Bitcoin L2 Liquidity: All dressed up but where to flow?

Bitcoin Layer 2s have seen explosive growth in 2024, propelling the total value locked (TVL) across these scaling solutions to unprecedented heights. In our last piece, The History of Bitcoin L2s, we mapped out the journey that brought these L2 protocols to the forefront of the crypto landscape, from early scaling solutions to today’s multi-billion-dollar behemoths.

But now, there’s a deeper question lingering beneath this rise: Where is all this liquidity actually going? Understanding where Liquidity and Value is can help us paint a picture of the state of an ecosystem. Where it is healthy and where it isn’t, what it is lacking and where it is doing well. When looking at the billions on Bitcoin L2s however we do not see a scarcity, rather an overabundance. In this article we will dive into the specifics–unpacking where the liquidity resides, what protocols have captured much of it and how much it is being used and why so much of it remains dormant.

Key Takeaways

- 2024 was a turning point for Bitcoin Layer 2s: Over 20 new Bitcoin L2s launched, driving an impressive 766% surge in TVL (Total Value Locked).

- Impressive growth, but low usage: Bitcoin L2s surpassed major chains like Cardano and Ethereum L2s in TVL. However, some lending platforms are barely being used, with utilisation rates below 5%, and most DEX pools are offering low returns, with annual percentage rates (APRs) under 2%.

- Lending dominates, but underutilised: It dominates the DeFi space on Bitcoin L2s, pulling in nearly 40% of the total funds, but actual utilisation remains as low as 5% due to a limited stablecoin ecosystem that still needs to evolve.

- CDPs – Small but full of potential: Collateralized Debt Position (CDP) protocols show potential, representing 11% of TVL. However, the lack of stablecoins is holding back broader ecosystem growth, making CDPs expansion critical to future success.

- Prime Opportunity for BTC L2s in DeFi: Most Bitcoin DeFi activity still revolves around wBTC, and L2s have not yet fully captured this demand. By focusing on Bitcoin DeFi, L2 protocols could unlock new avenues for growth and success.

- Unlocking the full potential: Bitcoin L2s are capital-rich, but increased user engagement is needed to turn this potential into thriving ecosystems. With standardised bridges, stablecoins, and cross-chain DeFi integration, these networks are poised to become industry powerhouses.

The 2024 Cambrian BTC L2 Explosion

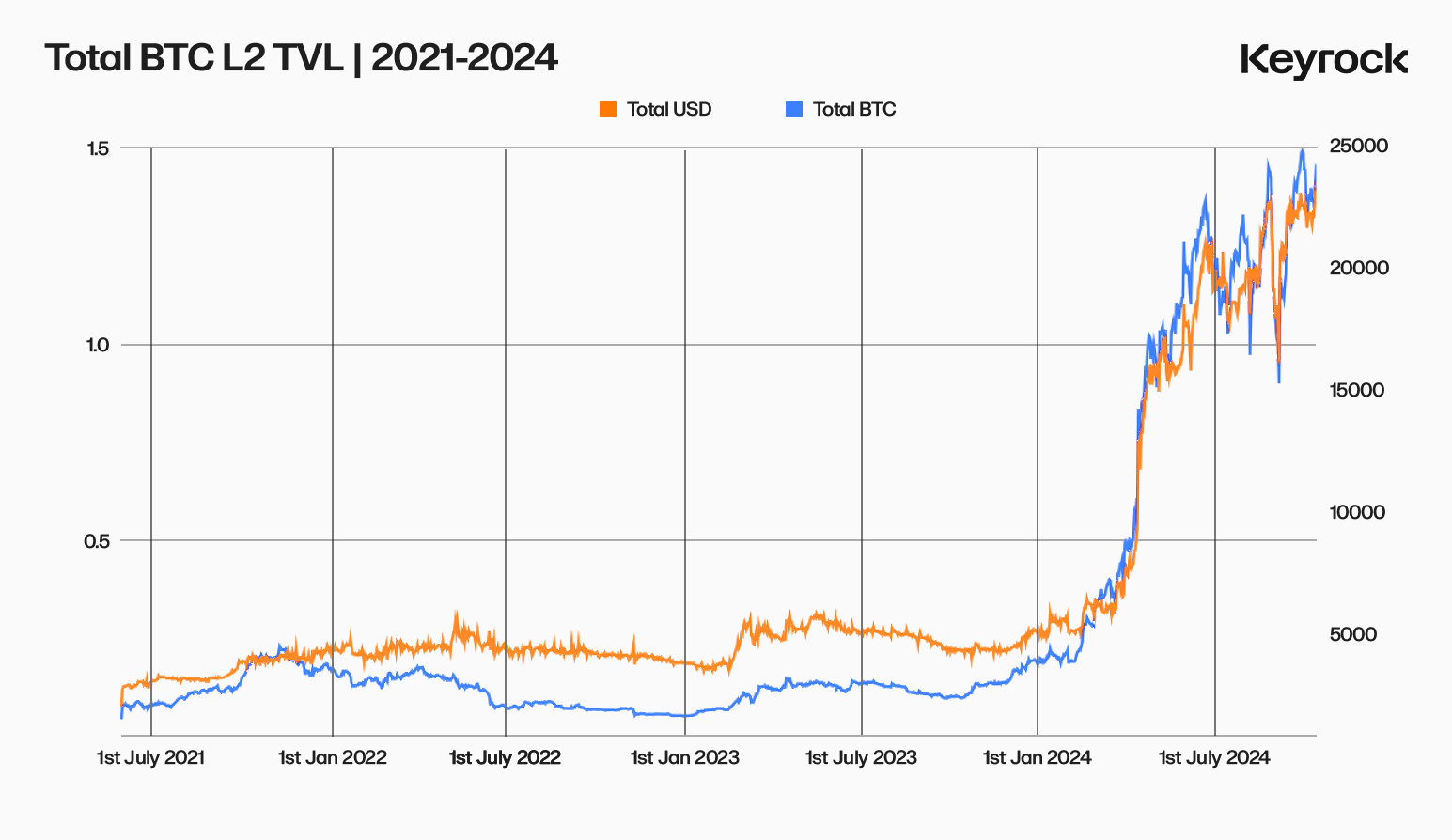

If we trace the historical TVL on Bitcoin L2s back to 2021, 2024 stands out as a game-changing year. While growth had been steady since mid-21’, this year marks a clear inflection point where TVL shot up exponentially, surpassing the cumulative growth of the previous three years combined. Whether measured in USD or in BTC, the data shows a stark shift in momentum.

At first glance, the rapid spike in 2024 may make it seem like little was happening prior to this year, but that’s not the case. Before this explosive growth, Bitcoin L2 TVL was already increasing at a respectable 11% per month on average across 2.5yrs. The difference now? The pace has accelerated nearly fivefold in the last 10 months, pushing the entire ecosystem into overdrive.

It’s crucial to measure TVL in both USD and BTC terms since most of this liquidity is held in bridged Bitcoin itself, not in stablecoins. Relying solely on USD can paint a distorted picture, especially with Bitcoin’s price volatility.

The Catalyst for change in the BTC L2 landscape

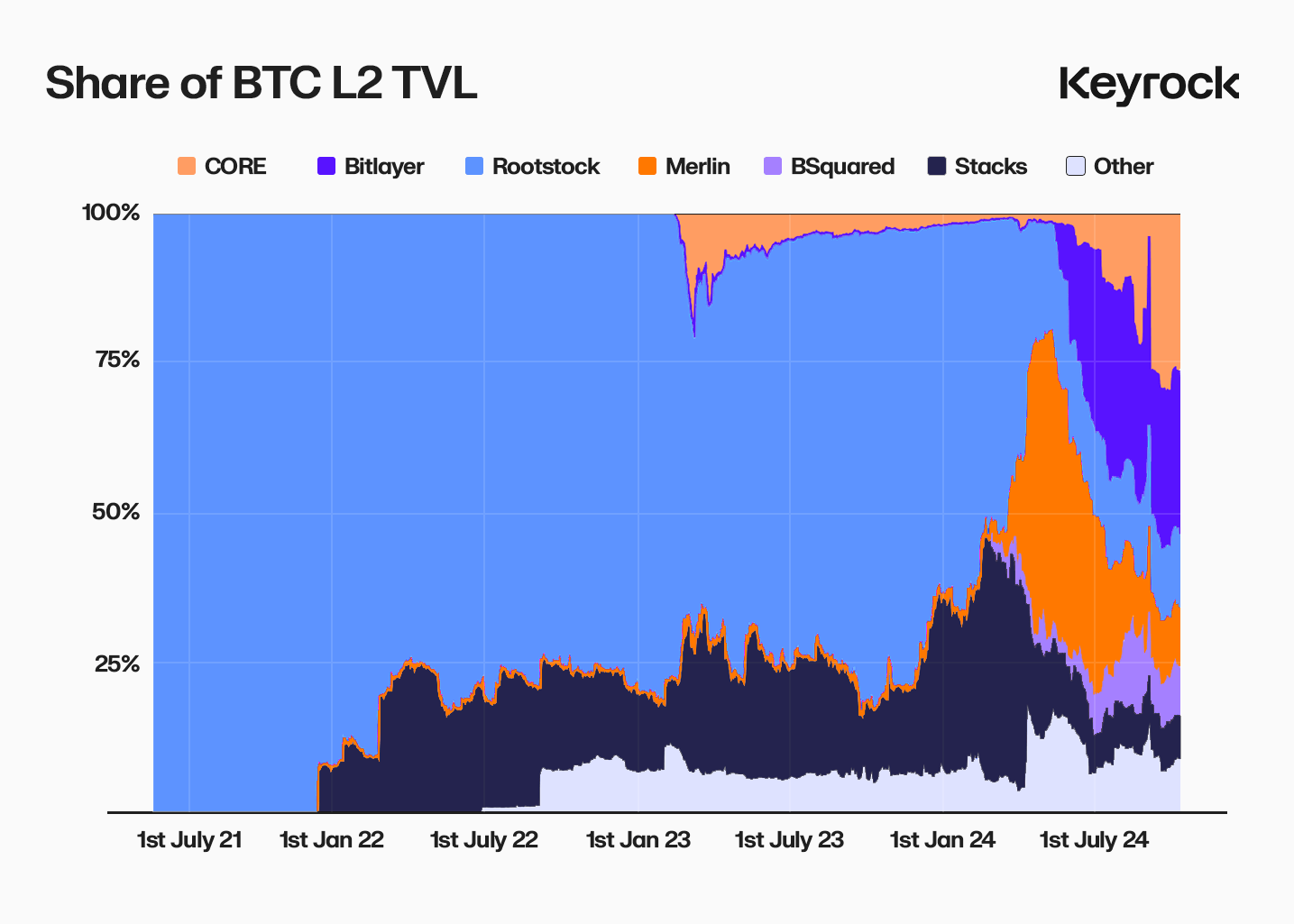

So what triggered this sudden uptick in growth? A dramatic change in the competitive landscape and influx of players. Until early 2024, Stacks and Rootstock were the dominant forces, controlling over 90% of TVL. While CORE existed, it wasn’t the powerhouse it has become today. By the start of the year, these two giants still controlled the vast majority of TVL. But that all changed quickly.

Over the course of 6mo, the arena saw the arrival of over 20 new L2s—including Bitlayer, Merlin, and Bsquared, diversifying and spurring competition. Today, the top six L2s account for about 92% of total TVL, but none of them hold more than 30%, indicating a healthy yet unresolved race for market share.

Long-standing players like Rootstock who saw significant positive TVL growth–nearly 50% since January have seen its market share fall from 61% to just 11%, demonstrating just how much jostling there is going on.

Putting things in perspective

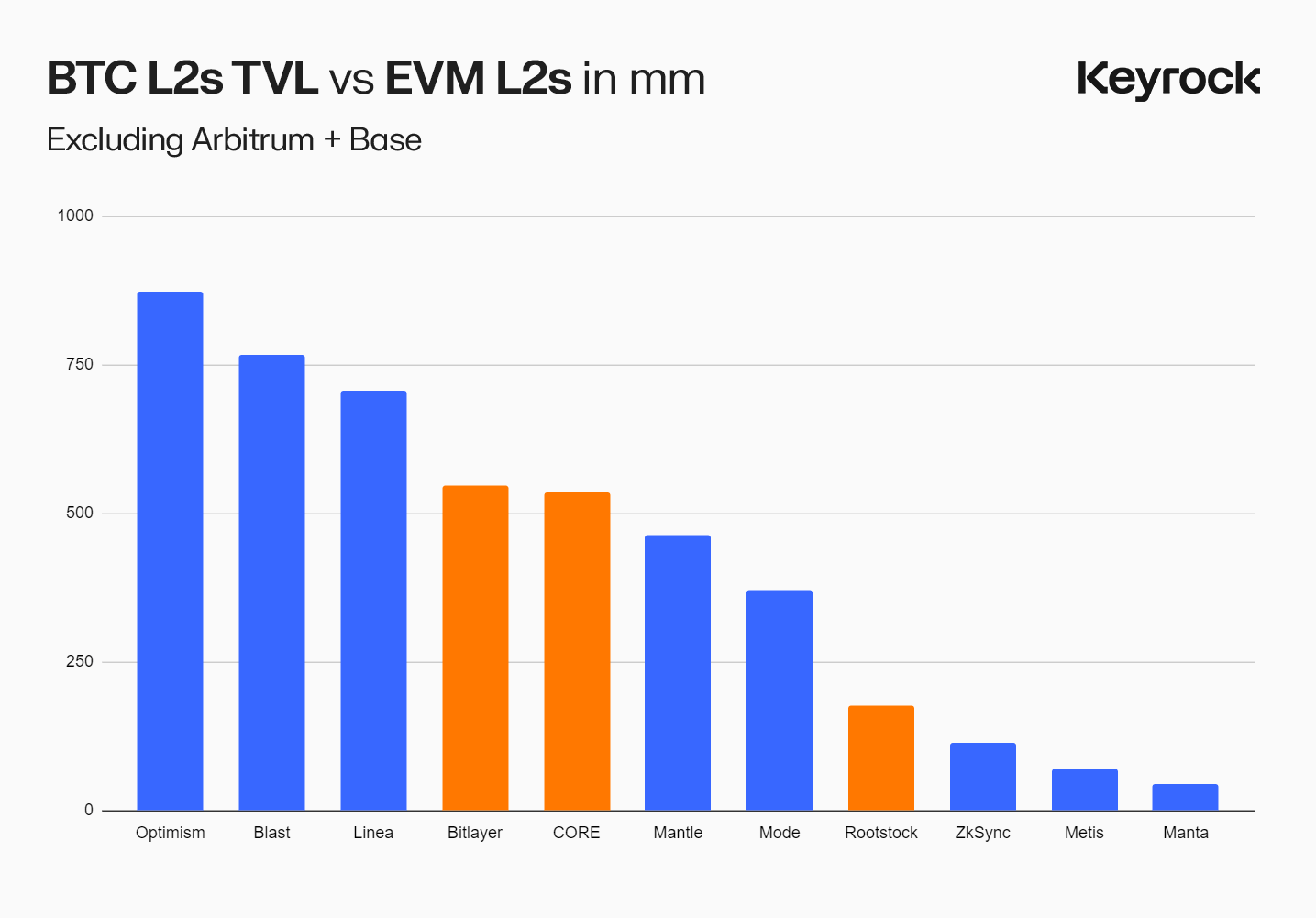

But this growth isn’t just large compared to the early years of BTC L2s. If we look at current TVLs in comparison to their larger Ethereum counterparts, Bitcoin L2s are making a strong case for themselves and clearly not to be ignored. While Ethereum’s ecosystem remains more mature and interconnected, the rapid growth of Bitcoin L2 variety and inflow suggest that if dApp accessibility and users come they might play at the same level. However as we will discuss they only seem to be going toe to toe for TVL not in usage, with respective growth being unmatched.

The Bridge to the other side

For every dollar of TVL on these L2s, a bridge had to be crossed. This is where things get messy. Each L2 discussed today has its own native BTC bridge to maintain control, but there are also multiple competing bridges. Since not all bridges connect directly from Bitcoin—some route through ETH-based EVMs—this creates confusion over which version of Bitcoin is the “right” one on these L2s.

For example, if you wanted to make a swap on Core’s CoreX exchange, you might need to choose from six different versions of BTC: native BTC, WBTC from ETH, BTCB from Binance, and three different versions of Solv BTC. This is not unique to Core; the same situation extends to most BTC L2s. As a result, it’s hard to accurately track how much BTC is actually bridged and what might be double-counted. Solutions like Solv aim to offer a multichain BTC, but with so many variants, most retail users are likely left confused—despite $300 million bridged to CORE.

Add in WBTC from ETH or its L2s, and the landscape becomes even more complicated. For many of these L2s, it may be worth simplifying the user experience by focusing on one or two BTC versions, even if it means sacrificing some bridged TVL.

Where is All the Bitcoin L2 TVL going?

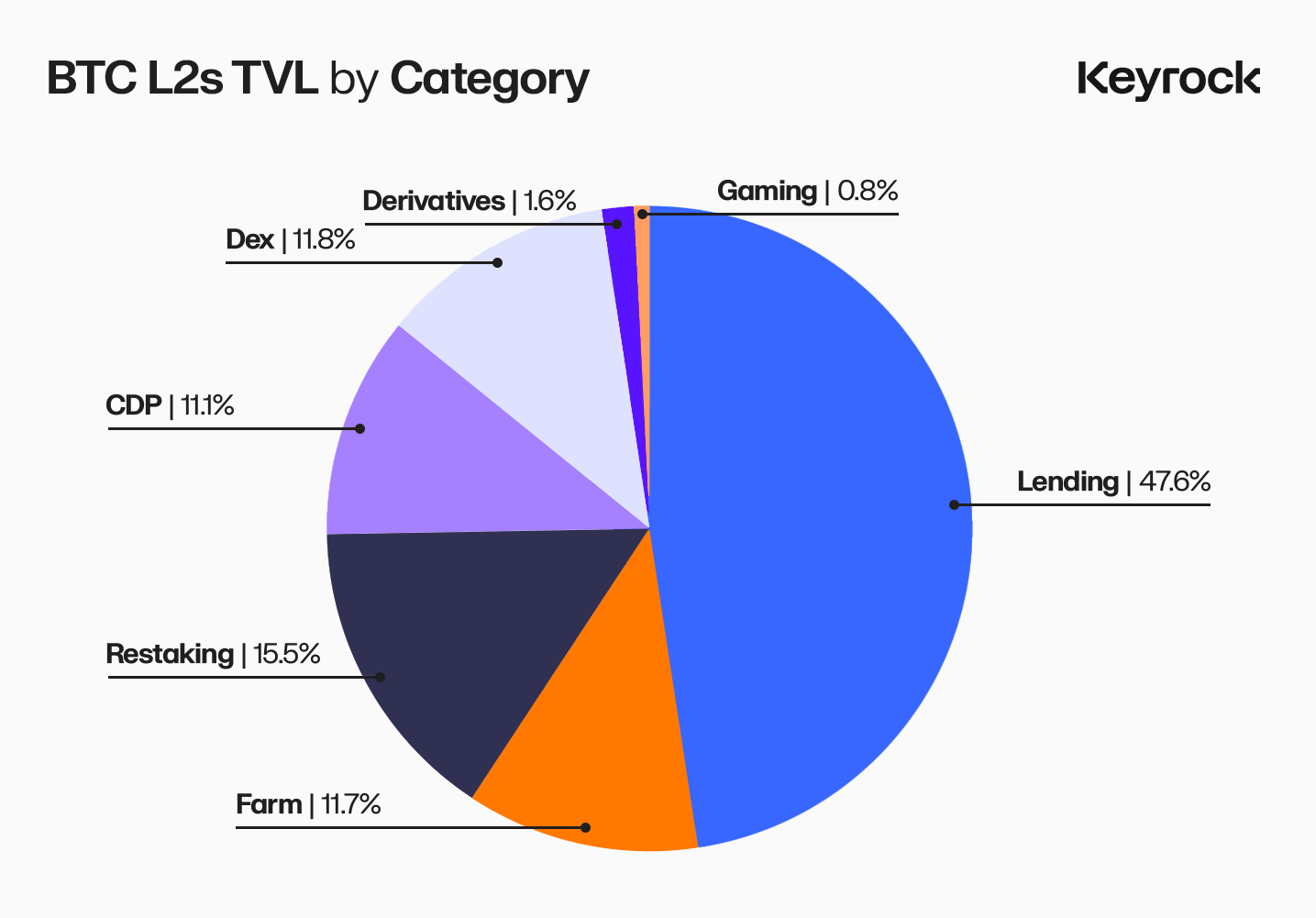

So, where is this liquidity actually flowing? Broadly speaking, the activities on Bitcoin Layer 2s (L2s) can be categorised into five main areas: Lending, Farming/Restaking, CDPs (Collateralized Debt Positions), and Decentralised Exchanges (DEXes).

These categories largely reflect the broader DeFi ecosystem, with one notable difference: the absence of bridging dApps to other chains. However it should be said the majority of the 26bn Bridge dApp TVL some 17.5bn is BTC ported to various EVMs (Ethereum Virtual Machine) rather than L2s.

Yet, given the diversity of allocation of liquidity across these categories, the key question becomes: how is it being utilised in each area, and which protocols are leading the charge?

Lending on BTC L2’s: A generous auction with few bidders

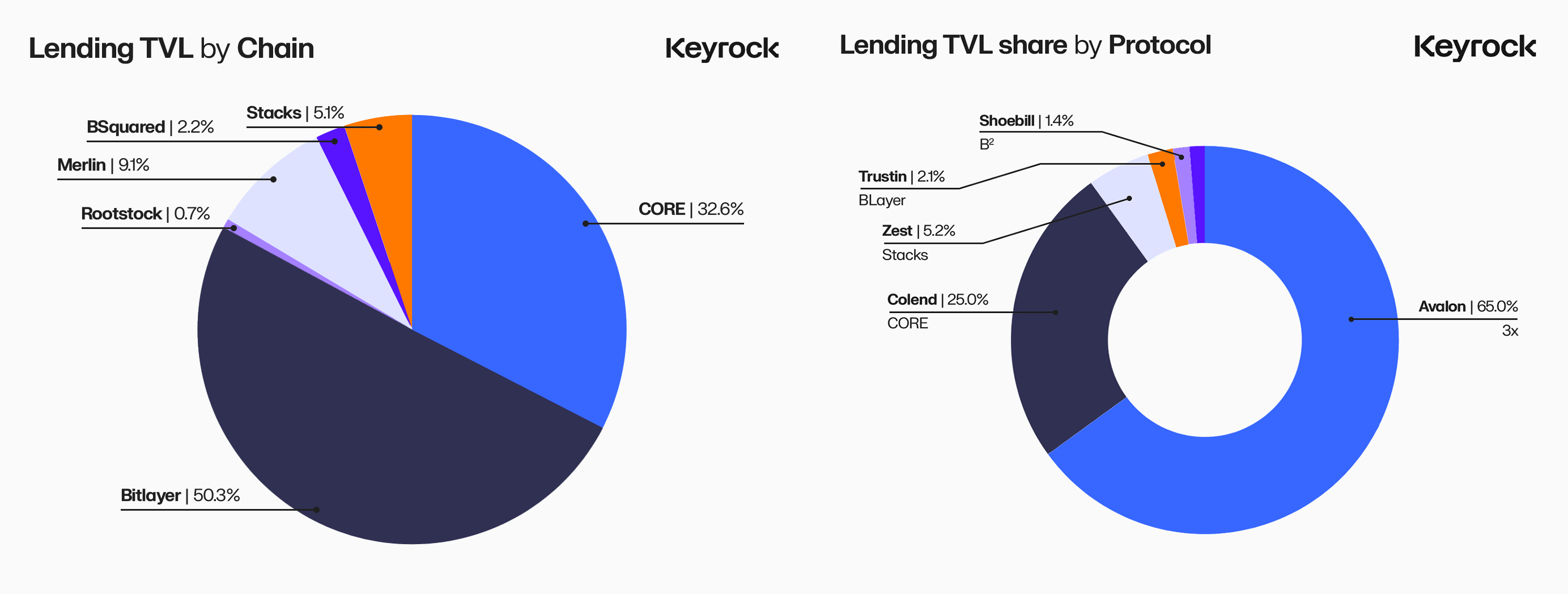

Lending stands as the largest category of DeFi liquidity on Bitcoin Layer 2s, commanding 47.6% of the TVL, which equates to approximately $711 million. Lending markets are an incredibly critical infrastructure in any financial system. These markets are essential because they redistribute capital to where it is most productive, allowing borrowers to unlock value and lenders to earn returns. This flow of capital drives efficiency, supports price discovery, and stabilises liquidity across the broader ecosystem.

Of the $711 million locked in lending markets, the majority is concentrated in Avalon Lending, a BTC L2 platform supporting multiple chains: Merlin, CORE, and Bitlayer. In second place is Colend, a native dApp on CORE. Despite these substantial figures, utilisation rates across the top six lending platforms tell a different story—most hover around or below 2%. Avalon stands out with a 33% usage rate, though this is largely driven by a wrapped BTC (WBTC) to BTC market on Bitlayer. Even when factoring in this outlier, the effective usage across these lending platforms remains an overly optimistic 21%, with our estimate of true market utilisation likely sitting closer to a mere 3-4%.

There are a few key factors contributing to this low utilisation. First and foremost is the scarcity of both backed and synthetic stablecoins across these Bitcoin L2s. Lending markets thrive on the exchange between volatile assets and stable, non-volatile assets, but there’s a glaring mismatch when we examine the actual issuance of stablecoins. For example, on CORE, there are only about $4 million in native USDT, which represents a mere 1% of the bridged BTC value on the chain. Similarly, USDC issuance on CORE stands at just $1.3 million.

This pattern repeats across other L2s. Rootstock’s internal stablecoin, DOC (Dollar on Chain), has a market cap of just $2.9 million, while Merlin’s bridged m-USDT shows a circulation of $1.2 million, with its native m-USDC at a smaller $387,000. While gaining a hard number is tricky given how many stable variations and unique bridges there are, we estimate that there are perhaps 25-30mm in accessible Stables on BTC L2s, some 2% of the total TVL.

The mismatch between liquidity and the demand for stablecoins likely drives low utilisation rates. Of the $25-30 million in stables, many are not available in ‘Native’ formats—being wrapped from other chains, having multiple versions, or being hard to redeem. We believe the solution lies in focusing on CDPs (Collateralized Debt Protocols) on respective chains minting within their ecosystems, rather than relying on external providers issuing ‘Native’ stables. If BTC is the future store of value, using it to back highly collateralized synthetic stables should pose no issue. Rallying around a ‘DAI’-like stable per protocol would streamline swaps, centralise liquidity, and reduce complexity. Later, we’ll explore the TVL in CDPs and which are succeeding.

In short, BTC L2s are still in their early days. The liquidity exists, but without sufficient stable assets or effective ways to deploy borrowed funds, supply far outweighs demand. This imbalance leaves a vast liquidity pool dormant, waiting for the right conditions to unlock its potential.

DEXes of Bitcoin L2’s: Lots of groceries, few cooks in the kitchen

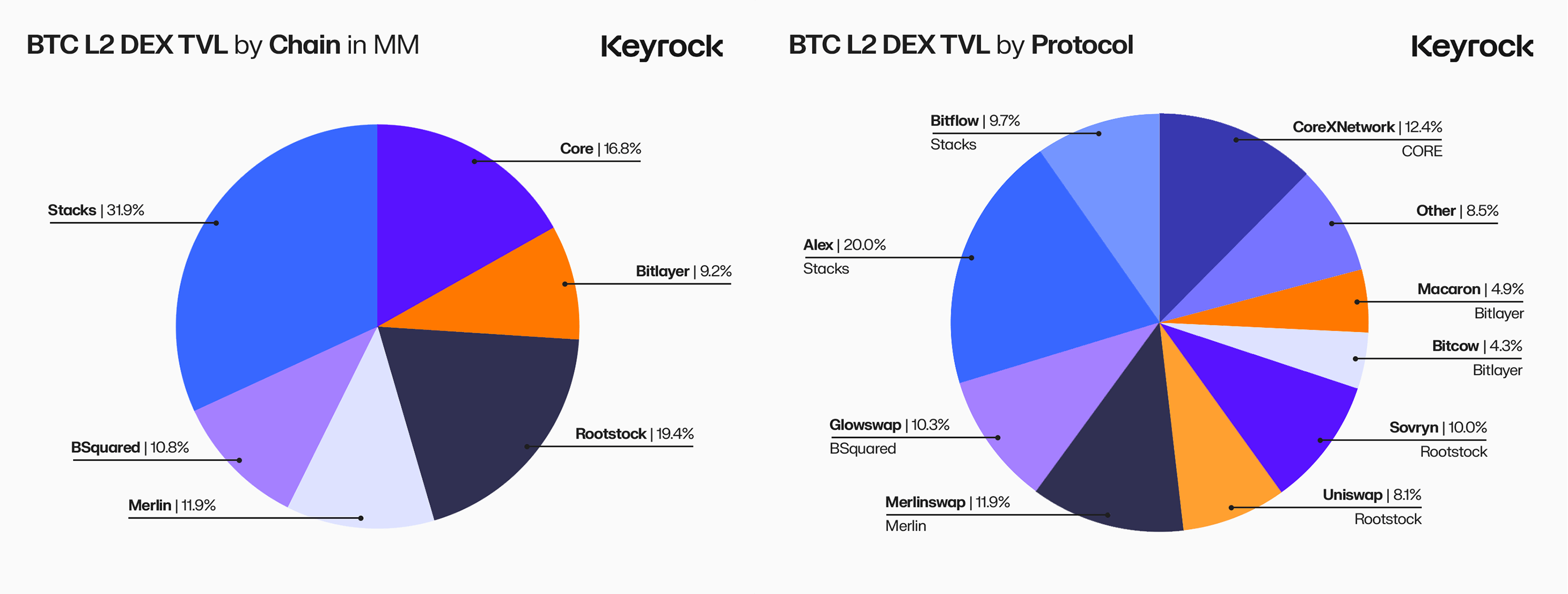

Let’s begin by skipping ahead to decentralised exchanges (DEXs), which currently hold the third-largest share of total value locked (TVL) on Bitcoin Layer 2s, accounting for approximately 12%, or $179 million. We will return to the second-largest category shortly, but DEXs warrant immediate attention due to their critical role in liquidity provision. Despite the integration of well-known platforms like Uniswap and Sushiswap on certain Layer 2s, no single protocol has managed to dominate the space. Notably, Stacks leads in DEX liquidity, even though it ranks as the smallest Bitcoin L2 by overall TVL. This makes Stacks the most active chain for swaps, at least from a liquidity standpoint.

All of the Top 6 L2s have their own Native or supported Dex developed in tandem with their chain with some having additional third party dApps as well. Liquidity here is decent on BTC pairs especially against their protocol’s native Governance or Utility tokens, often LP’d by the foundations themselves.

However, when we dig into the numbers for actual DEX usage, a familiar pattern emerges—similar to the lending markets, utilisation is relatively low. Aggregating data from the week of October 10–17, we observed a total volume turnover of approximately $28 million across all DEX protocols on Bitcoin L2s, equating to around 16% of the available liquidity. For context, compare this to Uniswap V3, which boasts $3 billion in TVL and racked up $12 billion in volume over the same period—yielding a turnover rate of 400%, a factor of 25x higher than Bitcoin L2 DEXes.

This in turn creates a problem in that for users coming onboard looking to put their assets to work there is little reward for the risk of impermanent loss they may be taking. Most of the major pools seem to only offer low single digit APRs often under 3%. Some protocols offer generous “Farming” incentives to potential LP’ers but many of the biggest pools still largely consist of the initial liquidity used to create it.

One challenge that Lending markets face is also present here — a shortage of stablecoins to pair against these pools. As a result, despite the 179mm in liquidity, much of it consists of one-sided Uni V3 ranges, LSD/BTC pairs, or Native-Token/BTC pools. However, this doesn’t reflect a lack of demand to swap BTC for stablecoins and vice versa on-chain, away from centralised exchanges. It’s simply that much of this activity is taking place elsewhere.

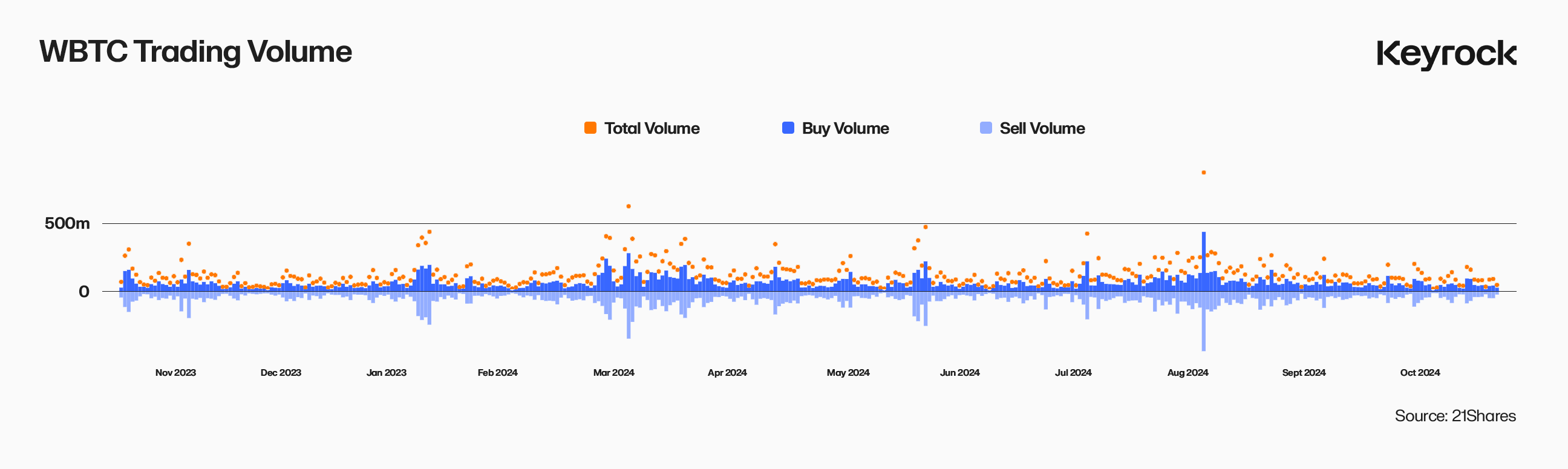

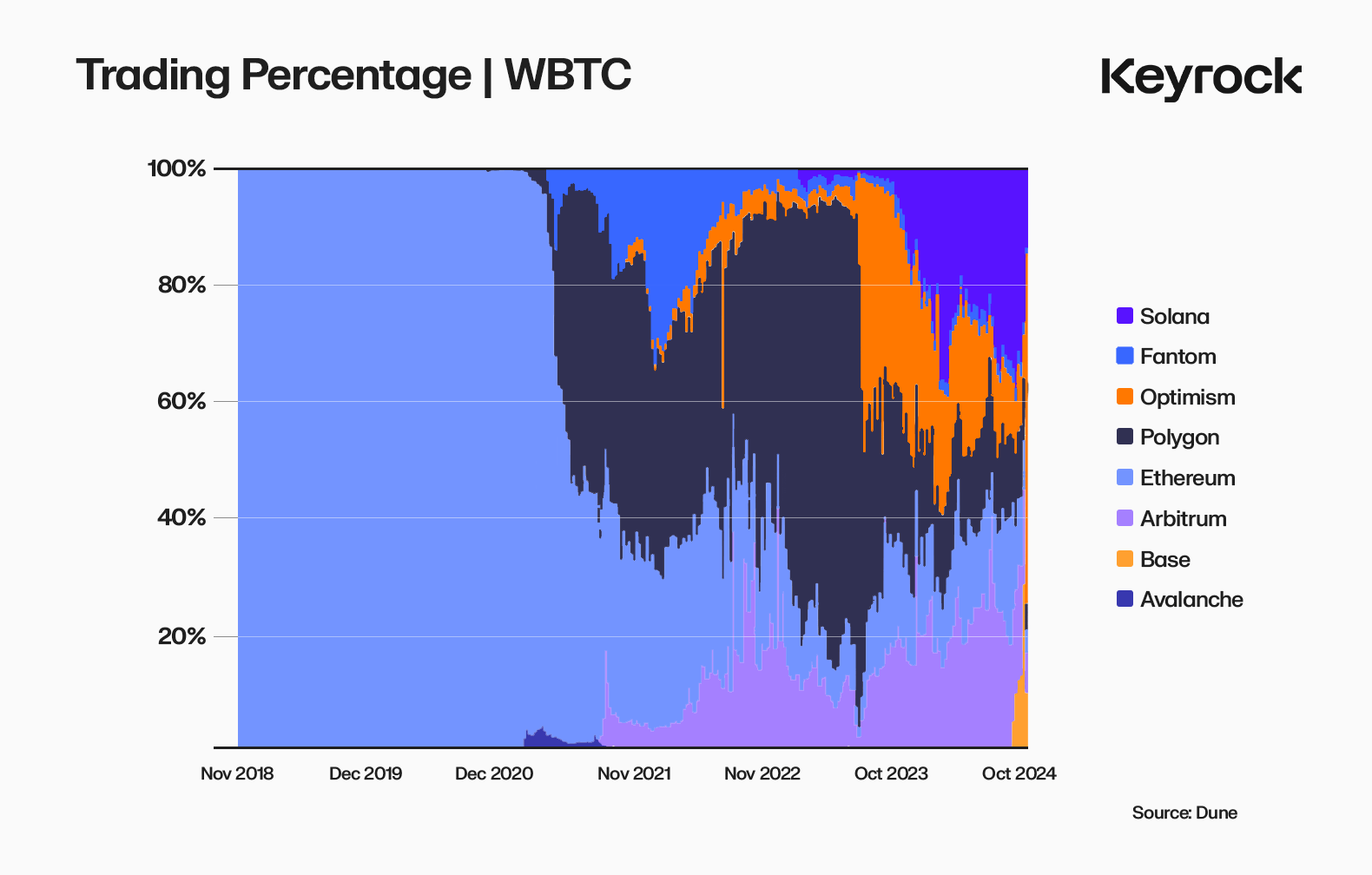

The truth is most onchain BTC Defi activity occurs on Ethereum & ETH L2 or other major chains like Solana, where Wrapped BTC (WBTC) dominates. These collective pools across non L2 platforms regularly see around $100 million in daily swap volume—three times the weekly total of all pairs on Bitcoin L2s combined.

WBTC has had a while to build the trust and dominance over these BTC L2s, having launched 2019 predating every BTC L2 except Rootstock. So with liquidity spread thin and a well-established WBTC ecosystem on larger chains, traders lack the incentive to bridge to Bitcoin L2s for their swaps. Add on the complexity of managing Uni V3-style LPs, which require active position management for optimal rates, and the dire lack of both synthetic and native stables and we see the disappointing volume and lack of users we have today.

The deeper question is: what role do Bitcoin L2 DEXes seek to play in the broader crypto landscape? Large BTC swaps typically happen through OTC providers like Keyrock, B2C2, or Cumberland, where large firms and whales can easily access fiat or stables. Those who trade very actively or with large margin still largely prefer CEXs (though this is slowly changing). And for those who care about staying on chain, the vast majority of BTC to swap is concentrated on Ethereum or its L2s with far deeper pools with less slippage and more versatile & exotic trading options.

It’s clear those who believe in Bitcoin L2s and have ported their BTC have put their money where their mouth is commitment wise but it is not enough. It is our opinion that in large part for the future of L2 Dexs and the networks themselves to succeed they need to focus on capturing the swap volume market share on liquid BTC across external blockchains, making Bitcoin L2s the hub to do so. This will take a combination of increased non-volatile asset pairs as well as easier bridging and onboard as well as LP incentives to pull off.

Farming & Restaking on BTC L2s: Seeds waiting for rain

Moving back up to the 2nd and 3rd largest categories of TVL are Farming and Restaking, which account for a total of 11.7% and 15.5% of TVL respectively. Because of their similarities and overlap we will talk about them in tandem. Starting with Farming and its 172mm in TVL we have to acknowledge that this is a harder category to quantify, as the definition of farming can vary. On some L2s, farming refers to adding liquidity to pools, while on others it involves contributing to network security through Proof of Stake (PoS). The line between farming and restaking often blurs.

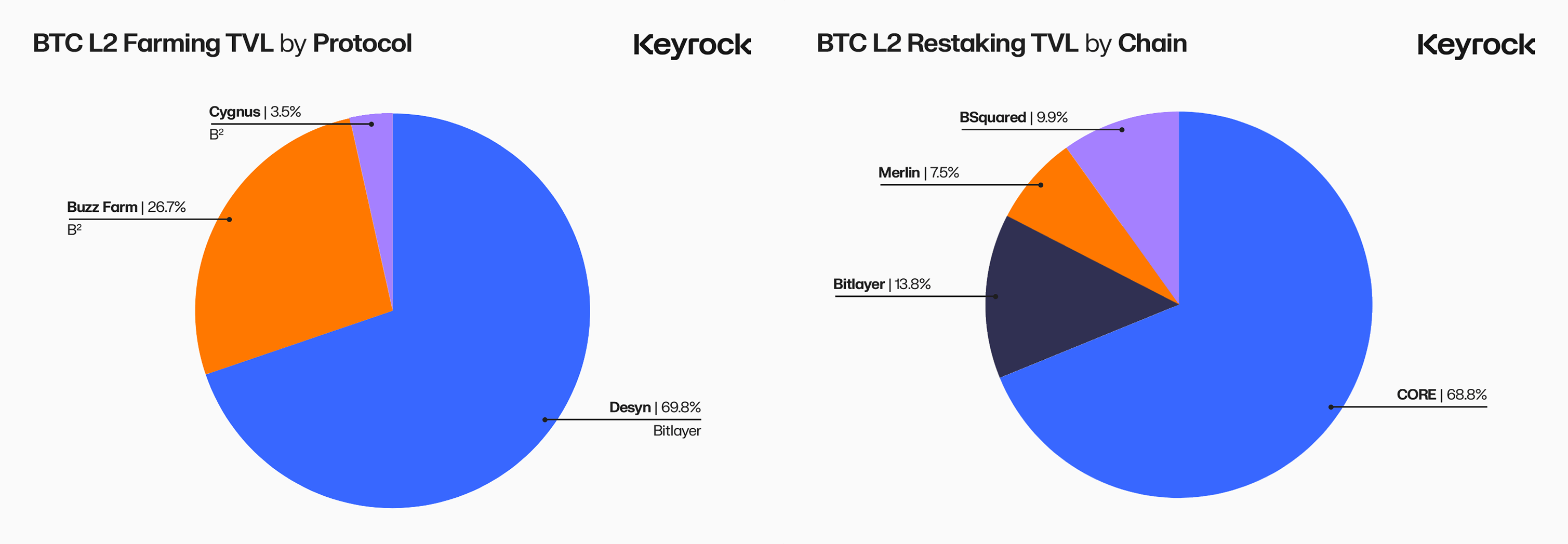

For our count we are only looking at the couple major protocols that claim to be purely farms, primarily focusing on two main protocols: Desyn and BSquared, which together account for nearly all the BTC TVL in farming. While technically many Dexs and Lending markets offer a way to utilise liquidity to “Farm” yield most of these are wrappers for depositing into either a Liquidity Pool or Lending Pool and thus would double count TVL.

The Desyn mystery

The first Farm we want to call attention to is Bitlayer’s Desyn, the largest with $123 million in liquidity or some 8% of total BTC L2 TVL. It operates a “flexible” system where users deposit Tokens into “Funds” controlled by onchain managers to generate yield functioning like a Vault or a Hedge Fund. On the face of it, it’s quite a good idea yet not new, one of the early stars of Defi on Ethereum was Yearn Finance, who saw meteoric success in 2021 with TVL peaking at nearly 7bn in November. No doubt if Desyn is positioning itself to take this mantle there are lingering questions that need to be answered.

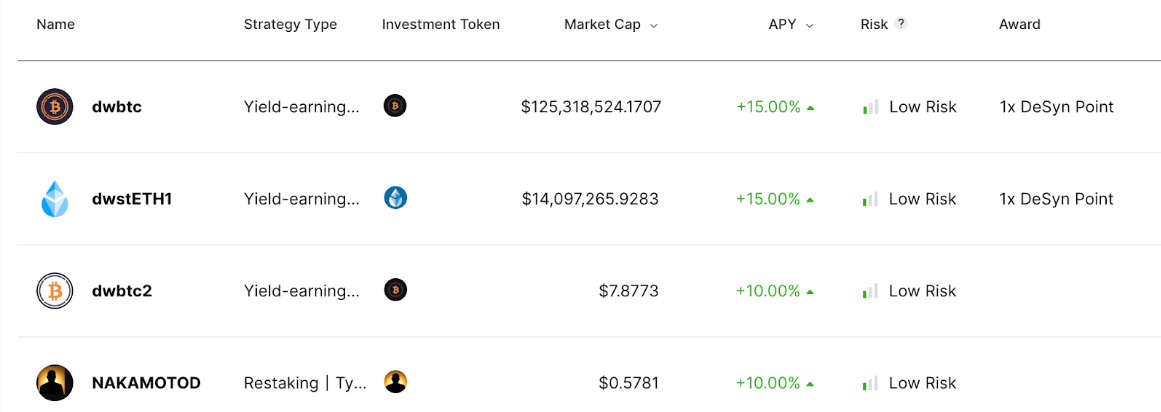

When we actually breakdown Desyn’s TVL we find that all of it is locked in just two funds: dwBTC and dwstETH, with stated yields of 15% and 15%, respectively.

On its own this isn’t strange, yet neither of these funds shows any activity and are only composed of 4 depositors, 1 for dwstETH and three for dwBTC. This liquidity is verifiable on Bitlayer’s explorer but it’s role in the ecosystem remains unclear. Each fund quotes a flat 15% APR which we cannot verify, and the management has no record of activity. Our best guess is that some of dwstETH’s yield comes from staking rewards but for dwBTC the funds just seemed to be parked. With dwBTC’s case the only sign of life outside the three depositors is a single sentence for the strategy introduction, “simple deposit wbtc and earn 1 x point form desyn and bitlayer(tba)”

BSquared farming

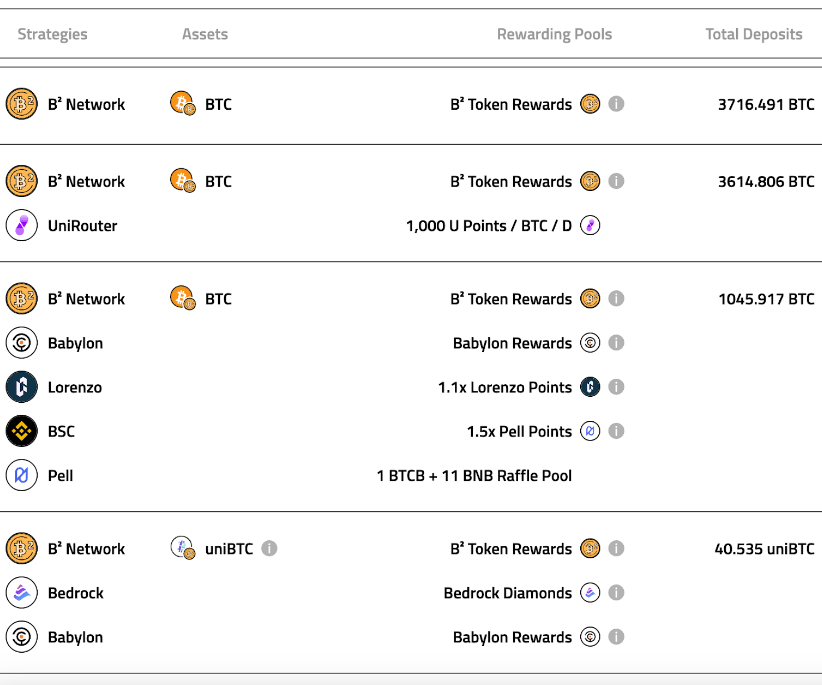

The second-largest farming protocol is BSquared Buzz Farming, which offers yield-generating strategies for bridged BTC. Despite the platform’s claim of managing $250 million, we can only verify about $47 million of actual liquidity on-chain. Like Desyn, BSquared doesn’t offer traditional token yields—instead, rewards are distributed in points, leaving users without clear immediate gains.

Buzz farming draws liquidity in multiple ways, accepting BTC in six different wrapped formats. However, much of this liquidity isn’t being actively utilised; instead, most farms simply park it in contracts that issue B² tokens. While some farms that accept uBTC, a multichain-wrapped version of BTC, claim the liquidity supports underutilised routers or contributes to network security, the lack of transparency from both B² and UniRouter makes it difficult to gauge their true impact. Currently, the options for hands-off BTC farming on L2s remain limited. But as DeFi ecosystems expand and yield-generating opportunities emerge, we could see more sophisticated farms or even aggregators similar to Yearn or Convex, which thrived in the early days of EVMs.

The Pell monopoly

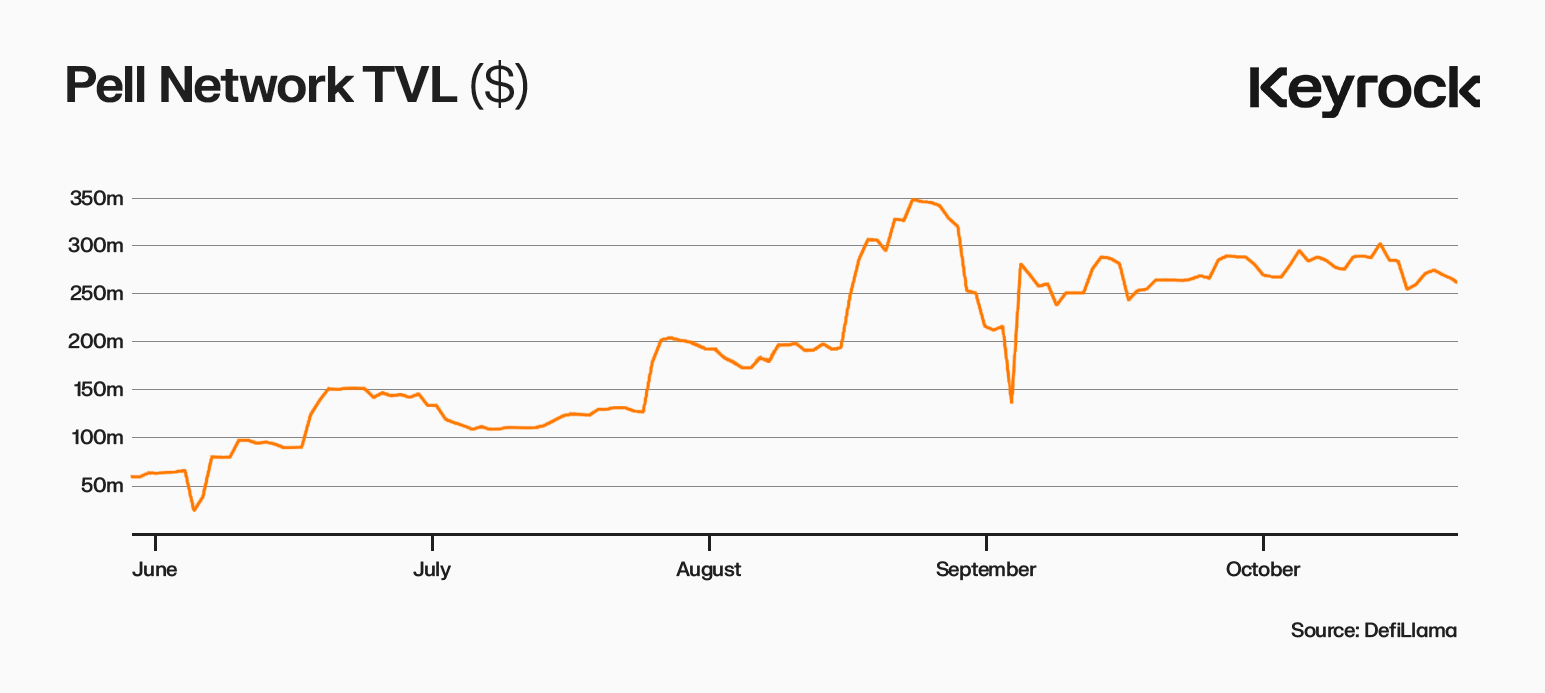

The second-largest category of Bitcoin L2 TVL is restaking, with around $235 million in total value locked, nearly all of which is parked with Pell Network. This provider operates a restaking service across multiple L2s, including Lightning Network. It’s no surprise that restaking dominates this space, mirroring the largest TVL category in DeFi: Liquid Staking. But what exactly is Pell Network, why does it exist, and how does it accept so many different forms of BTC?

Unlike Ethereum or Solana, Bitcoin does not generate native yield through staking, as it relies on Proof of Work. Thus, there’s no way to earn more Bitcoin simply by holding it, with yield only generated through mining. However, many of the L2s securing BTC liquidity use Proof of Stake, rewarding participants with native tokens—not more BTC. This disconnect leaves users questioning whether converting their BTC into various Liquid Staking Tokens (LSTs) is worthwhile, especially since many L2s haven’t launched governance or utility tokens yet.

Pell Network steps in as an infrastructure solution to the growing Bitcoin ecosystem, offering services like data-availability layers, validation, and oracle networks. It accepts various forms of BTC and LSTs from newer chains like Merlin, Bitlayer, and Core to secure its meta-layer. However, while Pell’s vision is ambitious, its role may conflict with the L2s it aims to support, potentially creating redundant infrastructure. This scepticism is shared by projects like Stacks and Rootstock.

Regardless its this flexibility in accepted deposit types across chains that have won TVL over. Anybody on these L2s who has already parked their BTC to secure their network in exchange for an LST can then restake it in Pell to get additional “Yield”. However as we understand most of this yield is often just as abstract as what users get on the L2 itself, with Pell just giving out “Points”.

Restaking, in principle, offers an exciting opportunity for users already contributing to the security of PoS networks to extract more value from their assets. Pell Network taps into this potential, positioning itself as a multi-layered infrastructure solution. Yet, questions linger around its long-term sustainability and true use case. If users are already satisfied with the rewards from traditional staking, would they still be drawn to farm Pell points?

For us, the added security risk of introducing another layer, which could become a point of failure for smart contract exploits, raises valid concerns. While Pell’s ambitions are bold, the question remains whether this additional complexity and risk outweighs the potential rewards. Nonetheless, if Pell can address these uncertainties, its model could unlock new possibilities for BTC holders within the PoS ecosystem.

The Staking alternative

While not counted towards our TVL numbers there is a point of contrast to be made with the four new BTC L2 networks against the older established Rootstock and STX.

Rootstock secures its network through Merge Mining, that is, those who are mining BTC already can opt in to effectively simultaneously mine Rootstock blocks as well, this ties the security of Rootstock directly to the Bitcoin blockchain, though the miners do not receive anything but the BTC they mine in return they only need to spend a very little processing overhead to help secure the RSK protocol. Given there is not PoS there is no room for staking.

As for Stacks, it also operates with its own proprietary consensus mechanism, Proof of Transfer (PoX). Sparing the technical details, PoX allows STX holders to earn BTC rewards and BTC stakers to receive STX while participating in validation. This self-contained reward system helps grant innate value to the STX token and offers those holding it a way to gain real tangible yield.

Ultimately with few other places currently available for those on PoS L2s to put their LSTs to use it is not a shock it has migrated to the only other place, Pell, even if little is received in return. There is no doubt this liquidity can likely be put to better more tangible use and be freed up, the question is which of the protocols will be the first to figure that out or offer a reward good enough to fully satiate stakers.

CDPs on Bitcoin L2’s: Future kingmakers?

Last up we have Collateralized Debt Position (CDP) protocols which account for about $168 million, or 11% of BTC L2 TVL, and arguably represent the most concrete use case we’ve discussed so far. For those unfamiliar, CDPs allow users to mint synthetic stablecoins using non-stable assets—in this case, BTC. These stablecoins can then be swapped for other assets, serve as a synthetic short on BTC, or be traded for actual stables and lent out.

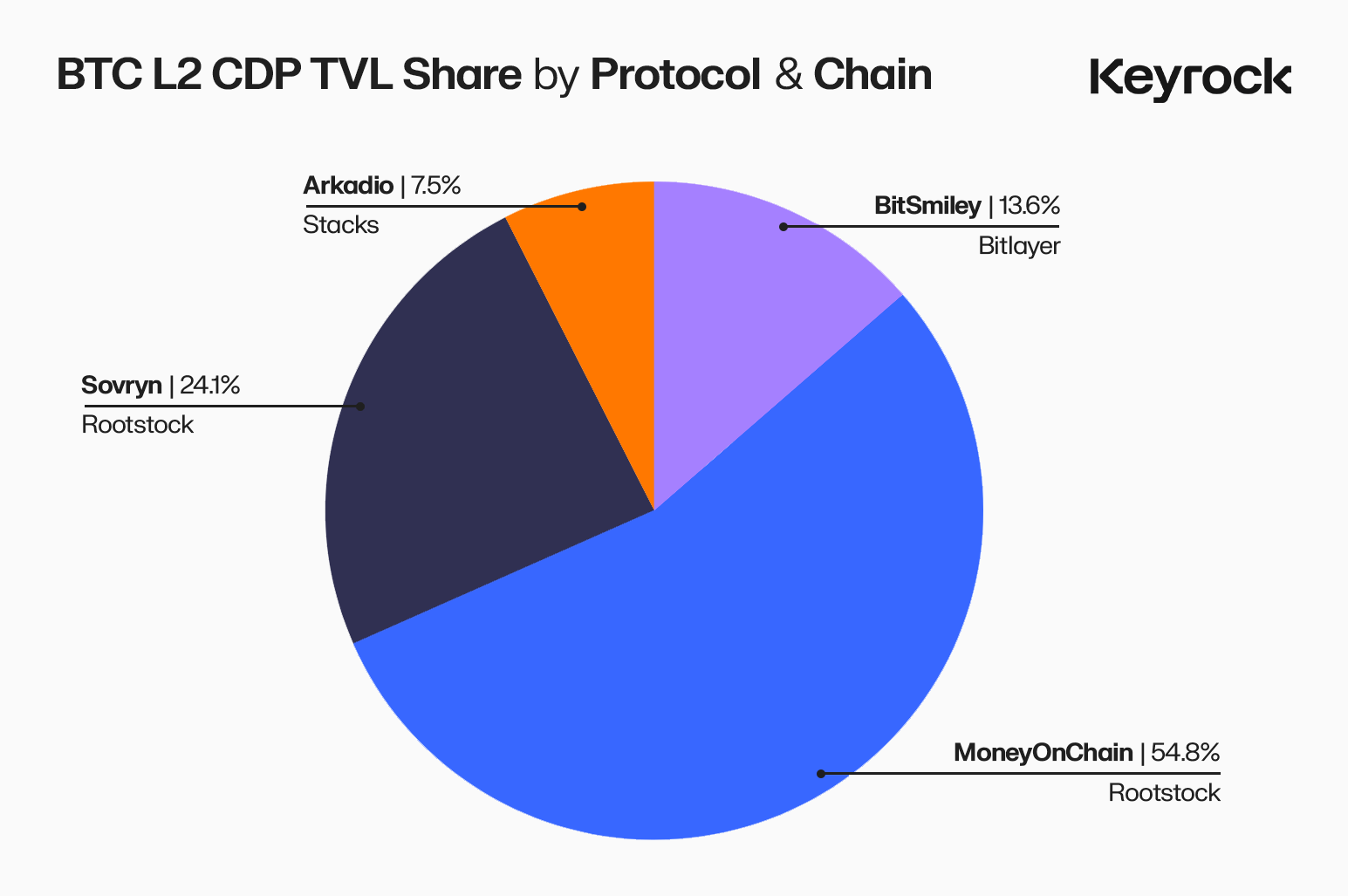

Across the six Bitcoin L2 chains we’ve studied, there are only four CDP protocols of note, with the bulk of CDP TVL concentrated on Rootstock, the oldest and most mature chain, where demand for such assets has been long-established. The remaining TVL is distributed across Bitlayer and Stacks.

However, despite the $168 million in CDP TVL, only a small fraction has been converted into synthetic stablecoins, our estimates put this at around 15mm or half of total stablecoins across all L2s. Much of the liquidity is simply parked within these protocols, leading to inefficiencies as a result significant over-collateralisation.

MoneyOnChain (MoC)

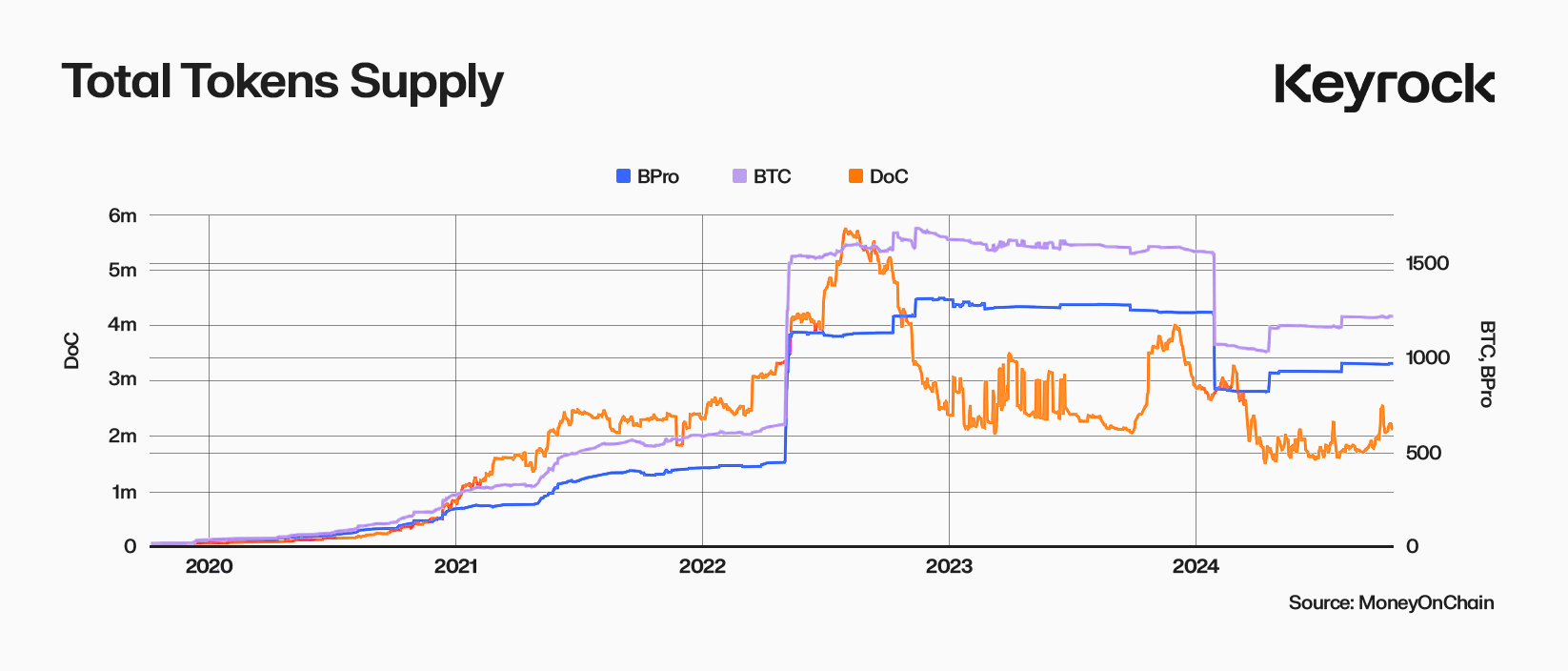

Case in point: Rootstock’s Money on Chain (MoC) protocol, the first CDP and one of the longest-running DeFi protocols on BTC L2s, holds $84 million in TVL yet has only minted $2.9 million in DoC (Dollar on Chain) stablecoins. Unlike traditional CDP protocols, MoC uses BPro, where Bitcoin holders seeking yield and leveraged BTC exposure provide the collateral backing DoC. This design links stablecoin minting to demand for leveraged Bitcoin products, rather than just collateral thresholds.

The minting of DoC is limited by this structure. Instead of relying solely on deposits meeting collateral ratios, DoC issuance depends on the activity of BPro holders and leveraged traders using BTCx. This balancing act ties DoC’s supply to market dynamics, making it less straightforward than typical CDP systems.

While this mechanism is innovative, offering Bitcoin holders both stablecoins and leverage, it also slows DoC’s growth. There is capacity for over five times the current amount, but issuance depends on user engagement. And with a UI that seems to have been left un updated since launch perhaps a facelift is necessary. Ideally with tweaks and increased attention more participants might join, and the system’s potential can be fully realised.

Sovryn

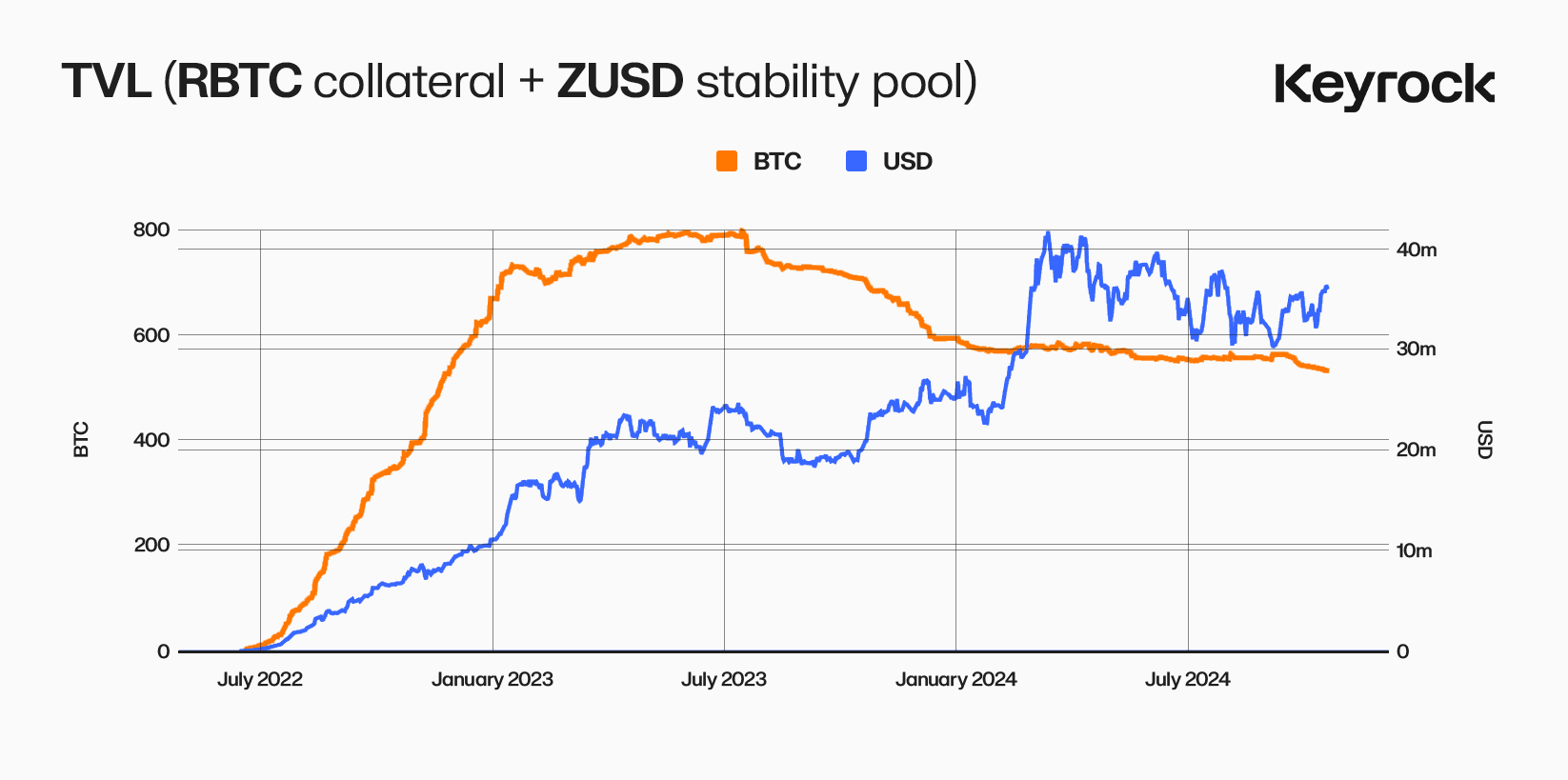

Next on the list is another Rootstock dApp Sovryn, also not a purely CDP platform it combines DEX services, margin trading, lending pools and market making alongside its CDP minting. Of its 60mm in total TVL $36 million in TVL allocated to its CDP minting system, Sovryn Zero. This all under one roof approach is unique to any other L2 dApp, and sets Sovryn up to both create market share on one suite of products and capture it internally with another.

Sovryn’s stablecoin, ZUSD, is backed by BTC with relatively low collateral requirements and offers near interest-free borrowing, although it lacks atomic redemption. Despite $36 million (531 BTC) collateralising the Sovryn Zero protocol, only $3.1 million ZUSD is currently in circulation, reflecting an overcollateralisation ratio of more than 1,100%. Both MoC and Sovryn face similar challenges, as their overcollateralised stablecoins compete for limited market share, fracturing liquidity pools. In response, Sovryn introduced DLLR, a meta-stablecoin that can be minted from multiple sources, including DoC and ZUSD, with the goal of streamlining stablecoin usage within DeFi on Rootstock.

With only $2.1 million DLLR minted so far, adoption is still in its early stages. Rootstock has the infrastructure in place to support a broader push for stablecoins, and Sovryn’s strategy of integrating MoC’s stablecoin, rather than competing with it, is a smart move toward consolidating liquidity. What’s needed now is for users on Rootstock to trust these stablecoins and actively utilise them. Increased adoption will create a virtuous cycle, where greater usage leads to even more utility and liquidity within the ecosystem.

BitSmiley

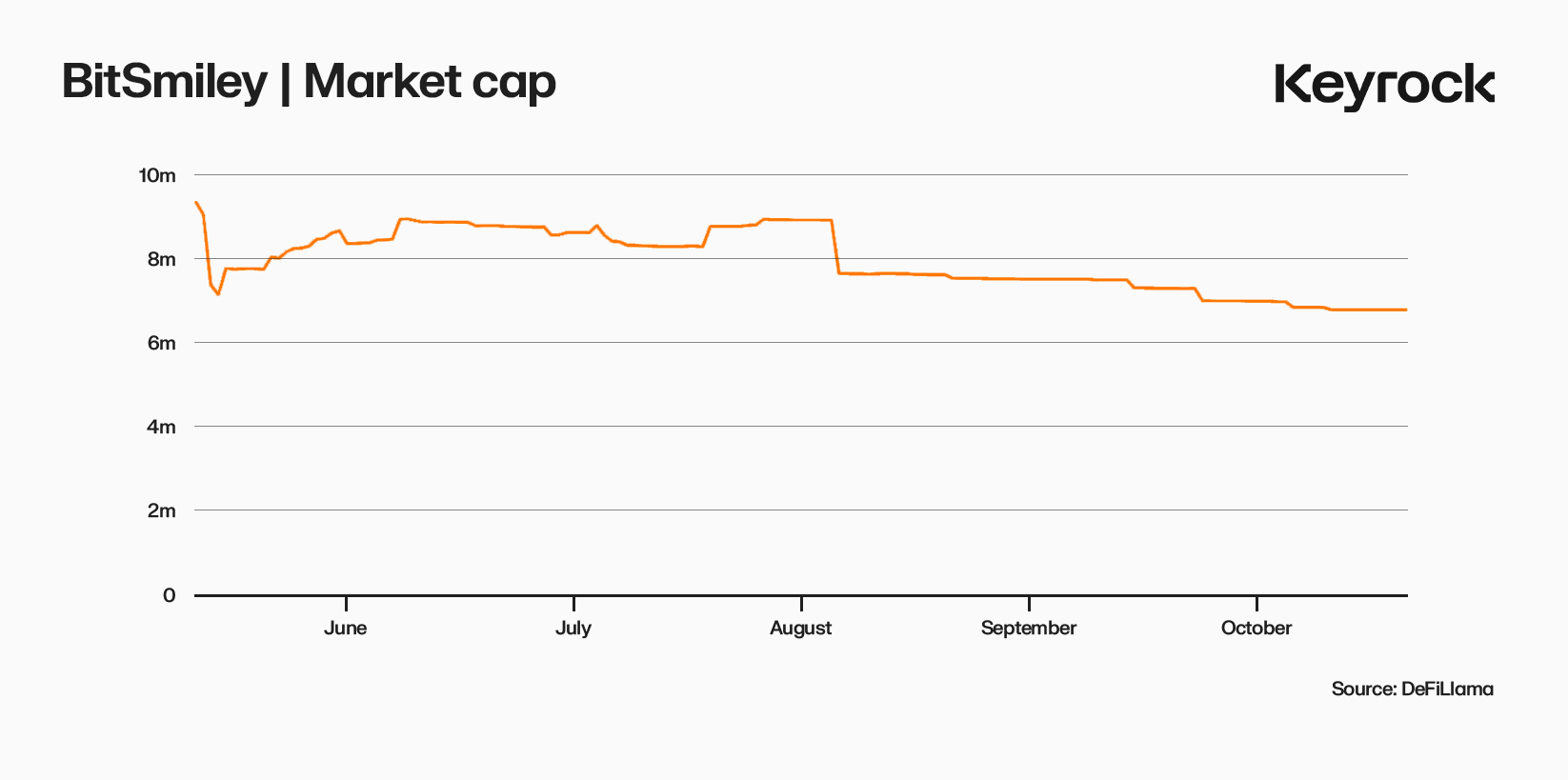

BitSmiley, Bitlayer’s native CDP protocol, takes a more straightforward approach to CDP minting with its stablecoin BitUSD. Sporting a retro-style UI, it offers a simple mechanism for turning BTC into BitUSD. With $28 million in TVL and $6.7 million BitUSD in circulation, Bitsmiley has outpaced the previous two CDPs in terms of issuance, despite having a smaller collateral base.

However since launch the total BitUSD has slowly gone down as there still is not much use for it in Bitlayer’s Defi ecosystem.

Whereas others suffer from lack of stables but an abundance of use cases Bitlayer has a great CDP with few places outside its native Dex to truly put the assets to work. Perhaps through incentive programs and the launch of fresh new dApps focused around accepting BitUSD can Bitlayer see a surge in real user activity.

The CDP Necessity

While crypto is exciting and financial gains come from volatile assets, DeFi, the facilitator of on-chain action, remains tied to stablecoins and will continue to be. Without that crucial component, lending markets dry up, DEXes see decreased use, and users seeking to de-risk have limited options. Across many of the L2s surveyed today, there’s significant value locked, but few opportunities to exchange it for something else. This hampers usage, dissuades users, and leaves much of the TVL collecting dust.

Additionally, the stablecoins that do exist on-chain are fragmented across various forms and bridge versions, with native and non-native assets competing against each other. With USDT minting and redemption still restricted to sophisticated parties, and Circle pushing USDC primarily on base L2s, we believe each protocol should aim to solve the stablecoin problem internally. Those already offering strong CDP solutions should focus on driving further adoption.

In recent years, synthetic stablecoins have developed a bad reputation, with Luna’s UST being a major offender. Users are still regaining trust. However, stable and reliable CDPs do exist, with DAI as a prime example. Fresh approaches like Ethena’s USDe have also found rapid success. BTC L2s would be wise to replicate both established and innovative solutions to catalyse broader DeFi usage.

Conclusion

As it stands, the situation for BTC L2s is as precarious as it is promising. While billions of dollars are locked across protocols, low usage rates in lending, borrowing, DEX volumes, and idle farming suggest a disconnect between liquidity and actual demand. There’s no denying that the 50% month-over-month growth in 2024 is impressive, but user growth hasn’t kept pace, lagging behind at a fraction of that rate.

Bitcoin L2s are in a holding pattern—flush with capital but fighting over a scattered and still small user base to activate it. As in any market, liquidity without velocity leads to stagnation, and eventually, dissipation. Economist Joseph Schumpeter’s theory of creative destruction highlights that for true innovation to flourish, many competing protocols may need to consolidate to allow a few dominant players to emerge.

The fractured landscape and complexity are pushing users away. Many protocols excel in only one or two areas, but the lack of integration between them has resulted in a fragmented ecosystem that struggles to compete with the more unified offerings on Ethereum and Solana. Additionally, there’s no clear consensus on which stablecoin or bridge to use across chains. This, combined with a general drought in liquidity, especially for the stablecoins that are available, only exacerbates the disconnect between liquidity and demand.

DEX volumes on Bitcoin L2s are regularly 20 times lower than their competitors, lending utilisation is a quarter of what it is on other blockchains, and farming yields are often based on point programs. Those with large sums of capital appear to believe in the potential of Bitcoin L2s but haven’t yet converged on a clear winner. With few resources available to explain the differences between L2s, retail users are left navigating a foggy landscape.

Each of the six L2s discussed here brings something fresh to the table, powered by passionate teams trying to make their solutions work. The reality is that most Bitcoin on-chain swapping is still dominated by wBTC. If BTC L2s want to succeed, focusing on capturing this existing BTC DeFi demand may be the most viable path forward. To couple with this and for it to work these L2s need to have lots of stables available and given the fracturing of outside mainline stable providers focusing on inhouse CDPs with collateralized by the vast TVL already onboarded it a way to help this.

BTC L2s are a space worth keeping up with. The potential and the money are there, and as BTC’s price rises, more people may look to put their assets to work. But until a clear winner emerges,with a comprehensive integrated DeFi system, standardisation of bridging and ample stables available, Bitcoin L2s risk remaining a wealthy ghost town.

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.