Airdrops in the Barren Desert: Surveying the traits behind 2024’s 11% success rate

Gaining and retaining crypto users is tough. In our last article we dived into how Memecoins and Prediction Markets were used to onboard the masses. In this article we will analyse:

- The most successful and the biggest fails among 2024 airdrops

- How successful crypto projects were in retaining users

- How does the size of an airdrop influence the token price

- How High FDV damages token price

- What is the optimal ratio of Liquidity to FDV

Airdrops, offering free tokens, aim to attract long-term engagement but often lead to quick sell-offs. While some succeed in boosting adoption, many fail. This article examines how 2024’s airdrops fared and what influenced their outcomes.

Key Takeaways

Hard to keep up

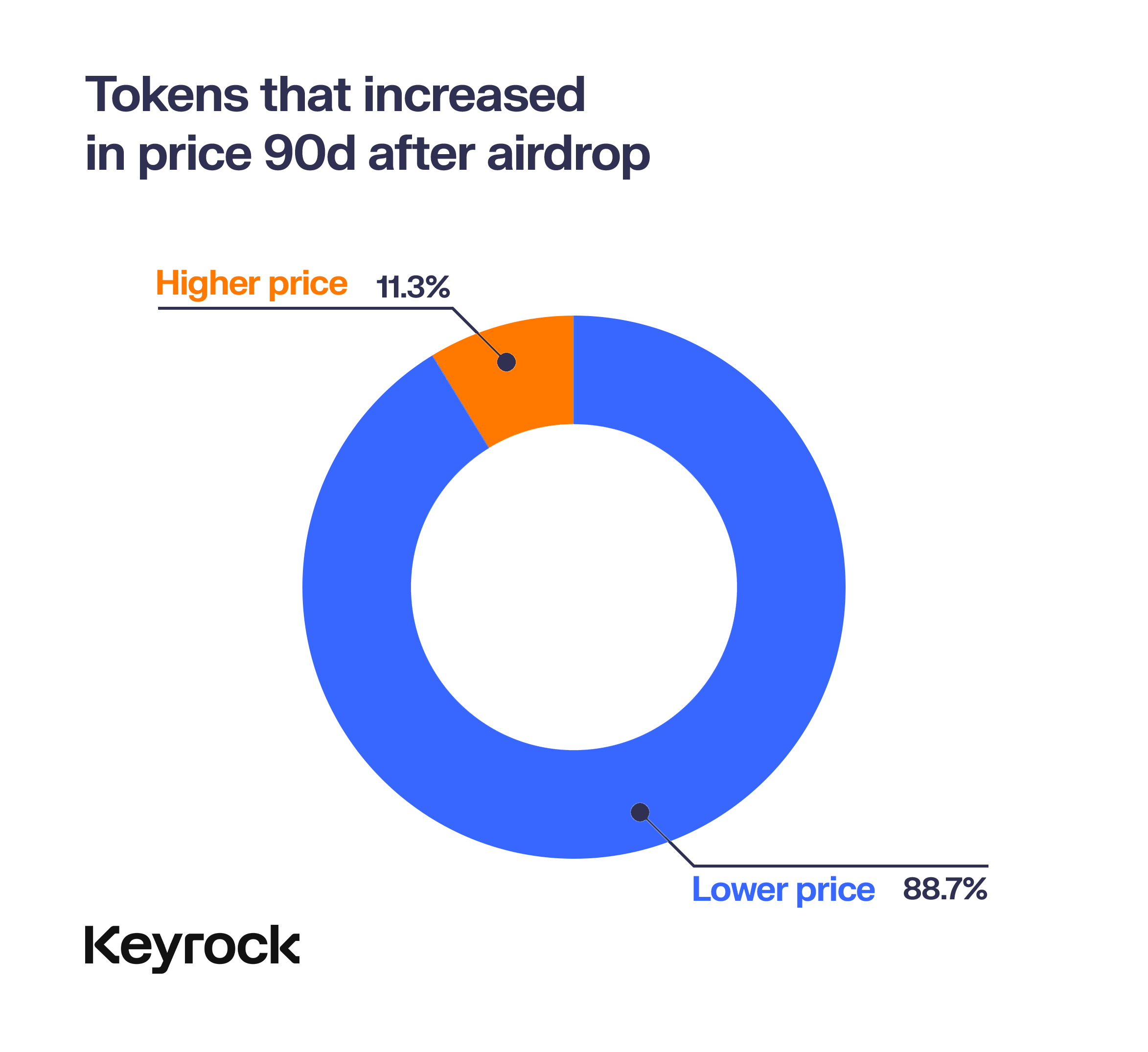

Most airdrops crash within 15 days. In 2024, 88% of tokens declined within months, despite initial price spikes.

Big drops, big wins

Airdrops distributing over 10% of total supply saw stronger community retention and performance. Those under 5% often faced quick sell-offs post-launch.

Targeting FDVs

Inflated Fully Diluted Valuations (FDVs) hurt projects the most. High FDVs stifled growth and liquidity, leading to steep price declines post-airdrop.

Liquidity is crucial

Without enough liquidity to support high FDVs, many tokens crumbled under sell pressure. Deep liquidity is key to post-airdrop price stability.

Tough year

Crypto struggled in 2024, with most of the airdrops hit hardest. The few successes? Smart distribution, strong liquidity, and realistic FDVs were their playbook.

Preparing for an airdrop? Get in touch for a personalised liquidity plan.

Airdrops: the double-edged sword of token distribution

Airdrops have been a popular strategy for distributing tokens and generating early hype since 2017. However, in 2024, many projects have struggled to achieve lift off due to oversaturation. While airdrops still drive initial excitement, most have resulted in short-term sell pressure which has led to low community retention and protocol abandonment. Despite this, a few standout projects have managed to buck the trend, demonstrating that with the right execution, airdrops can still deliver meaningful long-term success.

Purpose of this study

This report seeks to unravel the 2024 airdrop phenomenon—separating the winners from the losers. We analysed 62 airdrops across 6 chains, comparing their performance on several fronts: price action, user reception, and long-term sustainability. While individual protocols bring their own unique variables to the table, the collective data paints a clear picture of how effective these airdrops have truly been in achieving their intended goals.

The Performance of Airdrops in 2024

When examining the overall performance, the majority didn’t fare well post-launch. While a few saw impressive early returns, most tokens faced downward pressure as the market recalibrated their value. This pattern speaks to a broader issue within the airdrop model: many users may simply be there to farm the incentive rather than engage with the protocol long-term.

With all Airdrops, a key question arises—does the protocol have staying power? Do users continue to see value in the platform once the initial rewards have been distributed, or was their participation purely transactional? Our analysis, drawn from data across multiple time frames, reveals a crucial insight: for most of these tokens, the enthusiasm fades quickly, often within the first 2 weeks.

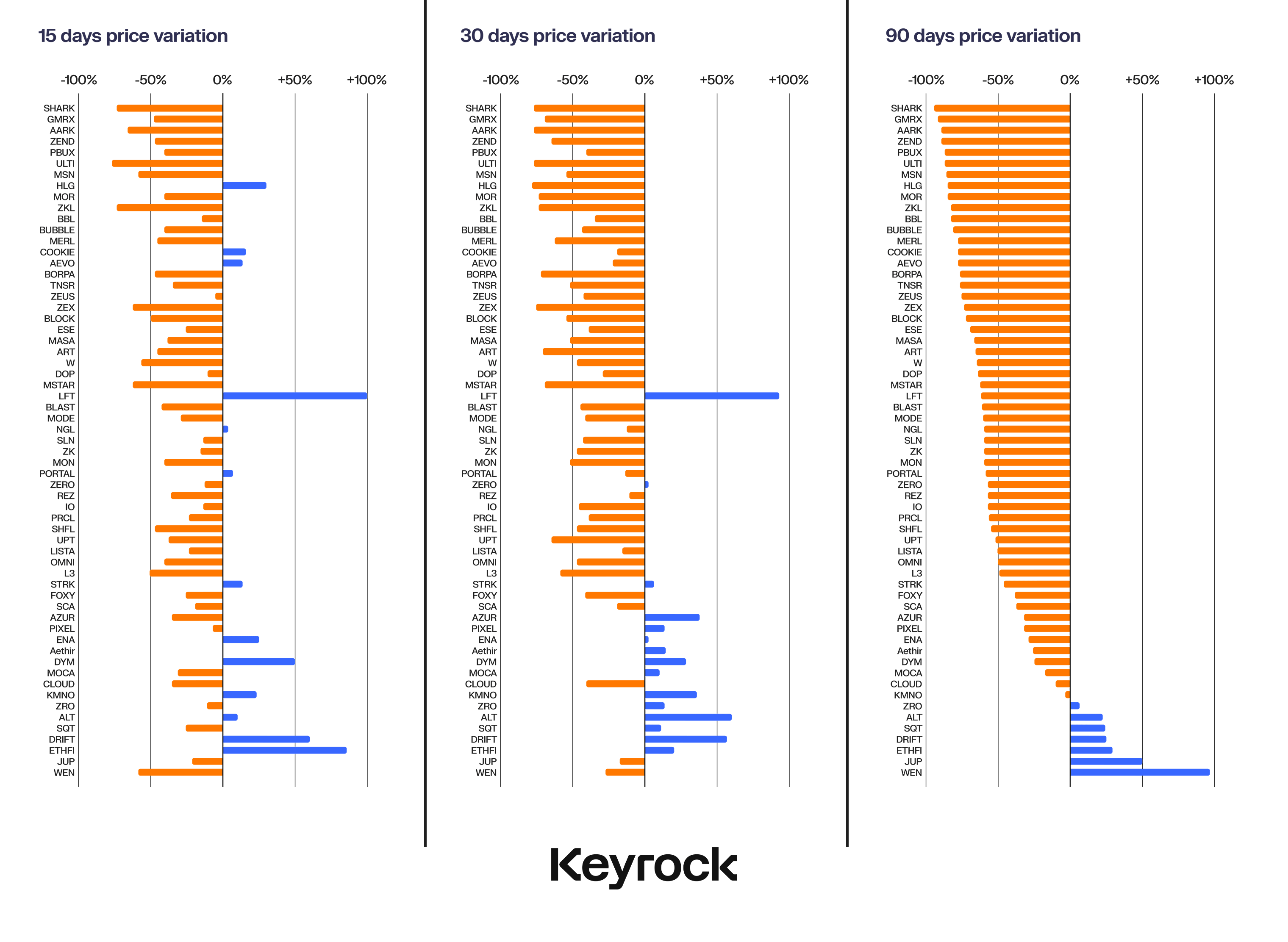

Overall Airdrop performance

Looking at price action over 15, 30, and 90 days, it becomes evident that the majority of price movement occurs in the earliest days following the airdrop. After three months, few tokens manage to return a positive result, with only a handful bucking this trend. That said, it’s important to consider the broader context: the crypto market as a whole has not performed well during this period, which complicates the picture.

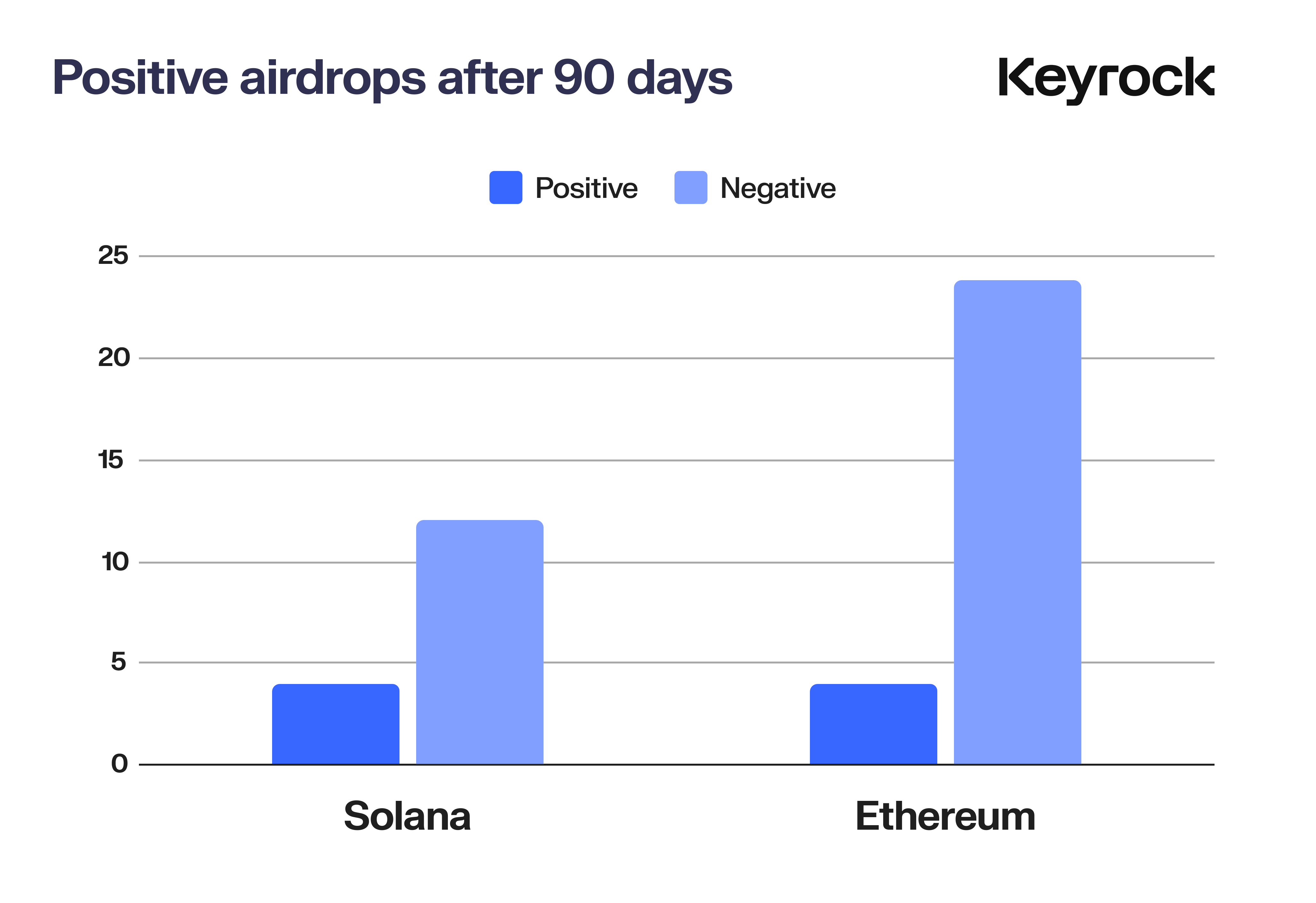

Airdrops performance on different blockchains

Though performance was poor overall, this wasn’t true across all chains. Of the 62 airdrops analysed, only 8 had positive returns after 90 days—4 on Ethereum and 4 on Solana. BNB, Starknet, Arbitrum, Merlin, Blast, Mode, and ZkSync had no winners. Solana had a 25% hit rate, and Ethereum 14.8%.

For Solana this is not surprising as the chain has become a retail favourite in the past two years and a true challenger to the dominance of Ethereum. And with many of the other chains we looked at being Layer 2s in direct competition with another it’s not a shock that only the parent chain held onto the select winners.

While we did not include Telegram’s Ton network we do want to note that there have been quite a few successful Airdrops there as enthusiasm and adoption expands on the network.

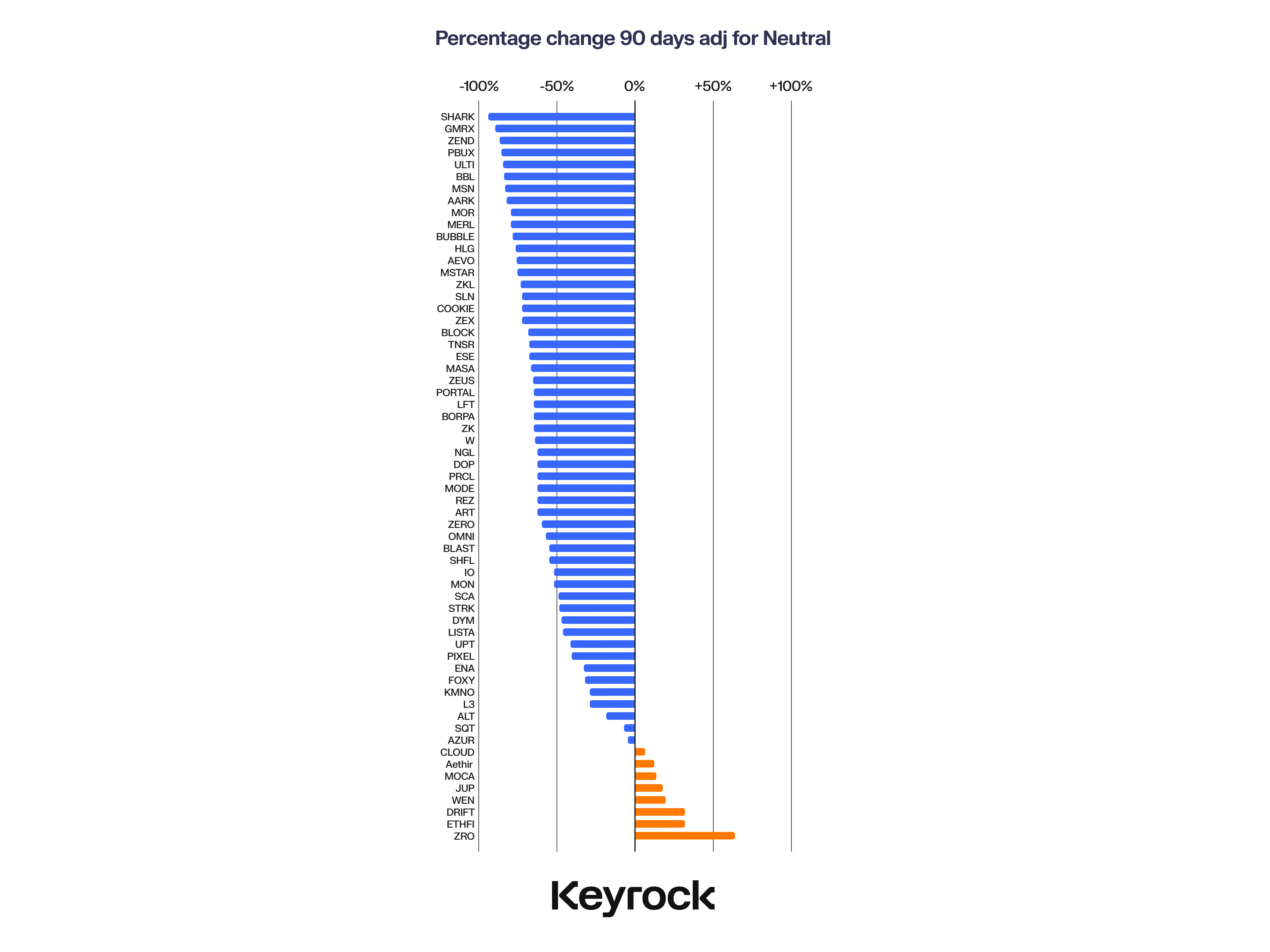

Normalised performance

That said, what if we try to separate the larger chains from their Airdrops. Does this data change if we account for how the parent tokens moved? When we normalise these airdrop prices against the performance of their respective ecosystems—comparing, for example, an airdrop on Polygon to the price movements of $MATIC, or one on Solana to $SOL—the results still remain grim.

Yes the market has come down, cooling off highs in 2023 and yet that is not enough to cover the downturn of the Airdrops either compared to system tokens or to altcoins in general. These selloffs while not isolated from the larger narrative are a reflection of the general trepidation of the market to flourish short term. When things that are already considered “Established” are going down the last thing anyone wants is something untested or “new”.

Overall improvements are modest at best with Solana and ETH having roughly 15-20% drawdowns at worst over some 90 day slots, it still shows these airdrops are far more volatile and only tethered in overall narrative not price action.

How the size of an Airdrop influences the token price

Another critical factor influencing the performance of airdrops is the distribution of the total token supply. How much of the token supply a protocol decides to distribute can significantly affect its price performance. This raises key questions: Does generosity pay off? Or is it safer to be conservative? Does empowering users with more tokens lead to better price action, or does it create a risk by giving away too much too quickly?

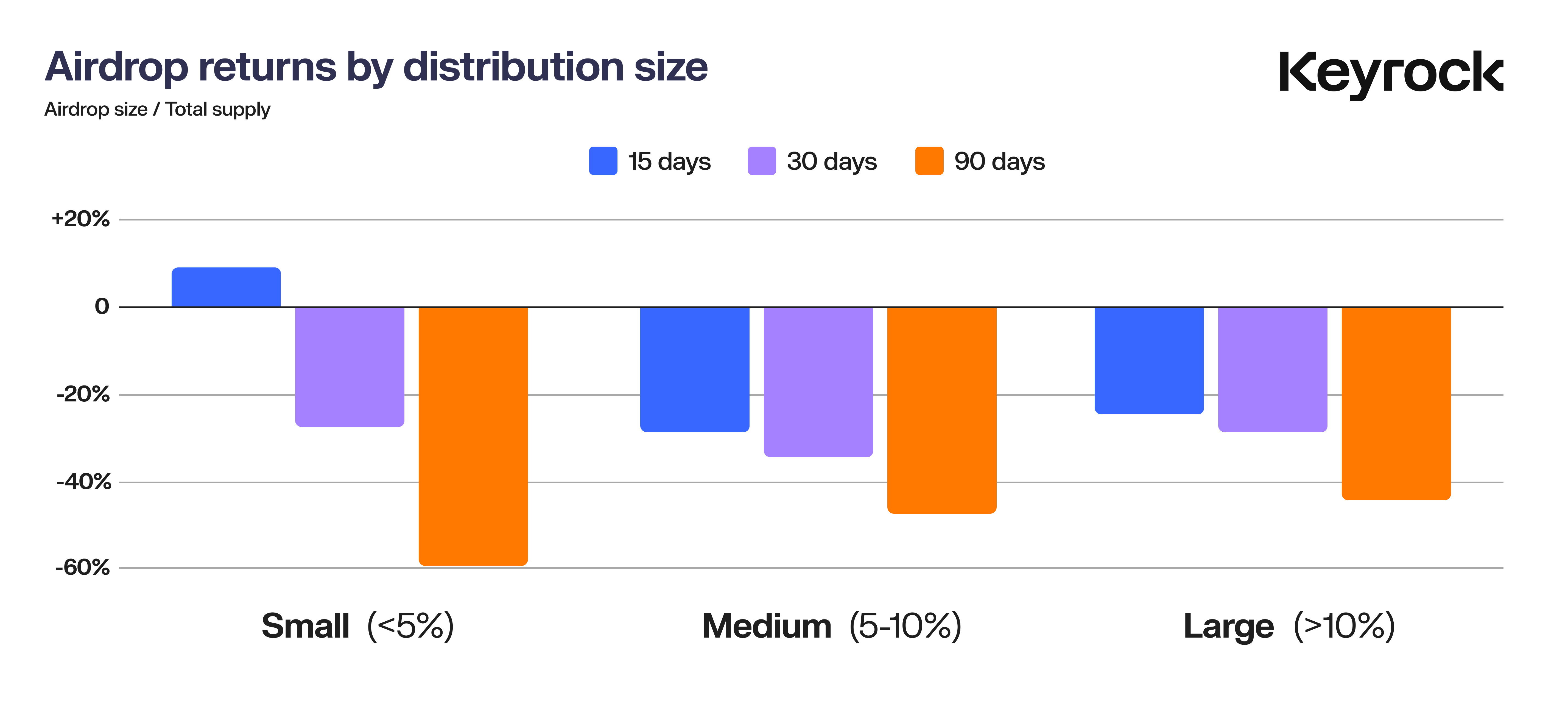

To break this down, we categorised the airdrops into three groups:

- Small airdrop: < 5% of total supply

- Medium airdrop: > 5% and ≤ 10%

- Large airdrop: > 10%

We then examined their performance over three time frames—15 days, 30 days, and 90 days.

In the short term (15 days), smaller airdrops (<5%) tend to perform well, likely because the limited supply creates less immediate selling pressure. However, this initial success is often fleeting, with tokens from smaller airdrops experiencing significant dumps within three months. This is likely due to a combination of factors: low supply initially curbs sell-offs, but over time, as narratives shift or insiders begin to sell, the broader community follows suit.

Medium-sized airdrops (5-10%) tend to fare slightly better, balancing supply distribution with user retention. However, it’s the large airdrops (>10%) that perform the best over longer time horizons. These larger distributions, while potentially riskier in terms of short-term selling pressure, seem to foster a stronger sense of community ownership. By distributing more tokens, protocols may empower users, giving them a greater stake in the project’s success. This, in turn, can lead to better price stability and long-term performance.

Ultimately, this data suggests that being less stingy with token distributions pays off. Protocols that are generous with their airdrops tend to cultivate a more invested user base, leading to better outcomes over time.

Distribution dynamics

Effect of token distribution

Our analysis shows that the size of the airdrop has a direct impact on price performance. Smaller airdrops create less initial selling pressure but tend to see significant dumps within a few months. On the other hand, larger distributions do create more early volatility but result in stronger long-term performance, suggesting that generosity encourages more loyalty and token support.

Correlating distribution with market sentiment

Community sentiment is a crucial, though often intangible, factor in the success of airdrops. Larger token distributions tend to be seen as fairer, giving users a stronger sense of ownership and involvement in the project. This creates a positive feedback loop—users feel more invested and are less likely to sell their tokens, contributing to long-term stability. In contrast, smaller distributions may feel safer initially but often result in brief enthusiasm followed by quick sell-offs.

While it’s difficult to quantify sentiment or “vibes” across all 62 airdrops, they remain powerful indicators of a project’s lasting appeal. Signs of strong sentiment include an active and engaged community on platforms like Discord, organic discussions on social media, and a genuine interest in the product. Additionally, novelty and innovation in the product often help sustain positive momentum, as they draw in more committed users rather than opportunistic reward hunters.

Fully Diluted Value effects

One important area of focus is whether the Fully Diluted Value (FDV) of a token at launch had a notable impact on its performance post-airdrop. FDV represents the total market value of a cryptocurrency if all of its possible tokens were in circulation, including tokens yet to be unlocked or distributed. It’s calculated by multiplying the current token price by the total token supply, which includes both circulating tokens and any locked, vested, or future tokens.

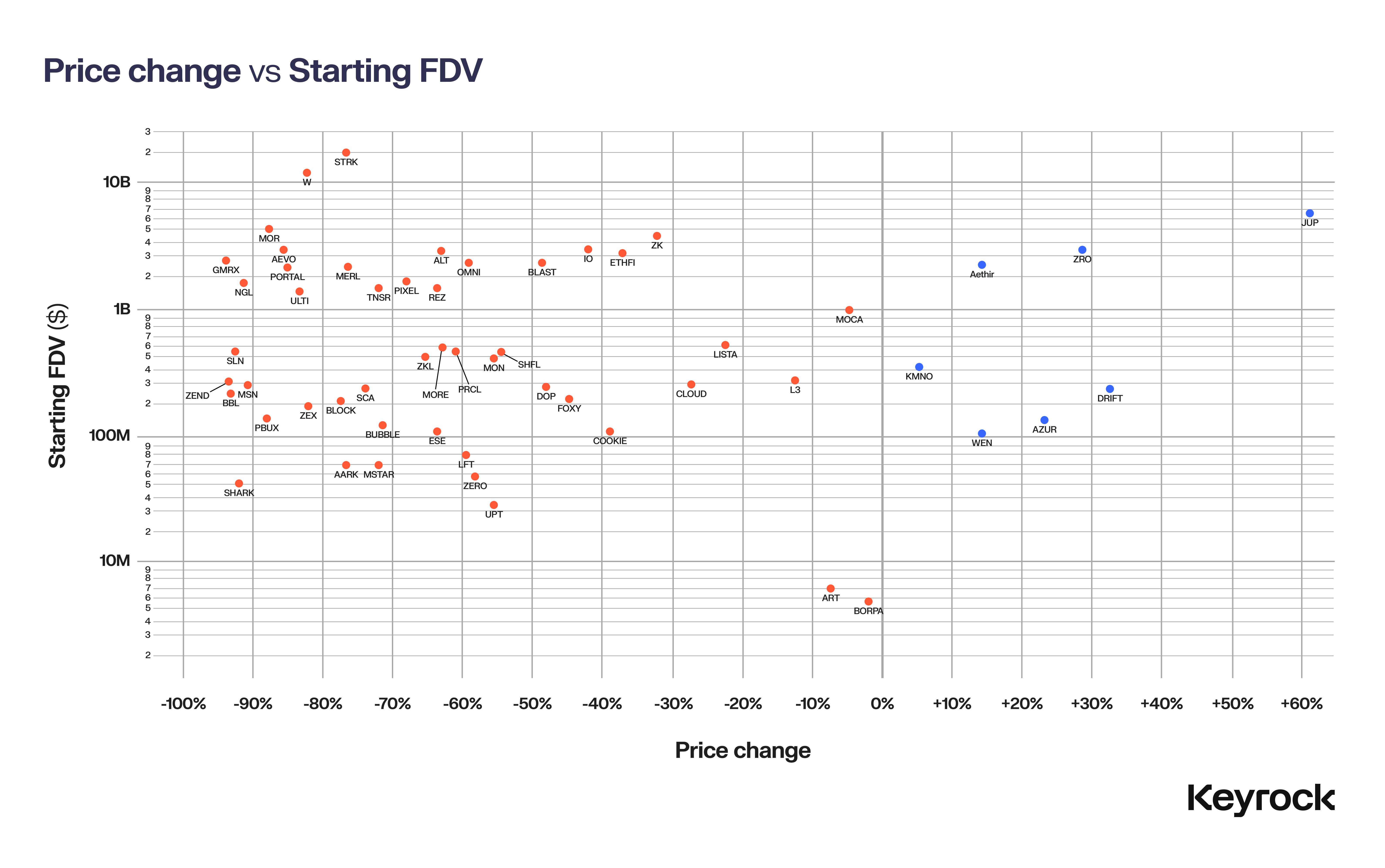

In the crypto space, we frequently see projects with FDVs that seem disproportionately high relative to the actual utility or impact of the protocol at the time of launch. This raises a key question: Are tokens being penalised for launching with inflated FDVs, or does the impact of FDV vary by project?

Our data spans a wide range of projects, from those launching with a modest FDV of $5.9 million to those with a staggering $19 billion—representing a 3,000x difference across the 62 airdrop samples we analysed.

When we map out this data, an unmistakable trend emerges: the larger the FDV at launch, the greater the likelihood of a significant price drop, irrespective of the project type, level of hype, or community sentiment.

FDV relationship reasons

There are two primary factors at play here. The first is a fundamental market principle: investors are drawn to the perception of upward mobility. Tokens with a small FDV offer room for growth and the psychological comfort of being “in early,” attracting investors with the promise of future gains. On the other hand, projects with inflated FDVs often struggle to sustain momentum as the perceived upside becomes limited.

Economists have long discussed the idea of market “headroom.” As Robert Shiller aptly puts it, “irrational exuberance” fades quickly when investors feel returns are capped. In crypto, when a token’s FDV signals limited growth potential, that exuberance vanishes just as fast.

The second factor is more technical: liquidity. Tokens with large FDVs often lack the liquidity to support those valuations. When substantial incentives are distributed to the community, even a fraction of users looking to cash out can create immense sell pressure, with no buyers on the other side.

Consider the example of $JUP, that launched with an FDV of $6.9 billion, backed by a collection of liquidity pools and market makers we estimate to be $22 million on launch day. This gave $JUP a liquidity-to-FDV ratio of just 0.03%. While a low number compared to its memecoin $WEN who had Liquidity-FDV ratio of 2% its relatively high compared to others in the same weight class.

When we compare that to Wormhole, which launched with an large FDV of $13 billion. To match the same 0.03% liquidity ratio, Wormhole would have needed $39 million in liquidity across venues. However, even including all available pools, both official and unofficial and Cex Liquidity, our best estimate was closer to $6 million—a fraction of what was needed. With 17% of its tokens distributed to users, the stage was set for a potentially unsustainable market cap. $W has fallen 83% since launch.

As a market maker, we know that without sufficient liquidity, prices become highly sensitive to sell pressure. The combination of two factors—the psychological need for growth potential and the actual liquidity needed to support large FDVs—explains why tokens with higher FDVs struggle to maintain their value.

The data confirms this. Tokens with lower FDVs experienced far less price erosion, while those that launched with overinflated valuations suffered the most in the months following their airdrop.

Overall winners and losers

To dig in a bit deeper and get a better sense of some of the players we picked an example of a winner and loser of this airdrop season to look at. To explore what exactly they did well and what they blundered on that resulted in a successful community launch and not so successful launch.

Airdrop season: a case study on winners and losers

As we delve into the airdrop season, let’s examine a standout winner and a notable underperformer to uncover the factors that contributed to their contrasting outcomes. We’ll explore what these projects did right—or wrong—that ultimately shaped their success or failure in the community’s eyes.

The winner: $DRIFT

First up is Drift, a decentralised futures trading platform that has operated on Solana for nearly three years. Drift’s journey has been marked by both triumphs and challenges, including surviving several hacks and exploits. Yet each setback forged a stronger protocol, evolving into a platform that has proven its worth far beyond airdrop farming.

When Drift’s airdrop finally arrived, it was met with enthusiasm, particularly from its long-standing user base. The team strategically allocated 12% of the total token supply for the airdrop, a relatively high percentage, and introduced a clever bonus system that kicked in every six hours after the initial distribution.

Launching with a modest market cap of $56 million, Drift surprised many, especially when compared to other vAMMs (virtual automated market makers) that boasted fewer users and less history but higher valuations. Drift’s value soon reflected its true potential, reaching a market cap of $163 million—a 2.9x increase post-launch.

The key to Drift’s success lay in its fair and thoughtful distribution. By rewarding long-term, loyal users, Drift effectively filtered out newer Sybil farmers, fostering a more authentic community and avoiding the toxicity that can sometimes plague such events.

What set Drift apart?

- Legacy and Strong Foundations

- Drift’s well-established history allowed it to reward an existing, dedicated user base.

- With a high-quality, proven product, the team could easily identify and reward true super-users.

- Generous Tiered Distribution

- Allocating 12% of the total supply—a significant proportion for an airdrop—demonstrated Drift’s commitment to its community.

- A staggered release structure helped minimise sell-off pressure, keeping value stable post-launch.

- Crucially, the airdrop was designed to reward actual usage, not just metrics inflated by point-farmers.

- Realistic Valuation

- Drift’s conservative launch valuation avoided the pitfalls of overhyping, keeping expectations grounded.

- Adequate liquidity was seeded in the initial liquidity pools, ensuring smooth market functioning.

- The low fully diluted valuation (FDV) not only set Drift apart but also prompted a broader industry discussion around overvalued competitors.

Drift’s success was no accident; it was a result of deliberate choices that prioritised product strength, fairness, and sustainability over short-term hype. As the airdrop season continues, it’s clear that protocols looking to replicate Drift’s success would do well to focus on building a strong foundation, fostering real user engagement, and maintaining a realistic view of their market value.

$ZEND: From hype to collapse – A Starknet airdrop gone wrong

ZkLend ($ZEND) is now facing a significant downturn—its value has plummeted by 95%, and daily trading volumes struggle to exceed $400k. This is a stark contrast for a project that once boasted a $300 million market cap. Adding to the unusual situation, ZkLend’s total value locked (TVL) is now more than double its fully diluted valuation (FDV)—an uncommon occurrence in the crypto world, and not a positive one.

So how did a project, riding high on the hype surrounding Starknet—a zk-rollup solution aimed at scaling Ethereum—end up in such a precarious position?

Riding the Starknet wave, but missing the boat

ZkLend’s concept wasn’t particularly groundbreaking—it aimed to be a lending and borrowing platform for various assets, benefiting from Starknet’s narrative. The protocol leveraged Starknet’s momentum, positioning itself as a key player in a cross-chain liquidity ecosystem.

The premise:

- Generate a farming network where users could earn rewards across different protocols.

- Attract liquidity and users through rewards and cross-chain activity.

However, in execution, the platform ended up attracting “mercenary” activity farmers—users solely focused on short-term rewards, without any commitment to the long-term health of the protocol. Rather than nurturing a sustainable ecosystem, ZkLend found itself at the mercy of reward-hunters, leading to fleeting participation and low retention.

The airdrop that backfired

ZkLend’s airdrop strategy compounded its problems. With no significant product or brand recognition prior to the airdrop, the token distribution attracted speculators rather than genuine users. This critical misstep—failing to adequately vet participants—resulted in:

- A flood of reward hunters, eager to cash out quickly.

- Little loyalty or real engagement, with no long-term commitment from participants.

- A rapid collapse in token value, as speculators sold off their tokens immediately.

Rather than building traction and fostering loyalty, the airdrop created a short-lived burst of activity that quickly fizzled out.

A stark warning for the industry

ZkLend’s experience is a powerful reminder that while hype and airdrops can bring in users, they don’t inherently create value, utility, or sustainable communities.

Key lessons:

- Hype alone isn’t enough – Building real value requires more than just buzz around a hot narrative.

- Airdrops without vetting users can invite speculation and destroy value, as ZkLend experienced.

- Sky-high valuations for new products carry immense risk, especially without proven use cases.

Conclusion

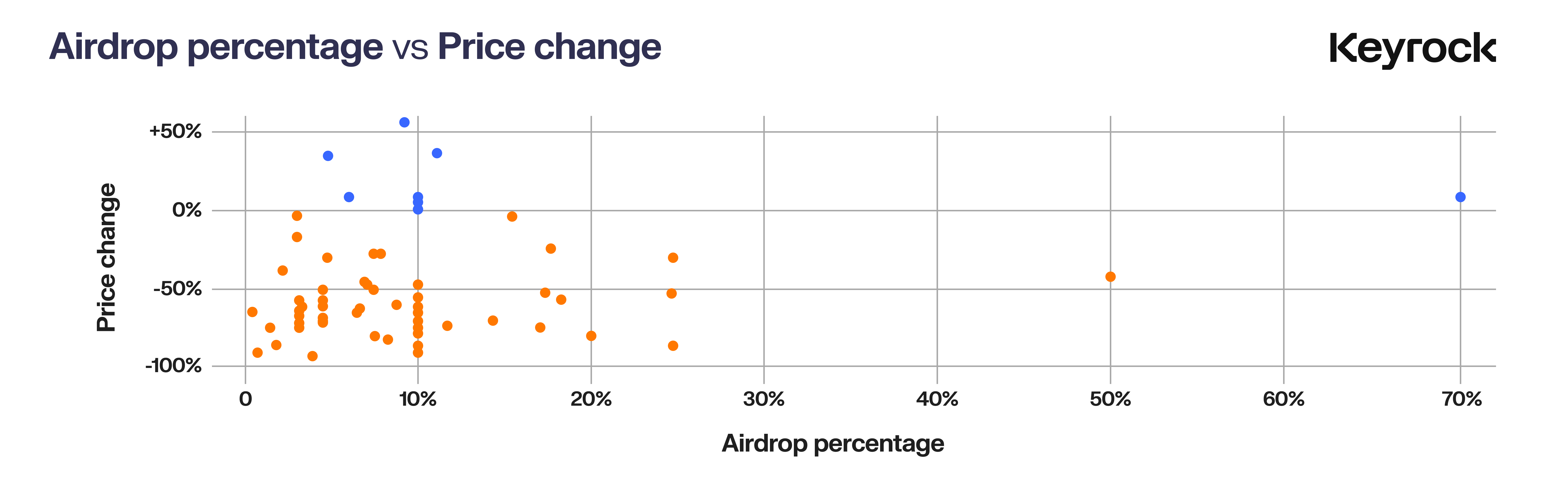

If maximising returns is your goal, considering selling on day 1—85% of airdropped tokens see price declines within months. Solana led in 2024 as the top chain for airdrops, but when adjusting for market conditions, the overall performance wasn’t as dire. Projects like WEN and JUP stood out as success stories, showing that a strategic approach can still yield strong returns.

Contrary to popular belief, larger airdrops don’t always lead to dumps. A token with 70% airdrop allocation saw positive gains, highlighting that FDV management is more important. Overestimating FDV is a critical mistake. High FDVs limit growth potential and, more importantly, create liquidity problems—an inflated FDV requires substantial liquidity to sustain, which often isn’t available. Without enough liquidity, airdropped tokens become prone to severe price drops, as there isn’t enough capital to absorb sell pressure. Projects that launch with realistic FDVs and solid liquidity provision plans are better equipped to survive post-airdrop volatility.

Liquidity is crucial. When FDV is too high, it puts immense strain on liquidity. With insufficient liquidity, large sell-offs crush prices, particularly with airdrops, where recipients are quick to sell. By maintaining manageable FDVs and focusing on liquidity, projects can create better stability and potential for long-term growth.

Ultimately, airdrop success depends on more than just distribution size. FDV, liquidity, community engagement, and the narrative all matter. Projects like WEN and JUP struck the right balance, building lasting value, while others with inflated FDVs and shallow liquidity failed to maintain interest.

In fast-moving markets, many investors make quick decisions—day-one selling is often the safest bet. But for those looking at the long-term fundamentals, there are always a few gems worth holding.

Read more: DeFi dynamics: The critical role of the top 6 stablecoins

- Looking for a liquidity partner? Get in touch

- For our announcements and everyday alpha: Follow us on Twitter

- To know our business more: Follow us on Linkedin

- To see our trade shows and off-site events: Subscribe to our Youtube

Stay up to date

Get the latest industry insights, in-house research and Keyrock updates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.