Comparing Layer 2 launches: Liquidity provider profiles

Key Takeaways

In our latest report, “Comparing Layer 2 Launches,” we dive into the behaviors of Liquidity Providers (LPs) across various Layer 2 networks. It’s a landscape of contrasts where sophisticated LPs are gravitating toward certain platforms while others are becoming the go-to choices for those newer to the game. This analysis isn’t just about numbers—it’s about understanding the diverse ecosystem of L2 networks and how these differences in LP sophistication are shaping the future of blockchain technology.

Interested? Let’s take a closer look.

Introduction

Liquidity providers are the lifeblood of any network, and they are especially important in a protocol’s earliest days when liquidity is vital to the maintenance of security, incentives, and useful applications. In the last few years, the blockchain ecosystem has seen many notable layer 2 launches, all of which have competed for a finite pool of liquidity providers and their funds.

Competition for these liquidity providers has spawned creative incentive mechanisms to attract liquidity on L2s and their apps — most notably, retroactive token distributions and yield farming. However, L2s aren’t just challenged with attracting liquidity; they are additionally challenged with ensuring they attract the right liquidity providers.

At the end of the day, networks want to attract liquidity providers that have sufficient funds, yes — but also liquidity providers that understand blockchain technology, are active throughout web3, and are familiar with DEXes and other apps. These types of “sophisticated” liquidity providers are the ones who will stick around despite fluctuating incentive schemes, providing sustainable, consistent liquidity and on-chain activity — ultimately helping establish the frontrunners in the emerging L2 ecosystem.

In this report (Part 3 of our “Comparing Layer 2 Launches” series — Part 1 & Part 2), we dive into the behaviors of liquidity providers across 7 major L2s that launched between 2021 and 2023. Specifically, we sought to answer the questions: which layer 2 networks succeeded in attracting the most sophisticated liquidity providers in their earliest days and weeks? Conversely, which L2s were inundated with less sophisticated LPs?

TL;DR Data Conclusions

In this data piece, we sought to profile the liquidity providers of each L2 in terms of “sophistication.” We refer to a sophisticated liquidity provider as one who has a deep understanding of market dynamics and uses advanced strategies for providing liquidity. These providers are well-versed in market trends, risk management and may use complex financial instruments or algorithms to maximize returns or minimize associated risks. We determined “sophistication” by comparing the on-chain activity of LPs across each L2 network.

We determined:

- Arbitrum attracted the most “sophisticated” LPs compared to other L2s, especially in terms of their wallet balance and on-chain activity.

- Mantle, Linea, and zkSync Era attracted the least “sophisticated” LPs compared to other L2s, as measured by the variety and volume of those LPs’ other on-chain transactions.

- Mantle and Linea, in particular, attracted mostly token farmers seeking airdrop opportunities.

- Polygon zkEVM underperformed compared to many L2s in terms of ETH bridged and number of LPs. However, wallet activity reveals that the early LPs of Polygon zkEVM were, on average, more sophisticated compared to competitors like zkSync Era, Mantle, Base, and Linea.

Our quantitative conclusions led us to some more general conclusions about the state of the L2 ecosystem. Arbitrum, one of the earliest L2 contenders, is best suited to withstand market fluctuations and retain liquidity as the L2 ecosystem evolves. Across the board, its LPs have the most longstanding and dynamic on-chain activity across Ethereum. Considering Arbitrum launched during the bull market and has withstood this most recent bear market, the sustainability of its LPs is being currently proven.

On the other hand, Mantle, Linea, and zkSync Era are more likely to struggle in the medium and long term, as the low sophistication of their LPs butts heads with market conditions and waning token incentives. If we learned anything from the layer 1 bull market in 2021, it is that early adoption is not an indication of long-term success.

Mantle, Linea, and zkSync Era achieved in attracting high numbers of individual LPs early on, but a strikingly low number of these LPs came with no notable on-chain activity. Likely, these networks will struggle to further engage their early LPs, who may have joined just in the hopes of an eventual token distribution. For continued on-chain activity, these 3 networks will need to attract new LPs with higher sophistication.

The conclusions above were supported by a 2-phased data approach. First, we observed just the overall number of individual LPs for each L2 and the number of “high value” (i.e. +10 ETH) LPs for each network. From this first phase, we arrived at superficial conclusions about the success of each L2. Second, we dug deeper into those superficial conclusions by looking at the sophistication of the LPs across the L2 networks. Let’s dive into each phase.

Measuring Liquidity Providers Traction

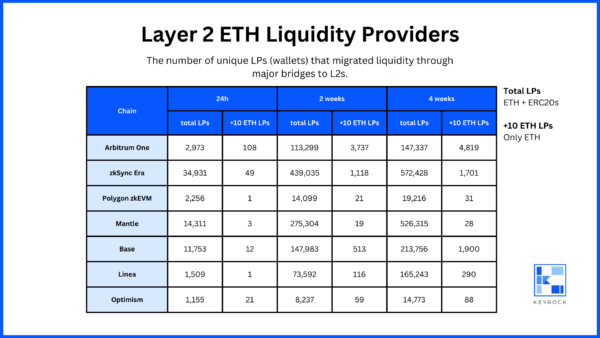

Observing just the number of individual liquidity providers across all L2s during the first 24 hours, 2 weeks, and 4 weeks after launch, we reached some initial insights.

Over a four-week time period, Mantle and zkSync Era had the most individual LPs (+526k and +572k, respectively). Polygon zkEVM (+19k) and Optimism (+14k) had the least individual LPs. And Arbitrum (+147k), Base (+213k), and Linea (+165k) fell in between either end. This early analysis would suggest that Mantle and zkSync Era were the most widely-adopted L2 networks.

However, we looked deeper into the individual LPs of these L2s in their earliest days — specifically at high-value liquidity providers. The more funds that LPs are willing to deposit into an L2, the greater their trust in the network’s capacity to keep their money safe and to pay off in the long run.

In this regard, Arbitrum had the largest number of high-volume LPs within its first 4 weeks after launch. 4,819 LPs deposited more than 10 ETH in the first 4 weeks after launch — equal to 3.3% of all LPs. The next highest number of +10 ETH LPs by both number and percentage was Base, with 1,900 (or 0.89%).

Through this analysis, we began arriving at the conclusion that Mantle LPs stood out. Of the +526,000 Mantle LPs, only 28 (0.005%) deposited more than 10 ETH in the network’s first 4 weeks. Among the remaining 4 LPs, between 0.1% and 0.6% of total LPs deposited more than 10 ETH.

Liquidity Provider Sophistication

From observing just the number of LPs across each L2, we came to two general conclusions.

First, Arbitrum stood out among other L2s in terms of ETH volume migrated and high-value LPs. Second, Mantle and zkSync Era stood out in terms of number of LPs, and Mantle stood out for its low number of high-value LPs.

We looked at more statistics to answer the question, how sophisticated are the LPs that migrated liquidity to each L2 in its earliest days? We answered this question by looking at the different cumulative activity of each wallet that provided liquidity to L2s in the first 24 hours after launch, as of November 24, 2023.

Wallet Age & Balance

Wallet age is measured as the length of time between its first and last transaction on Ethereum (as of Nov. 24, 2023). The wallets that migrated liquidity to Optimism and Arbitrum are the oldest since their first on-chain transaction was at the earliest the transaction that migrated liquidity to either network.

As of November 24, 2023, the wallets that LP’d to Optimism or Arbitrum had the highest per-wallet ETH balance among all L2s. Despite ETH prices at the time being at or above today’s prices (December 1, 2023), these wallets still have a higher ETH balance than those that were active in 2023 L2 launches. Likely, these wallets were either active before 2021 during the previous bear markets or remained active following the 2021 bear market and continued to acquire ETH over time — bolstering the emerging conclusion that Optimism and Arbitrum attracted the most sophisticated LPs.

Mantle again stands out on the lower end, with the highest number of young wallets and low-balance wallets. By looking at wallet age and balance, it becomes clear that the majority of Mantle LPs had only recently joined crypto, further bolstering our conclusion that airdrop hunting was a primary driver for these participants.

On-Chain Wallet Activity

We looked deeper into each LP, drawing conclusions about the sophistication of each L2’s early LPs by looking at their other on-chain activity. Specifically, we looked at: transaction volume, DEX activity, and asset variety.

Our methodology was as follows. For each L2, we took all wallets that provided liquidity within the first 24 hours after launch. Then, we observed those wallets’ cumulative on-chain activity up to November 24, 2023.

Again, Arbitrum and Optimism stand out as having the most sophisticated traders with the most diverse and high-volume on-chain history. 40-50% of early Optimism and Arbitrum LPs have made over 100 on-chain transactions, compared to <20% for every other L2. Similarly, over 70% of the early LPs of Optimism and Arbitrum hold over 50 unique assets in their wallets, compared to <50% of every other L2.

It was through on-chain wallet activity analysis that we further concluded the low sophistication of Linea, Mantle, and zkSync Era LPs. Linea and Mantle, in particular, were provided liquidity by wallets with comparatively low transaction volume, low DEX activity, and particularly low asset holding variety.

While looking further into asset variety, less than 5% of early Mantle LPs and less than 7% of early Linea LPs hold more than 10 unique assets today. Base is the third in line, with over 25% of early LPs holding more than 10 unique assets today. At the highest end, over 70% of early LPs of Arbitrum and Optimism hold more than 10 assets today.

Even among the 2023 launches, Mantle and Linea stand out in the low sophistication of their LPs. Less than 9% of Linea LPs and less than 6% of Mantle LPs have done more than 10 on-chain transactions. This is compared to other 2023 launches like zkSync Era (over 34%), Polygon (over 50%), and Base (over 30%).

The relative sophistication of Polygon zkEVM LPs was an unexpected conclusion from this LP behavior analysis. Across other statistics (number of LPs, number of +10 ETH LPs, wallet age, and wallet balance), Polygon was either average or below average. However, when looking at on-chain activity, we can see that Polygon zkEVM LPs were quite sophisticated.

In fact, among all 2023 L2 launches, Polygon’s LP behavior stands out. ~50% have interacted with more than 2 DEXes (compared to runner-up zkSync Era’s ~30%). Over 50% have made more than 10 on-chain transactions (compared to runner-up zkSync Era’s 34%). And 44% own more than 10 unique assets (compared to zkSync Era’s 28%). Because Polygon zkEVM launched from Polygon Labs, it’s safe to assume that a large number of the zkEVM LPs were already active in the Polygon ecosystem, so their wallets already had significant on-chain activity compared to other L2s.

Conclusion

Looking at LP sophistication across on-chain activity, we reached the general conclusion that Arbitrum and Optimism attracted the most sophisticated LPs across the L2 ecosystem. Arbitrum, in particular, maintained high average LP sophistication even with its comparatively greater number of unique LPs (+147k vs. Optimism’s <15k in the first 4 weeks).

On the other hand, Mantle and Linea emerged as the L2s that attracted the least sophisticated LPs, with a high ratio of new, less experienced, and lower-balance wallets participating in early asset migration. Mantle’s high number of unique LPs (+526k) also suggests that Mantle’s low LP sophistication was the result of a large volume of airdrop hunters — wallets and bots seeking to do the bare minimum in the hopes of a retroactive airdrop in the future.

This is the final part in our series looking at the on-chain performance of layer 2 networks and their liquidity providers at pivotal moments after their launch. For more, see our Part 1 and Part 2 data studies. Learn more at keyrock.com.

____________________________________

Data Methodology

We observed the on-chain LP behavior of 7 different L2 networks that launched between 2021 and 2023. We observed which wallets provided liquidity (i.e. migrated ETH across major bridges) during the selected time frames.

Read more: The slow birth of Bitcoin’s Layered Ecosystem

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube