracts specific investor profiles and trading behaviors.

- DAI went from rivaling with USDC and USDT to a RWA-focused stablecoin.

- Against all odds, USDE takes the cake in terms of stablecoin offering the best APY out there. Making the most out of arbitrage opportunities and capitalising on it.

- Currently, FRAX is likely the last of the algorithmic stablecoins standing.

- PYUSD enabled institutional market entry and quickly became a serious challenger. But is hinges on larger adoption.

A game of a few

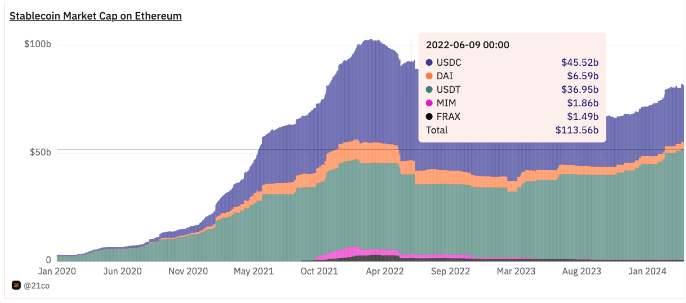

In our previous stablecoin piece, we covered the scale of the stablecoin market, examining the various chains they inhabit and identifying areas of significant activity from a broad perspective. Now, we’ll zoom in on stablecoins’ versatility and their application by analysing their onchain usage and focusing on the major players.

Considering there are over 100 different stablecoins, we will primarily focus on six of them: USDT, USDC, DAI, USDE, FRAX, and PYUSD. In terms of onchain usage, those offer a wider set of applications, as the remaining coins are either too small to be noteworthy or serve almost entirely singular roles within their ecosystems.

Take FDUSD. Despite having a market cap of $700 million, it has nearly no onchain presence and exists purely as an internal replacement for BUSD. Similarly, USDD is used almost exclusively for Tron settlements or is concentrated in a single lending platform, while BUIDL (BlackRock) does not have usage beyond being held in wallets.

When aggregating the portion of the six major stablecoins that are in smart contracts, we find $28 billion in motion, equating to only 18% of the $155 billion total stable market.

DeFi application of stablecoins

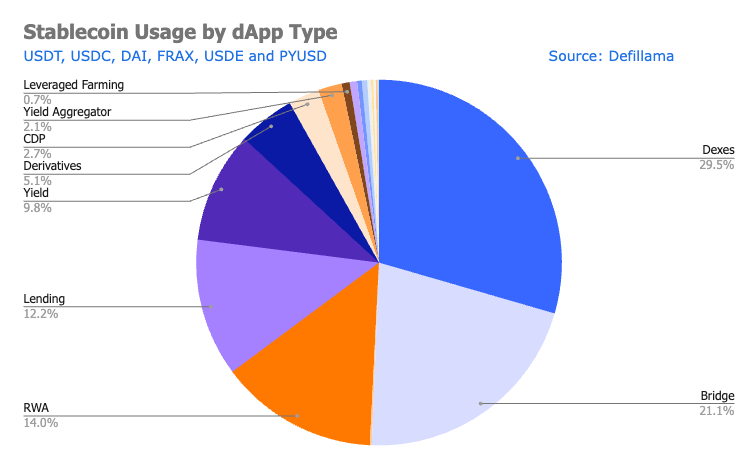

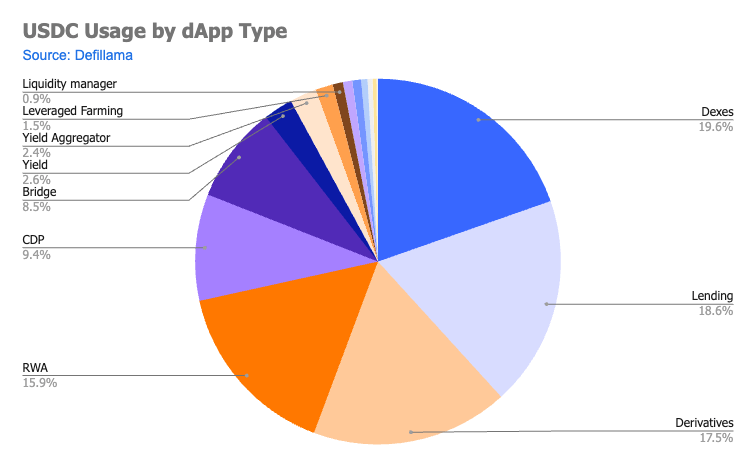

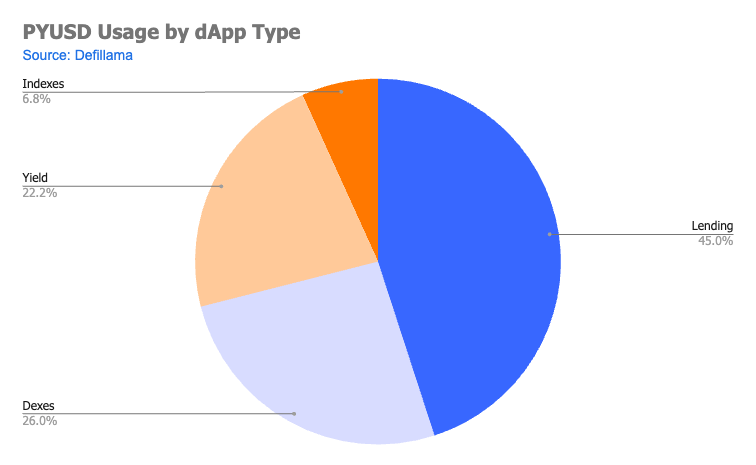

Looking at the chart below, we see a healthy mix of stablecoin usage across various dApps. However, a closer examination reveals that each stablecoin serves distinct roles within the ecosystem and contributes differently to each pie slice.

In this article, we will explore the specific usages of these major stablecoins, their contributions to the larger market, their rise in popularity, and the potential implications for the future.

USDT

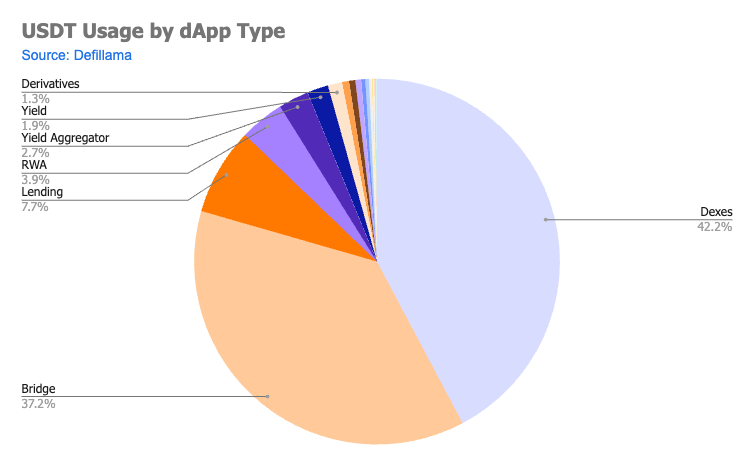

Approximately 11.5% of USDT’s total market cap, or $12.8 billion, is held within smart contracts across 10 different chains. This is the lowest % among the 6 major coins. Additionally, the distribution of this usage differs significantly from the overall usage chart, with dominance in two categories: bridges and decentralised exchanges (DEXs). Yet this makes sense if you understand the historic and ongoing role USDT has played in the crypto ecosystem.

The first mover advantage (USDT)

USDT was the first stablecoin to gain widespread adoption, becoming the standard counterparty for almost all trading pairs on centralised exchanges. Indeed, our previous analysis indicates that about 32% of USDT is held in known centralised exchange wallets. Consequently, when automated market makers (AMMs) emerged, USDT was either the first or second choice, alongside WETH, for trading pairs on these platforms.

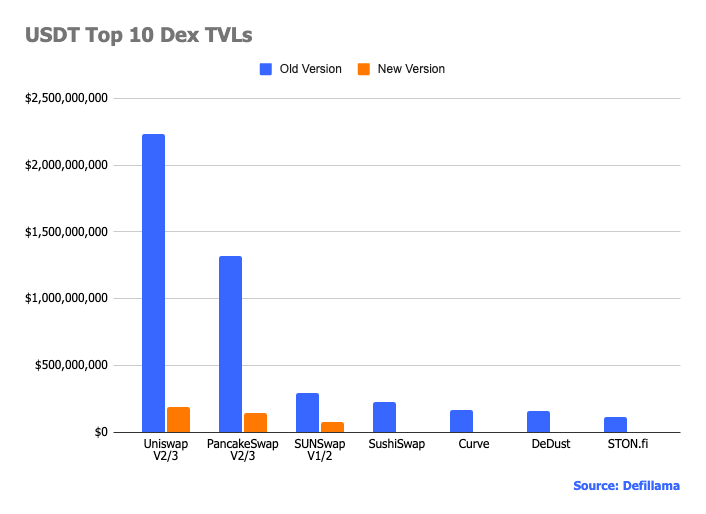

Dominant in older protocols’ versions

The first significant AMMs to gain traction were Uniswap V2 and PancakeSwap V1, where much of USDT’s DEX liquidity remains concentrated today. In fact, examining the top 10 DEXs in terms of USDT TVL, we find that 3 have a newer version pair that holds only a fraction of its legacy counterpart.

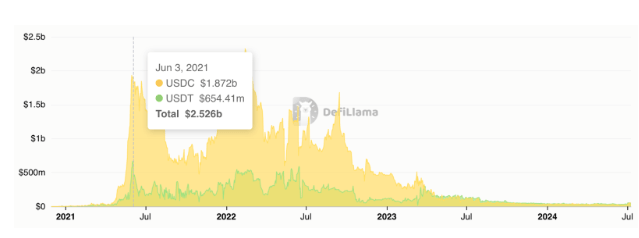

When considering the next largest share of USDT’s usage, lending accounts for 7.7%, with the majority clustered in Aave V2 and V3. Unlike its behaviour on DEXs, where liquidity remains in older protocol versions, does give more in V3 than V2 but has yet to surpass its peak TVL in Aave V2, achieved in 2021.

USDT vs USDC Aave V2 TVL | Source: Defillama

USDT vs USDC Aave V3 TVL | Source: Defillama

USDT vs USDC Aave V3 TVL | Source: Defillama

A legacy-based dominance

Ultimately, the picture with USDT is clear. Most of its DeFi use stems from the previous two cycle’s bull runs and its legacy status. While it remains crucial as a standard for trading pairs and price discovery, as evidenced by its significant exchange ownership and large DEX usage, USDT does not appear poised to drive the future of DeFi. It holds its ground as a staple of the past rather than a catalyst for new, innovative onchain protocols.

USDC

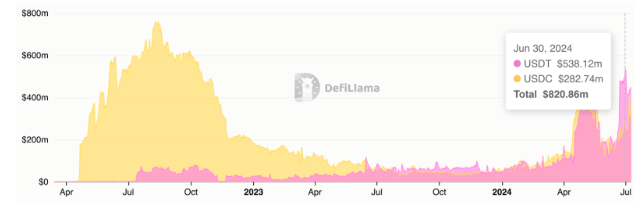

Examining USDC reveals a distribution more aligned with our overall market observations, showcasing a much more diverse application. Indeed, this is reflected in the fact that 20% of all circulating USDC, or $7 billion, is in smart contracts. This figure is nearly double that of USDT’s, and notably, only 8.5% of USDC is bridged compared to 37% of USDT.

Piece by Piece

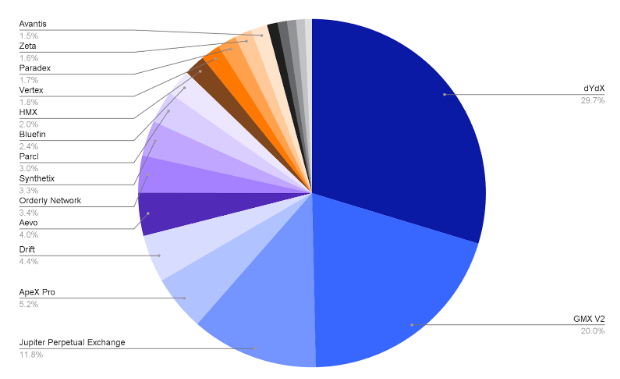

Breaking down further insights, USDC surpasses USDT in market share across three main areas: derivatives, real-world assets (RWAs), and collateralised debt positions (CDPs). Starting with derivatives, USDC has approximately $1 billion locked in protocols enabling derivative trading, primarily leveraged trading against oracles, which is more than six times the next USDT.

These derivative protocols are incredibly diverse. Beyond the top three major protocols, no other protocol holds more than 5% of the USDC TVL share. Notably, USDC does not compete much with USDT in this sector; of the top 20 on-chain derivative protocols, only GMX and Jupiter even accept Tether. We’ll get deeper into on-chain derivatives platforms and the vAMM landscape in the future, but for now, it’s clear that USDC is integrated into almost all of them.

While USDT and DAI were initially integrated into early derivatives, at least the continued uncertainty about USDT’s backing and redemption, as well as narratives, have led more to simply not bother with the outsized risk.

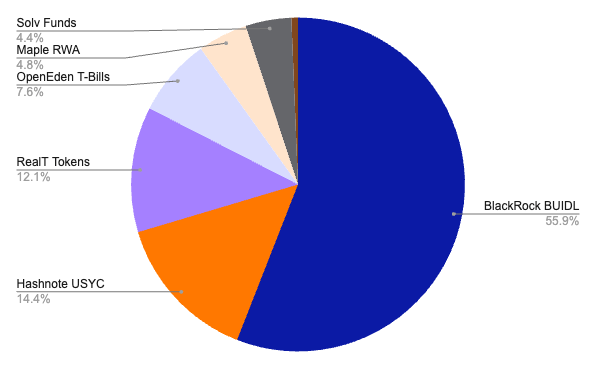

Institutional adoption backing RWA

Next, 15.9% of USDC’s supply is supporting RWAs. In this context, RWAs refer primarily to treasury bonds or T-bills, as nearly all USDC allocated to these yield-bearing protocols is tied up in such assets.

Of the $900 million in this category, the majority is in BlackRock’s BUIDL, which effectively mints a stablecoin, along with Hashnote’s USYC. This usage category is relatively new, made possible by regulatory clarifications and institutional backing, which have brought real yield from governments onchain. The easier redemption process for USDC facilitates this transformation.

Reliable as collaterals

This leads us to the third category, where USDC outperforms USDT: CDPs. Here, USDC is used to back the minting and creation of new tokens supported wholly or partially by its underlying value. For this 9% segment, almost all usage is within MakerDao’s protocol, backing DAI itself. This means that double counting is inevitable. Another significant portion backs FRAX, a semi-algorithmic stablecoin.

In the future, we anticipate CDPs to be backed by assorted assets, as evidenced by the slow disappearance of algorithmic stablecoins in favour of more stable collateral options. This is in large part due to their failure to deliver the dynamic printing they promised as a result of partial collateralisation, thus losing market usage.

However, this overview doesn’t fully cover the myriad of smaller protocols using USDC as collateral, such as prediction markets, automated farms, and options platforms, which are expected to grow alongside the market.

USDT vs. USDC Diversity Addendum

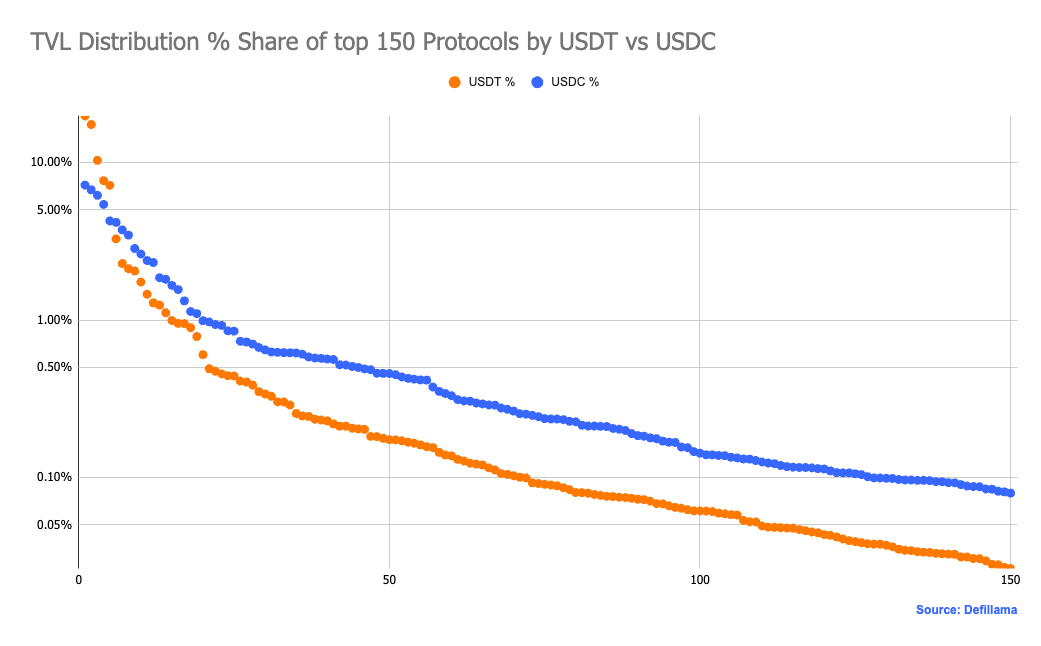

To further highlight the discrepancy between USDT and USDC in terms of onchain usage diversity, we examine the TVL distribution as a share of total deployment. This analysis reveals that USDC has a better distribution among dApps compared to USDT.

A more precise measure of this distribution is the Gini coefficient, which assesses inequality. When we calculate the Gini for TVL distribution across the top 150 protocols, USDT scores 0.6695, while USDC scores a significantly lower 0.3008, indicating a more balanced spread. Even the median distribution shows that USDC is more than twice as evenly spread across protocols on all blockchains compared to USDT.

The takeaway here is that USDC is more evenly distributed across DeFi and is in demand everywhere, leading to fewer dominant players and higher competition. The top 4 USDT protocols each have over 7.5% share, whereas the largest TVL dApp of USDC has less than 7.2%.

DAI

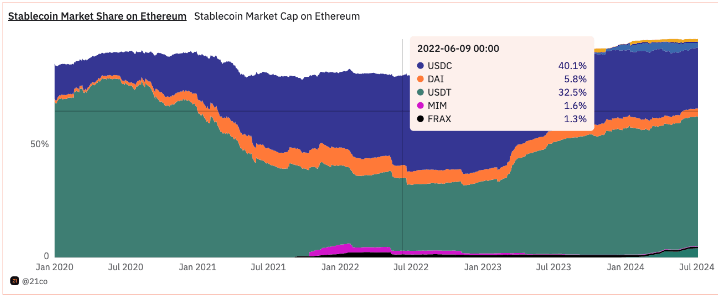

Segwaying into DAI, it’s clear the tale is not quite as exhilarating as it once was. Over the past three years, DAI has grappled with product definition and use case, clinging to a dwindling market share.

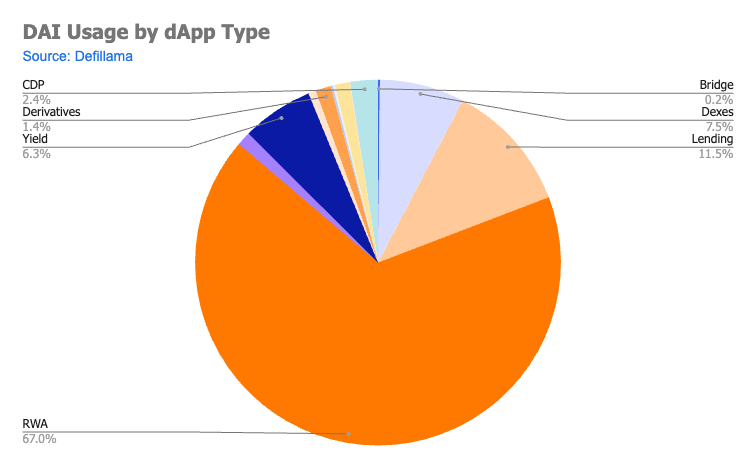

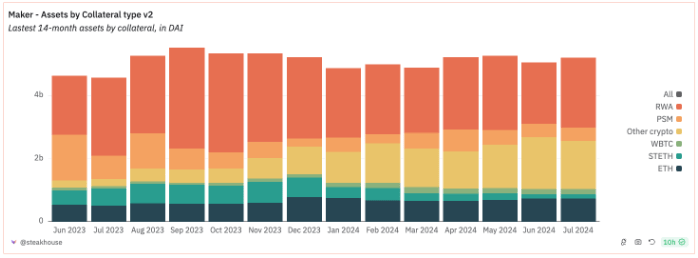

RWA-focused

With the advent of RWAs, they’ve executed a significant pivot through their new “Spark Platform” for minting and staking. Indeed, the TVL breakdown reflects this transformation.

Recognising the market’s direction, DAI has pivoted to now an estimated $2.34 billion RWA portfolio, including approximately $1.14 billion in US Treasury Bonds and $500 million in USDC earning yield in Coinbase Prime (the 9% of USDC TVL marked for “CDPs”). They assert that this shift drives 80% of their company’s revenue.

Source: Dune

DAI has struggled with its definition since its inception, never managing to exceed more than 10% of the stablecoin market share. This pivot to RWAs, represented by sDAI, seems to be the right move as interest in traditional forms of CDPs has waned. Whether this embrace of RWAs will help DAI compete with larger players, however, remains to be seen.

USDE

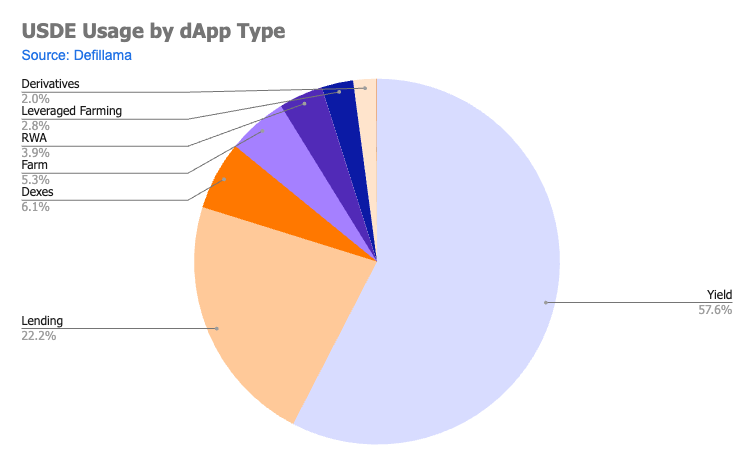

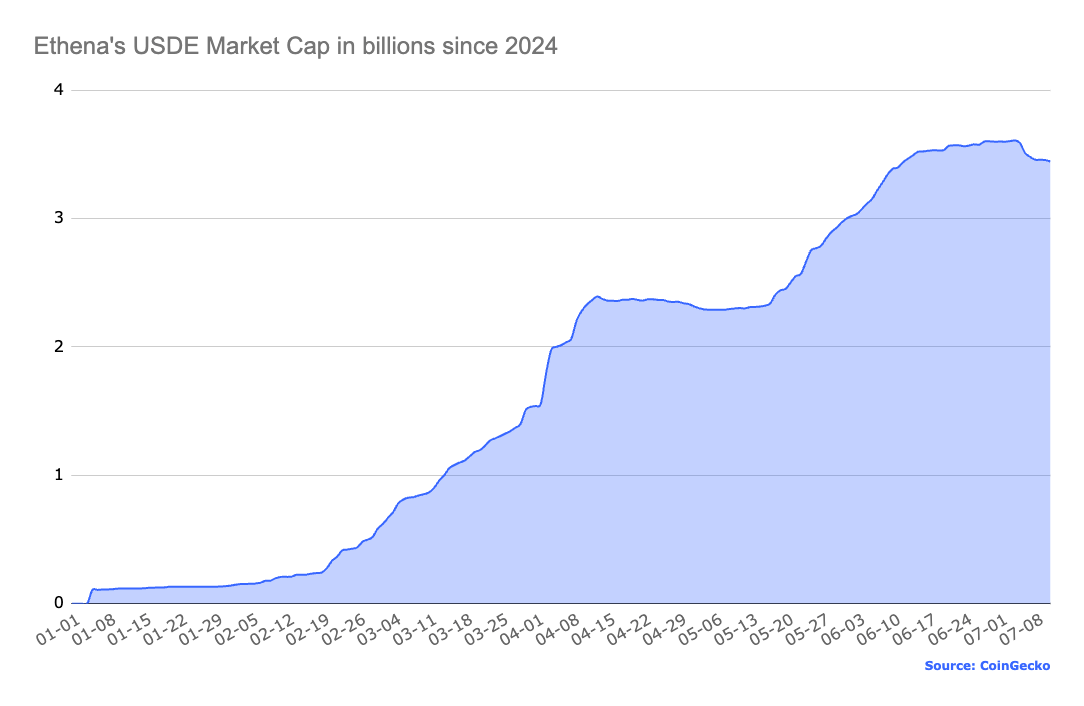

Ethena’s USDE is the newest challenger in the field and has one of the most innovative approaches to creating a stable asset and returning a good yield to the user.

Looking at its dApp distribution, it primarily yields protocols like Pendle, where users try to lock in predictable APR from their coins. It should be noted USDE does not need to be staked; it inherently has all its capital deployed in Basis Trading to generate its returns. Understanding “basis trading” is understanding the reasons why USDE was created.

Basis trading

In short, it’s the process of creating delta-neutral, synthetic positions whereby the two instruments are misaligned and waiting to arbitrage the gap collecting a few basis points.

Ethena does this by capitalising on the generally positive funding rates on Centralised exchanges. By using the actual crypto they are dealing with as collateral, they can safely enter a short position where funding is positive on a centralised venue and wait for the price difference to merge.

Thus, despite minting with non-stable assets, they remain delta-neutral. This is in contrast to DAI, which does not hedge and maintains a debt position. Ultimately, USDE has proved incredibly popular and accelerated from 0 to 3.5bn in market cap in less than a year. All this while offering APYs around 13%.

Yield

But is offering such a high APR sustainable? Especially when the next best things, like USDC or DAI, are offering 4%. “Anything that offers more than a 10% APR is unsustainable at best, and a scam at worst.” – Vitalik Buterin. And he might have been right when he made this comment a year ago.

However, with Ethena, the yield is not based on some underlying ponzinomic model with minting but on existing arbitrages opening up as a result of market sentiment. In a bear market, these basis trades would collapse and more likely go the opposite way with negative yield or even in neutral-ranging markets.

Ethena themselves are very transparent about this, and the yield itself is variable. But until then, it is real yield being paid out, and it’s offering an innovative take on the stablecoin market, utilising strategies on large scales mostly only done by market makers like ourselves.

FRAX

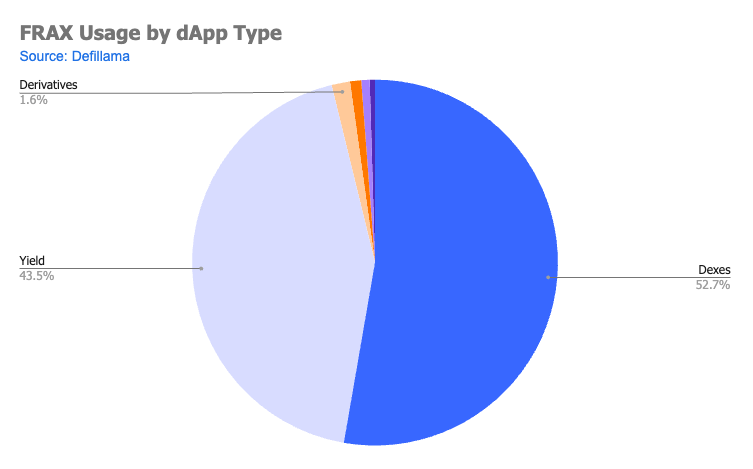

Second to last is FRAX, which currently has a market cap of $650 million, down from a peak of nearly $3 billion. Despite this decline, FRAX remains one of the few large algorithmic stablecoins that has maintained its peg.

FRAX operates through a central bank model, partially backing its stablecoins with USDC and the remainder with a dynamic peg from its governance token, $FXS. This approach, coupled with the protocol owning much of its liquidity, makes it mathematically challenging to depeg.

While innovative, FRAX never achieved the prominence of other algorithmic stablecoins like Luna’s UST or MIM Magic Internet Money. However, it has also avoided catastrophic failures. The project now faces an identity crisis, and it will be up to founder Sam Kazemian to navigate its future.

As for how Frax operates within the ecosystem, most of the FRAX in circulation is restaked internally within the protocol or held in DEXs, primarily owned by the FRAX Foundation itself. It’s a bit of a snake-eating-its-own-tail situation, as it hasn’t gained significant adoption outside its own ecosystem. This lack of external utilisation hinders its broader adoption and impact.

PYUSD

Last, we have PayPal’s PYUSD, which has an almost 400mm market cap. PYUSD represents perhaps the first major external institution to get directly involved in stablecoins. PayPal has long been an innovator in the digital payment space, and releasing a stablecoin was perhaps inevitable. It’s a great first step for them and the industry, and it is slowly growing but still quite small compared to others.

Being so small, PYUSD is still finding its footing and doesn’t really contribute that much to the stablecoin landscape overall. It has a healthy spread between Lending protocols and DEXes, as well as some yield. What is to be seen is whether more complicated dApps like derivatives trading platforms will pick it up as collaterals.

Ultimately, adoption is controlled by third-party developers; PayPal just has to make it as attractive as possible. We look forward to seeing how it grows and potentially when it reaches the billion threshold.

Solidified utility in DeFi

Looking at the overall stablecoin landscape and their dApp distribution, it is clear that of the major ones, each has found some niche in the larger diverse pie chart of the 28 billion within smart contracts. But it’s a non-stop competition nonetheless, with USDT and USDC leading the market. And if there isn’t a one-size-fits-all coin any time soon, USDC has risen to be the most versatile.

USDT continues to dominate as a trading pair standard on centralised exchanges, benefiting from its first-mover advantage. In contrast, USDC is making big moves in DeFi applications, offering a more diversified use case portfolio that includes derivatives, real-world assets, and collateralised debt positions.

It is unlikely that USDT will lose its lead market cap-wise at the current rate of new stable printing, especially if USDT continues to be the standard for quoting, but in terms of deployment in DeFi ecosystems, USDC isn’t far behind. This serves as a reminder that innovation continues to drive stablecoins to new use cases.

DAI has strategically pivoted towards RWAs, using its “Spark Platform” to integrate traditional financial instruments. FRAX, with its unique hybrid model of partial algorithmic and collateralised mechanisms, has maintained its peg despite market challenges. Both highlight the diverse approaches within the stablecoin market, each having to adapt to DeFi’s demands in unique ways.

A perspective we look forward to for PYUSD. How adaptable to DeFi will the coin be? It has seen rapid growth and could set a precedent for other traditional financial institutions entering the market. But even if Goldman Sachs or Citibank releases a stablecoin, it’ll be up to protocols to integrate them to determine if they will be successful.

Finally, experimental models like Ethena’s USDE prove that novel approaches can quickly spin up from 0 to 1 billion, demonstrating the potential for high-yield stablecoins.

All these actors solidify the idea that stablecoins are versatile. Their application is spreading, always reaching new heights in DeFi. With increasing institutional interest, technological advancements, and regulatory support, stablecoins are set to be one of the main characters in the expansion of tokenised economies.

We’re witnessing a multifaceted growth trajectory showing that while no single stablecoin will dominate all use cases, their collective impact on the financial landscape will be far-reaching. An impact we’ve looked into in our first piece ‘The scale of stability: the stablecoin landscape dissected’.

Read more: The scale of stability: the Stablecoin landscape dissected

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.