Comparing DeFi AMM V3s

Last week, Uniswap announced its plans to migrate to Uniswap V4, marking its fourth major protocol upgrade since its launch in 2018. Uniswap’s V4 announcement and eventual release means that, inevitably, other DeFi AMMs will soon announce and launch their own V4 equivalents. How do we know? Because it has happened before.

It’s a common trend in web3 — particularly in DeFi — where leading protocols often inspire a host of nearly-equivalent protocols, sometimes differentiated by nothing more than new branding on top of the same smart contracts. Over the past two years, we’ve seen this mimicry play out in the world of V3 AMMs, with Uniswap serving as the original inspiration.

As Uniswap’s historical V3 imitators inevitably copy the new V4 codebase, will they be successful?

To answer this question, we looked back at the history of V3 copycats and asked: how did their first 30 days compare to Uniswap’s?

The History of “Vs”

AMMs form the bedrock of an open financial system. Their primary role is to incentivize liquidity providers so that trading can occur in a stable, fair, efficient, available, and secure manner. Founded in 2018, Uniswap brought AMMs to market and continues to dominate the non-stablecoin AMM ecosystem. Each version (“V”) of Uniswap (and its imitator AMMs) have evolved how the protocol works and, importantly, how to incentivize LPs.

V1: The Early Days

The first version of AMMs, the V1s, was launched by Uniswap in November 2018. At the time, Uniswap was limited in its functionality: it only existed on Ethereum and allowed for ERC20s to be traded for ETH, but not for ERC20s to be traded directly. Despite these limitations, Uniswap proved highly effective in providing an innovative way for people to trade without having to deal with OTC headaches, especially considering the DeFi ecosystem was in its infancy.

V2: The Lighting Rod for AMMs

The era of AMM V2s is inseparable from the DeFi Summer of 2020. In May 2020, Uniswap launched its V2. The most significant update was the introduction of liquidity pools that allowed anyone to create a market with two ERC20s. With Uniswap V2, traders no longer had to swap just between ERC20s and ETH, but could directly swap between ERC20s. On the backs of its V2 innovation, Uniswap soared to unprecedented heights during DeFi Summer.

Then, in August 2020, DeFi changed. Sushi (then, “SushiSwap”) was launched seemingly out of nowhere. It was, for all intents and purposes, an exact replica of Uniswap V2, but it provided extremely high liquidity mining APYs on the same markets as Uniswap. The result was a liquidity drain from Uniswap as LPs chased high APYs during the 2020 liquidity mining frenzy. This was the first “Vampire Attack” in DeFi, and paved the way for V2 mimicry. A month later, PancakeSwap (also a V2) launched, providing the same functionality as Uniswap and Sushi, but for the Binance ecosystem.

V3: Today’s AMMs

Today, we are in the world of V3 AMMs. Uniswap’s V3 launched on May 5, 2021. PancakeSwap’s V3 launched on April 3, 2023. And Sushi’s V3 launched on May 4, 2023.

These AMM V3s introduced several significant features and improvements over their V2 predecessors. These include concentrated liquidity, which gives (LPs) granular control over what price ranges their capital is allocated to. Other features include capital efficiency, range orders, flexible fees, advanced oracles, non-fungible liquidity, and deployment on both L1 and L2 networks.

V4: Tomorrow’s AMMs

With Uniswap’s announcement, we are now on the cusp of a V4 AMM ecosystem. Uniswap’s V4 features include: hooks & custom pools, dynamic fees and on-chain limit orders (powered by hooks), improved architecture and gas savings, and more. Notably, Uniswap V4 will be subject to a four year business source license (BSL).

The V4 BSL means that we will likely not see identical competitor V4s in the market for many years, but we can expect AMMs like Sushi and PancakeSwap to start planning anyway. To anticipate what we can expect in the inevitable V4 landscape, we can look back at what happened in the first 30 days of each AMM’s V3.

The Data Framework

To judge the relative performance of Uniswap, Sushi, and PancakeSwap V3 in their first 30 days, we looked at the following metrics:

- Total Value Locked (TVL)

- Number of Pools Created

- Multichain Pool Analysis

As stated, we looked at each V3 during its first 30 days after launch:

- Uniswap: May 5 to June 5, 2021

- PancakeSwap: April 3, to May 3, 2023

- Sushi: May 4 to June 4, 2023

V3 Total Value Locked

It’s important to recognize that Uniswap V3 was launched in a very different market than Sushi and PancakeSwap V3. At a macro level, TVL across all of DeFi was $114.5bn USD the day of Uniswap’s V3 launch, but was $49.2bn and $48.8bn on the day of PancakeSwap’s and Sushi’s V3 launch, respectively.

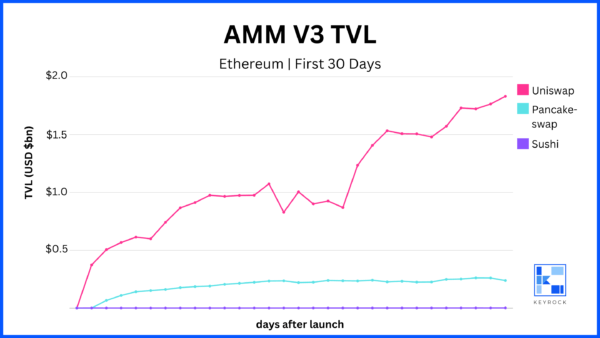

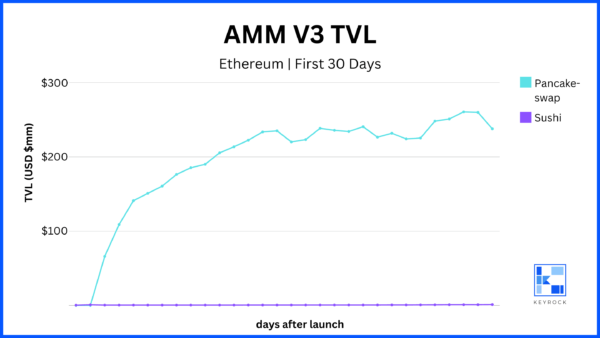

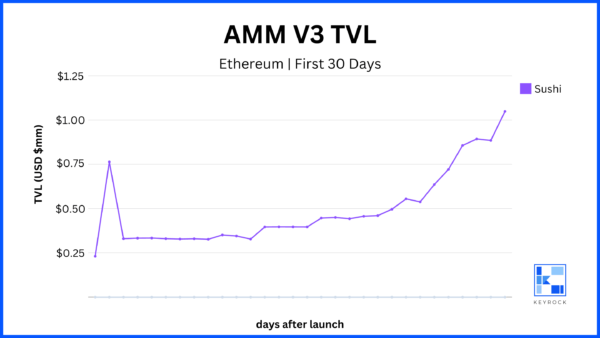

The three graphs below show the TVL of each protocol’s V3 on Ethereum.

The first graph clearly shows how much larger Uniswap V3’s TVL was during its first 30 days than either PancakeSwap or Uniswap. Although the general DeFi market size was 3x the size during Uniswap’s first 30 days compared to the others’ (~$150bn vs. ~$50bn), Uniswap V3 ended its first 30 days with 8x the TVL of PancakeSwap V3 ($1.8bn vs. $225mm) and 1,500x that of Sushi ($1.5bn vs. $1.2mm).

PancakeSwap V3 and Sushi V3 launched in nearly identical markets, and yet PancakeSwap ended its first 30 days with 187x more TVL. Interestingly, the trajectory of PancakeSwap’s and Sushi’s TVL differ. PancakeSwap V3 saw a burst of TVL in the first 2 weeks, and then remained fairly unchanged for the last 2 weeks. Sushi, on the other hand, saw stagnant TVL the first two weeks, then began a steady increase in TVL starting in week 2.

V3 Number of Pools

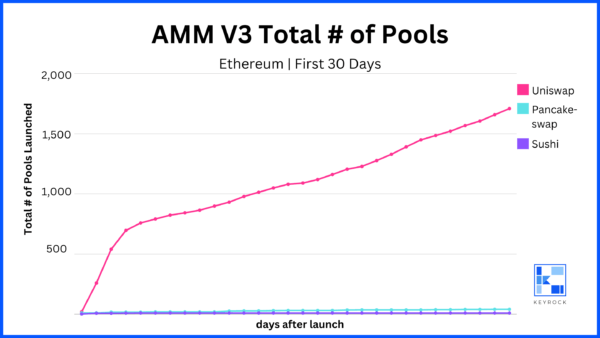

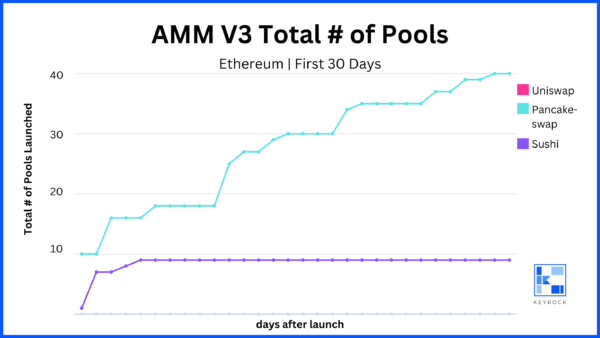

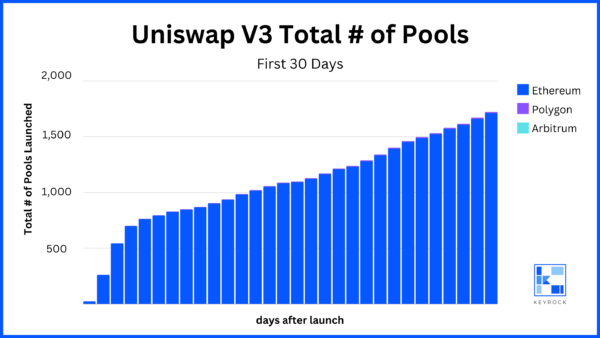

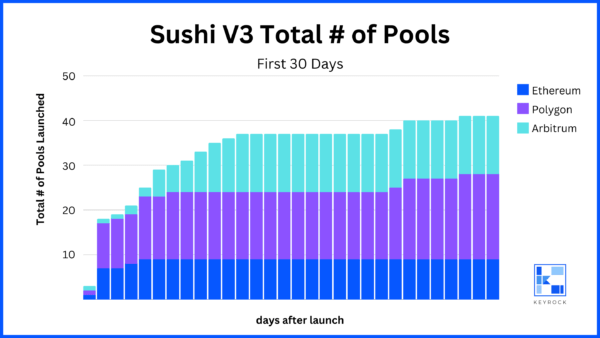

The graphs below show the number of individual pools on V3s on the Ethereum mainnet in the first 30 days after launch. For V3s, it’s important to remember that the same token pair can have multiple pools based on different fee models; for example, USDC/ETH 0.3% and 0.05% pools. In this comparison, each of these fee pools is counted individually.

Again, Uniswap V3 vastly outperformed PancakeSwap V3 and Sushi V3 in its first 30 days, ending with nearly 2,000 pools compared to Pancake’s 40 and Sushi’s 10. Uniswap and PancakeSwap followed a similar trajectory of growth — fairly linear and consistent. Sushi, on the other hand, shot up to 10 in the first days, and then plateaued for the following weeks.

V3 Multi-chain Pool Analysis

The graphs above show Uniswap V3’s clear dominance over PancakeSwap V3 and Sushi V3 on Ethereum in their respective initial 30 days after launch. However, the blockchain ecosystem has become vastly more interoperable since the days of AMM V1s or even V2s. We looked beyond Ethereum to see if the conclusions above held up under a multichain analysis.

Of the nearly 2,000 pools on Uniswap V3 in its first 30 days across Ethereum, Polygon, and Arbitrum, the overwhelming majority went live on Ethereum. Crypto moves quickly, but it’s worth remembering that when Uniswap V3 went live in May 2021, the L2 ecosystem was much smaller than today. Arbitrum and Polygon, though well known, weren’t widely used, so it’s unsurprising Ethereum accounted for most of the pools.

PancakeSwap and Sushi tell a more nuanced story. Both of these V3s went live during a time where L2s were not only useable, but where crypto’s attention was focused heavily on the L2 ecosystem, still reeling from the network congestion of the 2021 NFT boom.

Although PancakeSwap V3’s TVL was much higher than Sushi V3’s, Sushi V3 ended its first 30 days with a greater number of pools across Polygon, Ethereum, and Arbitrum than Panckeswap V3 did across Ethereum and BNB.

The per-chain view sheds new light on the conclusions drawn from the previous, Ethereum-only graphs. Though Uniswap V3 still remains the undisputed outlier, the vast majority of Sushi’s traction was not captured on Ethereum, but rather on Polygon and Arbitrum. This outcome doesn’t align with what we see from Uniswap and PancakeSwap, which had most of their traction on their “original” chain (Ethereum for Uniswap, BNB Chain for PancakeSwap).

Sushi broke from this pattern. Even though it is a natively Ethereum AMM, its traction has mostly been captured by L2 networks.

V3 Macro Conclusions (And An Eye Towards V4)

From observing what happened with the three leading V3 AMMs over the last two years, we can make the following conclusions about what will also happen with the inevitable age of V4s that will start with Uniswap’s upgrade:

- Uniswap V4 will continue to dominate the AMM market. In TVL and the number of distinct pools, Uniswap will remain the market leader by a long shot.

- The majority of Uniswap V4’s success and market share will be captured on the Ethereum L1. Despite the continued rise of L2s, Uniswap’s veteran status in the ecosystem and home to big money means that it will continue playing a dominant role in the coffers of funds still on Ethereum’s L1.

- PancakeSwap V4 will remain a “BNB-first” AMM, followed by traction on Ethereum. With its origins in the Binance ecosystem, PancakeSwap will continue to own that market, followed not by scalable L2s, but rather by the trustworthy Ethereum alternative.

- Sushi will be the AMM that leads V4 liquidity on Ethereum L2s. Unable to compete with Uniswap in its L1 dominance, Sushi will instead be the spearpoint into a broader L2 AMM ecosystem. If we are to see a battle for dominance within the V4 space, it will be in who dominates the L2 migration.

Read more: All the basics on Liquidity pool management

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube